Guía paso a paso para el desarrollo de un exchange de criptomonedas

Contenidos

A medida que la industria de las criptomonedas continúa creciendo en popularidad y valor, lanzando su propio intercambio de criptomonedas Sin duda, esta plataforma ha conquistado el corazón de muchos emprendedores emergentes y visionarios tecnológicos. Estas plataformas son la columna vertebral de la economía blockchain, conectando a compradores y vendedores de monedas digitales, a la vez que facilitan la negociación de criptomonedas emergentes y proyectos blockchain.

Ser propietario de una plataforma de intercambio suena como una forma emocionante de participar en este sector en auge y, al mismo tiempo, construir un negocio lucrativo. Sin embargo, no es una tarea que se pueda tomar a la ligera: construir una plataforma de intercambio con buena reputación y que cumpla con las normas, capaz de competir en el mercado actual, requiere una planificación cuidadosa, presupuestos sólidos y experiencia técnica. Pero, sin duda, tampoco es imposible si se investiga y se sigue un proceso de desarrollo estructurado.

En este artículo, desglosaremos los pasos necesarios para conceptualizar, diseñar y lanzar tu propio exchange de criptomonedas desde cero. Considéralo tu guía definitiva para entrar en esta industria competitiva y consolidarte. Al finalizar, comprenderás a fondo los requisitos y tendrás una hoja de ruta clara para hacer realidad tu visión.

¿Qué es un exchange de criptomonedas?

Las plataformas de intercambio de criptomonedas funcionan como un mercado donde se pueden intercambiar criptomonedas por otras monedas, activos digitales o moneda fiduciaria. Desempeñan un papel importante en el mundo de los activos digitales al conectar a compradores y vendedores. Las plataformas de intercambio permiten intercambiar fácilmente bitcoins por dólares o ether.

Sin plataformas de intercambio, sería mucho más difícil comprar, vender e intercambiar criptomonedas. Sin embargo, con las plataformas de intercambio, el mercado de criptomonedas tiene más liquidez Para aprovechar, haciéndolo más accesible para los usuarios. También permiten que el valor fluya hacia y desde diferentes monedas digitales, lo que contribuye a que las criptomonedas se usen y adopten de forma más generalizada.

Las plataformas de intercambio de criptomonedas son más que simples plataformas para facilitar las transacciones; ofrecen diversas opciones de inversión para ayudar a las personas a aumentar su capital en criptomonedas. Ofrecen servicios como trading con margen, trading de futuros y staking, que permiten a los usuarios adoptar un enfoque más activo si lo desean. Las plataformas también proporcionan herramientas como datos de precios en vivo para que los operadores puedan sacar conclusiones fundamentadas.

En esencia, cualquier plataforma de intercambio de criptomonedas de buena reputación busca ofrecer una plataforma segura y fácil de usar. Buscan facilitar la conexión entre compradores y vendedores en un lugar centralizado. El objetivo es que las personas puedan intercambiar fácilmente criptomonedas a través de un sistema seguro y confiable.

En esencia, sustentan toda la criptoeconomía. Conectan las finanzas tradicionales con este nuevo mundo digital. Al ofrecer alternativas de intercambio descentralizadas, promueven una mayor democratización del dinero a nivel mundial. Los exchanges son la base del funcionamiento de las criptomonedas y su adopción generalizada.

Aspectos clave de los intercambios de criptomonedas

- Pares comerciales: Los exchanges promueven el intercambio de diferentes pares de criptomonedas. Por ejemplo, Bitcoin a Ethereum o Litecoin a USD. Esto permite a los usuarios intercambiar una moneda por otra fácilmente.

- Libro de pedidos:El intercambio también mantiene una libro de pedidos Que enumera todas las órdenes de compra y venta abiertas realizadas por los usuarios. Cuando se colocan órdenes coincidentes, se realiza una operación.

