MT4 y MT5 Alternativas: Resumen de la Plataforma de Trading

Contenidos

Explorar alternativas a MetaTrader 4 y MetaTrader 5 expone un mundo de soluciones de trading avanzadas con más características, ejecución más rápida y más libertad de personalización. Con MT4 y MT5 dominando el mercado minorista de forex, hay varias alternativas robustas que ahora ofrecen herramientas de nivel institucional, interfaces modernas y soporte multi-activo que pueden transformar tu experiencia de trading. Esta guía explora las mejores plataformas utilizadas para el trading hoy y te ayuda a tomar la decisión correcta sobre la solución que mejor se adapte a tus requisitos.

¿Qué son MT4 y MT5?

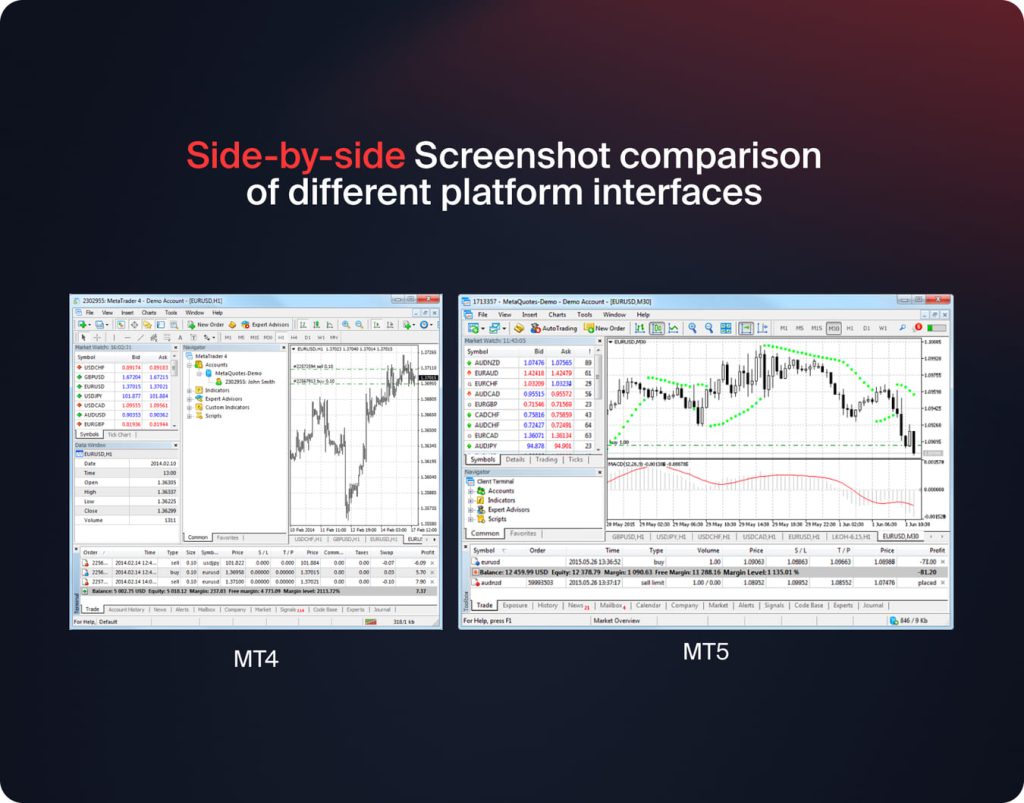

Las plataformas MetaTrader han dado forma al comercio en línea durante casi dos décadas. MT4, lanzado en 2005, se convirtió en la opción estándar de la industria para los traders de forex en todo el mundo gracias a su facilidad de uso y su enorme comunidad de ayuda. MT5 se lanzó en 2010 con comercio de múltiples activos y más capacidades analíticas.

