การซื้อขายสำหรับผู้เริ่มต้น: จะเริ่มต้นอย่างไร?

เนื้อหา

กระบวนการซื้อขายที่เกี่ยวข้องกับตลาดการเงินประกอบด้วยการซื้อและขายสินทรัพย์ต่างๆ เพื่อให้ได้กำไร เทรดเดอร์จำเป็นต้องซื้อสินทรัพย์ในราคาที่ต่ำกว่า แล้วจึงขายในราคาที่สูงกว่า ฟังดูง่ายและชัดเจน

จากการวิจัยของ Modern Trader พบว่าจำนวนเทรดเดอร์ที่เทรดเดอร์เป็นประจำมีมากกว่า 14 ล้านคน ในแต่ละปีมีเทรดเดอร์มือใหม่หลายล้านคนเข้าสู่ตลาดนี้ แต่สถิติระบุว่าเทรดเดอร์มือใหม่กว่า 90% สูญเสียเงินฝากครั้งแรกและลืมการเทรดไปตลอดชีวิต พวกเขากลายเป็นเหยื่อของความผิดพลาดทั่วไป

ในบทความนี้เราจะสำรวจ:

- ผู้ประกอบการมือใหม่ควรทำตามขั้นตอนใดเพื่อเข้าสู่ตลาด?

- คำศัพท์หลักที่เกี่ยวข้องกับการซื้อขายมีอะไรบ้าง?

- ข้อผิดพลาดที่ผู้ค้ามักทำกันบ่อยที่สุดคืออะไร และจะหลีกเลี่ยงได้อย่างไร?

- รูปแบบและกลยุทธ์การซื้อขายที่ดีที่สุดสำหรับผู้ค้ามือใหม่คืออะไร?

วิธีเริ่มต้น: ขั้นตอนหลักในการเข้าสู่ช่องทางการซื้อขาย

ก่อนอื่นเลย เรามาทำความเข้าใจกลไกที่จำเป็นต่อการเข้าถึงการซื้อขายกันก่อน

ค้นหาแพลตฟอร์มการซื้อขายเพื่อก้าวขั้นแรก

การมีผู้เริ่มต้นที่มีรายได้ตั้งแต่ 100 ถึง 1,000 ดอลลาร์สหรัฐฯ ไม่สามารถเข้าถึงตลาดการเงินได้โดยตรง พวกเขาจำเป็นต้องหาตัวกลางที่เชื่อมโยงผู้เล่นรายย่อยและผู้เล่นหลัก แพลตฟอร์มโบรกเกอร์และตลาดแลกเปลี่ยนจึงมีบทบาทเป็นตัวกลางดังกล่าว

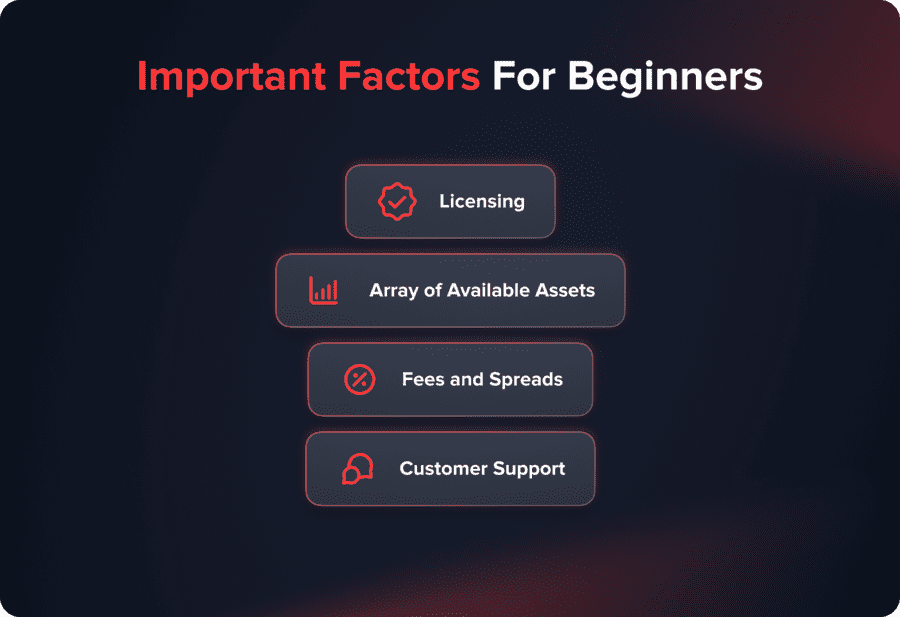

แพลตฟอร์มการซื้อขายหลายพันแห่งยินดีต้อนรับเทรดเดอร์มือใหม่ อย่างไรก็ตาม อย่ารีบร้อนตัดสินใจ พิจารณาปัจจัยสำคัญต่อไปนี้:

