Como Construir uma Exchange de Criptomoedas do Zero?

Conteúdo

O mercado de câmbio de criptomoedas está em alta—projeções colocam o mercado global em $71,6 bilhões em 2025 e alcançar $260 bilhões até 2032. Com o mercado de criptomoedas previsto para alcançar 963 milhões de usuários em 2026, definitivamente há espaço para novos jogadores. Mas aqui está a questão: você está competindo com gigantes como a Binance (que controla 40% do mercado), então você precisa ser inteligente sobre sua abordagem.

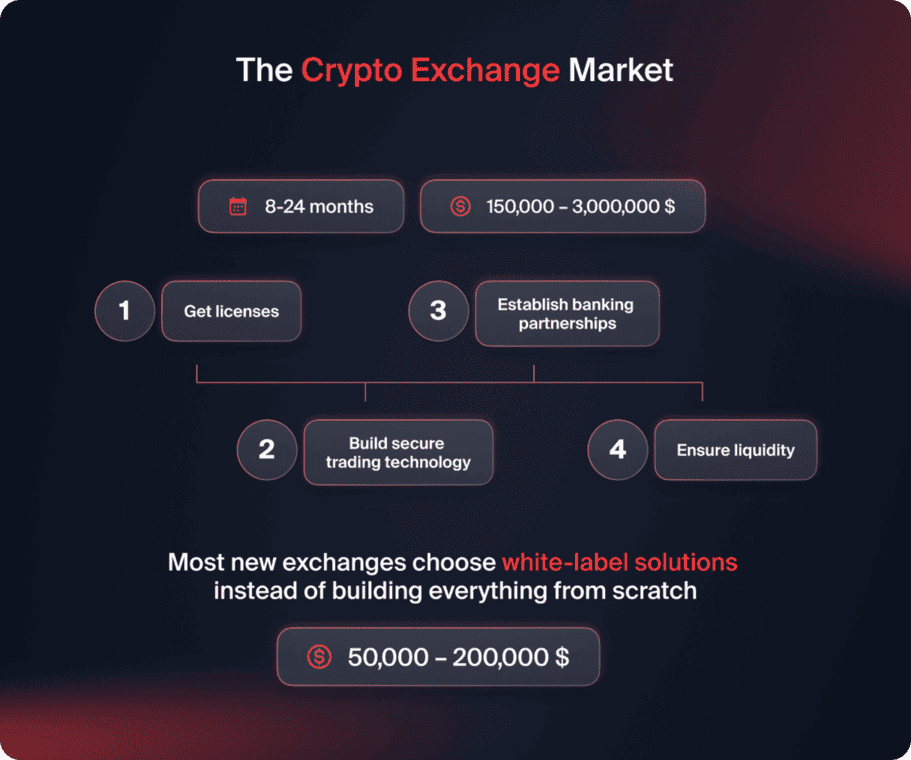

Construir uma exchange de criptomoedas leva de 8 a 24 meses e custa entre $150.000 e $3.000.000, dependendo da complexidade. Você precisará obter licenças, construir tecnologia de negociação segura, estabelecer parcerias bancárias e garantir liquidez. A maioria das novas exchanges opta por soluções de marca branca ($50.000-$200.000) para lançar em 6 a 12 semanas, em vez de construir tudo do zero.

Quanto Custa Construir uma Exchange de Criptomoedas?