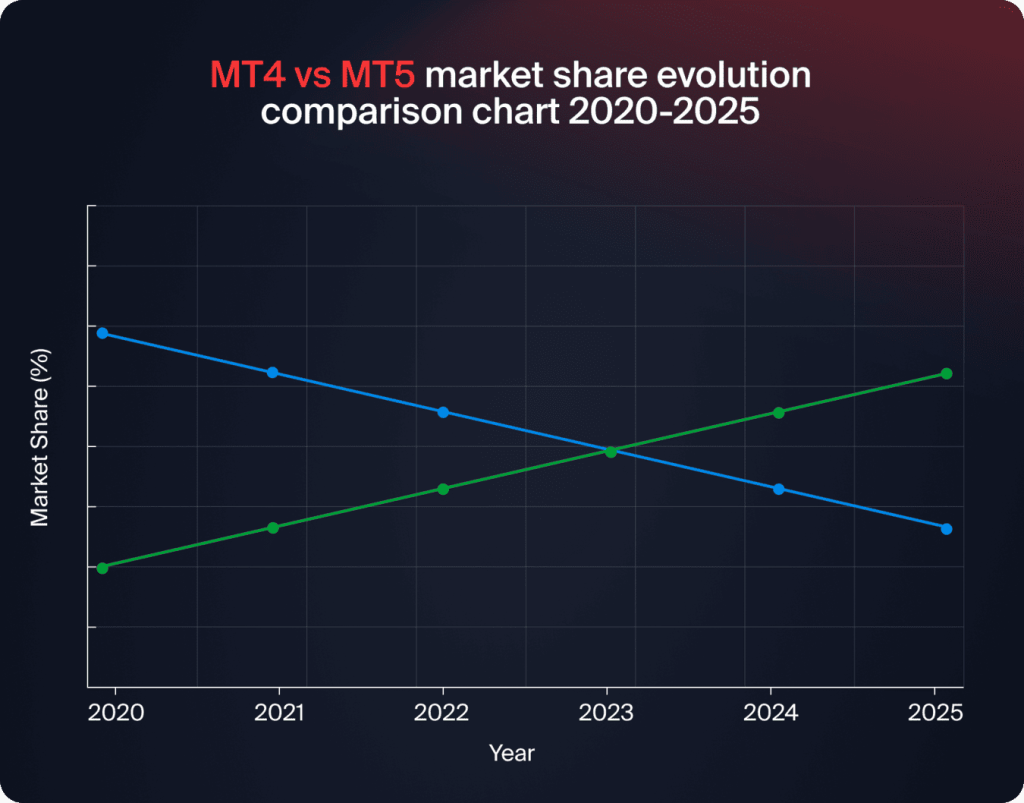

Las cifras pintan un cuadro interesante cuando se trata de estas plataformas. MT5 ha superado a MT4 en volumen de trading, con informes a principios de 2025 que muestran que capturó el 54.2% del volumen combinado entre las dos plataformas. El movimiento refleja cambios en las preferencias de los traders por herramientas más sofisticadas y un mejor acceso a los mercados.

A pesar del cambio en el volumen, MT4 retiene una base de usuarios vasta y leal. Sigue siendo ampliamente respaldado por los corredores y preferido por muchos traders, particularmente aquellos enfocados en forex, debido a su simplicidad, amplia biblioteca de Asesores Expertos (EAs) y fuerte apoyo de la comunidad.

¿Por qué considerar alternativas a MT4 y MT5?

Las plataformas MetaTrader sobresalen en la mayoría de los aspectos, pero no son para todos. Varios inconvenientes llevan a los traders hacia otras alternativas que abordan mejor sus requisitos específicos.

Las alternativas modernas ofrecen velocidades de ejecución más rápidas, interfaces más amigables y una mayor capacidad de personalización. La mayoría de las plataformas proporcionan funcionalidades a nivel institucional que no estaban disponibles para los traders minoristas antes, incluyendo tipos de órdenes sofisticados, soporte mejorado para el trading algorítmico y acceso total a múltiples activos.

El panorama de los mercados ha cambiado mucho desde el lanzamiento de MT4. Los traders de hoy anticipan experiencias móviles sin interrupciones, herramientas de colaboración en tiempo real y funcionalidad de trading social integradas en las plataformas. Las soluciones alternativas cumplen con estas expectativas a través de una arquitectura basada en la nube, los últimos principios de diseño y funciones innovadoras que se ajustan a la innovación del mercado.

