¿Cómo iniciar una corretaje de Forex en 2026?

Contenidos

Iniciar una correduría de Forex en 2026 requiere planificación estratégica, cumplimiento riguroso de regulaciones, tecnologías modernas y un posicionamiento inteligente en el mercado. Comprender y adaptarse a estos elementos ayudará a tener una presencia sólida en el mercado de Forex entre plataformas de trading sofisticadas, traders conocedores y una feroz competitividad mundial.

Antes de avanzar, puedes solicitar y revisar un plan de negocios de corretaje gratuito y revisar la lista de verificación de configuración.

- Obtén el plan de negocio de corretaje — haz clic aquí

- Vea la lista de verificación de configuración de corretaje — haga clic aquí

Cómo iniciar una correduría de Forex en 12 pasos:

- Identifica tu mercado objetivo

- Elaborar un Plan de Negocios

- Decidir sobre el tipo de corretaje

- Seleccionar Jurisdicción y Adquirir Licencia

- Elige una Plataforma de Trading

- Asegurar una Solución de Back Office

- Abordar las Necesidades de Liquidez

- Integrar Soluciones de Pago

- Implementar Protocolos de Gestión de Riesgos

- Desarrollar un Programa de Afiliados

- Diseñar una Estrategia de Marketing

- Iniciar la Adquisición de Clientes

Ahora, exploremos cada uno de estos pasos en detalle.

1. Identifica tu Mercado Objetivo

Comienza con una investigación de mercado exhaustiva. Identifica los principales tipos de comerciantes en tu región: nuevos minoristas, profesionales experimentados o clientes institucionales, y anota sus prioridades. Este mapeo inicial establece la dirección para cada decisión que sigue.

Demografía y Preferencias de Comercio

Adapta las características de la plataforma de intercambio al perfil de la audiencia. Los usuarios más jóvenes y expertos en tecnología responden a herramientas de trading móvil y automatización, mientras que los traders más experimentados suelen valorar la investigación profunda, la ejecución estable y una amplia gama de pares de divisas.

Personalizando Tus Ofertas

Utiliza los datos que recopiles para personalizar tu plataforma y servicios. Para los novatos, proporciona tutoriales y una interfaz limpia. Para usuarios avanzados, integra herramientas de gráficos sofisticadas e instrumentos de moneda raros. Alinea cada elemento con las necesidades de la audiencia.

Evaluación de Regulaciones Locales y Factores Culturales

En cada región, comprende las necesidades lingüísticas, las regulaciones locales, los días festivos y las actitudes culturales hacia el riesgo. Localizar el contenido y garantizar el cumplimiento de las pautas locales puede mejorar la credibilidad y atraer a usuarios que sienten que su contexto único es comprendido.

Evaluación de la Competencia y Diferenciación

Identifica los brokers existentes que atienden a tu grupo objetivo. Toma nota de sus fortalezas, debilidades y precios. Diferencia tu negocio de corretaje ofreciendo una mejor experiencia de usuario, un soporte más receptivo o opciones de trading únicas que llenen los vacíos dejados por los competidores.

Métodos de Pago Preferidos y Canales de Soporte

Estudia cómo tu audiencia suele depositar y retirar fondos—tarjetas de crédito, monederos electrónicos locales, transferencias bancarias—y luego integra esos métodos. Decide sobre los canales de atención al cliente (chat en vivo, correo electrónico, teléfono) que coincidan con las expectativas de los clientes en cuanto a velocidad y comodidad.

2. Formular un Plan de Negocios

Especifique con precisión lo que desea lograr: presencia en un mercado de nicho, énfasis en comerciantes de alto volumen, o una oferta de pares de divisas especializados. Establezca metas medibles que incluyan un margen de beneficio objetivo dentro de 24 meses o un número establecido de clientes activos al final del primer año.

Proyecciones Financieras y Presupuestación

Delimite todos los costos de inicio, incluidos los licencias de tecnología, tarifas regulatorias y campañas de marketing iniciales, y detalle los gastos continuos como salarios del personal, mantenimiento de la plataforma y costos de liquidez. Cree pronósticos de ingresos realistas basados en spreads, comisiones y servicios adicionales, y considere diversas condiciones del mercado: tiempos volátiles pueden aumentar el volumen, pero períodos tranquilos podrían reducir las ganancias.

Posicionamiento de Mercado y Diferenciación

Examine el panorama competitivo e identifique cómo se destacará. Quizás se enfoque en un soporte al cliente excepcional, ofertas de moneda únicas, recursos educativos o herramientas analíticas de vanguardia.

Escalabilidad y Adaptabilidad

Planifica el crecimiento y las condiciones cambiantes del mercado construyendo infraestructuras y procesos flexibles. Elige plataformas que puedan manejar volúmenes de negociación más altos e integrar nuevos instrumentos fácilmente, y mantén un marco de cumplimiento listo para ajustarse a medida que evolucionen las regulaciones.

Confianza de Inversores y Partes Interesadas

Los inversores, socios y posibles prestamistas se sienten tranquilos al ver un plan empresarial bien organizado que muestre tu investigación. Muéstrales que tienes ideas para superar obstáculos y que has considerado las complejidades operativas, los riesgos financieros y las restricciones legales.

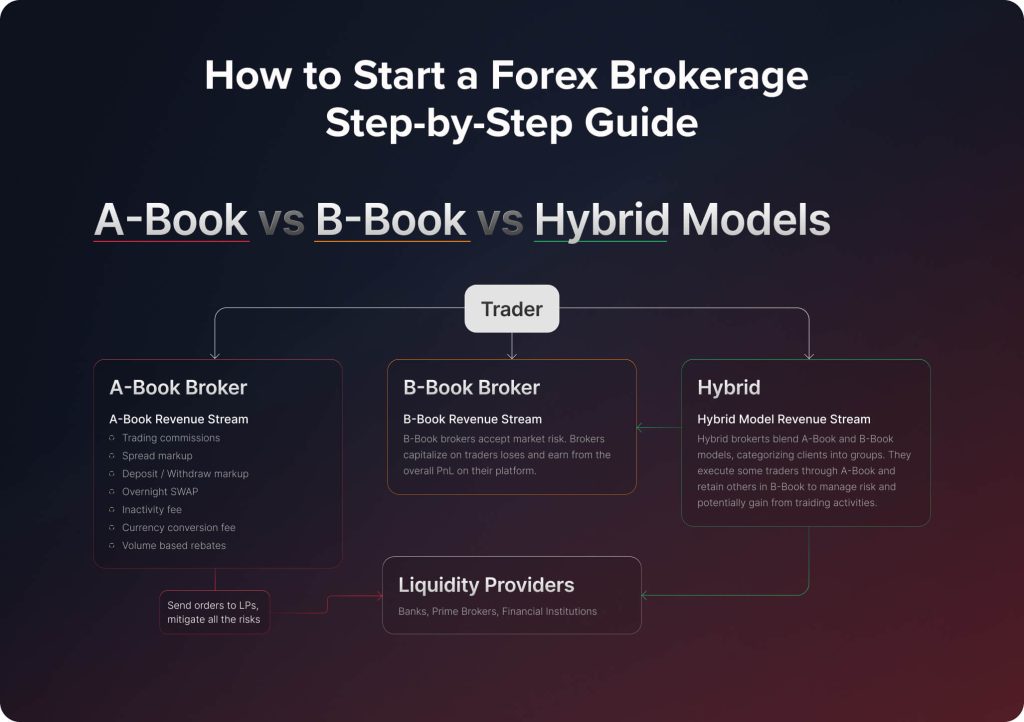

3. Decida sobre el tipo de corretaje

Seleccionar el modelo operativo para su corretaje de Forex afectará su perfil de riesgo, flujo de ingresos y posicionamiento en el mercado de la industria Forex. Con diferentes características y enfoques operativos, los tres modelos principales accesibles son los modelos A-Book, B-Book y híbrido.