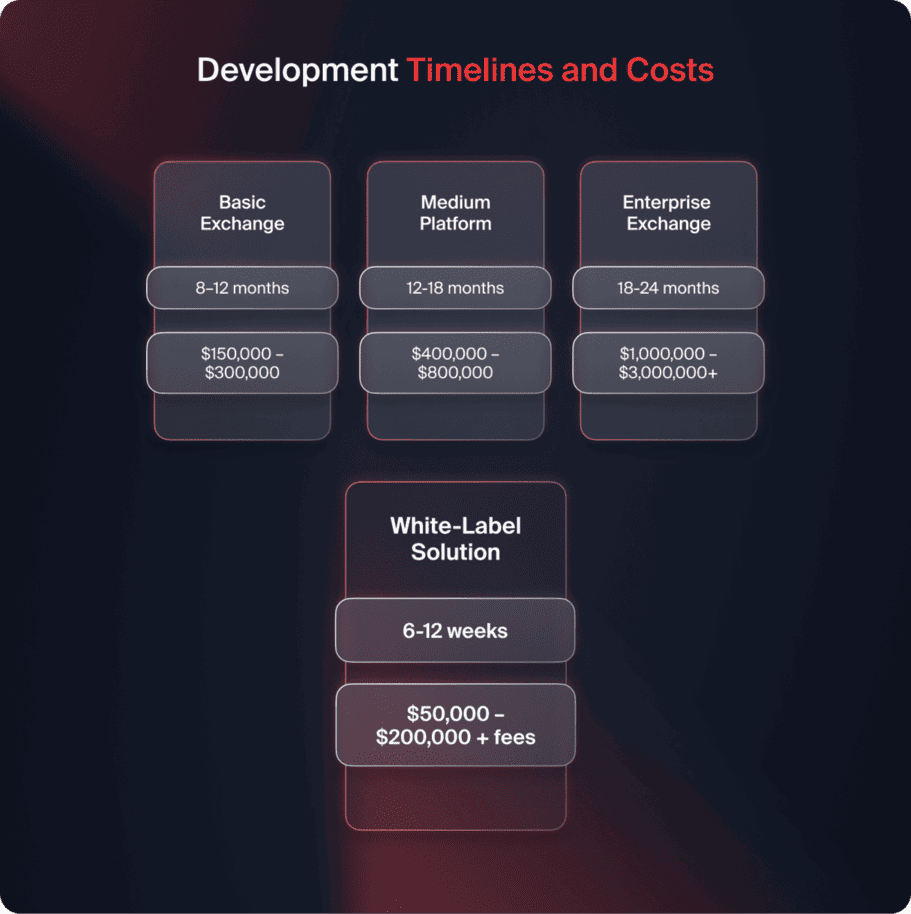

A sua maior dúvida provavelmente gira em torno do custo estimado para trazer sua exchange de criptomoedas à vida. Na tabela abaixo, você pode obter informações rápidas sobre o que esperar em termos de custo, tempo de desenvolvimento e recursos básicos do tipo de plataforma que você deseja construir.

| Tipo de Plataforma | Tempo de Desenvolvimento | Custo Estimado | Destaques |

| Troca Básica | 8–12 meses | $150,000–$300,000 | Motor de negociação principal, interface básica, pares de criptomoedas limitados |

| Plataforma Média | 12–18 meses | $400,000–$800,000 | Aplicativos móveis, 50+ moedas, armazenamento a frio, negociação de margem |

| Troca Empresarial | 18–24+ meses | $1,000,000–$3,000,000+ | Derivativos, integração DeFi, recursos institucionais |

| Solução de Marca Branca | 6–12 semanas | $50,000–$200,000 + taxas | Sistema pré-construído e testado, lançamento rápido, baixo risco |

Many successful founders start with sistemas de marca branca from providers, then upgrade with custom features once the business gains traction. Most of our clients choose this as it is quicker and cheaper.

Quais São os Custos Operacionais Mensais?

Construir a plataforma é apenas o começo. Aqui está o que você pagará a cada mês:

- Servidores e infraestrutura: $5,000-$200,000 (cresce com sua base de usuários)

- Provisão de liquidez: $20,000-$100,000+ (para que as pessoas possam realmente negociar)

- Conformidade e legal: $10,000-$40,000

- Equipe de suporte ao cliente e segurança: $50.000-$500.000

Portanto, você deve orçar pelo menos $100.000-$500.000 por mês para operar sua exchange de criptomoedas adequadamente.

Quanto Tempo Leva para Construir uma Exchange de Criptomoedas?

Desenvolvimento personalizado do zero:

- Versão básica: 8-12 meses

- Complexidade média: 12-18 meses

- Classe empresarial: 18-24+ meses

- Mais 3-12 meses para licenciamento

Solução de marca branca:

- 6-12 semanas no total (incluindo personalização e configuração)

Aqui está algo importante que aprendemos na Quadcode: O tempo não se trata apenas de codificação. Conseguir relacionamentos bancários por si só leva de 3 a 6 meses. Muitos de nossos clientes passaram 8 meses construindo plataformas incríveis, e depois descobriram que os bancos não trabalhariam com eles. É por isso que começar com questões legais e bancárias antes de codificar qualquer coisa evita grandes dores de cabeça.

Quais Licenças Você Precisa para uma Exchange de Criptomoedas?

Isso varia muito dependendo de onde você opera.

