Trading for Beginners: How to Get Started?

Contents

Related to financial markets, the trading process includes buying and selling different assets. To get profits traders need to purchase an asset at a lower price and then sell it at a higher price. The task sounds clear and simple.

According to Modern Trader research, the overall number of active traders exceeds 14 million. Year by year millions of newcomer traders enter this niche, but the statistics say that more than 90% of beginner traders lose their first deposits and forget about trading for the rest of their lives. They become victims of common mistakes.

In this article, we will explore:

- Which steps should beginner traders take to enter the market?

- What are the core terms related to trading?

- What are the most widespread mistakes traders make and how to avoid them?

- What are the best trading styles and strategies for newcomer traders?

How to Get Started: the Core Steps to Enter the Trading Niche

First and foremost, let’s understand the mechanisms that are mandatory to access trading.

Find a Trading Platform to Make the First Steps

Having some $100 – $1000 beginners cannot access financial markets directly. They need to find an intermediary that connects smaller and core players. Brokerage platforms and exchanges play the role of such an intermediary.

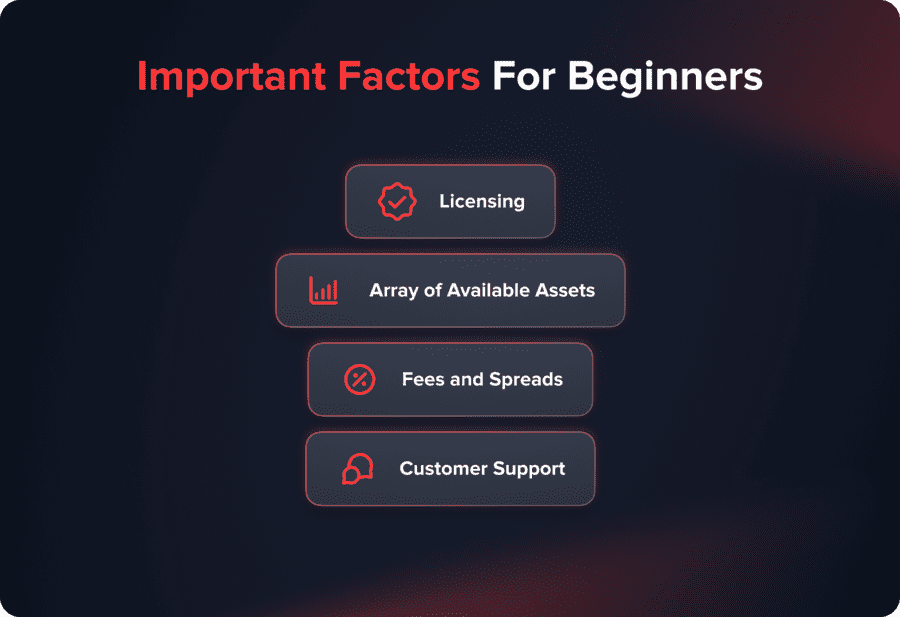

Thousands of trading platforms welcome beginner traders; meanwhile, never make a hasty decision. Take into account the following important factors:

- Licensing. Top-notch brokers and exchanges are licensed by the world’s leading financial regulators. Don’t trust unlicensed platforms as those can easily steal your funds and vanish.

- The array of available assets. Industry-leading platforms unlock access to hundreds of financial assets so that clients could trade different asset categories under one roof.

- Fees and spreads. Before signing up for a platform, find out the fullest information on account types, spreads, and commissions. Ensure that fees are transparent and no hidden commissions are charged.

- Customer support. The best brokerage companies and exchanges provide their clients with high-class customer support to solve their hurdles within the shortest terms.

Create an Account and Complete the Verification Procedure

When you have found a brokerage company/exchange that meets the above-mentioned criteria, you need to create an account.

The sign-up process is usually exceptionally simple: traders need to fill in their names, residence countries, emails, and phone numbers. Beginners need to spend some 3-5 minutes to create an account.

Top-notch trading platforms require their clients to complete the verification process. What does it mean? You need to upload photos or scans of your documents (ID, passport, driving license). The KYC verification is among the mandatory steps that unlocks withdrawals and some other features.

Note! All licensed brokerage platforms “force” their clients to complete the verification procedure, as it is required by financial regulators. When the KYC verification is not a mandatory step, do not trust this platform.

