Quay lại

Contents

Cược chênh lệch: Nó là gì và hoạt động như thế nào?

Demetris Makrides

Senior Business Development Manager

Vitaly Makarenko

Chief Commercial Officer

Cược chênh lệch giá là một phương pháp giao dịch phái sinh cho phép bạn dự đoán biến động giá trên thị trường tài chính và đặt cược vào số điểm giá sẽ biến động mà không cần sở hữu tài sản cơ sở. Bạn theo dõi giá trị của một tài sản và đặt cược vào hướng giá thị trường, kiếm lợi nhuận từ cả thị trường giảm và tăng. Kỹ thuật giao dịch tiết kiệm thuế này (ở một số khu vực pháp lý) mở ra khả năng tiếp cận hàng ngàn thị trường như ngoại hối, chỉ số, hàng hóa và cổ phiếu riêng lẻ chỉ trong một tài khoản.

Cá cược chênh lệch là gì?

Cược chênh lệch giá là một phương pháp giao dịch phái sinh, trong đó bạn đặt cược vào hướng biến động giá của các sản phẩm tài chính thay vì mua chúng. Lợi nhuận hoặc thua lỗ của bạn sẽ phụ thuộc vào mức độ chính xác của dự đoán biến động giá và mức độ thị trường biến động theo hướng bạn mong muốn.

Hệ thống hoạt động dựa trên "chênh lệch giá" - chênh lệch giữa giá mua và giá bán của nhà môi giới. Các nhà môi giới đưa ra hai mức giá cho cược chênh lệch giá - "giá mua" mà bạn có thể mua và "giá bán" mà bạn có thể bán, trong đó các nhà môi giới kiếm được một khoản nhỏ từ chênh lệch giá này dưới dạng lợi nhuận.

Các thị trường chính có sẵn:

- Cặp tiền tệ Forex - EUR/USD, GBP/USD, USD/JPY

- Chỉ số chứng khoán - S&P 500, FTSE 100, DAX 30

- Cổ phiếu riêng lẻ - Apple, Tesla, Amazon

- Hàng hóa - Vàng, dầu, khí đốt tự nhiên

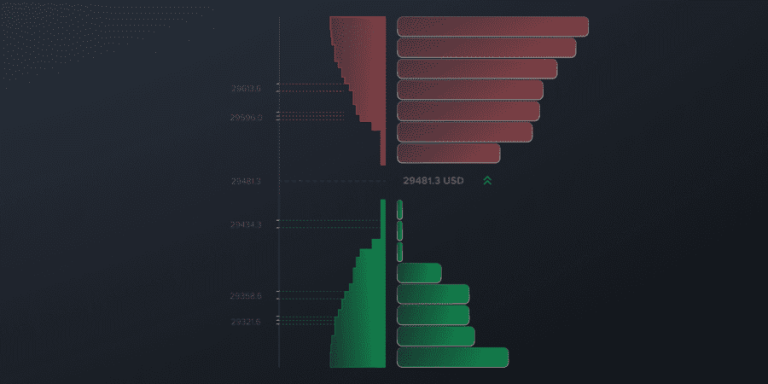

- Tiền điện tử - Bitcoin, Ethereum

Khác với đầu tư truyền thống, cá cược chênh lệch giá sử dụng đòn bẩy, cho phép bạn kiểm soát nhiều vị thế hơn với ít vốn hơn. Điều này làm tăng cả tiềm năng lãi và lỗ, và rủi ro phải được quản lý hợp lý để thành công.

Tính linh hoạt của nó chính là điểm hấp dẫn của cá cược chênh lệch giá. Bạn thắng dù thị trường tăng hay giảm, và bạn không cần phải tuân thủ giờ giao dịch cụ thể vì hầu hết các thị trường đều mở cửa 24/5.

Cách thức hoạt động của cá cược chênh lệch

Cơ chế lây lan

Mỗi cược chênh lệch giá bao gồm hai mức giá chính quyết định điểm vào và điểm thoát lệnh của bạn. Nhà môi giới đưa ra giá mua (cao hơn) và giá bán (thấp hơn), tức là mức chênh lệch giá, chính là biên lợi nhuận của họ.

Ví dụ, nếu EUR/USD có:

- Giá bán: 1.0985

- Giá mua: 1.0987

- Chênh lệch: 2 điểm

Trong cá cược chênh lệch giá, phí môi giới được bao gồm trong chênh lệch giá, do đó chênh lệch giá rộng hơn so với giao dịch CFD. Điều này có nghĩa là bạn sẽ phải trả nhiều hơn một chút cho sự tiện lợi và lợi ích về thuế mà cá cược chênh lệch giá mang lại.