También te puede gustar

Principales alternativas a plataformas de trading

A continuación se presentan las principales alternativas a las plataformas de trading MT4 y MT5, sin un orden en particular.

Quadcode

Quadcode ofrece una solución de plataforma de trading de marca blanca de extremo a extremo, construida específicamente para corredurías que desean lanzar su propio entorno de trading con marca. A diferencia de las plataformas diseñadas para el comercio minorista, Quadcode ofrece toda la pila tecnológica utilizada para operar una correduría moderna.

La plataforma tiene una interfaz de usuario de trading web y móvil altamente personalizable que se puede adaptar según los requisitos de la correduría. La personalización permite a las empresas crear experiencias de trading diferenciadas que las distingan en mercados competitivos.

La solución de Quadcode está integrada con la infraestructura de corretaje fundamental como sistemas de CRM, procesadores de pagos y soluciones de gestión de riesgos. La plataforma admite múltiples clases de activos como divisas, materias primas, criptomonedas, acciones e índices desde una única interfaz.

Lo que hace que Quadcode sea particularmente atractivo es su rápido cronograma de implementación. Los corredores pueden tener plataformas de trading completamente equipadas instaladas y en funcionamiento en dos semanas, un tiempo de comercialización significativamente reducido en comparación con el lanzamiento de soluciones personalizadas.

Los aspectos destacados son:

- Pantalla de trading personalizada con gráficos sofisticados

- Cobertura de múltiples activos de las principales clases de instrumentos

- Gestión integrada de liquidez y cotizaciones

- Características administrativas del back-office empresarial

- Comercio entre dispositivos con diseño móvil responsivo

cTrader

cTrader es una plataforma muy sofisticada específicamente para traders profesionales y entusiastas del trading algorítmico. Su diseño elegante y de vanguardia proporciona una experiencia de usuario excepcional mientras ofrece características sólidas que rivalizan con soluciones institucionales.

La plataforma sobresale en ciertos aspectos críticos que son más importantes para los traders serios. El Acceso Directo al Mercado (DMA) proporciona precios transparentes sin pasar por un intermediario, asegurando una ejecución justa en cada operación. Las sofisticadas capacidades de gráficos incluyen más de 70 indicadores técnicos, varios marcos de tiempo y personalización ilimitada.

Los traders algorítmicos aprecian especialmente el entorno cAlgo de cTrader que ofrece desarrollo de estrategias automatizadas a través de C#. El motor de backtesting de la plataforma proporciona resultados precisos, y su arquitectura basada en la nube permite un despliegue sin problemas de estrategias a múltiples brokers.

cTrader es ofrecido por IC Markets y otros brokers de alto nivel y puede ser fácilmente accesible para traders de nivel profesional. La plataforma soporta plataformas de escritorio, web y móviles con el mismo conjunto de características en todos los dispositivos.

Ventajas clave:

- Ejecutación rápida de pedidos con latencia de sub-milisegundos

- Precio del Nivel II para la transparencia de la profundidad total del mercado

- Funcionalidades avanzadas de gestión de riesgos como stops móviles y stops garantizados

- API completa para integración y desarrollo personalizados

TradingView

TradingView revolucionó totalmente la forma en que los traders analizan los mercados al combinar características de gráficos robustos con aspectos de redes sociales. La plataforma cuenta con millones de traders de todo el mundo que comercian, intercambian ideas, conceptos, estrategias y análisis de mercado en tiempo real.

El gráfico por sí solo vale la popularidad de TradingView. Más de 100 indicadores técnicos vienen preinstalados, y hay miles más disponibles a través de contribuciones de la comunidad. El lenguaje de programación, Pine Script, permite a los usuarios crear sus propios indicadores y estrategias personalizados sin requerir habilidades de codificación extensas.

Lo que realmente distingue a TradingView es su comunidad social. Los traders comparten análisis, informan sobre las condiciones del mercado y siguen a inversores exitosos cuyas estrategias satisfacen sus necesidades. Este proceso colaborativo transforma el trading de una actividad individual a un evento social divertido.