Deposit Funds through One of the Available Methods

Traders need to make a deposit first to unlock the possibility to open orders. High-end platforms support diverse payment methods and ensure clients that payments are secured enough. In most cases traders are obliged to withdraw funds the same way they have made deposits previously. Take this peculiarity into account when deciding on which option to choose for refilling your account.

Start Trading on a Platform

After depositing funds traders are able to open orders and get real profits. Meanwhile, the vast majority of beginners are repeating the same mistakes. What are those mistakes and how to avoid them?

Key Terms Used Within the Trading Niche

Spot market. Traders use their own funds only to open positions.

Margin trading. Traders can borrow funds from a brokerage or exchange platform and open a leveraged position. The leverage shows the ratio between a trader’s funds and borrowed costs.

Bid price. The highest price a buyer is ready to offer for purchasing an asset. The opposite is the ask price, the lowest price a seller is ready to accept for selling an asset.

Market order. A trader is ready to buy or sell an asset at the best possible price no matter what the exact price is.

Limit order. A trader sets a certain price for buying or selling an asset. Such an order is executed when the opposite side accepts this price.

Long position. A leveraged position that shows a trader expects an asset’s price to grow higher. The opposite position, short position, shows that a trader predicts an asset’s price drop.

Technical analysis. The approach is based on historical data and associated with different instruments, patterns, and graphical figures that help traders predict where an asset’s price will go further.

Fundamental analysis. The approach is based on macro-economic factors like financial statements, political, economic, and social factors, and other crucial information. Using fundamental analysis, traders are able to build long-term predictions.

Bullish market. The market situation when an asset’s price is rising. When an asset’s price is going down, the market is bearish.

The above-mentioned terms form the basis a trader can use for further development. In fact, the niche comprises hundreds or even thousands terms, and a professional trader constantly upgrades his skills, finding out something new and useful.

Furthermore, newcomer traders “adore” making one and the same mistakes. What are they and what are the ways to avoid them?

The Most Widespread Mistakes Newcomer Traders Make and Ways to Avoid Them

Lack of Knowledge and Wrong Understanding of How the Market Functions

Trading seems to be elementary at first sight. Buy low – sell high: doesn’t it sound simple? Meanwhile, beginner traders do not understand which factors affect an asset’s price, what they should do after a losing deal, and many other nuances.

As such, you are making your first steps on the financial markets but have no idea what to start with. Here is the list of useful tips:

- Learn the basic trading terms. Before entering the market, you need to know what is the difference between long and short orders, what does the leverage mean, and why are stop-loss and take-profit orders useful for a trader. Look through textual or video tutorials to understand the basics.

- Open a demo account first. Industry-leading brokerage platforms provide their clients with an opportunity to open a demo account. Utilize virtual money to invest in different assets. Every newcomer trader makes mistakes, and that’s okay. Demo accounts help traders to avoid risking their real funds.

