Como Lançar Sua Plataforma de Negociação de Opções Binárias em 2026

Conteúdo

Lançar uma plataforma de negociação de opções binárias em 2026 posiciona você em um mercado de valor de $2,8 bilhões em 2023, com valores esperados alcançando $6,5 bilhões até 2032 com um CAGR de 9,5%.

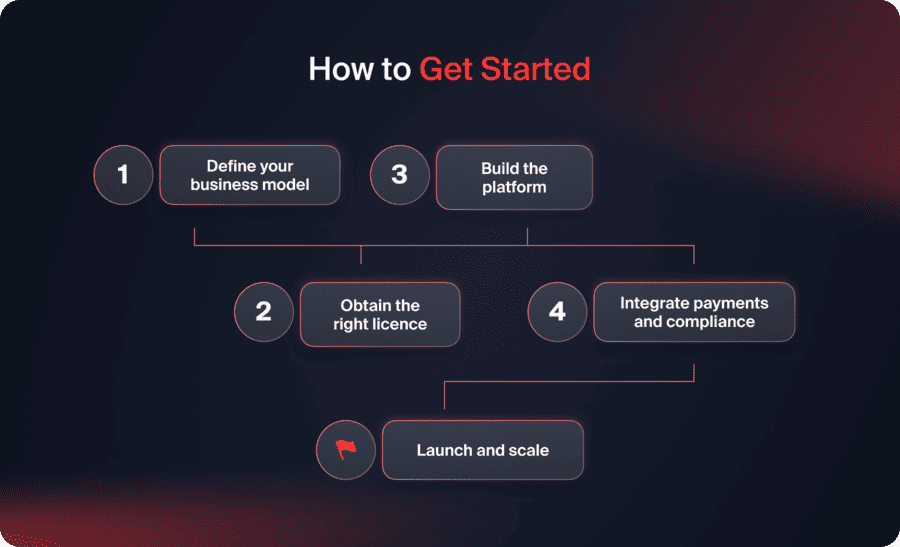

Se você está se perguntando como começar, aqui está uma resposta curta antes de mergulharmos nos detalhes:

- Defina seu modelo de negócios – escolha seus usuários-alvo, ativos e lógica de pagamento.

- Obtenha a licença correta – registre-se em uma jurisdição regulamentada ou offshore.

- Construa a plataforma – desenvolva do zero ou use uma plataforma de negociação de marca branca.

- Integre pagamentos e conformidade – configure KYC, AML e fluxos de transação seguros.

- Lançar e escalar – atrair traders por meio de educação, parcerias e programas de afiliados.

Vamos agora analisar o que será necessário para construir uma plataforma em conformidade, escalável e competitiva em 2026.

Mas, o Negócio de Opções Binárias é Lucrativo em 2026?

O mercado global de corretoras de opções binárias tinha um tamanho de $0,87 bilhão em 2024 e está previsto para crescer para $1,85 bilhão até 2033, com um CAGR de 9,1%. Um conjunto diferente de previsões alternativas coloca o mercado em um patamar mais alto, com o mercado global de corretoras de opções binárias sendo de $2,8 bilhões em 2023 e previsto para atingir $6,5 bilhões até 2032, com um CAGR de 9,5%.. As diferenças existem devido a diferenças metodológicas, mas ambas confirmam enormes oportunidades de crescimento.

As plataformas de negociação móvel estão experimentando um hiper crescimento, com 60% das negociações de opções binárias sendo executadas agora por smartphone ou tablet. Esse domínio móvel exige o desenvolvimento da plataforma, enfatizando design responsivo, interface de usuário otimizada para toque e experiência baseada em aplicativos em vez de estratégias focadas em desktop. Sua pilha de tecnologia precisa reconhecer essa mudança desde as decisões de arquitetura iniciais até a implantação final.

Onde o Comércio de Opções Binárias Está Crescendo?

