The Ultimate Guide to Starting a Crypto Business

Contents

Within the always changing landscape of finance, cryptocurrencies have found a niche and are fast rising from a concept to a major participant in the financial industry. Particularly for those thinking about starting brokerages and trading platforms, the opportunities within the crypto sector are rather great. This guide delves deep into the practical steps and nuances of establishing a firm footing in this vibrant space.

Key Takeaways

- The crypto space has a great deal of growth potential, particularly for brokerages and trading platforms.

- Success will depend on understanding markets, differentiating clearly, and establishing a strong infrastructure.

- Strong compliance, effective liquidity strategies, and risk management efforts are key.

- Marketing, marketing transparency, and trust are important to client retention.

Understanding the Crypto Businesses

The cryptocurrency industry is a vast realm, comprising myriad segments such as miners, developers, traders, and enthusiasts. Yet, among all these entities, brokerages shine with unparalleled significance.

Between the ordinary individual and the often complicated world of cryptocurrencies, brokerages serve as the conduit. By working with brokerages, anyone may quickly purchase or sell cryptocurrencies without engaging in the complexities of direct trading on cryptocurrency exchanges. They remove the complexities and provide consumers with an easily available platform, therefore simplifying the trading process.

Driving Liquidity and Market Stability

Maintaining market liquidity depends much on brokerages. A more stable market is indicative of high liquidity levels, as large transactions are less likely to result in abrupt, substantial price fluctuations. With their ongoing high-volume trading activity, trading platforms and institutions guarantee that there is always a buyer or seller at any one moment, therefore improving the market depth and stability.

Growth and Evolution of the Crypto Brokerage Market

Cryptocurrency brokerage is a rapidly expanding industry. As interest in the cryptocurrency market surged, there was a rising need for automated and simpler trading solutions. More than just a passing fad, this growing fascination has statistical support. There is a lot of capital flowing into this space, as the value of the worldwide cryptocurrency market soared into trillions of dollars at its peak.

We are simply at the tip of the iceberg regarding possible expansion given the worldwide adoption of cryptocurrencies is on an increase. The obstacles for entry will lower as more countries acknowledge and regulate digital currencies, hence increasing the crypto market involvement. Brokerages and trading companies will surely be very important in this future as they will guide both institutional and personal investors over the always changing terrain of cryptocurrencies.

Preliminary Steps Before Starting Your Crypto Brokerage

Starting on a path to open a trading or crypto brokerage is no easy task. Like every commercial endeavor, a strong foundation is absolutely vital. Careful preparation, strategic forethought, and a sharp awareness of the market environment help to create this basis. Certain fundamental issues have to be taken care of before delving further into the operational aspects of your company to create the conditions for a profitable and sustainable business.

Market Research

Before you even consider the logistics of your business, you must first truly understand the market. This isn’t merely about recognizing competitors, though that’s essential. It’s about immersing yourself in the crypto ecosystem, discerning its ebbs and flows. Consider the crypto brokerages that currently dominate the landscape. What services do they offer? More importantly, where do they fall short?

By actively engaging with platforms, forums, and community discussions, you can unearth the challenges traders face and the deficiencies they feel are present in current platforms. But market research isn’t static. Since market dynamics change almost everyday, cryptocurrencies are by their very nature volatility. Beyond only price adjustments, the sector is changing as new technology, revised regulations, and creative trading techniques constantly emerge.

Defining Your Unique Selling Proposition

In a saturated market, standing out is paramount. So, what makes your brokerage unique? Is it the promise of unparalleled transaction speeds, or perhaps a wider array of cryptocurrencies for trading? Or maybe it’s not about the tangible services but the intangible experience. Consider the value of a groundbreaking analytics dashboard, a tool that offers traders insights they can’t find anywhere else.

Alternatively, think about the novice traders, those overwhelmed by the intricate world of cryptocurrencies. They’d gravitate towards a platform that educates, guides, and supports. Offering webinars, informative articles, or tutorial videos might be the very USP that distinguishes your platform.

Building a Team

Technology and strategy are critical, but it is the people behind them that actually move an organization ahead. The value of a competent team, particularly in the complicated crypto industry, cannot be emphasized. Your blockchain professionals will create the fundamental foundation of your platform, ensuring that everything functions smoothly, safely, and effectively. Then there are your trading analysts. Their role goes beyond merely keeping an eye on market trends. They offer invaluable insights, guiding traders and enhancing the overall credibility of your platform.

And let’s not forget customer service. In the digital world, a human touch is very important. Prompt resolutions, active engagement, and an honest desire to assist users might be the defining factors that foster brand loyalty.