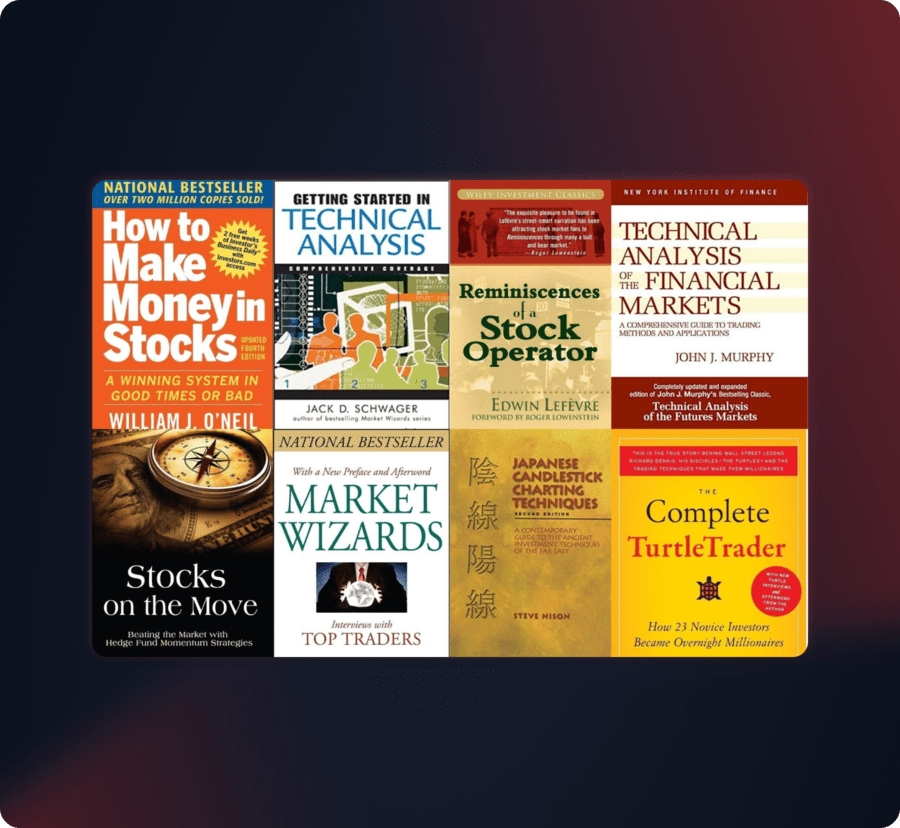

- Upgrade your skills. Experienced professional traders never stop developing themselves. They upgrade skills through useful books, webinars, and their own research. As for beginners, there are some must-have books that give the powerful boost toward success:

- Steenbarger B. A Trader’s Guide to Discipline;

- Neiman E. The Small Trader’s Encyclopedia;

- Soros G. The Alchemy of Finance;

- Taleb N. Fooled by Randomness;

- Murphy J. Technical Analysis of the Financial Markets.

Do not compare the trading niche with lotteries and casinos. Luck does matter somehow, but 90% of a trader’s success consists of your professionalism, skills, and experience.

Using All the Assets a Trader Can Reach

Top-notch trading platforms unlock access to hundreds of assets, and beginner traders frequently try to cover all that variety of instruments. In the morning they open positions with Forex currencies. In the afternoon such traders use metals, stocks, and indices. Closer to the night it is time for cryptocurrencies or commodities.

Why does such behavior lead to losses? The price movements of an asset obey certain laws. Professional traders understand different interconnections and monitor news to predict the further price movement correctly. For instance, the AUD/USD and NZD/USD pairs depend much on the climatic situation in the region.

When a trader wants to trade everything he can access, they cannot analyze assets properly.

Inability to Manage Risks and Emotionality

One of the most widespread reasons for which beginners lose their first deposits lies in the inability to manage risks.

For instance, a trader has made a profound analysis and understands that TSLA shares are going to rise in price. He uses 50-70% of the overall deposit to open a long position. Instead, the TSLA share’s price drops down due to some unpredictable events, and a trader experiences heavy losses.

What do professional traders do in such a situation? They follow the chosen risk management strategy no matter how profitable a deal seems to be. Experienced market players use 3-5% of the whole deposit for each position. As for newcomers, they are recommended to start with 1-2%.