Consideraciones del Modelo A-Book

En el modelo A-Book, tu papel como corredor de Forex es similar al de un intermediario. Pasas las operaciones de tus clientes directamente a los proveedores de liquidez o al mercado interbancario. Este modelo es elogiado por su transparencia, alineando los intereses de tu correduría con los de tus clientes. Obtener ingresos principalmente a través de comisiones y diferenciales requiere fuertes conexiones con proveedores de liquidez reputables para asegurar precios competitivos y ejecución de operaciones para tus traders. Sin embargo, este modelo requiere una comprensión profunda de la liquidez en el mercado de divisas y una infraestructura tecnológica robusta para una ejecución eficiente de las operaciones.

Dinámica del Modelo B-Book

El modelo B-Book presenta un enfoque diferente donde internalizas el riesgo actuando como la contraparte de las operaciones de tus clientes. En este escenario, la rentabilidad depende de las pérdidas comerciales de tus clientes, estableciendo un escenario donde los intereses del bróker pueden contrastar con los de los clientes. Este modelo ofrece control sobre las operaciones comerciales y puede ser lucrativo si tienes un buen entendimiento de las tendencias del mercado y el comportamiento de los clientes.

Flexibilidad del Modelo Híbrido

Combinando las ideas del A-Book y B-Book, un modelo híbrido ofrece adaptabilidad y una fuente de ingresos variada. Dependiendo de la evaluación de riesgo de cada transacción del cliente, permite enviar algunas a proveedores de liquidez externos (A-Book) y retener otras internamente (B-Book). Este modelo permite una gestión de riesgos efectiva al diversificar las exposiciones comerciales. Implementar un modelo híbrido requiere sistemas avanzados para analizar y categorizar con precisión las operaciones y una comprensión matizada de diversas estrategias de trading y sus riesgos asociados.

Los objetivos particulares de su correduría, la capacidad de gestión de riesgos y las preferencias del público objetivo deben guiar su decisión sobre un modelo A-Book, B-Book o híbrido. Cada modelo tiene diferentes beneficios y desventajas; el mejor para sus traders de Forex dependerá de cuán bien se ajuste a sus demandas y a su estrategia general de empresa.

4. Seleccionar Jurisdicción y Adquirir Licencia

Establecer un bróker de Forex requiere una decisión crucial: seleccionar la jurisdicción adecuada y obtener una licencia. Este paso es fundamental para el cumplimiento legal y para establecer confianza y legitimidad a los ojos de los traders de Forex y los mercados financieros en general.

Navegando por los Marcos Regulatorios y la Elección de Jurisdicción

Iniciar un bróker de Forex requiere una decisión importante sobre la jurisdicción y el cumplimiento regulatorio. Aunque autoridades respetadas como la Comisión de Valores e Inversiones de Australia (ASIC) o la Autoridad de Conducta Financiera del Reino Unido (FCA) tienen una gran reputación, obtener sus licencias puede ser difícil, particularmente para brókeres más pequeños o nuevos. Este desafío lleva a muchos a considerar opciones alternativas en jurisdicciones offshore.

También te puede gustar

Explorando Jurisdicciones Offshore como Alternativas

Las jurisdicciones offshore a menudo proporcionan un punto de entrada más accesible para nuevas corredurías de Forex. Si bien pueden no tener el mismo prestigio que la FCA o ASIC, ofrecen varias ventajas prácticas:

- Proceso de Licenciamiento Más Fácil: Las jurisdicciones offshore suelen tener un proceso de licenciamiento más directo y rápido, lo que puede ser crucial para las corredurías que desean ingresar al mercado sin demoras prolongadas.

- Rentabilidad: Las startups o pequeñas empresas podrían encontrarlo más financieramente viable, ya que los gastos de adquisición y mantenimiento de permisos en países offshore suelen ser menores.

- Regulaciones Flexibles: Generalmente, al tener regulaciones más flexibles, estas naciones brindan a las corredurías más libertad operativa y menos obligaciones de cumplimiento estrictas.

- Acceso al Mercado Global: Las licencias offshore aún brindan acceso a un amplio espectro de mercados extranjeros, lo que permite a las corredurías atender una base de clientes variada.

Seychelles, Mauricio, Labuan, Comoras y Santa Lucía son opciones populares para 2026, cada una con sus propios plazos, necesidades de capital y requisitos de informes.

Comprendiendo el Proceso de Licenciamiento

Obtener una licencia de corredor de Forex es un procedimiento minucioso y difícil. Significa satisfacer ciertos criterios legales, demostrar solidez financiera, implementar políticas de control de riesgos sensatas y asegurarse de que el equipo de gestión tenga el conocimiento y las credenciales requeridas. Junto con esto, el procedimiento implica prepararse y entregar una documentación completa y revisarla detenidamente por las autoridades.

La jurisdicción afectará sustancialmente el tiempo y los gastos involucrados en la obtención de una licencia de corredor de Forex. Estos cargos incluyen los honorarios legales, las tarifas de licencia y los gastos operativos necesarios para adaptar su empresa a los requisitos legales. Por lo tanto, debe incluir estos gastos en el plan de negocios inicial y estar preparado para el compromiso de tiempo necesario.

Contar con la orientación profesional puede ser inmensamente beneficioso, dada la complejidad de las regulaciones de Forex y el proceso de licenciamiento. Los expertos legales y las firmas de consultoría especializadas pueden ofrecer información y apoyo invaluables, ayudando a agilizar el proceso de solicitud, asegurar el cumplimiento de los estándares regulatorios y, potencialmente, acelerar la obtención de su licencia de Forex.

En el entorno regulatorio de 2026, donde los requisitos de debida diligencia son más estrictos y la aplicación de la AML es más fuerte, la orientación experta es a menudo esencial para un proceso de licencia sin contratiempos.