Business Models in the Crypto Market

Entrepreneurs looking to make their mark in the crypto industry have many different and exciting business models to explore:

NFT Marketplaces

Non-Fungible Token (NFT) marketplaces are a place for users to buy, sell and trade unique digital items (such as art, music and collectibles). As people’s interest in ownership of digital assets increases, community-driven NFT platforms represent a big opportunity for new enterprises.

Successful NFT marketplaces typically highlight:

- User experiences that are easy for creators and buyers

- Strong security and authenticity validation

- Community engagement, as well as promotions when applicable.

Crypto Asset Management

The cryptocurrency asset management platform provides investors with the tools they need to manage their cryptocurrency portfolio. Specifically, crypto asset managers produce tools for users to track performance of assets, risk management and include analytics to assist in making investing decisions.

Key features include:

- Integration across several exchanges with minimal effort.

- Reporting and analytics including diverse strategies and performance views.

- Security of assets and for users.

Blockchain-Based Crowdfunding Platforms

These platforms are built based on blockchain technology to improve the transparency and security of fundraising activities. Entrepreneurs and startups are using blockchain and crowdfunding to gain capital directly from their investors, and bypassing the traditional financial intermediaries.

Advantages of blockchain crowdfunding include:

- Increased transparency and accountability of the fundraising activities.

- Lower costs and fees than the traditional fundraising mechanisms.

- Global access, creating a larger pool of potential investors.

Cryptocurrency Payment Gateways

Cryptocurrency-focused payment gateways provide businesses the ability to accept digital currency transactions quickly and securely. This type of service tends to appeal to businesses looking to entice cryptocurrency experience consumers and businesses looking for faster payment options for lower costs.

What to expect:

- Fast and reliable transaction processing options.

- Simple to integrate with your current e-commerce solutions.

- Fraud detection and other security methods for transactions.

Decentralized Exchange Platforms (DEX)

Decentralized exchanges allow for peer-to-peer crypto trading without central intermediaries, leading to enhanced security and control for the trader. Traders prefer DEX platforms because of the decrease in potential centralized hacks and enhanced autonomy regarding the control and management of their assets.

Key elements of decentralized exchanges:

- Increased privacy and user control.

- Transparent fees and operations.

- Limited risk of attacks on platform as whole.

Crypto Lending and Borrowing Services

Crypto lending and borrowing services allow users to loan out their crypto assets in exchange for interest or to borrow money and secure that loan with their crypto assets. Crypto lending and borrowing services offer liquidity to crypto asset holders without forcing them to liquidate it.

Key benefits:

- Flexible terms for both lending and borrowing.

- Competitive interest rates.

- Sophisticated risk management tools that help protect the interests of lenders and borrowers.

Legal and Regulatory Considerations for Crypto Brokerages

Entering the cryptocurrency industry involves more than just commercial tactics; it also requires legal and regulatory compliance.

The rules that regulate the cryptocurrency industry are as diverse as the countries that enforce them. In the United States, for example, the Securities and Exchange Commission (SEC) often classifies particular cryptocurrencies as securities, subjecting them to strict rules. In contrast, Singapore and Malta have cryptocurrency policies that encourage innovation while protecting consumers.

It’s not just about understanding these regulations; it’s about comprehending their implications. What does operating under the SEC mean for a crypto brokerage regarding reporting, transparency, and investor protection? And how do the more lax regulations in other regions translate to business operations, customer acquisition, and growth potential? By thoroughly grasping these nuances, brokerages can tailor their operations to align with both regulatory mandates and market demands.

You may also like

Securing Necessary Licenses

The most important thing to know is the rules; second is to actively follow them. Regarding crypto brokerages, this entails obtaining the required licenses and permissions to operate lawfully. Often requiring a thorough investigation of the operations, financial situation, and credentials of its key individuals, this procedure may be demanding. These licenses have importance beyond just legality. From the perspective of prospective customers, a fully licensed brokerage is associated with credibility and consumer confidence. From the perspective of prospective customers, a fully licensed brokerage equates with legitimacy and trust. It conveys a clear message: this platform emphasizes the security of its users and their assets.

Maintaining Compliance

In cryptocurrencies, rules are dynamic rather than fixed; they reflect the vitality of the market, technical innovation, and lessons learnt from prior market events. For brokerages, this means that compliance is an ongoing process that never finishes. It’s about always being current with the most recent changes to legislation, adjusting operations, and making sure every aspect of the company—from user data security to transaction processes—stays in line with these developments. Beyond this, there is the logical requirement of license and permit renewals, which can call for operational assessments, financial reports, and regular audits.

In the crypto universe, regulatory compliance is both a shield and a beacon. It enhances the brokerages’ credibility from customers’ perspective and protects them from any legal dangers. Those brokerages that give regulatory compliance a priority will always stand out as the market develops and draw discerning clients who seek transparency and protection.

