Hướng dẫn phát triển sàn giao dịch tiền điện tử từng bước

Mục lục

Khi ngành công nghiệp tiền điện tử tiếp tục bùng nổ về mức độ phổ biến và giá trị, ra mắt sàn giao dịch tiền điện tử của riêng họ Nền tảng này chắc chắn đã chiếm được cảm tình của nhiều doanh nhân trẻ và những người tiên phong trong lĩnh vực công nghệ. Các nền tảng này đóng vai trò là xương sống của nền kinh tế blockchain, kết nối người mua và người bán tiền kỹ thuật số, đồng thời tạo điều kiện thuận lợi cho việc giao dịch các loại tiền điện tử và dự án blockchain mới nổi.

Sở hữu một sàn giao dịch nghe có vẻ là một cách thú vị để tham gia vào lĩnh vực đang bùng nổ này, đồng thời xây dựng một doanh nghiệp sinh lời. Tuy nhiên, đây không phải là một nỗ lực dễ dàng — việc xây dựng một sàn giao dịch uy tín và tuân thủ quy định, có thể cạnh tranh trên thị trường hiện nay đòi hỏi phải lập kế hoạch cẩn thận, ngân sách hợp lý và chuyên môn kỹ thuật. Nhưng chắc chắn điều này cũng không phải là không thể nếu bạn nghiên cứu kỹ lưỡng và tuân thủ một quy trình phát triển có cấu trúc.

Trong bài viết này, chúng tôi sẽ phân tích các bước toàn diện cần thiết để hình thành ý tưởng, thiết kế và ra mắt sàn giao dịch tiền điện tử của riêng bạn ngay từ đầu—hãy xem đây là cẩm nang tối ưu để bạn bước vào ngành công nghiệp đầy cạnh tranh này và tạo dựng dấu ấn riêng. Cuối cùng, bạn sẽ có được sự hiểu biết vững chắc về những gì cần thiết và có lộ trình rõ ràng để hiện thực hóa tầm nhìn của mình.

Sàn giao dịch tiền điện tử là gì?

Sàn giao dịch tiền điện tử đóng vai trò là một thị trường nơi mọi người có thể giao dịch tiền điện tử với các loại tiền tệ khác, tài sản kỹ thuật số và/hoặc tiền pháp định. Chúng đóng vai trò quan trọng trong thế giới tài sản kỹ thuật số bằng cách kết nối người mua và người bán. Các sàn giao dịch giúp việc trao đổi những thứ như Bitcoin lấy đô la hoặc Ether trở nên dễ dàng.

Nếu không có sàn giao dịch, mọi người sẽ khó mua, bán và giao dịch tiền điện tử hơn nhiều. Tuy nhiên, với sàn giao dịch, thị trường tiền điện tử có nhiều... tính thanh khoản để khai thác, giúp người dùng dễ tiếp cận hơn. Chúng cũng cho phép giá trị chảy vào và ra khỏi các loại tiền kỹ thuật số khác nhau, giúp tiền điện tử được sử dụng và áp dụng rộng rãi hơn.

Các sàn giao dịch tiền điện tử không chỉ là nền tảng hỗ trợ giao dịch; chúng còn cung cấp nhiều lựa chọn đầu tư khác nhau để giúp mọi người sinh lời từ tiền điện tử. Chúng cung cấp các dịch vụ như giao dịch ký quỹ, giao dịch tương lai và đặt cược (staking), cho phép người dùng chủ động hơn nếu muốn. Các sàn giao dịch cũng cung cấp các công cụ như dữ liệu giá trực tiếp để các nhà giao dịch có thể đưa ra kết luận chính xác.

Về cốt lõi, bất kỳ sàn giao dịch tiền điện tử uy tín nào cũng hướng đến việc cung cấp một nền tảng an toàn và thân thiện với người dùng. Họ muốn tạo điều kiện thuận lợi cho người mua và người bán kết nối tại một nơi tập trung. Mục tiêu là cho phép mọi người dễ dàng giao dịch tiền kỹ thuật số thông qua một hệ thống an toàn và đáng tin cậy.

Về bản chất, chúng hỗ trợ toàn bộ nền kinh tế tiền điện tử. Chúng kết nối tài chính truyền thống với thế giới kỹ thuật số mới này. Bằng cách cung cấp các giải pháp thay thế cho sàn giao dịch phi tập trung, chúng hướng tới sự dân chủ hóa tiền tệ trên toàn thế giới. Sàn giao dịch thực sự là xương sống cho cách thức hoạt động của tiền điện tử và được áp dụng rộng rãi hơn.