Estados Unidos:

- Registro de Empresas de Serviços Financeiros (MSB) a nível federal

- Licenças de Transmissor de Dinheiro do Estado (individualmente por estado)

- Total: $100,000-$500,000+ apenas em licenças e garantias

União Europeia:

- Licença MiFID II ou autorização de instituição de moeda eletrônica

- Conformidade com a MiCA para acesso unificado ao mercado da UE

- Mais rigoroso, mas dá acesso a toda a UE

Ásia:

- Cingapura, Hong Kong e Japão possuem licenças específicas para exchanges de cripto

- Hong Kong recentemente licenciou cinco bolsas, abrindo oportunidades

Opções Offshore:

- Seicheles, Ilhas Cayman ou Malta

- Licenciamento mais rápido e barato

- Licenciamento menos caro e mais rápido

Se você tiver alguma dúvida ou confusão, é recomendável que contrate advogados especializados em criptomoedas em seu mercado-alvo desde o primeiro dia. As regulamentações mudam diariamente, e um movimento errado pode fazer com que você seja encerrado.

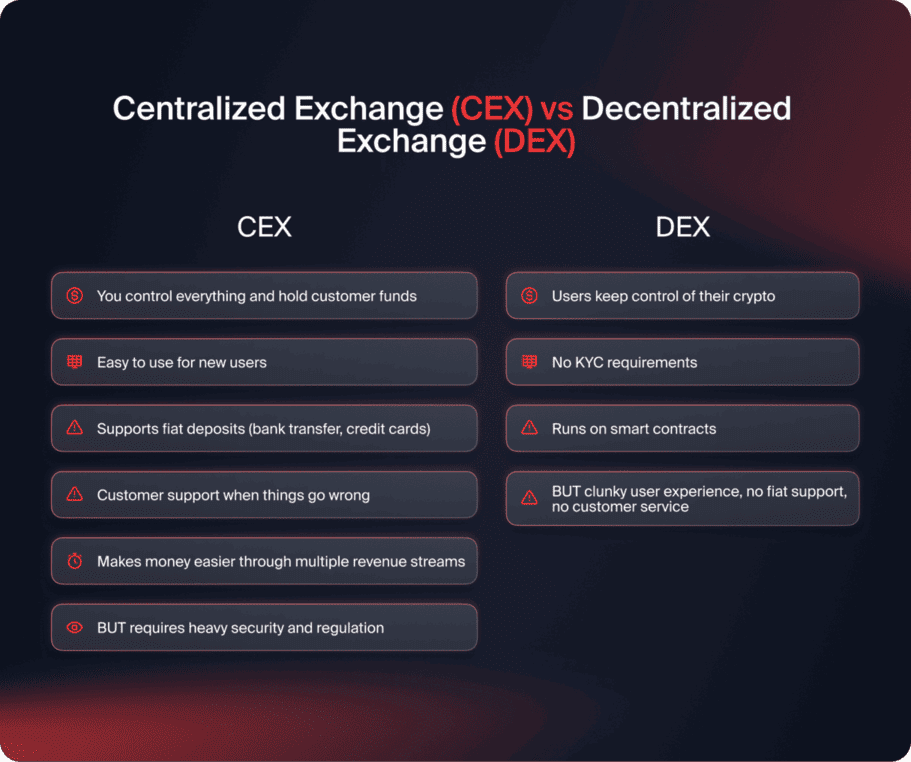

Você Deve Construir uma Exchange Centralizada ou Descentralizada?

Exchange Centralizada (CEX)

- Você controla tudo e mantém os fundos dos clientes

- Fácil de usar para novos usuários

- Suporta depósitos em fiat (transferência bancária, cartões de crédito)

- Suporte ao cliente quando as coisas dão errado

- Facilita o dinheiro através de múltiplas fontes de receita

- MAS requer segurança e regulamentação rigorosas

Exemplos são Binance, Coinbase e Kraken.

Troca Descentralizada (DEX)

- Os usuários mantêm o controle de suas criptomoedas

- Sem requisitos KYC

- Funciona com contratos inteligentes

- MAS experiência do usuário desajeitada, sem suporte a fiat, sem atendimento ao cliente

Exemplos são Uniswap e PancakeSwap.

Se você está construindo um negócio (não um projeto de hobby), opte por centralizado. É lá que estão os usuários e o dinheiro. Cerca de 87% do mercado são exchanges centralizadas porque as pessoas querem conveniência.

Que tecnologia você precisa para construir sua troca de criptomoedas?

Vamos descrever a pilha de tecnologia necessária para construir sua exchange de criptomoedas.

O Motor de Correspondência

É o sistema central que conecta compradores e vendedores. Ele precisa lidar com mais de 100.000 pedidos por segundo sem travar. É como o controle de tráfego aéreo para negociações—tudo passa por ele.