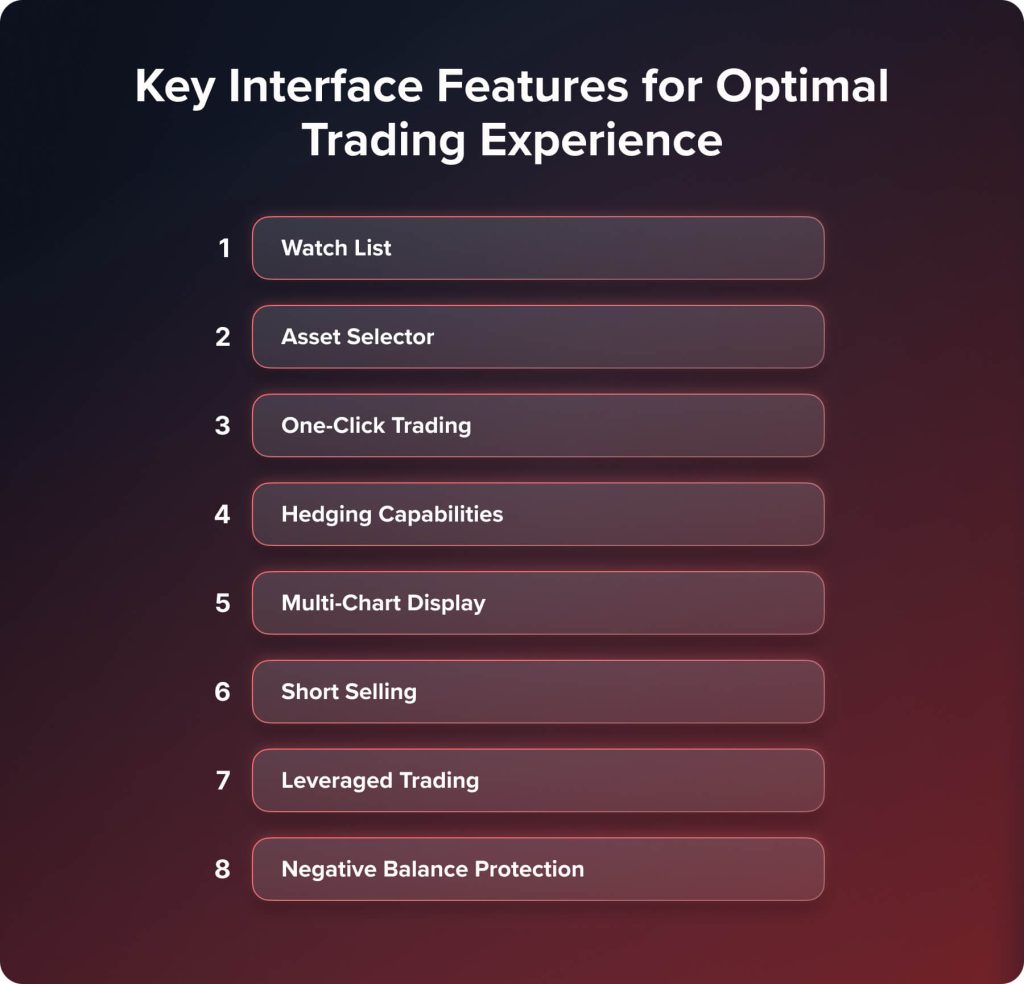

5. Elige una Plataforma de Trading

Elegir la plataforma de trading adecuada es fundamental para establecer un bróker de Forex. Esta plataforma no es solo una herramienta; es la puerta de entrada a través de la cual tus clientes interactuarán con el dinámico mercado de divisas. La decisión implica evaluar cuidadosamente diferentes plataformas, considerando sus características, fiabilidad y experiencia del usuario, y equilibrar estos factores con las especificaciones técnicas cruciales para operaciones de trading fluidas y eficientes.

Evaluando Plataformas de Trading

La escena de trading en Forex ofrece una variedad de sistemas con beneficios especiales. Debido en gran parte a su fiabilidad comprobada, amplias capacidades y reconocimiento general entre los traders de Forex, sitios populares como MetaTrader son generalmente la primera opción para muchas corredoras. Tanto para traders nuevos como experimentados, MetaTrader 4 y 5 combinan herramientas de trading sofisticadas, opciones de personalización y una comunidad de usuarios útil.

No obstante, aunque MetaTrader ha mantenido durante mucho tiempo una posición dominante en el mercado, cada vez se le considera algo prehistórico, especialmente frente a plataformas más nuevas y tecnológicamente avanzadas. A medida que el mercado evoluciona, los traders buscan plataformas que ofrezcan interfaces más modernas, funcionalidades mejoradas y mayores capacidades de integración. En este contexto, plataformas como la plataforma de trading Quadcode están ganando atención. Estas plataformas modernas están diseñadas con tecnología de vanguardia, ofreciendo diversas características más allá del trading tradicional. Proporcionan experiencias de usuario intuitivas, herramientas analíticas avanzadas y una mayor personalización para satisfacer las necesidades específicas de la diversa comunidad de trading de hoy.

Además, algunas corredurías podrían inclinarse hacia el desarrollo de una plataforma de trading personalizada. Esta opción permite una personalización adicional, adaptando así la plataforma a los requisitos particulares de los clientes o a un nicho de mercado específico. Las plataformas personalizadas requieren una inversión tecnológica significativa y un desarrollo continuo para mantenerse al día con la industria cambiante, aunque puedan ofrecer diferentes ventajas competitivas y factores de venta especiales. El auge de sitios como Quadcode demuestra un cambio en el sector donde atraer a una nueva generación de traders que buscan más de lo que las plataformas convencionales ofrecen depende de la innovación y la modernización.

Consideraciones sobre las Especificaciones Técnicas

Para mejorar la participación del cliente y la eficiencia comercial al elegir una plataforma de trading para su corretaje de Forex, dé prioridad a los criterios técnicos y a las características fáciles de usar. Las ricas características de la plataforma deberían ayudar a mejorar la experiencia del usuario y aumentar la participación, influyendo directamente en el Ingreso Promedio por Usuario (ARPU) y en el Valor de Vida (LTV) de los clientes.

Equilibrando la Riqueza Funcional con la Excelencia Técnica

La plataforma de trading elegida debe contar con características ricas y sobresalir en aspectos técnicos. Si bien factores como la velocidad de ejecución a menudo se asocian con proveedores de liquidez o mecanismos de negociación internos, la capacidad de la plataforma para apoyar estas operaciones sin problemas es vital. Debe ser capaz de manejar altos volúmenes de operaciones de manera eficiente y ofrecer sólidas capacidades de integración con otros sistemas clave, como proveedores de liquidez, soluciones de back-office y servicios de procesamiento de pagos.

Elegir la plataforma de trading adecuada para su empresa de corretaje de Forex se trata esencialmente de equilibrar una excelente capacidad técnica con una interfaz de usuario rica en funciones. Eventualmente, la plataforma debe ajustarse a sus objetivos estratégicos, satisfacer las necesidades de su mercado objetivo y ser parte de un entorno operativo coherente, ayudando así a elevar la participación de los clientes y el desarrollo de la empresa.