Các khía cạnh chính của sàn giao dịch tiền điện tử

- Cặp giao dịch: Các sàn giao dịch thúc đẩy giao dịch các cặp tiền điện tử khác nhau. Ví dụ: Bitcoin sang Ethereum hoặc Litecoin sang USD. Điều này cho phép người dùng dễ dàng trao đổi một loại tiền này sang một loại tiền khác.

- Sổ lệnh:Sàn giao dịch cũng duy trì một sổ lệnh liệt kê tất cả các lệnh mua và bán đang mở do người dùng đặt. Khi các lệnh khớp được đặt, một giao dịch sẽ diễn ra.

- Ví: Người dùng phải lưu trữ tiền kỹ thuật số và tiền pháp định của mình trên sàn giao dịch thông qua ví tiền điện tử tích hợp cho đến khi cần giao dịch. Những ví này hỗ trợ việc gửi, rút và giao dịch.

- Bảo vệ:Các sàn giao dịch uy tín triển khai các tính năng bảo mật mạnh mẽ như lưu trữ lạnh tiền điện tử, mã hóa cấp ngân hàng, xác thực đa yếu tố, v.v. để bảo vệ tiền và dữ liệu của người dùng.

- Phí: Hầu hết các sàn giao dịch kiếm tiền bằng cách tính phí giao dịch trên mỗi giao dịch. Phí này thường được tính theo phần trăm giá trị giao dịch.

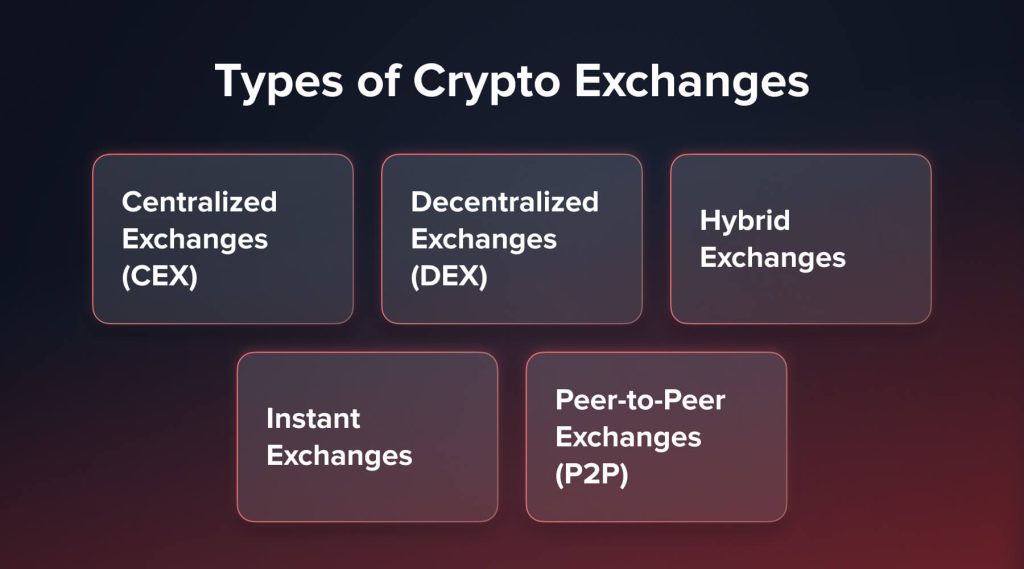

Có những loại sàn giao dịch tiền điện tử nào?

Việc hiểu rõ bối cảnh đa dạng của các sàn giao dịch tiền điện tử là rất quan trọng đối với cả nhà phát triển và người dùng. Mỗi loại sàn giao dịch đều có những tính năng, lợi ích và điểm cần lưu ý riêng. Dưới đây là các loại sàn giao dịch khác nhau, đặc điểm, ưu điểm và nhược điểm tiềm ẩn của chúng.