Setting Up the Infrastructure for Your Crypto Business

A cryptocurrency business’s infrastructure is more than simply its foundation; it is the equipment that drives development, provides trust, and assures sustainability. Every component—from the tech stack supporting your platform to the risk management systems safeguarding your customers—requires careful design and implementation.

Technology and Platform

The value of a trustworthy trading platform cannot be emphasized in a world where milliseconds could define the difference between profit and loss. However, what does this mean?

First of all, a user-friendly interface lets traders—new and experienced—navigate easily. This is complemented by robust backend algorithms that ensure swift and precise order execution.

Then comes the question of security. Your platform requires modern encryption, multi-factor authentication, and frequent security audits to guarantee that user payments and data are constantly safeguarded as cyberthreats are proving ever more complex.

Liquidity Management

A brokerage or trading firm’s vitality hinges on its liquidity. It’s what ensures that traders can execute their buy or sell orders without undue price slippage or delays. How is this achieved? By partnering with multiple liquidity providers. This ensures a diverse and abundant pool of assets, enabling the platform to handle large volumes of simultaneous transactions without affecting the market price adversely. Remember, in the eyes of a trader, liquidity translates to trust.

Risk Management

The volatile nature of cryptocurrencies is both their allure and their Achilles heel. Price swings that might seem erratic to the layman are patterns to seasoned traders. However, these fluctuations also introduce significant risks. To mitigate this, a crypto business must have robust risk management tools in place. These could range from setting trading limits to offering features like stop-loss orders that automatically sell a cryptocurrency once its price falls to a certain level. Furthermore, continuous trader education about the inherent risks can foster a culture of informed trading.

Gaining Trust in the Crypto Community

Any successful financial endeavor is based on trust, especially so in the young and often misunderstood world of cryptocurrencies. A company may have the most sophisticated platform, but it will always run against problems if it does not build confidence. Building a bond of trust with the crypto community requires more than just reliable services. It involves a consistent effort to engage, educate, and be transparent with your users.

Transparency Initiatives

The crypto sphere, despite its promise, has often been marred by dubious activities, such as the Terra Luna and the FTX collapses. In such a climate, being transparent can set your business apart. How can you achieve transparency?

By embracing regular public audits, you provide verifiable proof of your business’s legitimacy and integrity. Furthermore, clearly detailing your fee structures ensures users don’t feel short-changed or surprised. Open communication channels, be it through regular updates, newsletters, or direct engagement, reinforce that your business has nothing to hide and is committed to user satisfaction.

Providing Comprehensive Educational Content

Knowledge provides confidence. In the unpredictable world of cryptocurrencies, wise choices could make all the difference between profits and losses. Therefore, a platform that really stands out is one that gives its users instructional materials. From beginners struggling with the fundamentals to experts seeking to hone their skills, customized material may appeal to everyone. Webinars, how-to manuals, market studies, and interactive tools not only improve the value of your platform but also build user confidence as they see a company committed in their development and success.

Engagement Strategies

The dynamism of the crypto community is unparalleled. Here, engagement isn’t a one-time affair but an ongoing dialogue. Active participation in community forums can provide insights into user needs and market trends. Regular updates on social media platforms not only keep your users informed but also underscore your firm’s presence and activity in the crypto sphere.

Moreover, hosting or attending crypto events allows direct interaction, feedback collection, and showcasing of your platform’s features and advantages. It’s more than just marketing—it’s about fostering community and belonging among your users.

Marketing Strategies for Crypto Brokerages

Marketing a crypto brokerage is essential, and putting together effective marketing tactics is key to attracting and keeping clients. Here are some simple and practical techniques to help increase your brokerage’s awareness and credibility.

Educational Resources

Delivering valuable insights, guides and tutorials will better serve both new and experienced traders or investors. Providing educational content will also help establish your brokerage as an authority in the industry.

Social Media

You should always maintain communication across social media pages, including Twitter, LinkedIn, and Reddit. Often, posts can be about announcements or updates, and/or communicating directly with your audience.

Referrals

Clients should, if possible be incentivized to invite friends, family or colleagues to try your brokerage. Word-of-mouth organically expands your customer base without much effort or investment.

Partnerships

Partnering with other crypto companies, influencers, and industry professionals can create value for your brokerage and elevate your credibility.

Transparency

Be open and clear about your policies and fees so that clients learn to trust you. Transparency will help build relationships with your clients for the long haul.