Você também pode gostar

Você vai precisar:

- Ordens de mercado (comprar/vender instantaneamente ao preço atual)

- Ordens limitadas (comprar/vender apenas ao seu preço alvo)

- Ordens de stop-loss (venda automática se o preço cair)

- Coisas avançadas como ordens de iceberg para grandes traders

Carteiras e Segurança

A segurança não é opcional—é tudo. Um hack e você está acabado. Aqui estão algumas das maneiras de garantir proteção:

- Armazenamento a Frio: Mantenha 90-95% da criptomoeda offline em cofres físicos. Isso é como manter barras de ouro em um cofre.

- Hot Wallets: Mantenha 5-10% online para retiradas diárias. Os usuários precisam de acesso rápido, mas minimizem o risco.

- Carteiras multi-assinatura: Requerem várias chaves para aprovar retiradas. Mesmo que um hacker consiga uma chave, não poderá roubar os fundos.

A auditoria de segurança periódica por empresas como a CertiK ou Hacken economiza dinheiro, mas evita a falência.

Conexões de Blockchain

Você precisa se conectar ao Bitcoin, Ethereum e outras blockchains. Duas opções:

- Execute seus próprios nós: Máximo controle, mas caro (terabytes de armazenamento, manutenção constante)

- Use serviços como Alchemy ou Infura: Mais fácil, mas você depende de terceiros

A maioria das exchanges usa uma mistura de ambos.

Conformidade KYC/AML

A confirmação de identidade usando serviços como Sumsub ou Jumio ajuda a prevenir que usuários sejam bots ou criminosos. Para isso, você precisará:

- Verificação de documentos (passaporte, carteira de motorista)

- Reconhecimento facial

- Confirmação de endereço

- Monitoramento de transações para atividades suspeitas

Você também pode configurar a verificação em camadas. Camada básica para pequenas quantias (cadastro rápido), camada avançada para limites altos (documentação completa). Isso converte mais usuários do que exigir tudo de imediato.

Você também pode gostar

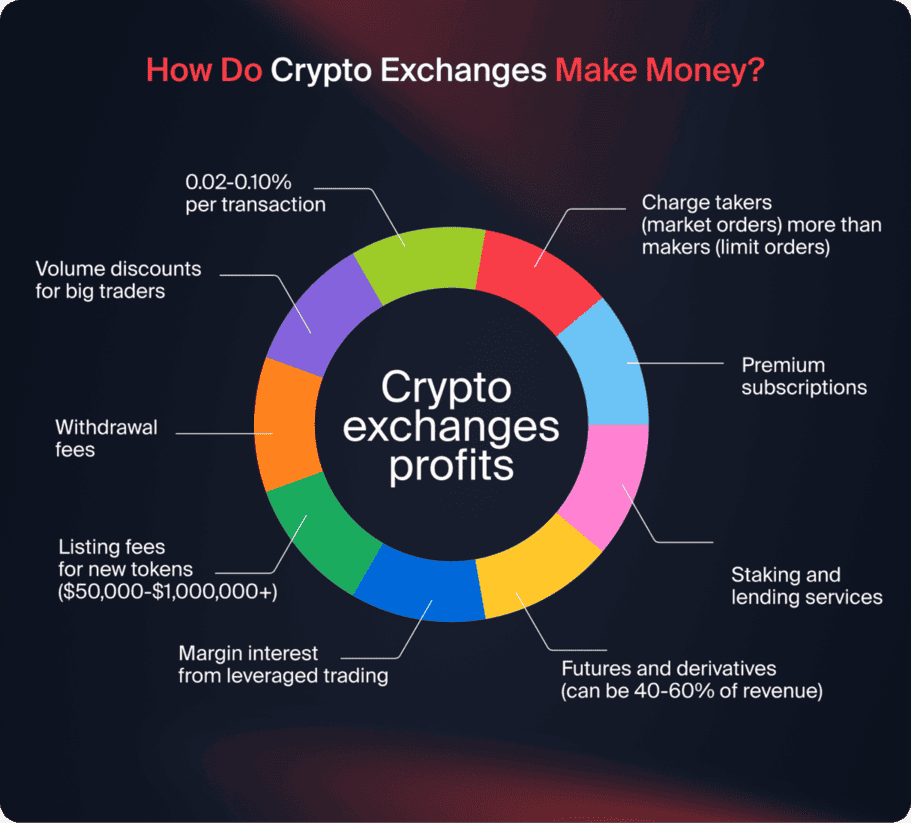

Como as Exchanges de Cripto fazem Dinheiro?