You may also like

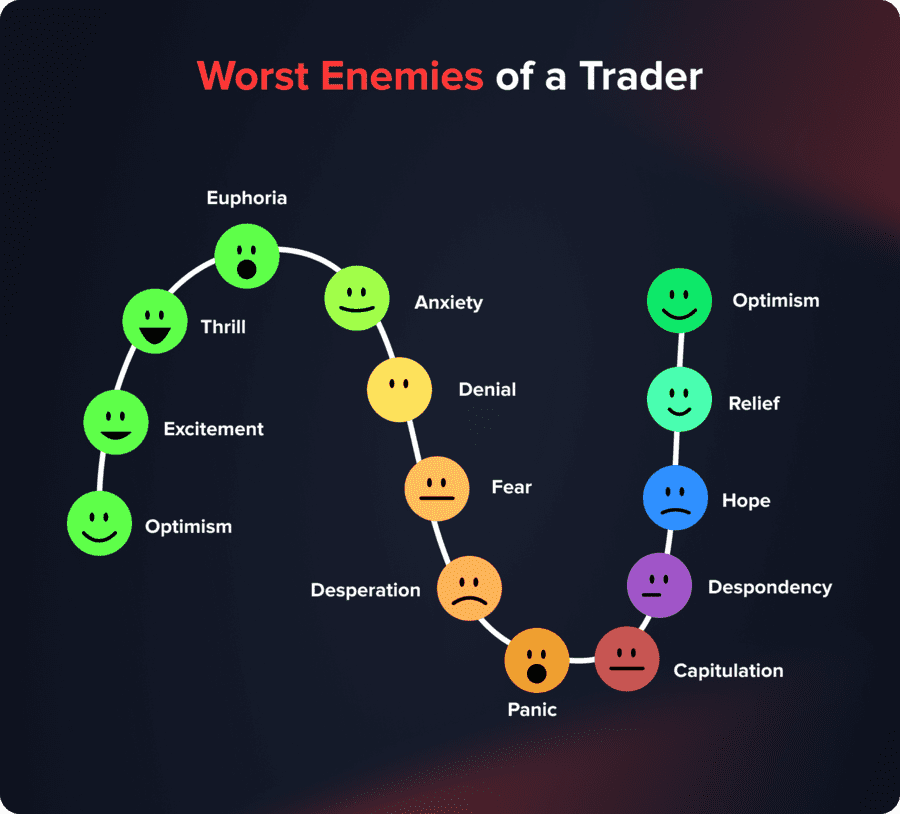

The risk management strategy is closely related to the emotionality of a trader. Emotionality falls into the category of the worst enemies of a trader.

When opening positions, it is worth thinking only with a cold head. Rely on the chosen risk management strategy and your trading plan. Professional traders understand that emotions may ruin all the progress.

Chaotic Trading Without Any Trading Plan

Which assets to purchase? Which leverage is the best one to select? How many positions to open within a day? A trading plan gives detailed answers to such questions. What does it mean, and why do traders need to follow a trading plan strictly?

A trading plan controls your activity, helps traders control their emotions, and unlocks the opportunity to implement automated programs.

Traders add the following categories into their plans: Trading strategy, Risk management strategy, Preferred assets, Possible leverages, and many more. The main task lies in following a plan strictly without letting your emotions interfere with the trading process.

Apart from a trading plan you need to understand which trading strategy to use.

A trading strategy defines which assets, timeframes, and technical instruments traders use for opening and closing positions.

You may also like

Expectation of Huge Profits

A lot of new entries expect to get millions of dollars within the shortest terms. They are inspired by YouTube videos and stories where a trader earns $1,000,000 starting from $100. Such expectations lead to exceptionally high risks, emotional trading, violation of all risk management rules. In 99% of cases newcomers lose their money.

Try to understand that professional successful traders set realistic goals. An average trader earns from $30,000 to $90,000 annually, and those are down-to-earth numbers. As for millions and billions, those are real as well, but traders achieve such goals step-by-step. Improve your skills, develop constantly but do not expect to get millions here and now.

How to Upgrade Your Trading Skills and Become a Professional trader: Useful Tips

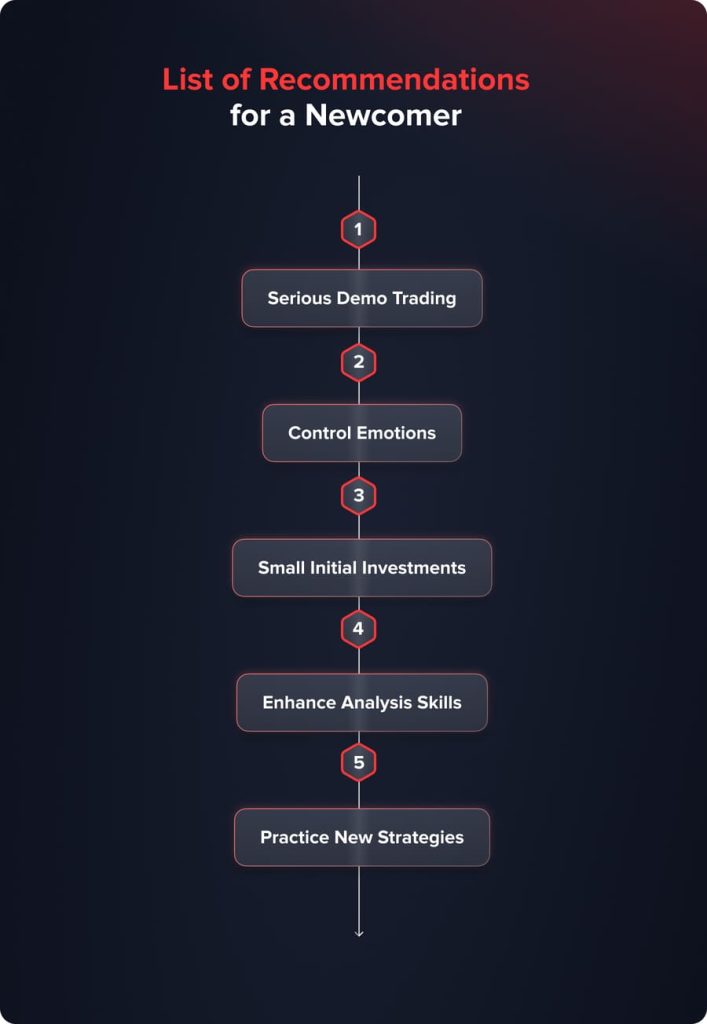

Here is the list of recommendations that help newcomer traders upgrade their skills, avoid heavy losses, and earn profits:

- Start from a demo account but take trading seriously. Don’t understand virtual money losses as some kind of a game.