- การออกใบอนุญาต โบรกเกอร์และตลาดแลกเปลี่ยนชั้นนำได้รับใบอนุญาตจากหน่วยงานกำกับดูแลทางการเงินชั้นนำของโลก อย่าไว้ใจแพลตฟอร์มที่ไม่ได้รับอนุญาต เพราะอาจขโมยเงินของคุณไปได้ง่ายๆ

- อาร์เรย์ของสินทรัพย์ที่มีอยู่ แพลตฟอร์มชั้นนำของอุตสาหกรรมช่วยให้เข้าถึงสินทรัพย์ทางการเงินหลายร้อยรายการเพื่อให้ลูกค้าสามารถซื้อขายสินทรัพย์ประเภทต่างๆ ได้ภายใต้หลังคาเดียวกัน

- ค่าธรรมเนียมและสเปรด ก่อนสมัครใช้งานแพลตฟอร์มใดๆ ควรศึกษาข้อมูลให้ครบถ้วนเกี่ยวกับประเภทบัญชี สเปรด และค่าคอมมิชชัน ตรวจสอบให้แน่ใจว่าค่าธรรมเนียมมีความโปร่งใสและไม่มีส่วนซ่อนเร้น มีการเรียกเก็บค่าคอมมิชชั่น -

- การสนับสนุนลูกค้า บริษัทนายหน้าและตลาดแลกเปลี่ยนที่ดีที่สุดจะมอบการสนับสนุนลูกค้าชั้นยอดให้กับลูกค้าเพื่อแก้ไขปัญหาต่างๆ ให้ได้ภายในระยะเวลาอันสั้นที่สุด

สร้างบัญชีและทำตามขั้นตอนการยืนยันให้เสร็จสิ้น

เมื่อคุณพบบริษัทนายหน้า/ตลาดแลกเปลี่ยนที่ตรงตามเกณฑ์ที่กล่าวมาข้างต้น คุณจะต้องสร้างบัญชี

ขั้นตอนการสมัครมักจะง่ายมาก เพียงกรอกชื่อ ประเทศที่พำนักอาศัย อีเมล และหมายเลขโทรศัพท์ ผู้เริ่มต้นอาจใช้เวลาประมาณ 3-5 นาทีในการสร้างบัญชี

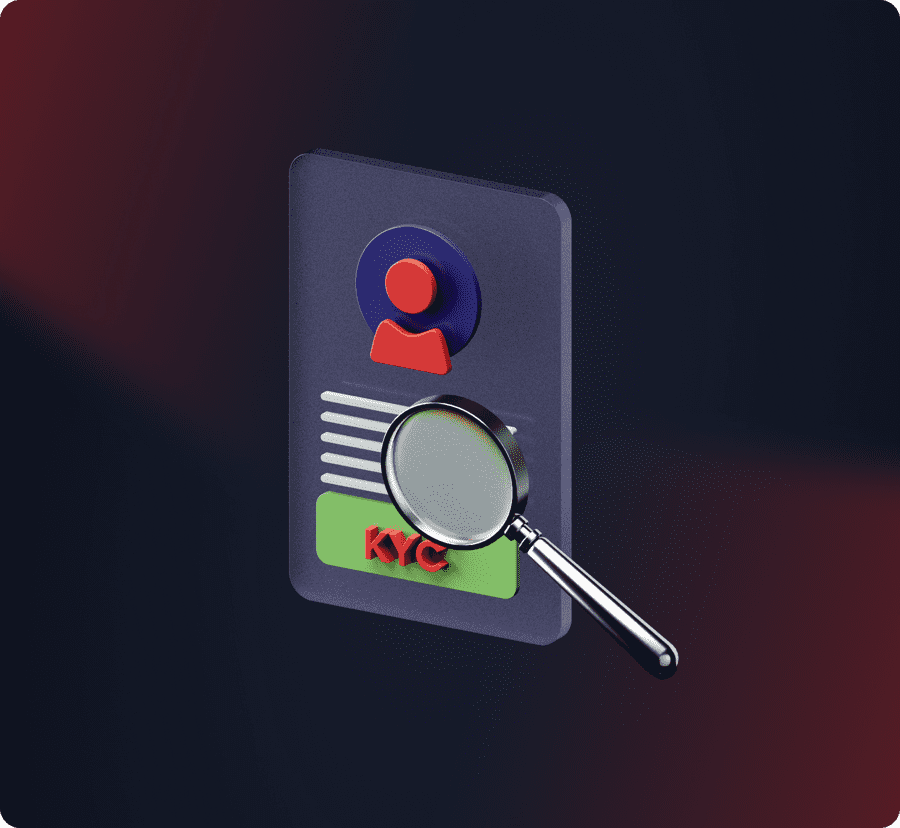

แพลตฟอร์มการซื้อขายระดับสูงสุด กำหนดให้ลูกค้าดำเนินการตามขั้นตอนการตรวจสอบให้เสร็จสมบูรณ์ หมายความว่าอย่างไร? คุณต้องอัปโหลดรูปถ่ายหรือสแกนเอกสารของคุณ (บัตรประจำตัวประชาชน หนังสือเดินทาง ใบขับขี่) การตรวจสอบ KYC เป็นหนึ่งในขั้นตอนบังคับที่ต้องดำเนินการเพื่อปลดล็อคการถอนเงินและฟีเจอร์อื่นๆ