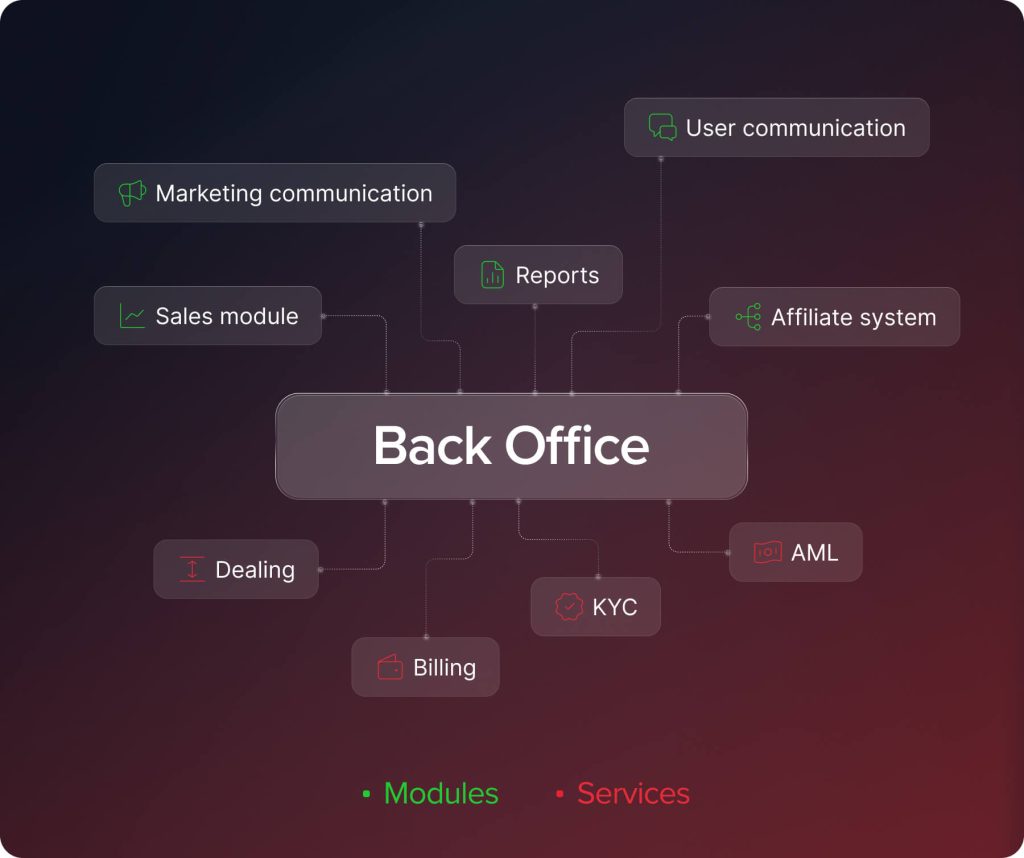

6. Asegurar una Solución de Back Office

En el ámbito de establecer una empresa de corretaje Forex exitosa, seleccionar una solución de back-office apropiada es fundamental. Esta solución sirve como el núcleo operativo de tu negocio, impactando todo, desde la gestión de clientes hasta la elaboración de informes financieros. Un sistema de back office bien elegido asegura eficiencia operativa y una funcionalidad robusta, lo cual es crucial para el buen funcionamiento de varios procesos empresariales.

En 2026, los corredores dependerán principalmente de análisis, flujos de trabajo automatizados y integraciones fluidas; por lo tanto, será necesario contar con una oficina de respaldo robusta en lugar de opcional.

Módulos y Servicios Clave de un Sistema de Back Office Efectivo

Un sistema de back office integral para una correduría de Forex debe abarcar una serie de módulos, cada uno abordando una necesidad operativa específica:

- Comunicación con el Usuario: Una plataforma para una comunicación fluida con los clientes, facilitando interacciones y abordando consultas, mejorando la calidad del servicio al cliente.

- Módulos de Ventas: Herramientas para rastrear actividades de ventas, gestionar prospectos y convertir oportunidades en clientes, crucial para impulsar el crecimiento empresarial.

- Informes: Capacidades de informes avanzados para una visión clara de las operaciones comerciales, incluyendo comercio, actividad del cliente e informes financieros, que ayudan en la toma de decisiones informadas.

- Comunicaciones de Marketing: Herramientas de marketing integradas para ejecutar campañas efectivas, gestionar promociones y conectar con clientes potenciales y existentes.

- Sistemas de Afiliados: Un sistema para gestionar y rastrear el rendimiento de los socios afiliados, asegurando una distribución precisa de recompensas y fomentando asociaciones rentables.

- Negociación: Herramientas para gestionar actividades de trading, incluyendo la ejecución de órdenes, la gestión de riesgos y el monitoreo de posiciones en el mercado.

- Facturación: Manejo eficiente de todas las transacciones de facturación y financieras, asegurando precisión en la facturación, pagos y conciliaciones financieras.

- KYC y Cumplimiento de AML: Módulos integrales para verificaciones de prevención de lavado de dinero y validación de clientes garantizan el cumplimiento normativo y ayudan a reducir el riesgo.

Básicamente, para un bróker de Forex, un sistema de back office completo con todos estos componentes importantes es una ventaja estratégica en lugar de solo una necesidad de backend. Garantiza una eficiencia operativa impecable y conformidad con los requisitos legales, proporcionando así los instrumentos necesarios para una buena gestión de la empresa y la interacción con los clientes. Por lo tanto, la elección del sistema de back office adecuado tiene una gran influencia en el rendimiento y la trayectoria de expansión de una correduría de Forex.

7. Abordar las Necesidades de Liquidez

Abordar las necesidades de liquidez es un aspecto crucial para establecer una correduría de Forex, influyendo significativamente en la calidad de los servicios al cliente. El enfoque de la liquidez varía según el modelo de correduría elegido—A-Book, B-Book o Híbrido. Cada modelo requiere una estrategia diferente en términos de gestión de liquidez y riesgo.

A-Book y Modelos Híbridos: Necesidad para los Proveedores de Liquidez

Asociarse con proveedores de liquidez de confianza es vital para las corredurías que operan en modelos A-Book y Híbridos. Estos modelos implican pasar las órdenes de los clientes directamente al mercado interbancario o a proveedores de liquidez externos.

- Asociaciones con Proveedores de Liquidez: Acceder a profundos pools de liquidez depende de tener relaciones sólidas con grandes bancos o instituciones financieras dentro del mercado interbancario. Crucial para atraer a traders de alto volumen o alta frecuencia, esto garantiza un flujo constante de liquidez y diferenciales de compra-venta atractivos. La fiabilidad y la velocidad de ejecución de estos proveedores influyen fuertemente en la experiencia de trading ofrecida a los clientes.

- Agregadores de Liquidez: Utilizar servicios de agregadores de liquidez ayuda a mejorar aún más las condiciones de trading. Compilando precios de varias fuentes, los agregadores ofrecen opciones de trading más competitivas y una mayor variedad de instrumentos. En mercados de rápida evolución, esto garantiza que los clientes puedan recibir las mejores tarifas posibles.

Modelo B-Book: Enfoque en la Gestión de Riesgos

Por el contrario, el énfasis se desplaza de los proveedores de liquidez a una gestión de riesgos robusta para las corredurías que siguen el modelo B-Book. En este modelo, la correduría actúa como contraparte de las operaciones de los clientes, lo que significa que gana cuando los clientes pierden y viceversa.

- Reducción de la Dependencia de la Liquidez Externa: Las corredurías B-Book no envían operaciones a mercados externos; por lo tanto, la necesidad de proveedores de liquidez se reduce significativamente. El enfoque principal está en gestionar los riesgos internos.

- Estrategias Efectivas de Gestión de Riesgos: Implementar sistemas de gestión de riesgos sofisticados se vuelve primordial. Esto incluye monitorear la actividad de trading de los clientes, identificar la exposición al riesgo y emplear estrategias para equilibrar las operaciones dentro de la correduría. Una buena gestión de riesgos asegura la sostenibilidad de la correduría, particularmente cuando los clientes son rentables.

- Costo Por Adquisición: Bajo el modelo de CPA, los asociados son pagados por cada cliente que promocionan y que cumple con ciertos requisitos, incluyendo depositar dinero o completar un número mínimo de transacciones. Por cada recomendación calificada, el mecanismo simple garantiza un reembolso para los afiliados.

- Participación en los Ingresos: Bajo este acuerdo, la actividad comercial de los clientes recomendados genera una parte de los ingresos compartidos. Dado que los ingresos del afiliado dependen del volumen de negociación del cliente a lo largo del tiempo, motiva a los asociados a recomendar clientes que presumiblemente son comerciantes activos a largo plazo.

- Participación en el Spread: Al igual que la participación en los ingresos, la participación en el spread otorga recompensas a los asociados dependiendo del volumen de comercio generado por sus recomendaciones. En el mercado Forex, donde los spreads definen los gastos de comercio, este concepto es muy intrigante.

- Comisiones y Diferenciales: La principal fuente de ingresos de los brókeres de Forex es la comisión por operaciones y el diferencial - la diferencia entre los precios de compra y venta de los pares de divisas. Las corredurías ganan al aumentar estos diferenciales o cobrar una comisión por cada operación ejecutada.