As exchanges de criptomoedas ganham dinheiro por meio de várias maneiras que você pode aproveitar. Elas incluem:

Taxas de Negociação

A principal fonte de renda para as exchanges de criptomoedas são as taxas de negociação que cobram de seus clientes. Estas incluem;

- 0,02-0,10% por transação

- Cobrar mais dos tomadores (ordens de mercado) do que dos criadores (ordens limitadas)

- Descontos por volume para grandes comerciantes

Outras Fontes de Receita

Outras fontes de receita para as exchanges de criptomoedas são;

- Taxas de retirada

- Taxas de listagem para novos tokens ($50.000-$1.000.000+)

- Juros de margem de negociação alavancada

- Futuros e derivativos (podem ser 40-60% da receita)

- Serviços de staking e empréstimo

- Assinaturas premium

Trocas bem-sucedidas não dependem apenas de taxas de negociação. Quanto mais fontes de receita, mais estável será seu negócio. Confira nosso guia sobre modelos de negócios de corretagem para entender diferentes estratégias de monetização.

Como Construir Uma Exchange de Criptomoedas do Zero: Guia Passo a Passo

Etapa 1: Organizar todos os Requisitos Legais

Antes de escrever uma única linha de código, é crucial que você faça o seguinte:

- Escolha sua jurisdição com cuidado. Alguns países amam cripto, outros a proíbem.

- Contrate advogados especializados em criptomoedas. Advogados comuns não vão resolver.

- Solicite todas as licenças necessárias. Isso leva de 3 a 12 meses.

- Estabeleça relacionamentos bancários cedo. Muitos bancos recusam negócios de criptomoedas—comece a procurar agora.

Na Quadcode, vimos clientes desperdiçarem 8 meses construindo plataformas perfeitas, para então perceberem que não conseguem abrir uma conta bancária. Este é um erro que você não quer cometer.

Passo 2: Escolha Sua Abordagem de Desenvolvimento

Opção A: Construir Tudo Personalizado

- Controle total sobre os recursos

- Custos de $150.000 a $3.000.000

- Dura de 8 a 24 meses

- Requer a contratação de toda a equipe de desenvolvimento

- Alto risco, alto custo

Opção B: Solução de Marca Branca

- Plataforma pré-construída e testada pronta para uso

- Custos de $50.000 a $200.000 + taxas contínuas

- Lançamento em 6-12 semanas

- Suporte profissional e atualizações incluídas

- Menor risco, mais rápido para o mercado

A maioria dos fundadores inteligentes escolhe a Opção B inicialmente, e depois adiciona recursos personalizados uma vez que estão ganhando dinheiro.

Etapa 3: Construir Recursos da Plataforma Principal

Seja personalizada ou de marca branca, sua exchange precisa de:

Interface de Negociação:

- Gráficos em tempo real (integrar a biblioteca TradingView)

- Livro de ordens mostrando todas as ordens de compra/venda

- Negociação com um clique para velocidade

- Painel de portfólio mostrando lucros/prejuízos

Sistemas de Segurança:

- Proteção DDoS (Cloudflare ou AWS Shield)

- Autenticação de dois fatores

- Criptografia em toda parte

- Programa de recompensas por bugs (pagar hackers para encontrar vulnerabilidades antes que os criminosos o façam)

Integração de Pagamento:

- Transferências bancárias (wire, ACH, SEPA)

- Cartões de crédito/débito através de processadores como Simplex ou MoonPay (caros com taxas de 3-8%)

- Stablecoins (USDT, USDC) como alternativas a moeda fiduciária

Passo 4: Organizar a Liquidez

A liquidez significa que sempre há compradores e vendedores. Sem ela, sua troca parece vazia, e as transações não são executadas a preços justos.

Como obter liquidez:

- Use bots de criação de mercado inicialmente (eles colocam ordens para preencher seu livro de ordens)

- Parceria com formadores de mercado institucionais como Jump Trading ou Wintermute

- Comece com pares populares como BTC/USDT e ETH/USDT

- Orçamento de $20.000 a $100.000+ mensais para provisão de liquidez

Pense na liquidez como ter estoque em uma loja. Prateleiras vazias significam nenhuma venda.

Passo 5: Teste Tudo Minuciosamente

Lance uma versão beta para usuários limitados primeiro. Teste em condições reais:

- Seu sistema pode lidar com picos de negociação repentina?