Đi dài so với đi ngắn

Mua dài hạn

Khi bạn kỳ vọng giá tăng, bạn "mua" hoặc mua dài hạn. Bạn sẽ có lãi khi thị trường tăng cao hơn giá vào lệnh của bạn. Nếu EUR/USD là 1,0987 và bạn mua 10 bảng Anh cho mỗi điểm, mỗi điểm cặp tiền tăng trên 1,0987 sẽ mang lại cho bạn 10 bảng Anh.

Bán khống (Bán)

Khi bạn dự đoán giá sẽ giảm, bạn "bán" hoặc bán khống. Bạn sẽ có lãi khi thị trường chạm dưới mức vào lệnh của bạn. Trong cùng ví dụ, khi bạn bán ở mức 1,0985 và cặp tiền tệ giảm xuống còn 1,0975, bạn kiếm được 10 điểm x 10 bảng Anh = 100 bảng Anh.

Khả năng kép này giúp cá cược chênh lệch giá trở nên hữu hiệu trong thời kỳ thị trường suy thoái khi các nhà đầu tư truyền thống gặp khó khăn.

Xác định vị thế và mức cược

Tiền cược của bạn quyết định lợi nhuận và thua lỗ trên mỗi biến động của điểm thị trường. Nếu bạn đặt cược 5 bảng Anh cho mỗi điểm vào FTSE 100 và chỉ số này tăng 20 điểm theo hướng có lợi cho bạn, bạn sẽ nhận được 100 bảng Anh (20 x 5 bảng Anh).

Quản lý rủi ro bằng cách định cỡ vị thế:

- Bắt đầu với số tiền cược tối thiểu khi học

- Tránh rủi ro trên 2% vốn cho mỗi giao dịch

- Sử dụng lệnh dừng lỗ để hạn chế thua lỗ

- Hãy cân nhắc đến sự biến động của thị trường khi đưa ra quyết định về quy mô vị thế

Việc xác định quy mô vị thế trở nên tối quan trọng vì đòn bẩy sẽ nhân lên từng nhịp biến động của thị trường. Một khoản lỗ nhỏ 50 điểm trên một vị thế lớn có thể khiến số vốn khổng lồ bốc hơi chỉ trong vài giây.

Các loại lệnh nâng cao trong cá cược chênh lệch

Hầu hết các nền tảng đều cung cấp các loại lệnh nâng cao ngoài lệnh thị trường cơ bản. Lệnh dừng lỗ tự động đóng vị thế khi mức lỗ đạt đến mức được xác định trước, trong khi lệnh chốt lời đảm bảo lợi nhuận ở mức giá được xác định trước.

Lệnh dừng lỗ được đảm bảo là một khoản bảo hiểm bổ sung trong thời kỳ biến động, nhưng thường phát sinh thêm chi phí. Chúng cam kết sẽ khớp lệnh theo giá của bạn, ngay cả khi thị trường có chênh lệch, mang lại sự an tâm khi có tin tức lớn hoặc thị trường mở cửa.

Lệnh dừng lỗ tự động điều chỉnh khi vị thế biến động theo hướng có lợi cho bạn, khóa lợi nhuận đồng thời cho phép tăng thêm lợi nhuận. Nếu bạn đang mua một cổ phiếu ở mức giá 100 xu với lệnh dừng lỗ 10 xu, lệnh dừng lỗ sẽ di chuyển đến 110 xu khi cổ phiếu chạm mức 120 xu, bảo vệ khoản lãi 10 xu của bạn trong khi vẫn duy trì tiềm năng tăng giá.

You may also like

Cược chênh lệch so với các phương pháp giao dịch khác

Cá cược chênh lệch so với giao dịch CFD

Cả hai công cụ đều cung cấp khả năng tiếp cận thị trường và đòn bẩy tương tự, nhưng những khác biệt chính sẽ ảnh hưởng đến lợi nhuận của bạn.

- Xử lý thuế: Cược chênh lệch giá được miễn thuế đối với lãi vốn, trong khi lợi nhuận CFD có thể được bù trừ với lỗ để được giảm thuế. Điều này có lợi cho việc đặt cược chênh lệch giá đối với các nhà giao dịch có lợi nhuận ở các mức thuế suất cao, trong khi CFD phù hợp với những người có thể sử dụng bù trừ lỗ.

- Các vấn đề về tiền tệ: Cược chênh lệch được trao đổi bằng đồng tiền trong tài khoản của bạn, trong khi CFD được giao dịch bằng đồng tiền của thị trường cơ sở. Điều này giúp tiết kiệm chi phí chuyển đổi tiền tệ trong cá cược chênh lệch nhưng có thể hạn chế độ chính xác trên thị trường nước ngoài.