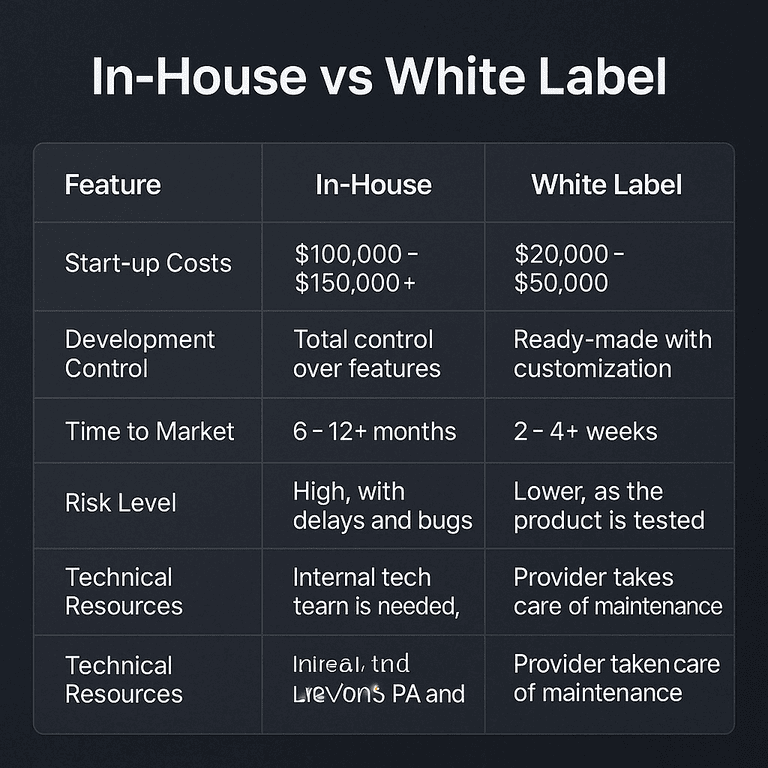

Leveraging White Label Services for Crypto Business Launch

In today’s changing cryptocurrency climate, starting a brokerage or trading platform from scratch might be a daunting endeavor. From building the basic architecture of the platform to guaranteeing security and regulatory compliance, the difficulties might appear insurmountable. This is where white label solutions step in as a game changer.

White label services provide companies ready-to-use products or platforms they may rebrand and market as their own. Imagine it as leasing a completely furnished apartment you can personalize with your own touch instead of starting from nothing. In the crypto space, these platforms provide a completely working trading environment with all required features.

You may also like

- Swift Market Entry

Because the fundamental infrastructure is already in place and established, firms may avoid the lengthy development process. This enables not just a more rapid go-to-market plan, which can be executed in as little as two weeks, but also a timely reaction to market needs and trends.

- Cost Efficiency

Creating a trading platform from nothing is not only difficult but also very costly. After development testing, security, and basic expenses taken into account, the cash expenditure might rapidly rise to around $150, 000. Conversely, white label products provide an affordable alternative. These services may be accessed for around $20,000 depending on a one-time setup or a subscription-based cost arrangement. They not only save a lot of money but also make sure companies won’t have to sacrifice the dependability and quality of their system.

- Customization and Branding

Even though the foundational platform is pre-built, white label services offer ample room for customization. Businesses can infuse their branding, introduce unique features, and tailor the user interface to resonate with their brand ethos and market strategy.

- Ensured Security and Compliance

Since experts in the field develop these platforms, they come with built-in security measures, often adhering to industry best practices. This alleviates the burden of ensuring top-notch security for the business. Additionally, many white label solutions are designed to comply with prevailing regulations, reducing the complexities of legal adherence for businesses.

- Continuous Support and Updates

Choosing a white label service marks a partnership as much as it marks a platform acquisition. Often providing ongoing support, service providers handle technical issues, provide upgrades, and guarantee the platform remains current with the newest crypto technology and trends.

Conclusion

Starting a crypto company, particularly when it comes to brokerages and trading platforms, seems to have a bright future. Although difficulties exist, with the appropriate strategies, ongoing education, and flexibility, success is certain rather than just a possibility. The crypto space presents a great possibility for would-be business owners. The secret is to make good use of tools, knowledge, and insights.

FAQ

You should start with a deep market analysis, outlining your unique selling propositions, and building a knowledgeable team.

Regulation is extremely important from a legal standpoint and will instill trust from your clients.

White-label will deliver a faster entry to market, save you money and has the necessary security and regulations built into it.

By producing educational content, having clearly defined operations, creating a social media presence, building referral programs, and seeking beneficial partnerships.

Start up costs vary based on the method chosen. A company which builds a platform from the ground up might spend over $150,000. Companies that provide a white label option can start you at anywhere from $20,000 to $50,000, and allow for unique branding on an established platform.

Updated:

April 21, 2025

9 February, 2026

What Is a Trading Halt? Why Stocks Stop Trading and What It Means for You

A trading halt is when an exchange temporarily stops trading in a stock or, in rare cases, the entire market. It’s not a glitch and it’s not random. It’s a deliberate pause triggered when prices move too fast, critical information is about to be released, or regulators need time to step in. From the outside, […]