O mercado da Ásia-Pacífico provavelmente demonstrará a maior taxa de crescimento, sendo impulsionado pelo aumento da penetração da internet e pela expansão da classe média. A Ásia-Pacífico está se desenvolvendo rapidamente, com mais traders entrando para capitalizar o crescimento do comércio de opções binárias na China, Índia e Japão. Existe um potencial estratégico para plataformas que atendem a mercados emergentes em pagamentos localizados, suporte a idiomas e ativos específicos da região.

A Europa e a América do Norte continuam a ser mercados sólidos, apesar de regulamentações mais rigorosas. A UE baniu a negociação de opções binárias para clientes de varejo em 2018, enquanto os EUA restringem a atividade a bolsas regulamentadas pela CFTC, como a Nadex. As barreiras regulatórias criam preocupações de conformidade, mas também reduzem a concorrência entre plataformas devidamente licenciadas.

Quanto Custa Construir uma Plataforma de Opções Binárias?

Visão Geral da Estrutura de Custos

- Plataformas básicas com recursos de negociação fundamentais, seleção simples de ativos, tipos de contratos padrão e acesso apenas pela web custam de $80.000 a $120.000 e levam de 4 a 6 meses para serem construídas.

- Plataformas de média complexidade com aplicativos móveis nativos, gráficos avançados, múltiplos tipos de contrato, sistemas de back-office completos e segurança aprimorada custam entre $150,000 e $250,000 e precisam de 6 a 9 meses.

- Plataformas empresariais avançadas com análises de IA, negociação social, negociação por cópia, gestão de riscos sofisticada e conformidade em múltiplos países custam entre $300,000 e $600,000+ e requerem de 12 a 18+ meses de desenvolvimento.

- Soluções de marca branca fazem você entrar no ar em 4-8 semanas por $30.000-$80.000 adiantados, além de taxas de licenciamento contínuas.

Custos Operacionais Recorrentes

A hospedagem em nuvem escala com seus usuários: $3,000-$12,000 por mês para servidores, bancos de dados e infraestrutura de aplicativos. Assinaturas de dados de mercado adicionam mais $500-$5,000, dependendo da cobertura de ativos. O processamento de pagamentos leva de 2-5% de cada depósito e retirada. A conformidade (consultoria jurídica, relatórios regulatórios) custa de $8,000-$20,000 mensalmente.

Seu maior gasto? Aquisição de clientes e marketing: $15.000-$100.000+ por mês, dependendo de onde você está mirando. Como as principais plataformas proíbem anúncios de opções binárias, você precisará se apoiar fortemente em programas de afiliados, marketing de conteúdo e parcerias.

Como as Plataformas de Opções Binárias Ganham Dinheiro?

As plataformas de opções binárias ganham dinheiro na maioria das vezes através da disparidade entre negociações lucrativas e perdedoras. Quando os traders fazem previsões de preços precisas, eles são recompensados com somas fixas, tipicamente na faixa de 70-95% do investimento inicial. Negociações perdedoras perdem todo o investimento, e o corretor retém esses fundos menos os pagamentos das negociações bem-sucedidas. O sistema de vantagem da casa deve ter percentuais de pagamento bem equilibrados em relação aos custos operacionais e à retenção de traders.

Quais são as Fontes de Receita Adicionais?

Fontes complementares de receita complementam a receita primária de negociação. Níveis de conta premium em camadas cobram uma taxa mensal por taxas de pagamento mais altas, gerentes de conta pessoais ou melhores análises. Conteúdo educacional, serviços de sinal e copy trading geram receita adicional enquanto aumentam as taxas de sucesso dos traders. Seu modelo de negócios de corretagem deve diversificar as fontes de renda para se proteger contra mudanças nos volumes de negociação.

Quem Você Deve Alvo com Sua Plataforma de Opções Binárias?