El modelo freemium de la plataforma ofrece un uso gratuito generoso, con niveles premium que desbloquean características avanzadas como múltiples gráficos, datos en tiempo real y soporte prioritario. El comercio directo a través de los gráficos de TradingView es facilitado con los mejores corredores, lo que elimina la inconveniencia de cambiar entre plataformas.

NinjaTrader

NinjaTrader está destinado a traders activos, particularmente a aquellos que se enfocan en los mercados de futuros. La plataforma proporciona herramientas de calidad profesional que son apropiadas para traders diurnos y scalpers que necesitan precisión y velocidad.

Las potentes capacidades de entrada de órdenes distinguen a NinjaTrader de otras plataformas. Los llenados de órdenes simulados, el análisis del flujo de órdenes y las teclas de acceso rápido definibles por el usuario permiten a los traders ejecutar estrategias con precisión de milisegundos. La función de Analizador de Mercado realiza un escaneo en tiempo real a través de múltiples instrumentos simultáneamente.

El desarrollo de estrategias en NinjaTrader requiere programación en C#, lo que ofrece a los traders una flexibilidad tremenda para estrategias algorítmicas sofisticadas. La función de Analizador de Estrategias evalúa el rendimiento bajo diversas condiciones del mercado, lo que permite a los traders optimizar parámetros antes de arriesgar capital en vivo.

NinjaTrader también es un bróker con comisiones competitivas para el trading de futuros. Es un paquete todo en uno que simplifica la gestión de cuentas pero proporciona a los traders una ejecución a nivel institucional.

ProRealTime

ProRealTime domina los mercados europeos con sus potentes características de análisis técnico y comercio automatizado. El sistema atrae especialmente a los traders que utilizan intensamente patrones gráficos e indicadores técnicos.

El lenguaje de programación ProBuilder permite a los traders construir indicadores personalizados sin necesidad de un amplio conocimiento en programación. Mientras tanto, ProOrder ejecuta estrategias automáticamente basadas en condiciones específicas del mercado, eliminando la toma de decisiones emocionales.

El escáner de ProRealTime está programado para monitorear miles de instrumentos simultáneamente y marcar oportunidades que cumplan con criterios técnicos específicos. Esta función es particularmente beneficiosa para los traders de posiciones y los traders de swing que operan en múltiples mercados.

El cumplimiento regulatorio dentro de Europa está integrado, lo que hace de ProRealTime una solución perfecta para los traders con sede en Europa que buscan emplear soluciones totalmente reguladas. La integración sin problemas con los principales brokers europeos está disponible en la plataforma, garantizando diferenciales competitivos y una ejecución estable.

También te puede gustar

Interactive Brokers TWS

La Trader Workstation (TWS) de Interactive Brokers ofrece capacidades a nivel institucional a traders individuales a precios simplemente excelentes. La plataforma proporciona acceso a 150 mercados en 33 naciones, brindando un acceso global sin igual.

TWS establece el estándar para el negocio de opciones con herramientas de análisis sofisticadas como calculadoras de probabilidad, analizadores de volatilidad y constructores de estrategias. Los traders de renta fija disfrutan de acceso sin restricciones a mercados de bonos completos con precios abiertos y liquidez significativa.

La función de trading de cesta de la plataforma permite la ejecución concurrente de órdenes contra múltiples valores, lo cual es útil en la reestructuración de carteras o estrategias de trading de pares. Las opciones de gestión de riesgos incluyen análisis de margen en tiempo real y personalización de alertas.

El plan de comisiones bajas de Interactive Brokers hace que TWS sea atractivo para los traders activos. La API de la plataforma soporta el desarrollo personalizado y la integración con software de terceros y sistemas de trading propietario.

TradeStation

TradeStation fue pionero en el comercio electrónico para inversores individuales y sigue empujando los límites de la innovación. El sistema tiene mejores herramientas para los operadores de opciones, incluyendo herramientas innovadoras de escaneo y análisis de estrategias.