- B-Book Profits: En el modelo B-Book, la correduría actúa como contraparte de las operaciones de los clientes, apostando esencialmente en su contra. Esto significa que cuando los clientes pierden sus operaciones, la correduría obtiene ganancias. Sin embargo, esto también implica consideraciones de gestión de riesgos, ya que grandes ganancias de los clientes pueden afectar las finanzas de la correduría.

- Servicios Adicionales: Muchas corredurías aumentan sus ingresos ofreciendo servicios adicionales como herramientas de trading premium, recursos educativos, cuentas gestionadas o servicios de VPS (Servidor Privado Virtual) para mejorar el trading.

- Tarifas de Swap: Las corredurías también pueden ganar a partir de tarifas de swap: cargos o créditos aplicados a las cuentas por mantener posiciones durante la noche. Estas se basan en las diferencias de tasas de interés entre las monedas negociadas.

- Comisiones por Conversión de Moneda: Si una correduría proporciona cuentas en múltiples monedas, los depósitos o retiros de los clientes en otras monedas resultarían en costos de conversión de moneda.

- Comisiones de Trading Social y Trading de Copia: La participación en los beneficios, las comisiones por rendimiento y los pagos por suscripción son ejemplos de tales comisiones.

- Ofertas de Múltiples Activos (Acciones, Cripto, ETFs, Índices): Los brókers con cobertura de múltiples activos ganan más dinero a través de una mayor retención de traders, más swaps y comisiones, y un mayor volumen de trading.

- Extensiones de Prop Trading: Hoy en día, muchos corredores inician programas internos de prop y ganan dinero a través de acuerdos de participación en beneficios, membresías mensuales y tarifas de evaluación.

- Costos Operativos y de Personal: El funcionamiento diario de una empresa de corretaje rentable implica varios gastos operativos, incluidos los salarios del personal para traders, analistas, agentes de servicio al cliente y soporte de TI.

- Tecnología e Infraestructura: Las plataformas de trading de Forex, el mantenimiento de servidores y la infraestructura de TI—todo lo cual es absolutamente vital para operaciones de trading eficientes y seguras—ocupan una parte significativa del presupuesto en la pila técnica.

- Marketing y Publicidad: Las corredurías realizan inversiones significativas en marketing y publicidad para atraer y mantener a los clientes. Esto incluye marketing en internet, programas de afiliados y esfuerzos promocionales.

- Costos Legales y de Cumplimiento: Asegurar el cumplimiento normativo incurre en tarifas por licencias, asesoría legal, personal de cumplimiento y presentaciones y auditorías regulatorias continuas.

- Gestión de Riesgos: Gestionar el riesgo comercial de los clientes, especialmente para las corredurías de B-Book, puede resultar en gastos, ya sea en coberturas de transacciones de clientes en el mercado o en la aplicación de técnicas internas de gestión de riesgos.

La forma en que una correduría de Forex aborda los requisitos de liquidez está estrechamente relacionada con su filosofía operativa. Construir una correduría de Forex exitosa que sirva adecuadamente a su clientela depende de conocer y ajustarse a los criterios particulares de su modelo seleccionado.

8. Integra Soluciones de Pago

Uno de los componentes clave a manejar al construir una empresa de corretaje de Forex es el uso de un sistema de pago fuerte y flexible. No solo es una conveniencia, sino que la experiencia comercial de sus clientes depende fundamentalmente de su capacidad para depositar y retirar dinero rápidamente. La efectividad de sus integraciones de pago puede influir significativamente en la satisfacción del cliente y en la fluidez operativa.

Ofreciendo una variedad de opciones de pago

Atender a una base de clientes mundial depende de que diversifiques tus fuentes de pago. En cuanto a cómo gestionan su dinero, varios comerciantes tienen gustos y restricciones diferentes. Especialmente para compras significativas, es aconsejable combinar muchos métodos de pago, incluyendo tarjetas de crédito y débito por su aceptabilidad y conveniencia en general, monederos electrónicos por su velocidad y simplicidad, y transferencias bancarias convencionales por su seguridad. Esta variedad garantiza que tu correduría pueda satisfacer las necesidades y preferencias de comerciantes de diferentes países y orígenes, mejorando así la usabilidad de tus ofertas.

Priorizando la Seguridad y el Cumplimiento

En lo que respecta a las transacciones financieras, particularmente en un sector tan activo como el comercio de divisas, la seguridad y el cumplimiento normativo son innegociables. Proteger el dinero y los datos personales de sus clientes depende principalmente de que sus soluciones de pago mantengan los más altos requisitos de seguridad, incluidas las transacciones encriptadas y estrictas normas de protección de datos. Además, especialmente para las transacciones transfronterizas, la adhesión a las normas locales y a las normas internacionales es crucial. Esto incluye garantizar la transparencia en todas las transacciones financieras y cumplir con los criterios de prevención de lavado de dinero (AML). Trabajar con proveedores de servicios de pago confiables puede ayudarle a controlar estas complicaciones al proporcionar soluciones de transacción seguras y conformes que se ajusten a las muchas demandas de sus clientes en todo el mundo.

La integración exitosa de soluciones de pago diversas, seguras y cumplidoras es un hito clave en el establecimiento de su propio negocio de corretaje Forex. No se trata solo de ofrecer varios medios para transacciones financieras; también se trata de establecer un ambiente en el que los clientes se sientan confiados y seguros en sus interacciones con su corretaje. Un sistema de pago bien considerado puede mejorar enormemente la confianza del cliente, la satisfacción y, por último, la reputación y el éxito de su firma de corretaje Forex.

9. Implementar Protocolos de Gestión de Riesgos

En el intrincado mundo de los brókers de Forex, establecer protocolos de gestión de riesgos sólidos es similar a configurar una póliza de seguro integral para su negocio de corretaje. Implica un enfoque meticuloso para mitigar varios riesgos, desde aquellos directamente relacionados con las actividades de trading hasta diversos desafíos operativos.

Estrategias contra los riesgos de trading

El trading de Forex tiene riesgos de contraparte y una montaña rusa natural de volatilidad del mercado. Su correduría debe tener planes de gestión de riesgos adaptables y sólidos si quiere negociar en este terreno. Estas técnicas pueden incluir establecer límites de apalancamiento razonables para los clientes, protegiendo así a su correduría y a ellos de los mayores peligros asociados con un apalancamiento demasiado alto. El riesgo de contraparte—donde siempre hay una posibilidad de que la otra parte involucrada en una transacción incumpla—es otro aspecto del riesgo de trading. Reducir este riesgo requiere una cuidadosa investigación de todos los involucrados, incluidos los proveedores de liquidez, y la creación de acuerdos destinados a proteger su correduría de cualquier repercusión financiera.

Abordando los Riesgos Operativos

Los riesgos operativos en un negocio de corretaje de Forex se extienden a través de varios dominios. Fallos tecnológicos, por ejemplo, pueden interrumpir las operaciones de trading, lo que lleva a la insatisfacción del cliente y a posibles pérdidas financieras. Esto requiere un marco de TI robusto, reforzado con medidas de seguridad y planes de contingencia. El mantenimiento y las actualizaciones regulares del sistema son parte de este escudo defensivo, asegurando que los fallos tecnológicos no obstaculicen las actividades de trading.

La ciberseguridad es otra área que requiere atención constante en la era digital de hoy. Gestionar información sensible de clientes y grandes transacciones financieras pone a un bróker de Forex directamente en la mira de los hackers. Establecer un escudo protector alrededor de tus activos digitales significa utilizar herramientas de ciberseguridad de vanguardia como auditorías de seguridad regulares, cifrado y cortafuegos para prevenir posibles ciberataques.