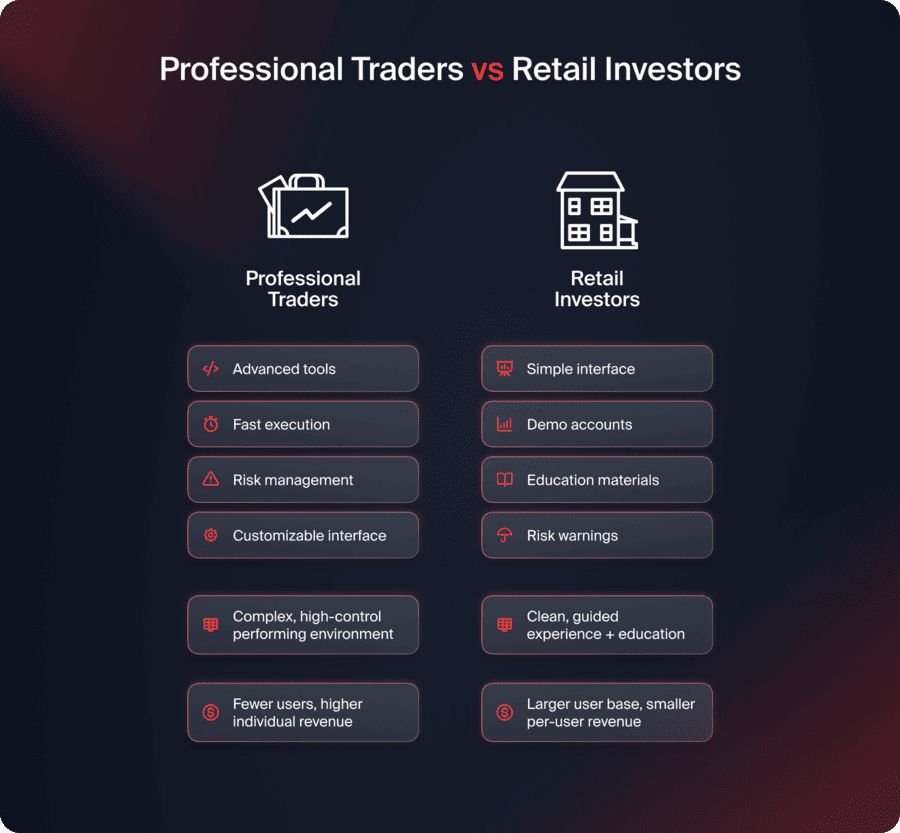

Definir seu mercado-alvo coloca você em uma posição poderosa para aproveitar ao máximo sua plataforma de negociação de opções binárias. Traders profissionais são os principais interessados que você precisa se preparar para atender. Eles precisam de ferramentas avançadas, execução rápida, ferramentas de gerenciamento de risco e interfaces fáceis de usar para máxima funcionalidade.

Os traders de varejo, particularmente os novatos, precisam de interfaces limpas que os guiem na configuração de trades sem serem sobrecarregados por muitas escolhas. Materiais educacionais, contas demo e avisos de risco educam os novos entrantes sobre a mecânica das opções binárias antes de arriscar capital real. Algumas jurisdições exigem certificação de educação do investidor e triagem de adequação antes de permitir a negociação ao vivo, portanto, esses aspectos são obrigatórios do ponto de vista regulatório.

As Opções Binárias São Legais? Quais Licenças Você Precisa?

As opções binárias são melhor controladas do que alguns produtos financeiros devido ao uso indevido histórico do setor. A venda, distribuição e promoção de opções binárias para consumidores de varejo na UE foram banidas pela Autoridade Europeia de Valores Mobiliários e Mercados (ESMA) em 2018. Os Estados Unidos apenas permitem a negociação de opções binárias em bolsas e derivativos regulados pela CFTC, e a Nadex é atualmente a única plataforma em operação.

Onde Você Pode Obter uma Licença para Negociação de Opções Binárias?

Locais offshore oferecem licenciamento de baixo custo com menos peso e processamento mais rápido. A Autoridade de Serviços Financeiros das Seychelles, a Comissão de Serviços Financeiros de Vanuatu e a Autoridade de Serviços Financeiros de Labuan são as melhores opções. Custam entre $10.000 e $50.000 com um tempo de processamento de 2 a 4 meses, o que é perfeito para novas startups com pouco capital.