- Cấu trúc chi phí: CFD liên quan đến việc mua các hợp đồng thể hiện biến động giá, trong khi cá cược chênh lệch liên quan đến việc đánh cược vào sự thay đổi giá theo từng điểm. CFD thường cung cấp mức chênh lệch hẹp hơn nhưng có thể kết hợp phí hoa hồng trong khi cá cược chênh lệch giá thì không.

Cá cược chênh lệch so với giao dịch chứng khoán truyền thống

Giao dịch chứng khoán truyền thống đòi hỏi vốn đầy đủ để mua cổ phiếu, trong khi cá cược chênh lệch giá chỉ cần ký quỹ. Hiệu quả vốn này cho phép đa dạng hóa trên nhiều thị trường hơn với ít vốn hơn.

Sự khác biệt về quyền sở hữu:

- Giao dịch truyền thống cấp quyền cho cổ đông và cổ tức

- Cá cược chênh lệch giá cung cấp khả năng tiếp xúc giá mà không có lợi ích sở hữu

- Không áp dụng thuế tem đối với giao dịch cá cược chênh lệch

Bạn có thể kiếm lời từ việc giá cổ phiếu giảm thông qua cá cược chênh lệch giá, trong khi giao dịch truyền thống đòi hỏi các thỏa thuận bán khống phức tạp mà hầu hết các nhà đầu tư bán lẻ không thể thực hiện được.

Ưu điểm của cá cược chênh lệch

- Hiệu quả thuế: Tại Anh và các nền kinh tế tương tự, lợi nhuận thu được từ cá cược chênh lệch giá được miễn thuế lãi vốn, giúp tăng đáng kể lợi nhuận ròng cho các nhà giao dịch thành công. Chỉ riêng lợi thế này đã có thể cải thiện lợi nhuận ròng của bạn từ 10-28% tùy thuộc vào nhóm thuế của bạn.

- Tận dụng cơ hội: Kiểm soát các vị thế thị trường lớn với số tiền ký quỹ nhỏ. Điều này rủi ro hơn nhưng cho phép các nhà giao dịch giàu kinh nghiệm kiếm được nhiều lợi nhuận hơn từ vốn so với giao dịch bằng tiền mặt.

- Khả năng tiếp cận thị trường: Truy cập thị trường toàn cầu chỉ với một tài khoản mà không cần liên kết với nhiều nhà môi giới. Chuyển đổi giữa cổ phiếu Mỹ, chỉ số châu Âu và tiền tệ châu Á chỉ trong vài phút.

- Bán khống thật dễ dàng: Kiếm tiền từ thị trường đang suy giảm mà không cần phải vay cổ phiếu hoặc chịu phí vay. Tính năng này đã cứu cánh cho bạn trong những đợt thị trường lao dốc như tháng 3 năm 2020.

- Không có thuế tem: Các nhà đầu tư ở Anh không phải trả thuế tem 0,5% khi mua cổ phiếu, giúp họ tiết kiệm được một khoản tiền lớn về lâu dài.

Tất cả những lợi thế này khiến cho cá cược chênh lệch giá trở thành một đề xuất rất hấp dẫn đối với các nhà giao dịch tích cực muốn có sự linh hoạt hoàn toàn và hiệu quả về thuế.

Rủi ro và bất lợi của cá cược chênh lệch

- Đòn bẩy khuếch đại tổn thất: Đòn bẩy giúp gia tăng lợi nhuận cũng có thể tàn phá tài khoản khi thị trường biến động bất lợi. Biến động bất lợi 2% với đòn bẩy 50:1 tương đương với khoản lỗ 100% tài khoản nếu không quản lý rủi ro hợp lý.

- Chi phí tài trợ qua đêm: Việc giữ vị thế qua đêm sẽ phát sinh chi phí tài chính, có thể làm xói mòn lợi nhuận trong các giao dịch dài hạn. Những chi phí này tăng dần theo ngày và ảnh hưởng đáng kể đến các chiến lược giao dịch lướt sóng.

- Chi phí chênh lệch: Người dùng cược chênh lệch có thể phải chịu nhiều chi phí chênh lệch hơn so với việc tiếp cận thị trường trực tiếp, làm giảm lợi nhuận cho tần suất cao chiến lược giao dịch .

- Rủi ro biến động thị trường: Khoảng trống thị trường đột ngột tạo ra các lệnh dừng lỗ ở mức giá bất lợi, dẫn đến tổn thất vượt quá mức rủi ro dự kiến. Điều này thường xảy ra trong thời kỳ thị trường hỗn loạn do COVID-19.