- CarterasLos usuarios deben almacenar sus monedas digitales y fondos fiduciarios en la plataforma de intercambio mediante billeteras criptográficas integradas hasta que las necesiten para realizar operaciones. Estas billeteras facilitan los depósitos, retiros y transacciones.

- SeguridadLos intercambios de buena reputación implementan funciones de seguridad sólidas como almacenamiento en frío de criptomonedas, cifrado de nivel bancario, autenticación multifactor y más para proteger los fondos y datos de los usuarios.

- HonorariosLa mayoría de los exchanges generan ingresos cobrando comisiones por cada transacción. Estas suelen ser un porcentaje del valor de la operación.

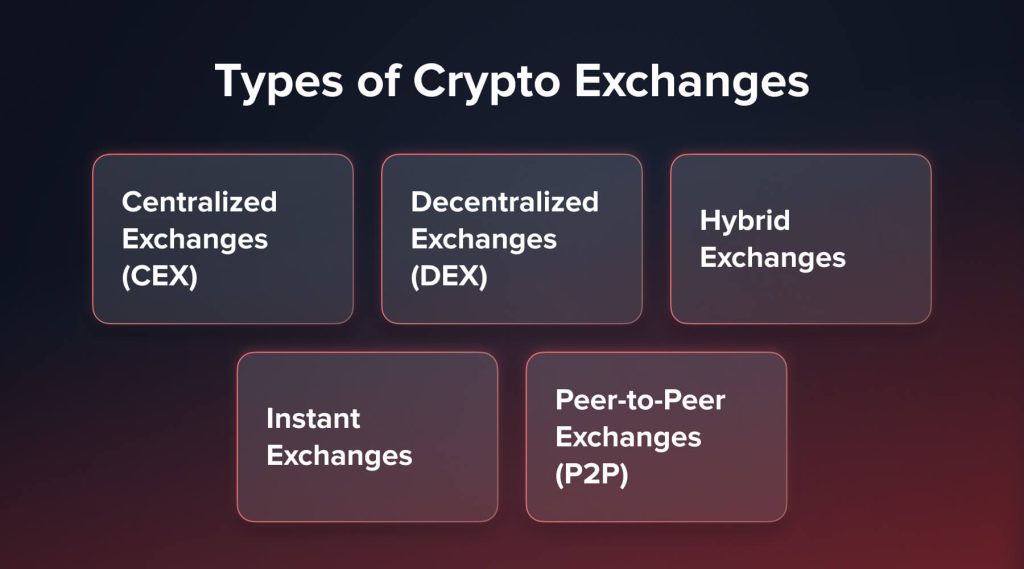

¿Cuáles son los tipos de intercambios de criptomonedas?

Es fundamental que tanto desarrolladores como usuarios comprendan la diversidad de plataformas de intercambio de criptomonedas. Cada tipo ofrece características, beneficios y consideraciones únicas. A continuación, se presentan los distintos tipos de plataformas, sus características, ventajas y posibles desventajas.

1. Intercambios centralizados (CEX)

Los Exchanges Centralizados (CEX) son el tipo más común de exchange de criptomonedas, y operan bajo una autoridad centralizada que supervisa y facilita todas las transacciones. Ejemplos comunes incluyen Coinbase, Binance y Kraken. Estos exchanges ofrecen una interfaz intuitiva y alta... liquidez y una amplia gama de criptomonedas y pares comerciales compatibles.

Ventajas:

- Fácil de usarLos intercambios centralizados son conocidos por sus interfaces intuitivas, lo que las hace accesibles tanto para operadores novatos como experimentados.

- Alta liquidez: La gran base de usuarios contribuye a aumentar los volúmenes de negociación, lo que garantiza la liquidez y permite a los usuarios ejecutar operaciones de manera eficiente.

- Funciones avanzadas:Muchos CEX ofrecen funciones comerciales avanzadas, como comercio de margen, futuros y derivados, que se adaptan a diversas estrategias comerciales.