No entanto, licenças offshore apresentam problemas de credibilidade e proibições de publicidade. Muitos processadores de pagamento se recusam a se juntar a sites de opções binárias licenciados offshore devido a preocupações com fraudes. O Google, o Facebook e outros grandes canais de publicidade não permitirão anúncios para opções binárias, o que significa que você terá que contar com canais de marketing alternativos.

Você pode considerar novos mercados regulamentados na América Latina, África e Ásia que oferecem estruturas regulatórias equilibradas sem custos proibitivamente altos.

Você também pode gostar

Quais Requisitos de Conformidade Você Precisa?

Regimes de conformidade robustos são a pedra angular da sua empresa, evitando violações regulatórias, multas ou revogação de licença. Procedimentos de Conheça Seu Cliente (KYC) verificam as identidades dos traders com o uso de documentos governamentais, verificação de endereço e potencialmente fotos de selfie, confirmando que o solicitante se parece com sua identificação. Ferramentas de verificação automatizadas como Sumsub ou Jumio facilitam esse trabalho enquanto fornecem trilhas de auditoria.

Os controles de Prevenção à Lavagem de Dinheiro (PLD) monitoram transações, registrando atividades suspeitas como depósitos e retiradas repentinas, padrões de negociação incomuns ou associações com atividades criminosas. Controles como limites de depósito, limites de perda, autoexclusão e períodos de reflexão trabalham contra as características de jogo da negociação de opções binárias. A maioria das jurisdições exige esses controles para clientes de varejo.

Como Construir Sua Plataforma de Negociação de Opções Binárias?

Para construir suas plataformas de negociação de opções binárias, há alguns fatores chave que você deve observar. Alguns deles foram destacados abaixo.

Recursos a Incluir

As interfaces de negociação de opções binárias são diferentes das plataformas regulares de ações ou forex. Os traders precisam: escolher um ativo, decidir se o preço vai subir ou descer, inserir o valor do investimento e confirmar a negociação.

A sua interface precisa mostrar claramente os pagamentos potenciais, os tempos de expiração, os preços atuais e o histórico recente de preços. Tudo deve ser óbvio à primeira vista.

As operações precisam ser executadas em milissegundos e confirmadas instantaneamente. Gráficos em tempo real com ferramentas de análise técnica (gráficos de velas, gráficos de linhas, gráficos de área cobrindo intervalos de tempo de 1 minuto a diário) ajudam os traders a tomar decisões informadas.

Quais Ativos Você Deve Oferecer?

Comece com o essencial: principais pares de moedas (GBP/USD, USD/JPY), ações populares (Apple, Tesla, Amazon), commodities (ouro, prata, petróleo), pares de cripto (BTC/USD, ETH/USD) e principais índices (S&P 500, NASDAQ, FTSE 100).

Many brokers are expanding into newer asset classes like more cryptocurrencies, ETFs, and even options based on economic indicators.

Quais Tipos de Contrato Você Deve Incluir?

A variedade mantém os traders envolvidos, então além de simples previsões de "vai subir ou descer", tente oferecer:

- Contratos Touch/No Touch – ganha se o preço atingir (ou não atingir) um nível específico antes do vencimento

- Contratos de intervalo – lucros quando os preços permanecem dentro dos limites

- Contratos de opções – múltiplos preços de exercício com diferentes pagamentos para risco/recompensa estruturados

Quais Recursos de Gestão de Risco São Necessários?

Calculadoras de tamanho de posição ajudam os traders a determinar os valores de investimento apropriados com base no tamanho da conta e na tolerância ao risco. A maioria das plataformas limita as negociações únicas a 5-10% do valor da conta para evitar perdas totais.

Os períodos de resfriamento impõem pausas após perdas consecutivas ou quando os limites de perda diária são alcançados, permitindo que os traders façam uma pausa e reconsiderem sua estratégia.