- Những cân nhắc về quy định: Cá cược chênh lệch giá là bất hợp pháp hoặc bị cấm ở một số quốc gia, hạn chế khả năng tiếp cận của các nhà giao dịch quốc tế. Vui lòng xác minh luật pháp địa phương trước khi mở tài khoản.

Nhận thức rủi ro này giúp thiết lập những kỳ vọng thực tế và thiết kế phù hợp quản lý rủi ro chiến lược quan trọng cho thành công lâu dài.

Những sai lầm phổ biến khi cá cược chênh lệch cần tránh

- Đòn bẩy quá mức và định vị vị thế kém: Các nhà giao dịch mới sử dụng quá nhiều đòn bẩy, tin rằng vị thế lớn hơn đồng nghĩa với lợi nhuận lớn hơn. Cách tiếp cận này thường dẫn đến việc tài khoản bị phá sản khi thị trường biến động bất lợi. Các chuyên gia dày dạn kinh nghiệm hiếm khi mạo hiểm quá 1-2% vốn cho một giao dịch, bất kể mức độ tự tin.

- Bỏ qua chi phí qua đêm: Nhiều nhà giao dịch mới thường bỏ qua chi phí tài chính cho các vị thế qua đêm, vốn là những khoản lợi nhuận đến từ các giao dịch dài hạn. Họ tích lũy hàng ngày và tổng số tiền khổng lồ trong nhiều tuần hoặc nhiều tháng, biến những giao dịch thắng thành thua.

- Quyết định giao dịch theo cảm xúc: Hơn cả việc phân tích thị trường, lòng tham và nỗi sợ hãi dẫn đến những quyết định sai lầm. Việc cắt ngắn các giao dịch thắng và để các giao dịch thua tiếp diễn sẽ đi ngược lại các nguyên tắc giao dịch cơ bản và dẫn đến thảm họa lâu dài.

- Thiếu kế hoạch giao dịch: Giao dịch mà không có chiến lược thoát lệnh rõ ràng sẽ khiến người ta bối rối trong thời điểm biến động mạnh. Cược chênh lệch giá thành công đòi hỏi các yêu cầu nhập lệnh, mức dừng lỗ và mục tiêu lợi nhuận chính xác trước khi thực hiện giao dịch.

- Theo đuổi động lực thị trường: Giao dịch theo hướng biến động lớn thường dẫn đến việc mua vào ở mức cao hoặc bán ra ở mức thấp. Thị trường thường đảo chiều sau khi thu hút được sự quan tâm cao nhất, và những người theo đuổi đà tăng thường chịu những khoản lỗ khổng lồ.

- Thiếu hiểu biết đúng đắn về thị trường: Việc hiểu sai bản chất của các công cụ tài chính được giao dịch có thể dẫn đến những cú sốc bất ngờ. Các cặp tiền tệ hoạt động khác với chỉ số chứng khoán, và hàng hóa có những mô hình theo mùa kỳ lạ, ảnh hưởng đến giá cả.

Cách bắt đầu với cá cược chênh lệch

Chọn một nhà môi giới được quản lý

Hãy chọn các nhà môi giới có giấy phép từ các cơ quan quản lý uy tín như FCA, ASIC hoặc CySEC. Xác minh tình trạng pháp lý của họ từ hồ sơ chính thức và đảm bảo các gói bồi thường cho khách hàng của họ.

Nghiên cứu mức chênh lệch giá giữa các sàn môi giới khác nhau vì chúng ảnh hưởng trực tiếp đến lợi nhuận. Tìm kiếm mức chênh lệch giá cạnh tranh trên các thị trường để giao dịch thường xuyên nhất.

Quy trình thiết lập tài khoản

Hầu hết các nhà môi giới đều cung cấp các ứng dụng trực tuyến đơn giản yêu cầu:

- Giấy tờ tùy thân

- Bằng chứng địa chỉ

- Bảng câu hỏi về hoàn cảnh tài chính

- Hoàn thành đánh giá rủi ro

Khuyến nghị giao dịch demo

Bắt đầu với tài khoản demo để làm quen với khả năng của nền tảng và động lực thị trường. Thử nghiệm các chiến lược khác nhau mà không cần mạo hiểm vốn thật cho đến khi bạn đạt được lợi nhuận mô phỏng ổn định.

Tập trung vào việc nắm vững các tính năng nền tảng, loại lệnh và chức năng quản lý rủi ro trong giai đoạn này. Hầu hết các nhà giao dịch thành công đều học cách nắm vững các nguyên tắc cơ bản trong 2-3 tháng trước khi bắt đầu giao dịch.