บันทึก! แพลตฟอร์มโบรกเกอร์ที่ได้รับอนุญาตทุกแห่ง “บังคับ” ลูกค้าให้ทำตามขั้นตอนการยืนยันตัวตนให้เสร็จสมบูรณ์ ตามที่หน่วยงานกำกับดูแลทางการเงินกำหนดไว้ หากการยืนยันตัวตนด้วย KYC ไม่ใช่ขั้นตอนบังคับ อย่าไว้วางใจแพลตฟอร์มนี้

ฝากเงินผ่านหนึ่งในวิธีที่มีให้เลือก

เทรดเดอร์จำเป็นต้องฝากเงินก่อนจึงจะสามารถเปิดออเดอร์ได้ แพลตฟอร์มระดับไฮเอนด์รองรับวิธีการชำระเงินที่หลากหลาย และช่วยให้ลูกค้ามั่นใจได้ว่าการชำระเงินมีความปลอดภัยเพียงพอ ในกรณีส่วนใหญ่ เทรดเดอร์จำเป็นต้องถอนเงินด้วยวิธีเดียวกับที่ฝากเงินไว้ก่อนหน้านี้ โปรดพิจารณาคุณสมบัตินี้เมื่อตัดสินใจเลือกวิธีการเติมเงินเข้าบัญชีของคุณ

เริ่มต้นการซื้อขายบนแพลตฟอร์ม

หลังจากฝากเงินแล้ว เทรดเดอร์จะสามารถเปิดออเดอร์และรับกำไรได้จริง ในขณะเดียวกัน มือใหม่ส่วนใหญ่ก็ทำผิดพลาดซ้ำแล้วซ้ำเล่า ข้อผิดพลาดเหล่านั้นคืออะไร และจะหลีกเลี่ยงได้อย่างไร

คำศัพท์สำคัญที่ใช้ภายในกลุ่มการค้า

ตลาดสปอต. ผู้ซื้อขายใช้เงินของตนเองเพื่อเปิดสถานะเท่านั้น

การซื้อขายมาร์จิ้นเทรดเดอร์สามารถกู้ยืมเงินจากโบรกเกอร์หรือแพลตฟอร์มแลกเปลี่ยน และเปิดสถานะเลเวอเรจ เลเวอเรจแสดงอัตราส่วนระหว่างเงินทุนของเทรดเดอร์และต้นทุนการกู้ยืม

ราคาเสนอซื้อราคาสูงสุดที่ผู้ซื้อพร้อมจะเสนอเพื่อซื้อสินทรัพย์ ตรงกันข้ามคือ ขอราคาราคาต่ำสุดที่ผู้ขายพร้อมจะยอมรับในการขายสินทรัพย์

คำสั่งซื้อขายในตลาด. ผู้ประกอบการค้าพร้อมที่จะซื้อหรือขายสินทรัพย์ในราคาที่ดีที่สุดไม่ว่าราคาที่แน่นอนจะเป็นเท่าใดก็ตาม

คำสั่งจำกัด. เทรดเดอร์จะกำหนดราคาที่แน่นอนสำหรับการซื้อหรือขายสินทรัพย์ คำสั่งดังกล่าวจะดำเนินการเมื่ออีกฝ่ายยอมรับราคานี้

ตำแหน่งยาวสถานะเลเวอเรจที่แสดงให้เห็นว่าเทรดเดอร์คาดหวังว่าราคาของสินทรัพย์จะสูงขึ้น สถานะตรงกันข้าม ตำแหน่งสั้นแสดงให้เห็นว่าผู้ซื้อขายคาดการณ์ว่าราคาสินทรัพย์จะลดลง

การวิเคราะห์ทางเทคนิคแนวทางดังกล่าวอิงตามข้อมูลในอดีตและเชื่อมโยงกับตราสาร รูปแบบ และรูปภาพกราฟิกต่างๆ ที่ช่วยให้ผู้ซื้อขายคาดการณ์ได้ว่าราคาสินทรัพย์จะเคลื่อนไหวไปทางใดต่อไป

การวิเคราะห์ปัจจัยพื้นฐานแนวทางนี้อิงจากปัจจัยมหภาค เช่น งบการเงิน ปัจจัยทางการเมือง เศรษฐกิจ และสังคม และข้อมูลสำคัญอื่นๆ การวิเคราะห์ปัจจัยพื้นฐานช่วยให้เทรดเดอร์สามารถคาดการณ์ระยะยาวได้

รั้น ตลาด สถานการณ์ตลาดเมื่อราคาสินทรัพย์สูงขึ้น เมื่อราคาสินทรัพย์ลดลง ตลาดจะ งุ่มง่าม-

คำศัพท์ที่กล่าวมาข้างต้นเป็นพื้นฐานที่เทรดเดอร์สามารถนำไปใช้พัฒนาตนเองต่อไปได้ อันที่จริงแล้ว ช่องทางนี้ประกอบด้วยคำศัพท์หลายร้อยหรือหลายพันคำ และเทรดเดอร์มืออาชีพจะพัฒนาทักษะของตนเองอย่างต่อเนื่อง เพื่อค้นพบสิ่งใหม่ๆ ที่เป็นประโยชน์

ยิ่งไปกว่านั้น เทรดเดอร์มือใหม่ “ชอบ” ทำผิดพลาดซ้ำๆ เดิมๆ ความผิดพลาดเหล่านั้นคืออะไร และมีวิธีหลีกเลี่ยงอย่างไร?