1. Sàn giao dịch tập trung (CEX)

Sàn giao dịch tập trung (CEX) là loại hình sàn giao dịch tiền điện tử quen thuộc nhất, hoạt động dưới sự quản lý tập trung của một cơ quan quản lý, giám sát và tạo điều kiện thuận lợi cho mọi giao dịch. Các ví dụ phổ biến bao gồm Coinbase, Binance và Kraken. Các sàn giao dịch này cung cấp giao diện thân thiện với người dùng, tính bảo mật cao. tính thanh khoản và nhiều loại tiền điện tử và cặp giao dịch được hỗ trợ.

Thuận lợi:

- Thân thiện với người dùng:Các sàn giao dịch tập trung được biết đến với giao diện trực quan, giúp cả người mới bắt đầu và người giao dịch có kinh nghiệm đều có thể tiếp cận.

- Tính thanh khoản cao: Lượng người dùng lớn góp phần tăng khối lượng giao dịch, đảm bảo tính thanh khoản và cho phép người dùng thực hiện giao dịch hiệu quả.

- Tính năng nâng cao:Nhiều CEX cung cấp các tính năng giao dịch nâng cao, chẳng hạn như giao dịch ký quỹ, tương lai và các sản phẩm phái sinh, phục vụ cho nhiều chiến lược giao dịch khác nhau.

Nhược điểm:

- Mối quan ngại về bảo mật: Vì mang tính tập trung, các sàn giao dịch này dễ bị tấn công và xâm phạm an ninh, đòi hỏi phải có các biện pháp bảo mật mạnh mẽ.

- Tuân thủ quy định: CEX phải tuân theo quy định giám sát chặt chẽ và phải tuân thủ các quy định của địa phương và quốc tế, có thể ảnh hưởng đến hoạt động của họ.

2. Sàn giao dịch phi tập trung (DEX)

Các sàn giao dịch phi tập trung (DEX) hoạt động mà không cần một cơ quan quản lý trung ương, cho phép giao dịch tiền điện tử ngang hàng. Các nền tảng như Uniswap, SushiSwap và PancakeSwap là những ví dụ điển hình. DEX tận dụng hợp đồng thông minh và công nghệ blockchain để tự động hóa và bảo mật các giao dịch, loại bỏ nhu cầu sử dụng trung gian.

Thuận lợi:

- Tăng cường bảo mật:Bản chất phi tập trung làm giảm nguy cơ bị tấn công và các điểm lỗi tập trung, mang lại cho người dùng mức độ bảo mật cao hơn.

- Kháng cự kiểm duyệt: DEX ít bị ảnh hưởng bởi sự can thiệp của cơ quan quản lý và kiểm duyệt, mang lại trải nghiệm giao dịch thực sự phi tập trung.

- Quyền riêng tư và Kiểm soát: Người dùng vẫn kiểm soát được khóa riêng tư và thông tin cá nhân của mình, tăng cường quyền riêng tư và bảo mật.

Nhược điểm:

- Khả năng sử dụng: Một số người dùng có thể thấy DEX kém trực quan và kém thân thiện với người dùng hơn so với các sàn giao dịch tập trung.

- Thanh khoản thấp hơn: Các sàn DEX có thể có khối lượng giao dịch và thanh khoản thấp hơn, ảnh hưởng đến hiệu quả thực hiện giao dịch.

3. Sàn giao dịch hỗn hợp

Các sàn giao dịch lai hướng đến việc kết hợp những ưu điểm của cả sàn giao dịch tập trung và phi tập trung. Họ tìm cách cung cấp tính thân thiện với người dùng và tính thanh khoản của CEX trong khi vẫn duy trì tính bảo mật và phi tập trung của DEX. Các ví dụ về sàn giao dịch lai ít phổ biến hơn nhưng đại diện cho một cách tiếp cận sáng tạo trong giao dịch tiền điện tử.

Thuận lợi:

- Cách tiếp cận cân bằng: Các sàn giao dịch kết hợp cung cấp trải nghiệm giao dịch cân bằng, kết hợp lợi ích của cả CEX và DEX.

- Tăng cường bảo mật:Bằng cách kết hợp các yếu tố phi tập trung, các sàn giao dịch kết hợp tăng cường bảo mật và giảm nguy cơ bị tấn công.

- Nhiều lựa chọn giao dịch: Người dùng có thể truy cập vào nhiều tùy chọn và tính năng giao dịch khác nhau, đáp ứng nhiều sở thích giao dịch khác nhau.

Nhược điểm:

- Độ phức tạp: Việc tích hợp các yếu tố tập trung và phi tập trung có thể làm tăng tính phức tạp và khiến người dùng phải học hỏi nhiều hơn.