- O que acontece se a conexão com a internet cair?

- Há algum erro no processo de retirada?

- O aplicativo móvel é fluido?

Corrija tudo antes de abrir ao público. Uma grande falha no lançamento e você terá dificuldades para recuperar a confiança.

Passo 6: Lançamento e Marketing

Lançamento suave primeiro: Aberto a um pequeno grupo de usuários, monitorar tudo e corrigir problemas.

Então, lançamento completo com marketing:

- Conteúdo em sites de notícias sobre criptomoedas

- Canais de criptomoedas no YouTube

- Comunidades de criptomoedas do Twitter/X

- Competições de trading com prêmios

- Bônus de indicação

Rastreie tudo:

- Volumes de negociação

- Inscrições de usuários

- Receita

- Desempenho do sistema

- Reclamações de clientes

Quais são os maiores riscos ao operar uma exchange de criptomoedas?

- Quebras de segurança: Um hack pode custar centenas de milhões. Mt. Gox perdeu 850.000 Bitcoin. Segurança não é opcional.

- Mudanças regulatórias: Os governos podem te fechar da noite para o dia com novas regras. Mantenha-se sempre em conformidade.

- Problemas de liquidez: Se os usuários não conseguirem negociar a preços justos, eles deixarão para os concorrentes.

- Perdas no relacionamento bancário: Perder sua conta bancária significa não ter depósitos em fiat. Jogo acabado.

- Falhas técnicas durante a volatilidade: Quando o Bitcoin cai 20% em uma hora e seu site cai, os usuários ficarão furiosos.

Você deve construir do zero ou usar marca branca?

A verdade é a seguinte: a menos que você tenha um orçamento de mais de $1.000.000 e 18 meses disponíveis, construir completamente do zero não faz mais sentido.

Considere a marca branca se:

- Você quer lançar rapidamente (semanas, não anos)

- Você quer tecnologia comprovada

- Você prefere gastar dinheiro em marketing e crescimento

- Você precisa de suporte técnico contínuo

- Você quer se concentrar em seus clientes, não na infraestrutura

Crie uma condição personalizada se:

- Você tem um financiamento massivo (vários milhões de dólares)

- Você precisa de recursos únicos

- Você tem mais de 18 meses antes do lançamento

- Você quer controle total sobre cada detalhe

A maioria das novas exchanges bem-sucedidas começa com white-label, prova o modelo de negócios e, em seguida, adiciona gradualmente recursos personalizados. É a estratégia inteligente e de baixo risco.

Conclusão

Construir uma exchange de criptomoedas é complexo, mas definitivamente possível. A chave é ser inteligente sobre sua abordagem. Não perca anos construindo do zero quando existem soluções white-label. Não comprometa a segurança e garanta que você não pule a configuração legal e bancária.

Com base em nossa experiência, vimos a diferença entre lançamentos bem-sucedidos e falhas caras. Os vencedores focam primeiro na conformidade, depois na tecnologia, e lançam cedo para começar a aprender com usuários reais. Os perdedores constroem em isolamento por anos, e então descobrem que o mercado mudou ou que as regulamentações não permitirão seu modelo de negócio.

FAQ

Sim, você pode criar sua própria exchange de criptomoedas. Para isso, você precisará das licenças adequadas, capital e tempo suficiente para desenvolvimento personalizado (preferencialmente de 12 a 24 meses). Você também pode criar sua plataforma de exchange de criptomoedas de forma barata e rápida com o uso de soluções de marca branca.

O custo de construir uma exchange de criptomoedas depende do tipo de plataforma que está sendo construída. Plataformas básicas do zero custam entre $150,000 e $300,000, plataformas de complexidade média custam entre $400,000 e $800,000, enquanto exchanges de nível empresarial custam entre $1,000,000 e $3,000,000.

Desenvolvimento personalizado leva de 8 a 12 meses para trocas básicas, de 12 a 18 meses para plataformas médias e de 18 a 24+ meses para soluções empresariais. Adicione mais 3 a 12 meses para licenciamento e aprovação regulatória. Soluções de marca branca são lançadas em apenas 6 a 12 semanas, incluindo personalização.

Ao construir sua exchange de criptomoedas, você deve cumprir plenamente as leis e regulamentos relevantes que orientam suas operações dentro de suas jurisdições preferidas. Tais leis e regulamentos incluem licenciamento e registro, KYC/AML, privacidade de dados, listagem de tokens e tributação, etc.

Atualizado:

13 de novembro de 2025