El entorno regulatorio del comercio de divisas es muy complejo y está en constante cambio. Mantener una cultura de cumplimiento dentro de su empresa, además de mantenerse al día con los desarrollos legales, le ayuda a adelantarse a las preocupaciones de cumplimiento. Esto incluye formación continua en cumplimiento para el personal, así como la evaluación y mejora continua de las políticas internas para adaptarse a los criterios legales cambiantes.

Establecer sistemas de gestión de riesgos sólidos en su propia correduría de Forex se trata de construir un entorno protegido que resista las numerosas amenazas del mercado de Forex. Cada nivel de su empresa se ve afectado por una cuidadosa mezcla entre el fortalecimiento de su infraestructura operativa y la promoción de una cultura de conciencia y preparación ante riesgos.

10. Desarrollar un Programa de Afiliados

Al establecer un robusto módulo de afiliados para una correduría de Forex, un componente clave es crear una red de asociaciones influyentes con individuos y entidades en el sector financiero. Esta red puede incluir influencers, educadores de trading y otros actores clave, cada uno de los cuales puede extender el alcance y mejorar la credibilidad de tu correduría. Además de crear estos lazos fuertes, también se deben tener en cuenta las muchas maneras en que un corredor podría pagar a los asociados por sus esfuerzos. Existen ventajas e incentivos únicos de estos modelos, que incluyen Costo Por Adquisición (CPA), Participación en Ingresos y Participación en Spread.

Aprovechando el Potencial de las Redes de Afiliados

La piedra angular de un módulo de afiliados exitoso radica en forjar relaciones productivas con individuos y entidades que tienen una presencia destacada en el mundo financiero. Los influencers y educadores de trading, con sus audiencias cautivas, pueden actuar como conductos poderosos para los esfuerzos de marketing de su correduría. Identificar y colaborar con socios cuyos seguidores se alineen con su público objetivo es clave. Por ejemplo, un educador con un seguimiento de traders novatos podría ser un activo invaluable para una correduría que se enfoque en nuevos entrantes al mercado Forex.

Estas afiliaciones van más allá de un mero alcance; añaden capas de credibilidad y confianza a tu correduría. Cuando figuras respetadas en la comunidad financiera respaldan tus servicios, esto mejora naturalmente tu atractivo para los posibles clientes. Este aspecto de credibilidad es especialmente crucial en el mercado de Forex, donde la confianza y la reputación juegan roles significativos en las decisiones de los clientes.

Los influencers ahora trabajan en un entorno más controlado. Tus acuerdos de afiliación deben contener directrices de cumplimiento para evitar multas en áreas como la UE, el Reino Unido y Australia que exigen una divulgación clara de promociones financieras.

Ahora es una práctica común proporcionar a los afiliados contenido preaprobado y enlaces de seguimiento.

Modelos de Compensación Diversos

Seguimiento Eficiente y Estructuras de Compensación Justas

Implementar un sistema de seguimiento robusto es vital para gestionar y recompensar las contribuciones de los afiliados de manera efectiva. Esto implica establecer un mecanismo transparente para monitorear referencias, conversiones de clientes y otros métricas esenciales que evalúan la eficacia de tus asociaciones con afiliados. El modelo de compensación para tus afiliados es un aspecto crítico de este sistema. Ya sea un modelo basado en comisiones, donde los afiliados ganan un porcentaje de los ingresos generados a través de sus referencias, o una tarifa fija por acciones específicas como registros de clientes, la estructura debe ser atractiva tanto para los afiliados como sostenible para tu correduría.

La clave para un programa de afiliados próspero radica en encontrar el equilibrio adecuado: ofrecer recompensas atractivas a los afiliados mientras se asegura que estas asociaciones sean rentables para su correduría. Además, mantener la transparencia, proporcionar datos en tiempo real y ofrecer informes claros a los afiliados es esencial. Esto fomenta la confianza y los motiva a dar lo mejor de sí en la promoción de sus servicios.

En esencia, desarrollar un módulo de afiliados para tu propia correduría de Forex se trata de construir una red de asociaciones mutuamente beneficiosas que amplíe el alcance de tu marca y mejore su presencia en el mercado. Un programa de afiliados bien estructurado, respaldado por un seguimiento eficiente y una compensación equitativa, puede contribuir significativamente al crecimiento y prominencia de tu correduría en el competitivo mercado de FX.

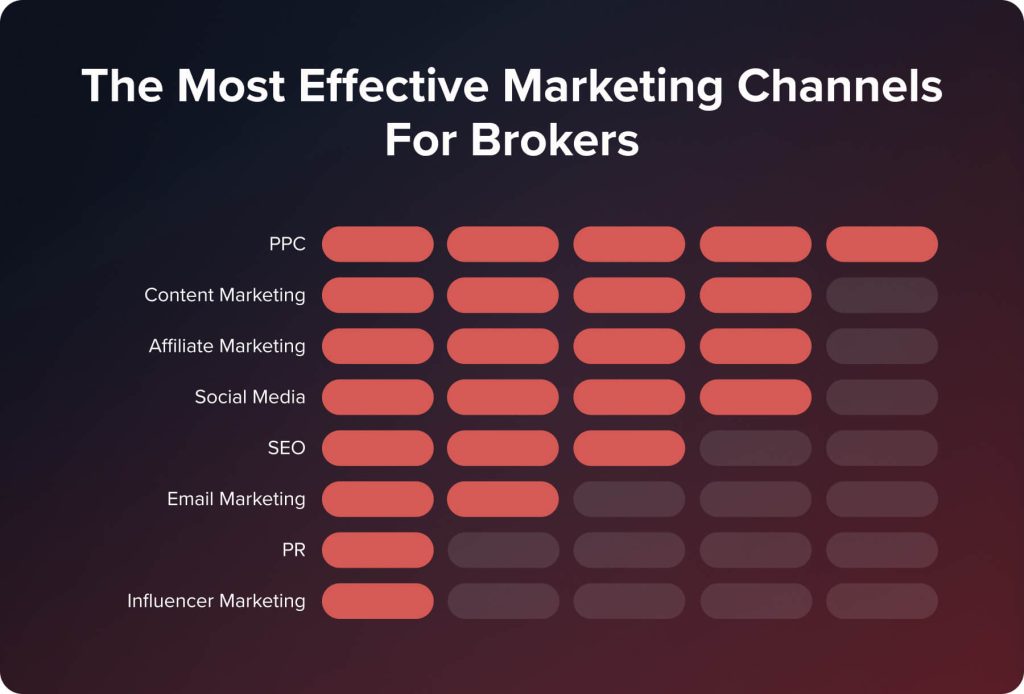

11. Diseñar una Estrategia de Marketing

Crear un plan de marketing completo es una tarea difícil para una empresa de Forex que va más allá de la simple publicidad de servicios. Se trata de construir una identificación de marca sólida que atraiga a su mercado objetivo y utilizar muchas plataformas de marketing digital para una interacción y alcance exitosos.

Construyendo una Fuerte Identidad de Marca y Posicionamiento en el Mercado

Su plan de marketing se centra principalmente en construir una identificación de marca única. Este método implica profundizar en los valores de su organización de trading de Forex y en la impresión que desea causar en el mercado. ¿Está dirigido a traders experimentados con herramientas de trading sofisticadas y estadísticas, o está tratando de ser la plataforma de referencia para principiantes con interfaces fáciles de usar y recursos educativos sustanciales? Cualquiera que sea su enfoque, su marca debe reflejar estas ideas.