Desventajas:

- Preocupaciones de seguridad: Al estar centralizados, estos intercambios son susceptibles a ataques informáticos y violaciones de seguridad, lo que hace necesarias medidas de seguridad sólidas.

- Cumplimiento normativo: Los CEX están sujetos a regulador escrutinio y deben cumplir con las regulaciones locales e internacionales, que pueden afectar sus operaciones.

2. Intercambios descentralizados (DEX)

Los exchanges descentralizados (DEX) operan sin una autoridad central, lo que permite el intercambio de criptomonedas entre pares. Plataformas como Uniswap, SushiSwap y PancakeSwap son ejemplos destacados. Los DEX utilizan contratos inteligentes y tecnología blockchain para automatizar y proteger las transacciones, eliminando la necesidad de intermediarios.

Ventajas:

- Seguridad mejorada:La naturaleza descentralizada reduce el riesgo de piratería y los puntos centrales de falla, brindando a los usuarios una mayor seguridad.

- Resistencia a la censura:Los DEX son menos susceptibles a las intervenciones regulatorias y la censura, y ofrecen una experiencia comercial verdaderamente descentralizada.

- Privacidad y control:Los usuarios conservan el control sobre sus claves privadas e información personal, mejorando la privacidad y la seguridad.

Desventajas:

- Usabilidad:Algunos usuarios pueden encontrar los DEX menos intuitivos y fáciles de usar en comparación con sus contrapartes centralizadas.

- Menor liquidez:Los DEX pueden experimentar menores volúmenes de negociación y liquidez, lo que afecta la eficiencia de la ejecución de operaciones.

3. Intercambios híbridos

Los exchanges híbridos buscan combinar lo mejor de los exchanges centralizados y descentralizados. Buscan ofrecer la facilidad de uso y la liquidez de los CEX, manteniendo la seguridad y la descentralización de los DEX. Los exchanges híbridos son menos comunes, pero representan un enfoque innovador para el trading de criptomonedas.

Ventajas:

- Enfoque equilibrado:Los intercambios híbridos ofrecen una experiencia comercial equilibrada, combinando los beneficios de los CEX y los DEX.

- Seguridad mejoradaAl incorporar elementos descentralizados, los intercambios híbridos fortalecen la seguridad y reducen el riesgo de ataques.

- Diversas opciones de trading:Los usuarios pueden acceder a una amplia gama de opciones y funciones comerciales, que se adaptan a diversas preferencias comerciales.

Desventajas:

- Complejidad:La integración de elementos centralizados y descentralizados puede aumentar la complejidad y hacer que la curva de aprendizaje del usuario sea más pronunciada.

- Modelo emergenteComo modelo relativamente nuevo, los intercambios híbridos aún están evolucionando y su eficacia y confiabilidad aún están por demostrarse por completo.

4. Intercambios instantáneos

Los intercambios instantáneos están diseñados para brindar a los usuarios una experiencia rápida y fluida al intercambiar criptomonedas. Plataformas como Changelly y ShapeShift son ejemplos destacados de intercambios instantáneos. Estos intercambios no retienen los fondos de los clientes, lo que los distingue de los intercambios tradicionales, y en su lugar facilitan intercambios inmediatos entre diferentes criptomonedas.

Ventajas:

- VelocidadLos intercambios instantáneos son conocidos por su rápido procesamiento de transacciones, lo que permite a los usuarios intercambiar criptomonedas rápidamente sin la necesidad de depositar fondos en la plataforma.

- Conveniencia:La interfaz de usuario suele ser sencilla y fácil de navegar, lo que la hace accesible para usuarios de todos los niveles de experiencia.

- Soporte diverso para criptomonedas:Estos intercambios a menudo admiten una amplia gama de criptomonedas, lo que proporciona a los usuarios múltiples opciones para operar.

Desventajas:

- Tarifas más altas: Los intercambios instantáneos pueden cobrar tarifas más altas que otros intercambios debido a su conveniencia y velocidad.