ข้อผิดพลาดที่พบบ่อยที่สุดที่ผู้ค้ามือใหม่มักทำและวิธีหลีกเลี่ยง

การขาดความรู้และความเข้าใจที่ผิดเกี่ยวกับการทำงานของตลาด

การซื้อขายดูเหมือนจะเป็นเรื่องพื้นฐานในตอนแรก ซื้อถูกขายแพง ฟังดูง่ายใช่ไหมล่ะ? ในขณะเดียวกัน เทรดเดอร์มือใหม่ยังไม่เข้าใจว่าปัจจัยใดบ้างที่ส่งผลต่อราคาสินทรัพย์ ควรทำอย่างไรหลังจากขาดทุน และรายละเอียดปลีกย่อยอื่นๆ อีกมากมาย

คุณกำลังเริ่มต้นก้าวแรกในตลาดการเงิน แต่ยังไม่รู้ว่าจะเริ่มต้นอย่างไร นี่คือเคล็ดลับที่เป็นประโยชน์:

- เรียนรู้คำศัพท์พื้นฐานในการเทรด ก่อนเข้าสู่ตลาด คุณจำเป็นต้องรู้ความแตกต่างระหว่างคำสั่ง long และ short เลเวอเรจหมายถึงอะไร และทำไมถึงเป็นเช่นนั้น จุดตัดขาดทุนและจุดทำกำไร คำสั่งที่เป็นประโยชน์สำหรับเทรดเดอร์ ดูบทช่วยสอนแบบข้อความหรือวิดีโอเพื่อทำความเข้าใจพื้นฐาน

- เปิดบัญชีทดลองก่อน แพลตฟอร์มโบรกเกอร์ชั้นนำในอุตสาหกรรมเปิดโอกาสให้ลูกค้าเปิดบัญชีทดลอง ใช้เงินเสมือนจริงเพื่อลงทุนในสินทรัพย์ต่างๆ เทรดเดอร์มือใหม่ทุกคนล้วนทำผิดพลาดได้ ซึ่งก็ไม่เป็นไร บัญชีทดลองช่วยให้เทรดเดอร์หลีกเลี่ยงความเสี่ยงจากเงินจริง

- ยกระดับทักษะของคุณ เทรดเดอร์มืออาชีพผู้มากประสบการณ์ไม่เคยหยุดพัฒนาตนเอง พวกเขายกระดับทักษะผ่านหนังสือที่มีประโยชน์ เว็บบินาร์ และงานวิจัยของตนเอง สำหรับผู้เริ่มต้น มีหนังสือที่ควรมีติดตัว ซึ่งจะช่วยผลักดันคุณสู่ความสำเร็จได้อย่างทรงพลัง:

- Steenbarger B. คู่มือการมีวินัยสำหรับผู้ค้า

- Neiman E. สารานุกรมพ่อค้ารายย่อย

- Soros G. การเล่นแร่แปรธาตุของการเงิน

- Taleb N. โดนหลอกด้วยความสุ่ม

- Murphy J. การวิเคราะห์ทางเทคนิคของตลาดการเงิน

อย่าเปรียบเทียบช่องทางการเทรดกับลอตเตอรี่และคาสิโน โชคก็สำคัญ แต่ 90% ของความสำเร็จของเทรดเดอร์นั้นขึ้นอยู่กับความเป็นมืออาชีพ ทักษะ และประสบการณ์ของคุณ

การใช้สินทรัพย์ทั้งหมดที่ผู้ค้าสามารถเข้าถึงได้

แพลตฟอร์มการซื้อขายชั้นนำเปิดโอกาสให้เข้าถึงสินทรัพย์หลายร้อยรายการ และเทรดเดอร์มือใหม่มักพยายามครอบคลุมตราสารที่หลากหลาย ในตอนเช้าพวกเขาจะเปิดสถานะด้วยสกุลเงิน Forex ส่วนในช่วงบ่าย เทรดเดอร์เหล่านี้จะใช้โลหะ หุ้น และดัชนี ยิ่งใกล้ค่ำก็ยิ่งเป็นเวลาของคริปโตเคอร์เรนซีหรือสินค้าโภคภัณฑ์