- Mô hình mới nổi:Là một mô hình tương đối mới, các sàn giao dịch kết hợp vẫn đang trong quá trình phát triển và hiệu quả cũng như độ tin cậy của chúng vẫn chưa được chứng minh đầy đủ.

4. Trao đổi tức thì

Giao dịch tức thời được thiết kế để mang đến cho người dùng trải nghiệm giao dịch tiền điện tử nhanh chóng và liền mạch. Các nền tảng như Changelly và ShapeShift là những ví dụ điển hình về giao dịch tức thời. Khác với các sàn giao dịch truyền thống, các sàn giao dịch này không nắm giữ tiền của khách hàng mà thay vào đó tạo điều kiện cho việc hoán đổi ngay lập tức giữa các loại tiền điện tử khác nhau.

Thuận lợi:

- Tốc độ: Các sàn giao dịch tức thời được biết đến với tốc độ xử lý giao dịch nhanh chóng, cho phép người dùng trao đổi tiền điện tử nhanh chóng mà không cần phải gửi tiền vào nền tảng.

- Sự tiện lợi:Giao diện người dùng thường đơn giản và dễ điều hướng, giúp người dùng ở mọi cấp độ kinh nghiệm đều có thể sử dụng.

- Hỗ trợ tiền điện tử đa dạng:Các sàn giao dịch này thường hỗ trợ nhiều loại tiền điện tử, cung cấp cho người dùng nhiều lựa chọn để giao dịch.

Nhược điểm:

- Phí cao hơn: Giao dịch tức thời có thể tính phí cao hơn các giao dịch khác do tính tiện lợi và tốc độ.

- Trượt giá: Do tính chất tức thời của giao dịch, người dùng có thể gặp phải tình trạng trượt giá, đặc biệt là trong điều kiện thị trường biến động.

5. Trao đổi ngang hàng (P2P)

Giao dịch ngang hàng, còn được gọi là giao dịch P2P, tạo điều kiện cho các giao dịch trực tiếp giữa người mua và người bán mà không cần trung gian. LocalBitcoins và Paxful là những sàn giao dịch P2P nổi tiếng. Các nền tảng này thường sử dụng dịch vụ ký quỹ để giữ tài sản cho đến khi cả hai bên hoàn thành nghĩa vụ của mình, do đó đảm bảo tính toàn vẹn của giao dịch.

Thuận lợi:

- Giao dịch trực tiếp:Sàn giao dịch P2P cho phép người dùng giao dịch trực tiếp với nhau, mang lại trải nghiệm giao dịch cá nhân hóa hơn.

- Tăng cường bảo mật:Việc sử dụng dịch vụ ký quỹ và hợp đồng thông minh giúp tăng cường tính bảo mật của giao dịch bằng cách đảm bảo tài sản chỉ được giải phóng khi cả hai bên đáp ứng các điều khoản đã thỏa thuận.

- Phương thức thanh toán linh hoạt:Người dùng có thể lựa chọn nhiều phương thức thanh toán khác nhau, bao gồm chuyển khoản ngân hàng, thanh toán bằng tiền mặt và ví điện tử, giúp giao dịch dễ tiếp cận và thuận tiện hơn.

Nhược điểm:

- Thanh khoản thấp hơn: Các sàn giao dịch P2P có thể có tính thanh khoản thấp hơn so với các sàn giao dịch tập trung và phi tập trung, điều này có thể ảnh hưởng đến tính khả dụng của các cặp giao dịch và tác động đến giá cả.

- Trải nghiệm người dùng đa dạng: Trải nghiệm của người dùng có thể thay đổi đáng kể tùy theo các bên tham gia giao dịch và việc giải quyết tranh chấp có thể gặp khó khăn trong trường hợp bất đồng.