- Deslizamiento de precios: Debido a la naturaleza inmediata de las transacciones, los usuarios podrían experimentar caídas de precios, especialmente en condiciones de mercado volátiles.

5. Intercambios entre pares (P2P)

Los intercambios entre pares (P2P) facilitan las transacciones directas entre compradores y vendedores sin necesidad de intermediarios. LocalBitcoins y Paxful son intercambios P2P muy conocidos. Estas plataformas suelen utilizar un servicio de custodia para guardar los activos hasta que ambas partes cumplan con sus obligaciones, garantizando así la integridad de la transacción.

Ventajas:

- Transacciones directas:Los intercambios P2P permiten a los usuarios realizar transacciones directamente entre sí, ofreciendo una experiencia comercial más personalizada.

- Seguridad mejorada:El uso de servicios de depósito en garantía y contratos inteligentes mejora la seguridad de las transacciones al garantizar que los activos se liberen solo cuando ambas partes cumplen los términos acordados.

- Métodos de pago flexibles:Los usuarios pueden elegir entre una variedad de métodos de pago, incluidas transferencias bancarias, pagos en efectivo y billeteras digitales, lo que hace que las transacciones sean más accesibles y convenientes.

Desventajas:

- Menor liquidez:Los intercambios P2P pueden tener menor liquidez que los intercambios centralizados y descentralizados, lo que puede afectar la disponibilidad de pares comerciales e impactar los precios.

- Experiencia de usuario variada: La experiencia del usuario puede variar significativamente según las contrapartes involucradas en la transacción y la resolución de disputas puede ser un desafío en caso de desacuerdos.

Si está tratando de determinar la mejor dirección para su negocio de criptomonedas, aquí hay una comparación resumida simple de los cinco tipos principales de intercambios: centralizado (CEX), descentralizado (DEX), híbrido, instantáneo y peer-to-peer (P2P).

| Característica | CEX | DEX | Híbrido | Instante | P2P |

| Autoridad central | Sí | No | Parcial | Sí | No |

| Custodia de fondos | Sí | No | Parcial | No | No |

| Liquidez | Alto | Bajo-medio | Medio | Medio | Bajo |

| Facilidad de uso | Alto | Medio | Medio | Alto | Bajo-medio |

| Carga regulatoria | Alto | Bajo | Medio | Medio | Bajo |

- Si está construyendo para comerciantes, un CEX es una opción sólida con su diseño fácil de usar y alta liquidez.

- Si la privacidad y la descentralización son clave para usted, consulte las opciones DEX o P2P que permiten a los usuarios tomar el control.

- ¿Buscas una solución intermedia? Una solución híbrida podría ser la combinación perfecta de eficiencia y transparencia.

- Si lo que necesita es velocidad, entonces considere los intercambios instantáneos como una opción rápida.

Guía paso a paso para configurar tu plataforma de intercambio de criptomonedas

Lanzar una plataforma de intercambio de criptomonedas exitosa requiere una planificación y una ejecución meticulosas. Con un proceso estructurado, puede desarrollar una plataforma que genere una adopción significativa de usuarios y se convierta en un negocio sostenible. Los pasos a continuación pueden ayudarle a crear una plataforma que atraiga usuarios y se convierta en un negocio real.

1. Seleccione los países en los que desea operar.

La primera decisión importante es determinar dónde operará su plataforma de intercambio. Comience por considerar las regulaciones de su mercado local: investigue qué países tienen la mayor audiencia de criptomonedas y las posturas más favorables hacia la industria. Operar localmente primero permite comprender mejor el panorama antes de expandirse globalmente.

2. Define tu público objetivo.

Involucrar a las comunidades de criptomonedas en redes sociales y foros para comprender las necesidades y el comportamiento de los usuarios potenciales. Identificar qué grupos demográficos comercian activamente con activos digitales: enfocarse en los primeros usuarios que buscan opciones de intercambio adicionales.