เหตุใดพฤติกรรมเช่นนี้จึงนำไปสู่การขาดทุน? การเคลื่อนไหวของราคาสินทรัพย์เป็นไปตามกฎเกณฑ์บางประการ เทรดเดอร์มืออาชีพเข้าใจความเชื่อมโยงที่แตกต่างกัน และติดตามข่าวสารเพื่อคาดการณ์การเคลื่อนไหวของราคาต่อไปได้อย่างถูกต้อง ตัวอย่างเช่น คู่สกุลเงิน AUD/USD และ NZD/USD ขึ้นอยู่กับสภาพภูมิอากาศในภูมิภาคเป็นส่วนใหญ่

เมื่อผู้ค้าต้องการซื้อขายทุกอย่างที่เขาสามารถเข้าถึงได้ พวกเขาไม่สามารถวิเคราะห์สินทรัพย์ได้อย่างถูกต้อง

ความไม่สามารถจัดการความเสี่ยงและอารมณ์

สาเหตุที่พบบ่อยที่สุดประการหนึ่งที่ทำให้ผู้เริ่มต้นสูญเสียเงินฝากครั้งแรกคือการไม่สามารถจัดการความเสี่ยงได้

ตัวอย่างเช่น เทรดเดอร์คนหนึ่งได้วิเคราะห์อย่างลึกซึ้งและเข้าใจว่าราคาหุ้น TSLA กำลังจะสูงขึ้น เขาจึงใช้เงินฝาก 50-70% ของเงินฝากทั้งหมดเพื่อเปิดสถานะซื้อ แต่กลับพบว่าราคาหุ้น TSLA ตกลงเนื่องจากเหตุการณ์ที่ไม่สามารถคาดการณ์ได้ และเทรดเดอร์ก็ประสบกับภาวะขาดทุนอย่างหนัก

เทรดเดอร์มืออาชีพทำอย่างไรในสถานการณ์เช่นนี้? พวกเขาใช้กลยุทธ์การบริหารความเสี่ยงที่เลือกไว้ ไม่ว่าการซื้อขายจะดูทำกำไรได้มากเพียงใดก็ตาม ผู้เล่นในตลาดที่มีประสบการณ์จะใช้เงินฝาก 3-5% ของแต่ละสถานะ สำหรับมือใหม่ ขอแนะนำให้เริ่มต้นด้วย 1-2%

You may also like

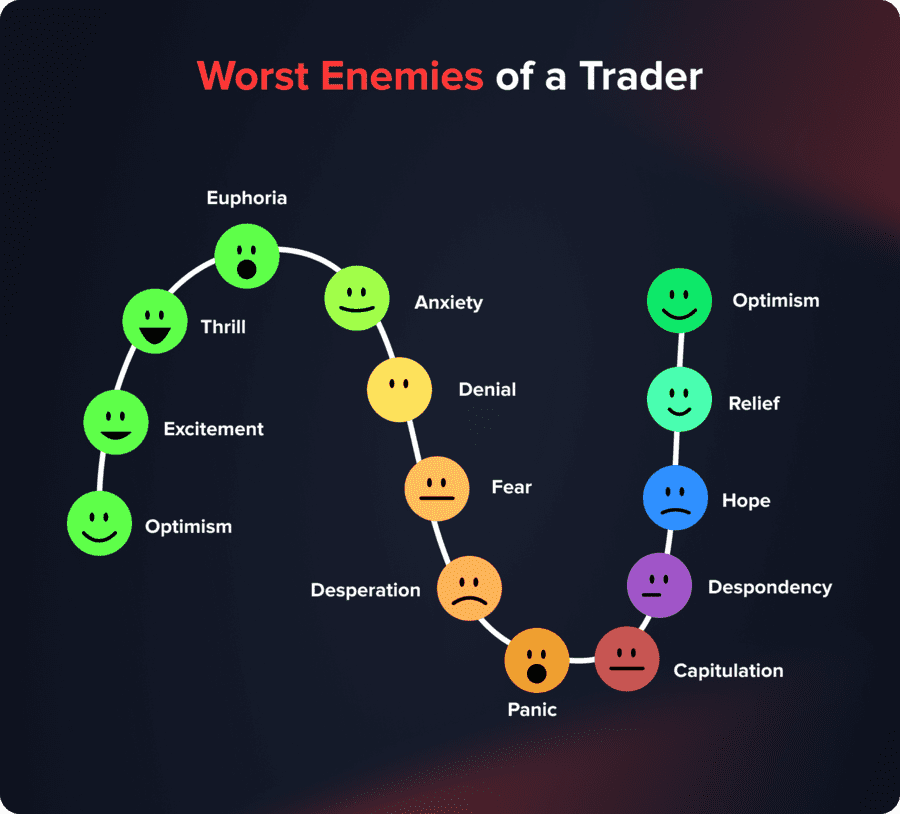

กลยุทธ์การบริหารความเสี่ยงมีความสัมพันธ์อย่างใกล้ชิดกับอารมณ์ของเทรดเดอร์ อารมณ์จัดอยู่ในประเภทศัตรูตัวฉกาจของเทรดเดอร์