Chiến lược quản lý rủi ro

- Không bao giờ mạo hiểm quá 2% vốn cho mỗi giao dịch

- Sử dụng lệnh dừng lỗ ở mọi vị thế

- Đa dạng hóa trên nhiều thị trường và khung thời gian khác nhau

- Giữ nhật ký giao dịch chi tiết để xác định các lĩnh vực cần cải thiện

You may also like

Phần kết luận

Cá cược chênh lệch giá mang đến một phương thức giao dịch linh hoạt và có tiềm năng hưởng lợi về thuế trên thị trường tài chính, cho phép bạn hưởng lợi từ việc giá cả tăng giảm của hàng ngàn công cụ tài chính với các vị thế đòn bẩy. Mặc dù lợi ích bao gồm ưu đãi về thuế, khả năng tiếp cận thị trường và hiệu quả sử dụng vốn, nhưng rủi ro về đòn bẩy, phí qua đêm và biến động thị trường cần được cân nhắc kỹ lưỡng và áp dụng biện pháp kiểm soát rủi ro nghiêm ngặt.

Cá cược chênh lệch giá thành công nhờ phân tích thị trường tốt, định lượng vị thế hợp lý và quản lý cảm xúc tốt hơn là dựa vào may mắn hay đầu cơ. Nếu bạn muốn đa dạng hóa danh mục đầu tư hoặc đang cân nhắc các phương pháp giao dịch chủ động, việc nắm vững những kiến thức cơ bản này và bắt đầu với tài khoản demo sẽ cho phép bạn đưa ra quyết định đúng đắn về cá cược chênh lệch giá, cũng như liệu nó có phù hợp với bạn hay không, dựa trên mục tiêu tài chính và khả năng chấp nhận rủi ro của bạn.

FAQ

Tính khả dụng của cá cược chênh lệch giá thay đổi tùy theo khu vực pháp lý. Nó được quản lý chặt chẽ ở Anh và một số nước châu Âu, nhưng bị cấm ở một số nước, chẳng hạn như Hoa Kỳ. Vui lòng tham khảo các cơ quan tài chính địa phương để biết các quy định mới nhất.

Hầu hết các nhà môi giới yêu cầu mức vốn tối thiểu từ 100 đến 500 bảng Anh, mặc dù giao dịch có lợi nhuận thường cần tài khoản lớn hơn để quản lý rủi ro hiệu quả. Tốt nhất nên bắt đầu với ít nhất 1.000 bảng Anh để duy trì quy mô vị thế trong giới hạn hợp lý.

Đúng vậy, cá cược chênh lệch giá có thể dẫn đến thua lỗ vượt quá tài khoản của bạn do đòn bẩy và chênh lệch giá thị trường. Hầu hết các sàn giao dịch đều có chế độ bảo vệ số dư âm để đảm bảo khoản lỗ trong trường hợp xấu nhất không vượt quá số tiền ký quỹ của bạn.

Mặc dù cả hai đều liên quan đến rủi ro, nhưng cá cược chênh lệch giá dựa trên phân tích thị trường tài chính và chiến lược quản lý rủi ro hơn là sự may rủi thuần túy. Các nhà giao dịch giỏi đưa ra quyết định sáng suốt dựa trên phân tích kỹ thuật và phân tích cơ bản.

Việc xử lý thuế cũng khác nhau tùy theo quốc gia và hoàn cảnh cá nhân. Tại Anh, lợi nhuận từ cá cược chênh lệch giá nhìn chung được miễn thuế, nhưng hãy tham khảo ý kiến của các cố vấn thuế có trình độ chuyên môn cho vị thế của bạn.

Các nhà môi giới áp dụng lãi suất hàng ngày cho các vị thế đòn bẩy được duy trì qua đêm dựa trên toàn bộ giá trị vị thế chứ không phải ký quỹ. Phí tài trợ qua đêm có thể ảnh hưởng nghiêm trọng đến các chiến lược giao dịch dài hạn.

Đã cập nhật:

28 tháng 7, 2025

9 tháng 2, 2026

What Is a Trading Halt? Why Stocks Stop Trading and What It Means for You => Hủy giao dịch là gì? Tại sao cổ phiếu lại ngừng giao dịch và điều đó có nghĩa gì đối với bạn

Hướng dẫn này sẽ đưa bạn qua CPA so với RevShare (và các sự kết hợp hỗn hợp), giải thích ý nghĩa thực sự của chúng đối với doanh nghiệp môi giới của bạn.