3. Cumplir con los requisitos legales y obtener licencias.

Busque asesoría legal para garantizar el cumplimiento de todas las regulaciones aplicables en las jurisdicciones elegidas. Regulaciones en torno a... Conozca a su cliente La lucha contra el blanqueo de capitales, los impuestos y las actividades restringidas varían considerablemente entre países. Obtener las licencias adecuadas legitima su negocio y brinda confianza a los usuarios.

4. Elija las funciones de intercambio de criptomonedas.

Integre elementos esenciales como sistemas de registro/verificación de usuarios, monederos electrónicos, libros de órdenes y herramientas avanzadas de gráficos. Considere qué funciones adicionales no ofrecen las plataformas de intercambio consolidadas para diferenciar su oferta. Priorice la experiencia del usuario y la seguridad para atraer a operadores reacios al riesgo.

5. Encuentra una empresa de desarrollo.

Investigue a los mejores programadores de blockchain y revise cuidadosamente sus portafolios, las tecnologías utilizadas y los comentarios de los clientes para identificar al socio adecuado. Un buen desarrollo es vital para el éxito: evite pagar menos a costa de la calidad.

6. Diseñe una plataforma fácil de usar.

El diseño de la interfaz de usuario (UI) y la experiencia de usuario (UX) también son cruciales. Contrate diseñadores profesionales de UX/UI para crear interfaces sencillas pero visualmente atractivas, optimizadas tanto para dispositivos móviles como para computadoras de escritorio. Haga que la navegación sea intuitiva con una integración rápida para reducir la curva de aprendizaje.

7. Iniciar el desarrollo de un intercambio de criptomonedas.

Elija los marcos adecuados para el rendimiento, la escalabilidad y la seguridad. Antes de las pruebas de fase, desarrolle el motor de trading, los servicios de billetera, los libros de órdenes y el panel de administración según los estándares de flujo de trabajo. Las pruebas rigurosas lo preparan para el lanzamiento.

8. Lanza y promociona tu exchange.

Lanzamiento con un completo estrategia de comercialización Abarcando la promoción en redes sociales, las relaciones públicas, las colaboraciones con influencers y los obsequios para la comunidad. Escuche a los primeros usuarios y siga mejorando el producto en función de sus comentarios para fidelizarlos a largo plazo.

6 errores que debes evitar al iniciar un exchange de criptomonedas

Lanzar una plataforma de intercambio de criptomonedas puede ser complicado, y un solo error podría perjudicar tu reputación, tu situación legal o el buen funcionamiento de la plataforma. Aquí tienes seis errores comunes que cometen los emprendedores y consejos para evitarlos.

Omitir los pasos de cumplimiento

Muchos exchanges intentan eludir los requisitos legales con la esperanza de ahorrar tiempo, pero esto puede llevar a cierres o multas en el futuro.

Asegúrese de mantenerse al día con las normas KYC y AML, registrarse en los lugares adecuados y obtener asesoramiento legal desde el principio. Solucionar problemas regulatorios posteriormente puede ser difícil y costoso.

Diseño UI/UX apresurado

Incluso si su backend es sólido, no importará si los usuarios no pueden entender cómo usar la plataforma.

Un proceso de registro confuso, paneles de control desordenados y aplicaciones móviles con fallos ahuyentarán a los usuarios. Dedica tiempo a crear una interfaz intuitiva que funcione bien tanto para principiantes como para operadores experimentados.

Olvidarse de la liquidez en el lanzamiento

Si se lanza sin un plan de liquidez sólido, podría enfrentar demoras y problemas con los precios, lo que puede asustar a los traders serios.

Colabore con proveedores de liquidez o cree fondos de liquidez antes de operar. Contar con un libro de órdenes confiable es crucial para ganarse la confianza de los usuarios.

Confiar en la seguridad débil de la billetera

Los intercambios de criptomonedas a menudo atraen a piratas informáticos, por lo que la seguridad de la billetera es esencial.