เมื่อเปิดสถานะ ควรพิจารณาด้วยสติสัมปชัญญะที่รอบคอบ เลือกใช้กลยุทธ์การบริหารความเสี่ยงและแผนการเทรดที่เหมาะสม เทรดเดอร์มืออาชีพเข้าใจดีว่าอารมณ์อาจทำลายความก้าวหน้าทั้งหมดได้

การซื้อขายแบบวุ่นวายโดยไม่มีแผนการซื้อขายใดๆ

ควรซื้อสินทรัพย์ใด? เลเวอเรจแบบไหนดีที่สุด? ควรเปิดสถานะกี่สถานะภายในหนึ่งวัน? แผนการเทรดจะให้คำตอบอย่างละเอียดสำหรับคำถามเหล่านี้ หมายความว่าอย่างไร และทำไมเทรดเดอร์จึงต้องปฏิบัติตามแผนการเทรดอย่างเคร่งครัด?

แผนการซื้อขายควบคุมกิจกรรมของคุณ ช่วยให้ผู้ซื้อขายควบคุมอารมณ์ของตนเอง และปลดล็อกโอกาสในการนำโปรแกรมอัตโนมัติมาใช้

เทรดเดอร์จะรวมหมวดหมู่ต่อไปนี้ไว้ในแผนของตน: กลยุทธ์การเทรด กลยุทธ์การบริหารความเสี่ยง สินทรัพย์ที่ต้องการ เลเวอเรจที่เป็นไปได้ และอื่นๆ อีกมากมาย ภารกิจหลักคือการทำตามแผนอย่างเคร่งครัดโดยไม่ปล่อยให้อารมณ์เข้ามาแทรกแซงกระบวนการเทรด

นอกเหนือจากแผนการซื้อขายแล้ว คุณจำเป็นต้องเข้าใจด้วยว่าควรใช้กลยุทธ์การซื้อขายใด

กลยุทธ์การซื้อขายจะกำหนดว่าสินทรัพย์ กรอบเวลา และเครื่องมือทางเทคนิคใดที่ผู้ซื้อขายใช้ในการเปิดและปิดสถานะ

You may also like

คาดหวังผลกำไรมหาศาล

นักลงทุนหน้าใหม่จำนวนมากคาดหวังว่าจะได้รับเงินหลายล้านดอลลาร์ภายในระยะเวลาอันสั้นที่สุด พวกเขาได้รับแรงบันดาลใจจากวิดีโอและเรื่องราวใน YouTube ที่เทรดเดอร์สามารถสร้างรายได้ 1,000,000 ดอลลาร์จากจุดเริ่มต้นเพียง 100 ดอลลาร์ ความคาดหวังดังกล่าวนำไปสู่ความเสี่ยงที่สูงเป็นพิเศษ การเทรดด้วยอารมณ์ และการละเมิดกฎการบริหารความเสี่ยงทุกประการ ใน 99% ของกรณี นักลงทุนหน้าใหม่มักจะสูญเสียเงิน

พยายามทำความเข้าใจว่าเทรดเดอร์มืออาชีพที่ประสบความสำเร็จมักตั้งเป้าหมายที่เป็นจริง เทรดเดอร์โดยเฉลี่ยมีรายได้ 30,000 ถึง 90,000 ดอลลาร์ต่อปี ซึ่งเป็นตัวเลขที่เข้าใจง่าย สำหรับเงินล้านและพันล้านนั้น ตัวเลขเหล่านี้ก็เป็นจริงเช่นกัน แต่เทรดเดอร์จะบรรลุเป้าหมายเหล่านี้ไปทีละขั้น พัฒนาทักษะของคุณ พัฒนาอย่างต่อเนื่อง แต่อย่าคาดหวังว่าจะมีรายได้หลายล้านในตอนนี้

วิธีอัพเกรดทักษะการซื้อขายของคุณและกลายเป็นผู้ค้ามืออาชีพ: เคล็ดลับที่เป็นประโยชน์