La consistencia en todos los elementos de la marca - desde los diseños visuales como logotipos y maquetas de sitios web hasta el tono de tus comunicaciones - es crucial. Fomenta entre tus posibles clientes la conciencia y la confianza. Conocer quiénes son tus competidores y saber qué te distingue de ellos puede permitirte crear tu propio nicho en el mercado. ¿Eres único en tu tecnología de vanguardia, precio razonable o excepcional servicio al cliente? Comunicar claramente esta propuesta de venta única es clave para destacar en el abarrotado mercado de Forex.

Utilizando el Marketing Digital para Ampliar el Alcance y el Compromiso

Una presencia en línea efectiva es muy esencial en el terreno digital de hoy. Un plan de SEO bien considerado mejorará tu huella en Internet, aumentará tu exposición y atraerá clientes orgánicos. Pero no termina ahí; adoptar el marketing en redes sociales es igual de crucial. LinkedIn, Twitter e Instagram son plataformas que te ayudan a interactuar con tu audiencia, crear una comunidad y proporcionar contenido que mejora su experiencia comercial, no son simplemente herramientas para la promoción.

El marketing por correo electrónico sigue siendo una herramienta efectiva para establecer una comunicación directa con tu audiencia. Puedes mantener a tu clientela informada y comprometida con las ofertas de tu correduría a través de boletines informativos y actualizaciones perspicaces. Incluir una mezcla de técnicas adicionales de marketing digital como publicidad de pago por clic, marketing de contenidos y asociaciones con influencers puede ayudarte a alcanzar más clientes.

Teniendo en cuenta todo, un buen plan de marketing para tu propia correduría de Forex es una combinación armónica de un enfoque de marketing digital dinámico y una identificación de marca bien definida. Se trata de establecer adecuadamente tu correduría en el mercado, atraer y retener a los clientes apropiados, y crear una marca que conecte con los traders y perdure en el tiempo.

12. Iniciar la adquisición de clientes

Lanzar la fase de adquisición de clientes es fundamental para tu corretaje de Forex, marcando la transición de la configuración a la operación activa. Siguiendo la dirección de los hallazgos de tu estudio de mercado, esta etapa se trata de atraer nuevos clientes e implementar un plan bien elaborado enfocado en tu público objetivo. El enfoque en la retención de clientes es igualmente importante para este proceso, ya que garantiza que los clientes que adquieras siempre apreciarán y estarán satisfechos con los productos o servicios que ofreces.

Dado que los traders ahora exigen una incorporación individualizada y un valor instantáneo, ganar clientes en 2026 requerirá tanto un enfoque centrado como estrategias efectivas de retención.

Dirigiéndose a la Audiencia Correcta con Precisión

En cuanto a la adquisición de clientes, el éxito de tus iniciativas depende de tu grado de precisión en la identificación de posibles clientes. Tu conocimiento de tu nicho de mercado debería guiar ahora tus proyectos de alcance. Por ejemplo, si tu investigación muestra que hay demanda de una plataforma diseñada para traders inexpertos, tu marketing y correspondencia deberían resaltar elementos como la simplicidad de uso y las herramientas instructivas. El secreto es redactar tu mensaje para adaptarlo a las demandas y gustos particulares de tu demografía objetivo.

Un Doble Enfoque en Atraer y Retener Clientes

Aunque adquirir nuevos negocios es importante, la viabilidad y expansión de su correduría dependen en gran medida de la habilidad de retención. La retención de clientes depende principalmente de un servicio al cliente excepcional. Esto abarca todo, desde garantías de una experiencia de trading impecable y fácil de usar hasta un servicio rápido y eficiente.

Las ofertas competitivas también contribuyen significativamente a la retención de clientes. Esto puede incluir ofrecer diferenciales atractivos, una amplia gama de instrumentos de trading y acceso a tecnología de trading de vanguardia. Estos factores atraen a los clientes a su plataforma y les dan razones para quedarse.

El compromiso regular es otra dimensión de la retención. Puedes mantener a tus clientes activamente involucrados con tu correduría a través de varios canales como webinars educativos, actualizaciones del mercado y comunicación personalizada. Estas interacciones continuas refuerzan el valor que ofrece tu plataforma, solidificando la lealtad del cliente.

Iniciar la adquisición de clientes para su empresa de Forex es una tarea compleja. Requiere una estrategia sofisticada dirigida al público apropiado y una concentración estratégica en atraer clientes y mantener su participación y satisfacción a largo plazo. Esta combinación de adquisición dirigida y estrategias de retención dedicadas impulsa, en última instancia, el éxito y el crecimiento de su correduría.

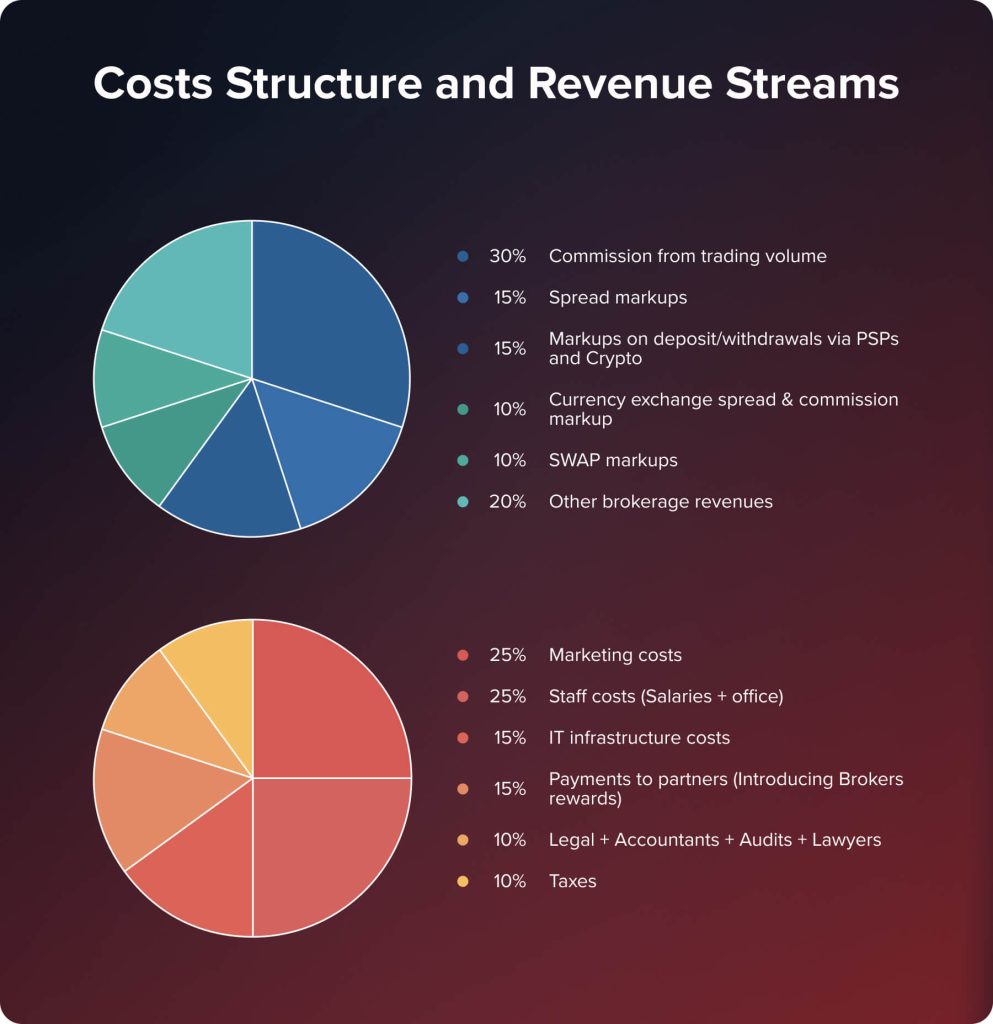

Costos y Fuentes de Ingresos para Diferentes Tipos de Corretajes

Una estrategia empresarial sostenible en la industria Forex depende de conocer las fuentes de ingresos y el tipo de gastos antes de entrar en el entorno. Independientemente de su modelo operativo particular, los corredores de divisas tienen muchas formas de ganar dinero y hacer frente a diferentes gastos operativos de la empresa.