A proteção contra saldo negativo impede que os traders percam mais do que o saldo de sua conta, mesmo quando os mercados se comportam de maneira extremamente errática. A divulgação clara das perdas máximas por negociação e dos resultados potenciais não é apenas uma melhor prática—os reguladores geralmente a exigem.

Você também pode gostar

Que tecnologia você precisa para uma plataforma de Opções Binárias?

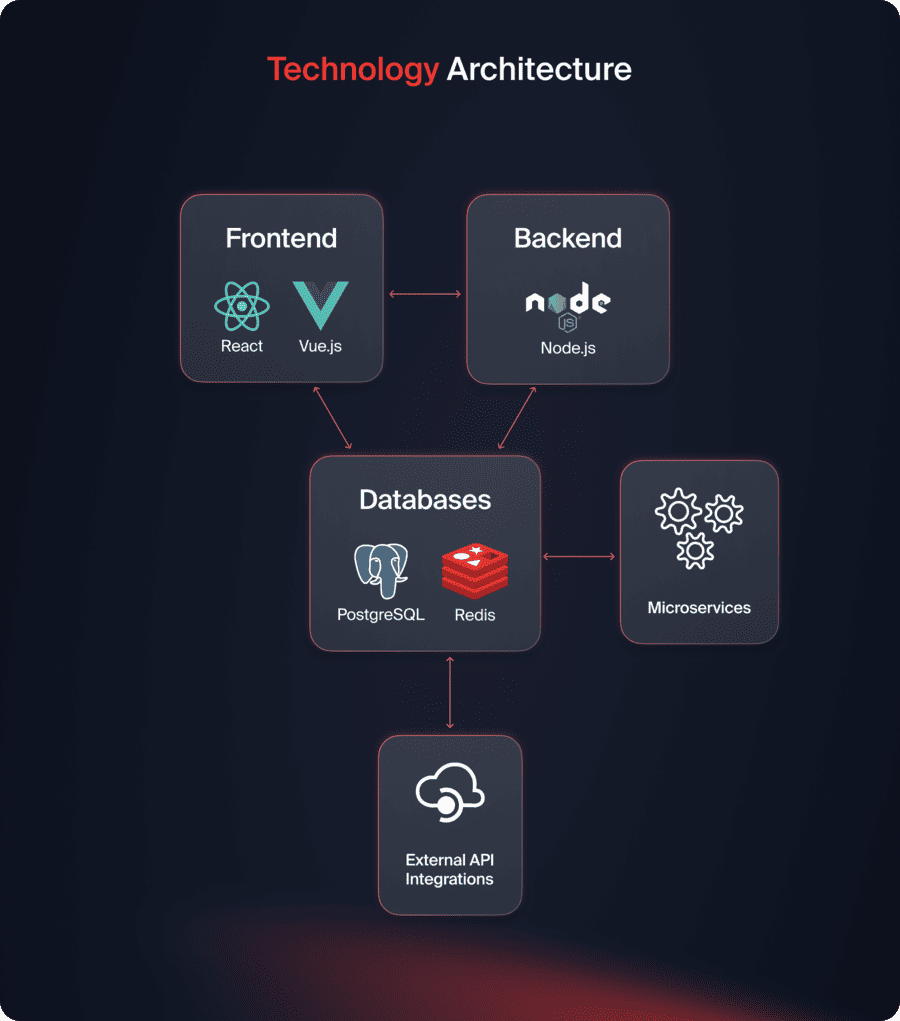

Desenvolvimento Frontend e Backend

React ou Vue.js funcionam muito bem para construir interfaces responsivas que funcionam suavemente em navegadores de desktop, tablet e mobile. Aplicativos Web Progressivos (PWAs) oferecem funcionalidade semelhante a aplicativos sem lidar com o processo de aprovação e restrições das lojas de aplicativos da Apple e do Google.