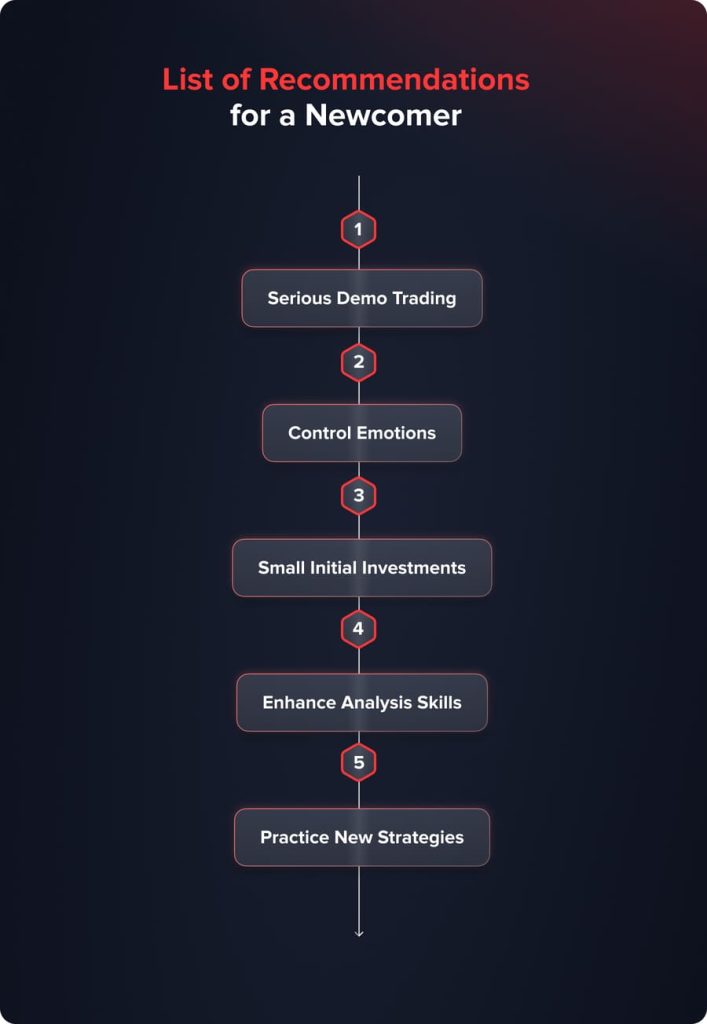

นี่คือรายการคำแนะนำที่จะช่วยให้ผู้ค้ามือใหม่อัพเกรดทักษะ หลีกเลี่ยงการสูญเสียหนัก และสร้างกำไร:

- เริ่มจากบัญชีทดลอง แต่ควรเทรดอย่างจริงจัง อย่าเข้าใจว่าการขาดทุนเงินเสมือนเป็นเพียงเกม

- พัฒนาอารมณ์ของคุณ เปิดสถานะตามแผนการซื้อขายและกลยุทธ์การบริหารความเสี่ยงของคุณเท่านั้น

- อย่าลงทุนมากตั้งแต่เริ่มต้น เมื่อเริ่มต้นเทรดจริง ควรลงทุนประมาณ 1-5 ดอลลาร์ในแต่ละสถานะ

- ยกระดับทักษะการวิเคราะห์ทางเทคนิคและพื้นฐานของคุณ ยิ่งคุณคาดการณ์การเคลื่อนไหวของราคาได้ดีเท่าไหร่ คุณก็จะได้รับกำไรมากขึ้นเท่านั้น

- ฝึกฝนกลยุทธ์ใหม่ๆ ไม่ว่ากลยุทธ์ปัจจุบันของคุณจะมีประสิทธิภาพและทำกำไรได้มากเพียงใด ตลาดการเงินก็เปลี่ยนแปลงอย่างรวดเร็ว เพื่อให้ทันยุคสมัย คุณจำเป็นต้องฝึกฝน พัฒนา และทดสอบกลยุทธ์ใหม่ๆ

ตัวบ่งชี้การวิเคราะห์ทางเทคนิค 5 อันดับแรกสำหรับผู้เริ่มต้น: ผู้ซื้อขายสามารถเข้าใจอะไรจากตัวบ่งชี้เหล่านี้ได้บ้าง?

เทรดเดอร์มืออาชีพอาจใช้เครื่องมือหลายร้อยชนิด แต่มือใหม่อาจสับสนกับอินดิเคเตอร์ที่หลากหลาย เริ่มต้นด้วยการใช้อินดิเคเตอร์พื้นฐานเพื่อทำความเข้าใจการทำงานของตลาด และลองคาดการณ์ราคาครั้งแรกของคุณ

นี่คือเครื่องมือที่แพร่หลายที่สุดซึ่งมีส่วนร่วมในกลยุทธ์การซื้อขายมากมาย:

- ค่าเฉลี่ยเคลื่อนที่ (MA)ตัวบ่งชี้นี้จะรวมราคาทั้งหมดจากช่วงเวลาก่อนหน้า แล้วหารผลรวมด้วยจำนวนช่วงเวลา ดังนั้น เทรดเดอร์จะได้เส้นที่อธิบายทิศทางแนวโน้มปัจจุบัน

- ออสซิลเลเตอร์สุ่มตราสารประเภทนี้ใช้ค่าเฉลี่ยเคลื่อนที่ (Moving Average) และแสดงสถานะราคาปัจจุบันที่สัมพันธ์กับช่วงราคาภายในระยะเวลาที่กำหนด ตัวบ่งชี้นี้แสดงด้วยมาตราส่วนตั้งแต่ 0 ถึง 100

- ดัชนีความแข็งแกร่งสัมพันธ์ (RSI)ดัชนีนี้จะวิเคราะห์การเคลื่อนไหวของราคาและหาจำนวนแท่งเทียนที่เป็นขาขึ้นและขาลงภายในระยะเวลาที่กำหนด หน้าที่หลักของดัชนี RSI คือการกำหนดโซนที่สินทรัพย์ถูกซื้อมากเกินไปหรือขายมากเกินไป