Nếu bạn đang cố gắng tìm ra hướng đi tốt nhất cho doanh nghiệp tiền điện tử của mình, sau đây là bản so sánh tóm tắt đơn giản về năm loại sàn giao dịch chính: Tập trung (CEX), Phi tập trung (DEX), Kết hợp, Tức thời và Ngang hàng (P2P).

| Tính năng | CEX | DEX | lai | Lập tức | P2P |

| Cơ quan trung ương | Đúng | KHÔNG | Một phần | Đúng | KHÔNG |

| Lưu giữ tiền | Đúng | KHÔNG | Một phần | KHÔNG | KHÔNG |

| Tính thanh khoản | Cao | Thấp-Trung bình | Trung bình | Trung bình | Thấp |

| Dễ sử dụng | Cao | Trung bình | Trung bình | Cao | Thấp-Trung bình |

| Gánh nặng quản lý | Cao | Thấp | Trung bình | Trung bình | Thấp |

- Nếu bạn đang xây dựng nền tảng cho các nhà giao dịch, CEX là lựa chọn phù hợp với thiết kế thân thiện với người dùng và tính thanh khoản cao.

- Nếu quyền riêng tư và tính phi tập trung là yếu tố quan trọng đối với bạn, hãy xem xét các tùy chọn DEX hoặc P2P cho phép người dùng kiểm soát.

- Bạn đang tìm kiếm một giải pháp ở giữa? Giải pháp lai có thể là sự kết hợp hoàn hảo giữa hiệu quả và tính minh bạch.

- Nếu bạn cần tốc độ, hãy cân nhắc trao đổi tức thì để có giải pháp nhanh chóng.

Hướng dẫn từng bước thiết lập sàn giao dịch tiền điện tử của bạn

Việc ra mắt một sàn giao dịch tiền điện tử thành công đòi hỏi phải lên kế hoạch và thực hiện tỉ mỉ. Với một quy trình bài bản, bạn có thể phát triển một nền tảng thu hút người dùng đáng kể và phát triển thành một doanh nghiệp bền vững. Các bước dưới đây có thể giúp bạn tạo ra một nền tảng thu hút người dùng và trở thành một doanh nghiệp thực sự.

1. Chọn quốc gia để hoạt động.

Quyết định quan trọng đầu tiên là xác định nơi bạn sẽ vận hành sàn giao dịch. Hãy bắt đầu bằng việc xem xét các quy định của thị trường địa phương - tìm hiểu xem quốc gia nào có lượng người dùng tiền điện tử lớn nhất và có thái độ thân thiện nhất đối với ngành. Vận hành tại địa phương trước tiên cho phép bạn hiểu rõ hơn về bối cảnh trước khi mở rộng ra toàn cầu.

2. Xác định đối tượng mục tiêu của bạn.

Thu hút cộng đồng tiền điện tử trên mạng xã hội và diễn đàn để hiểu nhu cầu và hành vi của người dùng tiềm năng. Xác định nhóm nhân khẩu học nào đang tích cực giao dịch tài sản kỹ thuật số - nhắm mục tiêu đến những người dùng sớm đang tìm kiếm các lựa chọn giao dịch bổ sung.

3. Tuân thủ các yêu cầu pháp lý và xin giấy phép.

Tìm kiếm tư vấn pháp lý để đảm bảo tuân thủ tất cả các quy định hiện hành tại khu vực pháp lý bạn đã chọn. Các quy định xung quanh KYC /AML, thuế và các hoạt động bị hạn chế khác nhau đáng kể giữa các quốc gia. Việc có được giấy phép phù hợp sẽ hợp pháp hóa hoạt động kinh doanh của bạn và mang lại sự tin tưởng cho người dùng.

4. Chọn tính năng trao đổi tiền điện tử.

Tích hợp các yếu tố thiết yếu như hệ thống đăng ký/xác minh người dùng, ví điện tử, sổ lệnh và các công cụ biểu đồ tiên tiến. Cân nhắc những chức năng bổ sung mà các sàn giao dịch uy tín không cung cấp để tạo sự khác biệt cho dịch vụ của bạn. Tập trung vào trải nghiệm người dùng và bảo mật trước tiên để thu hút các nhà giao dịch e ngại rủi ro.

5. Tìm một công ty phát triển.

Hãy tìm hiểu các lập trình viên blockchain hàng đầu và xem xét kỹ lưỡng danh mục đầu tư, công nghệ được sử dụng và phản hồi của khách hàng để xác định đối tác phù hợp. Phát triển tốt là yếu tố then chốt cho thành công - tránh trả lương thấp mà không quan tâm đến chất lượng.

6. Thiết kế nền tảng thân thiện với người dùng.

Thiết kế giao diện người dùng (UI) và trải nghiệm người dùng (UX) cũng rất quan trọng. Hãy thuê các nhà thiết kế UX/UI chuyên nghiệp để tạo ra những giao diện đơn giản nhưng hấp dẫn, được tối ưu hóa cho cả thiết bị di động và máy tính để bàn. Điều hướng trực quan với quy trình hướng dẫn sử dụng nhanh chóng giúp rút ngắn thời gian làm quen.