Node.js é mais adequado para transmissões ao vivo de informações e para lidar com múltiplas conexões necessárias em plataformas de negociação. PostgreSQL armazena contas de usuários, histórico de transações e dados de negociação com sólida confiabilidade. Redis fornece cache ultrarrápido para preços em tempo real e posições ao vivo.

A arquitetura de microserviços contém o mecanismo de negociação, gerenciamento de usuários, processamento de pagamentos e relatórios dentro de serviços distintos, cada um escalando de forma independente com base na demanda. Esses componentes arquitetônicos são frequentemente pré-integrados com plataformas de negociação de marca branca, reduzindo o nível de complexidade do desenvolvimento.

Como Você Obtém Dados de Mercado em Tempo Real?

As feeds de preços em tempo real de provedores como IEX Cloud, Alpha Vantage ou CryptoCompare alimentam os dados de mercado da sua plataforma. As opções binárias precisam de precisão de preços segundo a segundo, uma vez que as negociações são decididas em horários de expiração exatos.

Para criptomoedas, você precisará de conexões com várias exchanges e deve fazer uma média de preços para evitar manipulações causadas por picos repentinos em exchanges individuais. Seja qual for sua abordagem, os reguladores esperam uma divulgação clara de suas fontes de preço e métodos de cálculo.

Com base em nossa experiência, descobrimos que o processamento de pagamentos, os relacionamentos bancários e a infraestrutura operacional exigem tanta atenção quanto a tecnologia de negociação. Nossas soluções incluem processadores de pagamento pré-integrados, sistemas de conformidade e fluxos de trabalho operacionais comprovados que previnem essas falhas de supervisão.

Conclusão

O lançamento bem-sucedido de uma plataforma de opções binárias em 2026 envolve a navegação bem-sucedida por regulamentações sofisticadas, a utilização de gerenciamento de risco de grau A e tecnologia de ponta ou know-how especializado no mercado em crescimento. Aproveitar soluções de plataforma de negociação estabelecidas também reduz o tempo de lançamento no mercado.

Além disso, alinha recursos para conformidade regulatória e estratégias de aquisição de clientes que evitam proibições publicitárias. O posicionamento estratégico em mercados emergentes, o suporte a criptomoedas e a liderança em educação criam forças competitivas duradouras neste setor de fintech desafiador, mas lucrativo.

FAQ

Plataformas básicas custam $80,000-$120,000, e sistemas avançados $300,000-$600,000+. Plataformas com marca branca custam $30,000-$80,000 pela licença base e taxas adicionais opcionais de licença. Taxas de conformidade, marketing e infraestrutura são um adicional de $30,000-$150,000+ por mês.

A UE baniu completamente as opções binárias de varejo, e os EUA restringem as operações a bolsas regulamentadas pela CFTC, como a Nadex. Locais offshore, como Seychelles, Vanuatu e Labuan, oferecem licenciamento a baixo custo com preços entre $10.000 e $50.000, com um tempo de processamento de 2 a 4 meses, mas com limitações de marketing e bancárias.

As plataformas lucram com a diferença entre negociações vencedoras e perdedoras. As negociações perdedoras perdem todo o seu investimento, enquanto as negociações vencedoras ganham de 70 a 95% de retorno, e os corretores retêm o spread. Quando não considerado, outros lucros são gerados com assinaturas premium, vendas de sinais de negociação e a venda de materiais educacionais.

Ofertas de marca branca chegam ao mercado em 4-8 semanas, com personalização e licenciamento. O desenvolvimento personalizado leva de 4 a 6 meses para plataformas simples, de 6 a 9 meses para complexidade média e de 12 a 18+ meses para sistemas complexos. O licenciamento regulatório leva de 2 a 6 meses adicionais, dependendo da localização.

A legalidade das opções binárias varia significativamente de acordo com a jurisdição. Elas são proibidas para usuários de varejo na UE, restritas a bolsas da CFTC na América, mas permitidas na maioria da Ásia, África e América Latina com a devida licença. Sempre revise o status regulatório nos mercados-alvo antes do lançamento.

Atualizado:

26 de novembro de 2025