No te limites a las billeteras calientes. En su lugar, utiliza almacenamiento en frío, billeteras multifirma, controles de seguridad regulares y autenticación de dos factores desde el principio.

Sobrecarga de funciones demasiado rápida

Intentar ofrecer todas las opciones comerciales de inmediato puede ser contraproducente y generar errores y demoras en el lanzamiento.

Céntrate primero en las funciones básicas: trading al contado, configuración de la billetera e información en tiempo real. Siempre puedes añadir más opciones más adelante.

Pasando por alto la atención al cliente

Muchas empresas emergentes olvidan que después del lanzamiento, el soporte al usuario es crucial.

Prepare los canales de soporte, las preguntas frecuentes y los sistemas de tickets antes de lanzar su producto. Los tiempos de respuesta rápidos y la atención amable pueden fidelizar a sus clientes.

Evitar estos errores no solo protege su inversión, sino que también ayuda a sentar las bases para un crecimiento duradero. Tenga a mano esta lista de verificación mientras prepara su lanzamiento para asegurarse de tomar decisiones inteligentes.

¿Cómo funcionan la estructura de costos de instalación y el flujo de ingresos?

Poner en marcha tu plataforma de intercambio de criptomonedas requiere una inversión inicial considerable. Sin embargo, las plataformas exitosas tienen el potencial de generar millones en ganancias mensuales. Analicemos también la estructura de costos típica y cómo se generan los ingresos.

Antes de empezar con el presupuesto, conviene pensar en cómo tu desarrollo se ajusta a tus objetivos a largo plazo. ¿Estás considerando un exchange de criptomonedas de marca blanca listo para operar o prefieres construir una plataforma personalizada desde cero?

He aquí una rápida comparación resumida:

| Opción | Intercambio de marca blanca | Intercambio a medida |

| Tiempo de comercialización | Rápido (2 a 8 semanas) | Más largo (de 6 a 12+ meses) |

| Costo inicial | Más bajo | Más alto |

| Flexibilidad | Opciones limitadas | Control total sobre las funciones y el diseño |

| Escalabilidad | Moderado - depende del proveedor | Alto - diseñado para el crecimiento |

| Mejor para | MVP, startups, proyectos de lanzamiento rápido | Plataformas de nivel empresarial, casos de uso únicos |

Costos de instalación estimados

Los costos variarán según sus requisitos específicos, pero aquí hay algunas pautas generales:

- Soluciones de marca blancaUtilizar plataformas de intercambio listas para usar ahorra tiempo de desarrollo, pero limita la personalización. Las tarifas de licencia oscilan entre $50,000 y $200,000.

- Desarrollo personalizadoConstruir desde cero proporciona control total, pero requiere entre 6 y 12 meses y entre 150 000 y 500 000 dólares, según las características y tecnologías utilizadas.

Los costos adicionales incluyen cumplimiento, auditorías de ciberseguridad, presupuestos de marketing y gastos continuos de infraestructura y soporte.

Flujos de ingresos potenciales

Una vez lanzados, los exchanges ganan dinero principalmente a través de actividades comerciales:

- Tarifas de negociaciónCobrar entre el 0,1% y el 0,3% en todas las transacciones es el mayor generador de ingresos para los intercambios de gran volumen.

- Tarifas de retiroSe aplican pequeños cargos de $1 a $5 al retirar fondos para cubrir el procesamiento.

- Tarifas de cotización: Las nuevas criptomonedas pagan tarifas de cotización sustanciales, a veces mensuales después de eso.

- Comercio de margen: Ganar intereses sobre préstamos para comerciantes apalancados Es común.

- Cuentas Premium: Las herramientas avanzadas atraen suscripciones mensuales.

- API de datos:La monetización de datos del mercado en tiempo real implica el pago de comisiones por parte de las instituciones.

Con millones de transacciones diarias a nivel mundial, incluso las plataformas de intercambio con un éxito moderado pueden alcanzar la rentabilidad en uno o dos años para recuperar los costos de instalación. El crecimiento continuo y la innovación amplían aún más las fuentes de ingresos. Comprender los costos frente a los ingresos potenciales es clave para planificar la estrategia y las iniciativas de recaudación de fondos.