La tecnología RadarScreen escanea miles de acciones, opciones y futuros simultáneamente con alertas completamente editables. Los traders pueden escanear en busca de una configuración técnica específica, criterios fundamentales o patrones de actividad anormales en todos los mercados.

La programación en EasyLanguage hace que la creación de estrategias sea accesible para los traders con habilidades de codificación limitadas. Se pueden obtener cifras de rendimiento detalladas, incluyendo análisis de drawdown, factor de beneficio y estadísticas de tasa de éxito, del motor de pruebas de estrategias.

TradeStation es una firma de corretaje también, y ofrece operaciones de acciones y ETF sin comisiones además de tarifas competitivas para opciones y futuros. Esta integración mantiene la conveniencia en la gestión de cuentas mientras proporciona una ejecución de calidad profesional a los traders.

Tabla de Comparación: Visión General de Alternativas a MT4 & MT5

| Plataforma | Ideal Para | Características Clave | Activos Soportados | Personalización / Marca | Fortaleza Única |

| Quadcode | Corretajes y startups fintech | Pila de tecnología de trading white label de extremo a extremo, CRM integrado, pagos, herramientas de riesgo | Forex, Acciones, Commodities, Cripto, Índices | Personalización completa de marca blanca (UI, branding, integraciones) | Infraestructura de corretaje todo en uno con despliegue en 2 semanas |

| cTrader | Traders profesionales y algorítmicos | Acceso DMA, más de 70 indicadores, gráficos de múltiples marcos temporales, profundidad de mercado completa | Forex, CFDs, Commodities, Cripto | Limitado (a través de marca blanca del corredor) | Precios transparentes y calidad de ejecución institucional |

| TradingView | Traders minoristas y sociales | Gráficos basados en la nube, más de 100 indicadores, Pine Script, comunidad social | Acciones, Forex, Cripto, Commodities | No es marca blanca (enfocado en el usuario) | Masiva comunidad de trading social con gráficos poderosos |

| NinjaTrader | Traders activos de día y futuros | Análisis de flujo de órdenes, Analizador de Mercado en tiempo real, teclas de acceso rápido personalizables | Futuros, Forex, Acciones | UI propietario | Mejor para traders de futuros que buscan herramientas de calidad institucional |

| ProRealTime | Traders técnicos y de swing europeos | Más de 100 indicadores, trading automatizado ProOrder, escáner de múltiples mercados | Acciones, Forex, Futuros | Marca limitada | Análisis técnico profundo e integración regulatoria europea |

| Interactive Brokers TWS | Traders institucionales globales y avanzados | Análisis de opciones, trading de bonos, órdenes en cesta, análisis de margen | Más de 150 mercados globales (Acciones, Bonos, Forex, Opciones, Futuros) | Sin marca (plataforma propietaria) | Acceso al mercado global y análisis de calidad profesional |

| TradeStation | Desarrolladores de múltiples activos y estrategias | Escaneo RadarScreen, constructor de estrategias EasyLanguage, análisis profundo | Acciones, Opciones, Futuros, ETFs | Propietario | Integración fluida de corretaje + análisis avanzado |

| MT4 | Traders de Forex, principiantes | 30 indicadores incorporados, soporte EA, plugins de la comunidad | Solo Forex | Limitado (marca del corredor) | Simplicidad y ecosistema comunitario |

| MT5 | Traders de múltiples activos | 38 indicadores, retrocesos multihilo, más marcos temporales | Forex, Acciones, Commodities, Cripto | Limitado |

Cómo Elegir la Plataforma Correcta

- Coincidencia de plataforma y modelo de negocio: Si su negocio tiene un modelo híbrido (creador de mercado + ECN), elija un proveedor que ofrezca rutas de ejecución flexibles.

- Verificar la hoja de ruta del proveedor y la fiabilidad: Una plataforma necesitará evolucionar. Haga preguntas sobre mejoras futuras, soporte y garantías de tiempo de actividad.

- Evaluar personalización & APIs: Tu front end, CRM y oficina administrativa deben integrarse sin problemas.