- Work on your emotionality. Open positions only according to your trading plan and risk management strategy.

- Don’t invest much from the very beginning. When making the first steps in real trading, invest some $1 – $5 in a position.

- Upgrade your skills in technical and fundamental analysis. The better you predict further price movements, the more profit you earn.

- Practice new strategies. No matter how effective and profitable your current strategy is, financial markets change rapidly. To keep up with the times, you need to practice, develop, and test new strategies.

Top 5 Technical Analysis Indicators for Beginners: What Can a Trader Understand from Them?

Professional traders may utilize hundreds of different instruments but beginners may easily get lost in the variety of indicators. Start using some basic ones to understand how the market functions and try to make your first price predictions.

Here are the most widespread instruments that take part in numerous trading strategies:

- Moving Average (MA). The indicator combines all the prices from previous lengths of time and divides the sum by the number of time periods. As such, a trader gets a line that describes the current trend direction.

- Stochastic Oscillator. Such an instrument is based upon Moving Average and shows the current price position related to the range of prices within a given period of time. The indicator is represented by a scale from 0 to 100.

- Relative Strength Index (RSI). The index analyzes the price movement and finds out how many candles are bullish and bearish within the given period of time. The main task of the RSI index lies in defining the zones where an asset is either overbought or oversold.

- Bollinger Bands. Such an instrument consists of the three lines that form a cannel where an asset’s price is moving. When the price comes closer to the upper or lower border, there is a high probability that it will return to a cannel.

The above-mentioned indicators are enough for a newcomer trader who makes his first steps in predicting further price movements.

Let’s explore some trading strategies that are built upon the given indicators to understand how to open positions.

Trading Strategies for Newcomers

The Combination of Moving Averages (EMA)

Add two MA indicators to the chart. In the Type field set Exponential (EMA). Both Moving Averages should be exponential. Then you need to set the time period for both lines. Use 9 and 14. Now you get the following situation on the chart.

How to open positions based on this strategy?

- Open a long position when the EMA 9 crosses the EMA 14 line from the bottom to the top.

- Open a short position when the EMA 9 crosses the EMA 14 line from the top to the bottom.

The Simple Balanced System

To utilize such a strategy, add two SMA lines to the chart and select the following time periods: 5 for the first line and 10 for the second SMA. Then you need to add Stochastic with characteristics 14, 3, 3. The last indicator you need to add is RSI. Use default settings. When you have added all the required instruments, you get the following picture:

- Open a long position when the SMA 5 crosses SMA 10, Stochastic is going higher, and the RSI index is higher than 50.

- Open a short position when the SMA 10 line crosses SMA 5, Stochastic is going lower, and the RSI index is lower than 50.

The Combination of MA and RSI

Add the Moving Average Indicator setting 5 as the preferred time period. Use the simple type. Then add the RSI index, changing settings to 5 as well. We get the following picture:

- Open a long position when the SMA line crosses a bullish candle. The RSI index should be over the level of 50.

- Open a short position when the SMA line crosses a bearish candle. The RSI index should be under the level of 50.

Bottom Line

Trading falls into the category of exceptionally profitable activities; meanwhile, more than 90% of beginners just lose their money due to some common mistakes.

To start trading, newbies need to find a trustworthy and functional trading platform, create an account, complete the verification process, and deposit funds. That is enough to begin opening positions. On the other hand, beginners need to test their skills on a demo account first, understand the ways how to control their emotions, and upgrade their knowledge constantly.

Furthermore, never dream about millions and billions here and now. Set down-to-earth goals and achieve them gradually.

Updated:

December 19, 2024

9 February, 2026

What Is a Trading Halt? Why Stocks Stop Trading and What It Means for You

A trading halt is when an exchange temporarily stops trading in a stock or, in rare cases, the entire market. It’s not a glitch and it’s not random. It’s a deliberate pause triggered when prices move too fast, critical information is about to be released, or regulators need time to step in. From the outside, […]