¿Qué pila tecnológica debería utilizar?

La infraestructura tecnológica que impulsa su plataforma de intercambio de criptomonedas impacta significativamente su rendimiento, funcionalidad, escalabilidad y seguridad. Esta infraestructura tecnológica incluye lenguajes de programación como Java, PHP y Swift, bases de datos como MongoDB y MySQL, servicios en la nube de AWS o Google Cloud Platform, y API de plataformas de intercambio populares como Binance y Coinbase. La selección e implementación cuidadosas de la infraestructura tecnológica son fundamentales para el éxito.

- Interfaz

Los marcos front-end más populares incluyen React, Angular y Vue.js para crear interfaces comerciales receptivas en la web y en dispositivos móviles.

- Backend

Para las API y los servicios, las opciones eficientes son Node.js, Python, Java, C# y Go, según la experiencia del desarrollador.

- Bases de datos

Las bases de datos no relacionales como MongoDB son más adecuadas para grandes volúmenes de datos comerciales no estructurados. Considere PostgreSQL, MySQL o ClickHouse para obtener datos relacionales adicionales.

- Infraestructura

Los proveedores de nube AWS, Google Cloud y Microsoft Azure ofrecen arquitecturas sin servidor escalables optimizadas para cargas de trabajo de criptomonedas.

- Cadenas de bloques

La integración con redes públicas como Ethereum, Binance Smart Chain, Solana, etc., utiliza infraestructura de nodos. Las API de WebSockets transmiten precios en tiempo real.

- Bibliotecas e integraciones

Las soluciones prediseñadas aceleran los desarrollos, como CoinGecko para datos de precios, Coinpayments para pasarelas fiduciarias y Auth0 para autenticación.

- Seguridad

Las billeteras frías, las configuraciones de múltiples firmas, las auditorías regulares, el cifrado, el modelado de amenazas y las pruebas de penetración garantizan defensas sólidas.

- Pruebas

Las pruebas exhaustivas con herramientas como Jest, Cypress y Cucumber elevan los estándares de garantía de calidad antes de la implementación.

Lista de verificación de seguridad para el lanzamiento de un exchange de criptomonedas

Al iniciar un exchange de criptomonedas, la seguridad es fundamental. Toda tu operación depende de tu capacidad para protegerte contra las ciberamenazas y ganarte la confianza de los usuarios.

Aquí tienes una lista práctica de verificación de seguridad que debes tener en cuenta antes de empezar a operar. Seguir estos pasos puede ayudarte a mantener tu plataforma de intercambio segura desde el principio y a dar una buena impresión a los reguladores y usuarios institucionales.

Medidas de seguridad clave

- Almacenamiento en billetera fría*: almacene la mayoría de los fondos de los clientes en billeteras fuera de línea para reducir el riesgo de piratería.

- Limitación de velocidad y protección anti-DDoS: utilice firewalls y medidas anti-DDoS para protegerse contra ataques de fuerza bruta y sobrecargas de tráfico que puedan interrumpir su plataforma.

- Auditorías de contratos inteligentes (para plataformas híbridas/DEX): si utiliza contratos inteligentes, realice auditorías independientes para encontrar y corregir vulnerabilidades antes del lanzamiento.

- Pruebas de penetración periódicas: contrate a profesionales en ciberseguridad para que prueben su sistema contra ataques del mundo real y luego solucionen cualquier debilidad.

- Opciones de autenticación de dos factores (2FA) y acceso biométrico: implemente la autenticación multifactor para cuentas de usuario, áreas de administración y procesos de retiro. Considere añadir accesos biométricos a las aplicaciones móviles.

- Cifrado de datos confidenciales: asegúrese de que la información de inicio de sesión, los documentos KYC y los detalles de las transacciones estén todos cifrados.