- Calcular el costo verdadero y la licencia: No solo mires las tarifas iniciales; añade el mantenimiento, las extensiones de funciones y el alojamiento.

- Prueba con piloto/sandbox: Antes de la migración completa, prueba con unos pocos cientos de usuarios.

- Monitorear la retroalimentación del usuario y prepararse para iterar: La resistencia del cliente es real; minimiza la fricción en la incorporación.

Desde nuestra experiencia, diferentes tipos de personas son más adecuadas para diferentes alternativas. Para los minoristas en línea, opciones como cTrader, TradingView o NinjaTrader son excelentes elecciones sobre MetaTrader, con interfaces modernas y características adicionales. Las corredurías son mejor atendidas por soluciones de extremo a extremo como Quadcode que proporcionan pilas tecnológicas completas para una entrada inmediata en el mercado.

Conclusión

El mercado de plataformas de trading ofrece numerosas alternativas atractivas a MT4 y MT5 con características innovadoras, interfaces modernas y un rendimiento mejorado. Puede que seas un trader minorista en busca de herramientas más eficientes o una correduría creando tu propia plataforma. Comparar opciones más allá de MetaTrader desata una ventaja competitiva colosal. Tómate un tiempo para probar varias soluciones, considerando tanto las necesidades a corto plazo como las aspiraciones a largo plazo, para encontrar la plataforma que realmente transforme tu experiencia de trading.

FAQ

MT5 presenta comercio multi-activo junto con forex, como acciones, materias primas y criptomonedas, mientras que MT4 se centra principalmente en forex. MT5 ofrece indicadores técnicos más sofisticados (38 frente a 30), marcos de tiempo adicionales y capacidades de retroceso mejoradas con soporte multi-moneda. MT4 sigue contando con una comunidad más amplia con indicadores de terceros adicionales y asesores expertos en existencia.

Sí, muchos traders utilizan múltiples plataformas para aprovechar diferentes fortalezas. Podrías usar TradingView para el análisis del mercado y la elaboración de gráficos mientras ejecutas operaciones a través de cTrader para obtener velocidades de ejecución superiores. Asegúrate de gestionar adecuadamente las posiciones entre plataformas para evitar el sobreapalancamiento o órdenes en conflicto.

Las tarifas varían significativamente entre plataformas. Algunas plataformas, como TradingView, ofrecen productos básicos gratuitos con mejoras premium voluntarias. Las plataformas de nivel profesional como cTrader suelen ser proporcionadas de forma gratuita a los traders minoristas, ya que los corredores subsidian las tarifas de licencia. Las soluciones de nivel institucional pueden cobrar suscripciones mensuales o tarifas basadas en operaciones. Compara los costos totales, incluidos los diferenciales, comisiones y tarifas de datos, no solo las tarifas de la plataforma.

Las curvas de aprendizaje varían entre plataformas, pero la mayoría de las alternativas son fáciles de aprender y requieren poca capacitación. La mayoría de las alternativas tienen tutoriales extensos, cuentas demo y soporte al cliente para facilitar las transiciones. El mayor desafío es la migración de estrategias, ya que los asesores expertos de MT4/MT5 no migrarán automáticamente a otras plataformas y deben ser recodificados en nuevos lenguajes de programación.

Estas alternativas tienden a tener una ejecución más rápida que las plataformas MetaTrader a través de una mejor infraestructura y acceso directo al mercado. Alternativas como cTrader permiten tiempos de ejecución en sub-milisegundos, mucho más rápidos que las implementaciones típicas de MT4/MT5. La calidad de la ejecución también depende, sin embargo, en gran medida, de la infraestructura de tu bróker y de las relaciones con los proveedores de liquidez.

Plataformas de marca blanca como Quadcode ofrecen altos niveles de personalización, como marca, colores y conjuntos de características. Algunas plataformas, como cTrader, tienen soporte de marca blanca a través de alianzas con corredores. Las plataformas propietarias como Interactive Brokers TWS generalmente no aceptarán personalización de marca ya que son soluciones integradas de corredor-plataforma.

Actualizado:

29 de octubre de 2025