- แถบบอลลิงเจอร์ตราสารประเภทนี้ประกอบด้วยเส้นสามเส้นที่ก่อตัวเป็นแท่งเทียน (cannel) ซึ่งเป็นจุดที่ราคาสินทรัพย์กำลังเคลื่อนไหว เมื่อราคาเข้าใกล้ขอบบนหรือขอบล่าง มีโอกาสสูงที่ราคาจะกลับตัวกลับเข้าสู่แท่งเทียน

ตัวบ่งชี้ที่กล่าวข้างต้นเพียงพอสำหรับผู้ค้ามือใหม่ที่กำลังทำขั้นตอนแรกในการคาดการณ์การเคลื่อนไหวของราคาในอนาคต

มาสำรวจกลยุทธ์การซื้อขายบางอย่างที่สร้างขึ้นจากตัวบ่งชี้ที่กำหนดให้เพื่อทำความเข้าใจว่าจะเปิดสถานะอย่างไร

กลยุทธ์การซื้อขายสำหรับผู้มาใหม่

การรวมกันของค่าเฉลี่ยเคลื่อนที่ (EMA)

เพิ่มตัวบ่งชี้ MA สองตัวลงในกราฟ ในช่อง Type ให้ตั้งค่า Exponential (EMA) ค่าเฉลี่ยเคลื่อนที่ทั้งสองควรเป็นค่า Exponential จากนั้นคุณต้องกำหนดช่วงเวลาสำหรับเส้นทั้งสอง ใช้ค่า 9 และ 14 ทีนี้คุณจะได้สถานการณ์ต่อไปนี้บนกราฟ

จะเปิดตำแหน่งตามกลยุทธ์นี้ได้อย่างไร?

- เปิดสถานะซื้อเมื่อเส้น EMA 9 ตัดกับเส้น EMA 14 จากล่างขึ้นบน

- เปิดสถานะขายเมื่อเส้น EMA 9 ตัดกับเส้น EMA 14 จากบนลงล่าง

ระบบสมดุลแบบเรียบง่าย

ในการใช้กลยุทธ์นี้ ให้เพิ่มเส้น SMA สองเส้นลงในกราฟ และเลือกช่วงเวลาต่อไปนี้: 5 สำหรับเส้นแรก และ 10 สำหรับ SMA ที่สอง จากนั้นคุณต้องเพิ่ม Stochastic ด้วยคุณลักษณะ 14, 3, 3 ตัวบ่งชี้สุดท้ายที่คุณต้องเพิ่มคือ RSI ใช้การตั้งค่าเริ่มต้น เมื่อคุณเพิ่มตราสารที่จำเป็นทั้งหมดแล้ว คุณจะเห็นภาพต่อไปนี้:

- เปิดสถานะซื้อเมื่อ SMA 5 ตัดกับ SMA 10 ค่า Stochastic กำลังสูงขึ้น และดัชนี RSI สูงกว่า 50

- เปิดสถานะขายเมื่อเส้น SMA 10 ตัดกับ SMA 5 ค่า Stochastic กำลังลดลง และดัชนี RSI ต่ำกว่า 50

การรวมกันของ MA และ RSI

เพิ่มการตั้งค่าตัวบ่งชี้ค่าเฉลี่ยเคลื่อนที่ 5 เป็นช่วงเวลาที่ต้องการ ใช้แบบง่าย จากนั้นเพิ่มดัชนี RSI โดยเปลี่ยนการตั้งค่าเป็น 5 เช่นกัน เราจะได้ภาพต่อไปนี้:

- เปิดสถานะซื้อเมื่อเส้น SMA ตัดกับแท่งเทียนขาขึ้น ดัชนี RSI ควรอยู่เหนือระดับ 50

- เปิดสถานะขายเมื่อเส้น SMA ตัดกับแท่งเทียนขาลง ดัชนี RSI ควรอยู่ต่ำกว่าระดับ 50

บรรทัดล่าง

การซื้อขายจัดอยู่ในประเภทของกิจกรรมที่ทำกำไรได้อย่างมาก ในขณะเดียวกัน ผู้เริ่มต้นมากกว่า 90% สูญเสียเงินเนื่องจากความผิดพลาดทั่วไปบางประการ

ในการเริ่มต้นเทรด มือใหม่จำเป็นต้องค้นหาแพลตฟอร์มเทรดที่น่าเชื่อถือและใช้งานได้จริง สร้างบัญชี ทำตามขั้นตอนการยืนยันตัวตนให้ครบถ้วน และฝากเงิน เพียงเท่านี้ก็เพียงพอสำหรับการเปิดสถานะแล้ว ในทางกลับกัน มือใหม่จำเป็นต้องทดสอบทักษะของตนเองในบัญชีทดลองก่อน เข้าใจวิธีควบคุมอารมณ์ และยกระดับความรู้อย่างต่อเนื่อง

ยิ่งไปกว่านั้น อย่าฝันถึงเงินล้านหรือพันล้านในตอนนี้และเดี๋ยวนี้ ตั้งเป้าหมายที่เป็นรูปธรรมและค่อยๆ บรรลุผล

อัปเดต:

19 ธันวาคม 2567