Flujos de Ingresos en Corretajes de Forex

Costos Asociados con el Funcionamiento de una Correduría de Forex

Para garantizar la rentabilidad y sostenibilidad en el competitivo mercado de divisas, una firma de Forex exitosa equilibra de manera eficiente las fuentes de ingresos y los gastos, ajustándose así a las dinámicas del mercado y las demandas de los clientes.

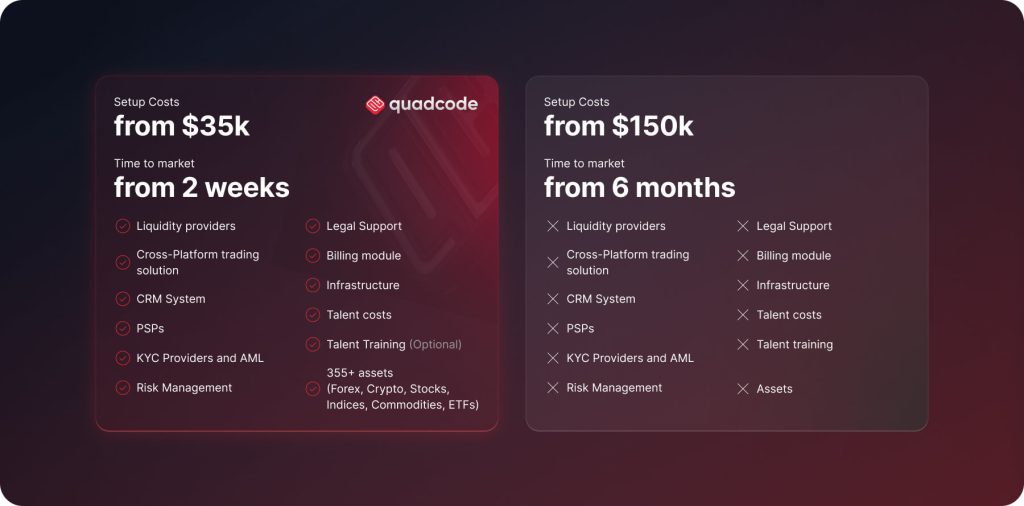

Comparando Empezar desde Cero vs. Solución de Marca Blanca

En el competitivo ámbito de las empresas de Forex, decidir entre comenzar desde cero y optar por una solución de marca blanca es fundamental. Si bien cada enfoque tiene sus méritos, la solución de marca blanca se presenta como una opción claramente más ventajosa, especialmente al considerar los aspectos de costo, eficiencia de tiempo y simplicidad operativa.

Empezando desde cero: una empresa costosa y que consume mucho tiempo

Emprender la construcción de una correduría de Forex desde cero ofrece un control total y el potencial de una profunda personalización. Sin embargo, este camino está marcado por demandas financieras y temporales significativas. Los costos de desarrollar tu propia plataforma de trading, asegurar licencias y establecer infraestructuras de cumplimiento y TI pueden aumentar fácilmente. Además, el plazo para lanzar una correduría totalmente funcional desde cero se extiende durante varios meses, si no años. Este prolongado período de desarrollo puede ser un inconveniente crítico en el rápidamente evolutivo mercado de Forex.

Solución de Marca Blanca: Entrada al Mercado Eficiente en Costos y Rápida

Por otro lado, tratar con un proveedor de etiqueta blanca de Forex presenta una ruta más fácilmente disponible para tener una correduría de Forex. Generalmente entre $10,000 y $70,000, los gastos para establecer una correduría de etiqueta blanca son mucho menores que los de comenzar desde cero. Esta asequibilidad permite que más propietarios de pequeñas empresas y emprendedores ingresen al mercado de divisas.

Quizás la característica más atractiva de un producto de etiqueta blanca es su rapidez de implementación. Un broker de Forex de etiqueta blanca puede estar en funcionamiento en unas pocas semanas, lo que permite una rápida entrada en el mercado. Esta rápida configuración es crucial para capitalizar las posibilidades actuales del mercado y establecer una posición en el sector sin los significativos retrasos involucrados en iniciar un broker desde cero.

Una ventaja importante de los sistemas de marca blanca es la simplicidad operativa. Al aliviar gran parte de la carga técnica y legal, permiten a la correduría concentrarse en la adquisición de clientes, la mejora del servicio y la construcción de la marca. Aunque la personalización puede ser algo limitada en comparación con una solución personalizada, la mayoría de los sistemas de marca blanca ofrecen suficiente flexibilidad y funcionalidad para establecer una clara presencia en el mercado. Las personas interesadas podrían explorar herramientas como el seminario web "Cómo iniciar una correduría de marca blanca desde cero" para tener una mejor comprensión sobre cómo empezar una correduría de marca blanca desde cero. Este seminario web te guía a través de las etapas clave y los problemas de iniciar una correduría de Forex de marca blanca rentable, proporcionando información útil y consejos prácticos.

Conclusión

Iniciar una corretaje de Forex en 2024 es un negocio exigente pero potencialmente rentable. Construirás la base para una empresa de corretaje de Forex rentable leyendo y aplicando cuidadosamente estas directrices. Ya sea que empieces desde cero o te apoyes en una solución de etiqueta blanca, el secreto del éxito es la planificación estratégica, el conocimiento del mercado y la adherencia a las restricciones regulatorias.

FAQ

Elegir tu modelo de negocio (A-Book, B-Book o Híbrido), registrar tu negocio, seleccionar una jurisdicción, obtener una licencia e integrar elementos esenciales como una plataforma de trading, CRM/back office, proveedores de liquidez y soluciones de pago son todos necesarios para lanzar una correduría de Forex. Construye tu sitio web, recluta personal y comienza el marketing y la adquisición de clientes tan pronto como la infraestructura esté preparada. La opción de lanzamiento más rápida y económica actualmente es proporcionada por soluciones de marca blanca.

Dependiendo de la selección de la plataforma y las características, el costo promedio de lanzamiento de una correduría de marca blanca en 2026 oscila entre $10,000 y $70,000. Debido al desarrollo, licencias, infraestructura y personal, comenzar desde cero puede costar entre $150,000 y $500,000 o más. También es necesario planificar los gastos operativos como marketing, cumplimiento y soporte.

Por supuesto. Para llevar a cabo negocios de manera legal y obtener acceso a servicios bancarios, PSP y de liquidez, se necesita una licencia. Tienes la opción de: Jurisdicciones de nivel 1: Australia, el Reino Unido y la UE Estándares más altos, mayor confianza Autoridades de nivel medio (Labuan, Mauricio y Chipre): Un equilibrio entre supervisión y costos Jurisdicciones offshore: Las configuraciones más rápidas y económicas, como en Seychelles, Comoras y San Vicente.

Actualizado:

1 de diciembre de 2025