- Control de acceso basado en roles (RBAC): limite los privilegios de administrador a roles específicos para reducir la posibilidad de errores o infracciones internas.

- Monitoreo continuo: configure el monitoreo en tiempo real para detectar actividad inusual y cree alertas para retiros grandes, irregularidades en el inicio de sesión o uso indebido de la API.

Otras consideraciones para su negocio de intercambio de criptomonedas

Además del desarrollo de la plataforma técnica, hay otros componentes comerciales importantes a tener en cuenta:

- LegalTómese su tiempo para garantizar el cumplimiento continuo de las regulaciones a medida que el mercado evoluciona. Registre las entidades comerciales necesarias y mantenga registros precisos.

- MarketingDesarrollar estrategias de marketing a largo plazo más allá de las promociones de lanzamiento. Publicitar constantemente nuevos listados de monedas, eventos, tutoriales y más.

- VentasDesarrollar procesos de ventas para atraer nuevos clientes y convertirlos en suscriptores de pago con el tiempo. Ofrecer funciones premium, suscripciones o soluciones empresariales.

- FinanzasCree prácticas contables, presupuestos y modelos de pronóstico. Gestione eficazmente balances, flujo de caja e intercambios entre monedas fiduciarias y criptomonedas.

- Operaciones: Establecer procedimientos para la atención al cliente, monitoreo del sitio, gestión de riesgos y seguridad. Auditar continuamente los sistemas y realizar pruebas de penetración.

- LiquidezObtenga suficiente liquidez de proveedores externos o conviértase en proveedor de liquidez. Asegúrese de contar con una amplia capacidad de conciliación de órdenes para evitar retrasos o interrupciones durante periodos de alta volatilidad.

Conclusión

Con esto concluye nuestro resumen sobre cómo establecer una plataforma de intercambio de criptomonedas. El proceso implica una planificación y ejecución exhaustivas en las dimensiones técnicas, operativas y comerciales. Es un reto, pero con el plan adecuado, cualquier emprendedor o equipo comprometido puede hacer realidad su visión.

Quienes se comprometan a dar los siguientes pasos deben revisar este material con frecuencia como referencia, aprovechar otros recursos disponibles y contactarnos si tienen alguna pregunta adicional. Con trabajo diligente, las bolsas establecidas desde cero pueden alcanzar un alto rendimiento, comparable al de las empresas líderes en el sector.

FAQ

El costo varía según optes por una opción de marca blanca o decidas desarrollar algo desde cero. Con las soluciones de marca blanca, espera pagar entre $50,000 y $200,000. Son ideales si quieres un lanzamiento rápido pero no necesitas muchas funciones personalizadas. Para intercambios personalizados, el costo oscila entre $150,000 y más de $500,000, dependiendo de lo que busques, tu ubicación y tus requisitos de seguridad. No olvides reservar fondos adicionales para cumplimiento normativo, controles de seguridad, infraestructura, marketing y mantenimiento continuo.

Sí, normalmente se necesita una licencia o algún tipo de aprobación regulatoria para operar legalmente, especialmente si se gestionan intercambios de moneda fiduciaria a criptomonedas o se mantienen los fondos de clientes. Normalmente, deberá cumplir con normas como: - Normativas KYC (Conozca a su Cliente) y AML (Antilavado de Dinero) - Leyes de protección de datos - Registro de servicios financieros en lugares como la UE, Emiratos Árabes Unidos, Reino Unido o EE. UU.

Si la velocidad es tu principal preocupación, optar por una plataforma de intercambio de criptomonedas de marca blanca es la opción más rápida. Estas incluyen: configuración preconfigurada; monederos, sistemas de trading e interfaces de usuario integrados; y lanzamiento rápido (semanas en lugar de meses). Ten en cuenta que podrías perder la posibilidad de personalizarla más adelante. Si tienes ideas específicas o elaboradas, el desarrollo a medida podría ser la mejor opción.

Actualizado:

25 de junio de 2025