7. Bắt đầu phát triển sàn giao dịch tiền điện tử.

Chọn các nền tảng phù hợp về hiệu suất, khả năng mở rộng và bảo mật. Trước khi thử nghiệm giai đoạn, hãy phát triển công cụ giao dịch, dịch vụ ví, sổ lệnh và bảng điều khiển quản trị theo tiêu chuẩn quy trình làm việc. Việc kiểm tra nghiêm ngặt sẽ giúp bạn chuẩn bị sẵn sàng cho việc ra mắt.

8. Ra mắt và quảng bá sàn giao dịch của bạn.

Ra mắt với một sự toàn diện chiến lược tiếp thị bao gồm quảng bá trên mạng xã hội, quan hệ công chúng, hợp tác với người có sức ảnh hưởng và tặng quà cộng đồng. Lắng nghe những người dùng đầu tiên và tiếp tục cải thiện sản phẩm dựa trên phản hồi để giữ chân họ lâu dài.

6 Sai lầm cần tránh khi bắt đầu giao dịch tiền điện tử

Việc ra mắt một sàn giao dịch tiền điện tử có thể rất phức tạp, và chỉ một sai lầm nhỏ cũng có thể gây tổn hại đến danh tiếng, vị thế pháp lý hoặc hiệu quả hoạt động của nền tảng. Dưới đây là sáu sai lầm phổ biến mà các doanh nhân thường mắc phải và lời khuyên để tránh chúng.

Bỏ qua các bước tuân thủ

Nhiều sàn giao dịch cố gắng cắt giảm các yêu cầu pháp lý, với hy vọng tiết kiệm thời gian, nhưng điều này có thể dẫn đến việc đóng cửa hoặc phạt tiền sau này.

Hãy đảm bảo bạn luôn tuân thủ các quy định về KYC và AML, đăng ký đúng nơi và nhận tư vấn từ các chuyên gia pháp lý ngay từ đầu. Việc giải quyết các vấn đề pháp lý sau này có thể khó khăn và tốn kém.

Thiết kế UI/UX vội vã

Ngay cả khi nền tảng của bạn vững chắc thì cũng không quan trọng nếu người dùng không biết cách sử dụng nền tảng.

Quy trình đăng ký phức tạp, bảng điều khiển lộn xộn và ứng dụng di động lỗi thời sẽ khiến người dùng rời bỏ sàn giao dịch. Hãy dành thời gian tạo ra một giao diện thân thiện, phù hợp cho cả người mới bắt đầu và nhà giao dịch giàu kinh nghiệm.

Quên đi tính thanh khoản khi ra mắt

Nếu bạn ra mắt mà không có kế hoạch thanh khoản vững chắc, bạn có thể gặp phải sự chậm trễ và các vấn đề về giá, điều này có thể khiến các nhà giao dịch nghiêm túc e ngại.

Hãy hợp tác với các nhà cung cấp thanh khoản hoặc thiết lập các nhóm thanh khoản trước khi triển khai. Việc có một sổ lệnh đáng tin cậy là rất quan trọng để tạo dựng lòng tin của người dùng.

Dựa vào bảo mật ví yếu

Các sàn giao dịch tiền điện tử thường thu hút tin tặc, vì vậy bảo mật ví là điều cần thiết.

Đừng chỉ sử dụng ví nóng. Thay vào đó, hãy sử dụng ví lạnh, ví đa chữ ký, kiểm tra bảo mật thường xuyên và xác thực hai yếu tố ngay từ đầu.

Quá tải tính năng quá nhanh

Cố gắng cung cấp mọi tùy chọn giao dịch ngay lập tức có thể phản tác dụng, dẫn đến lỗi và chậm trễ trong quá trình ra mắt.

Trước tiên, hãy tập trung vào các tính năng cơ bản: giao dịch giao ngay, thiết lập ví và thông tin theo thời gian thực. Bạn luôn có thể thêm các tùy chọn khác sau.

Bỏ qua Hỗ trợ Khách hàng

Nhiều công ty khởi nghiệp quên rằng sau khi ra mắt, sự hỗ trợ của người dùng là rất quan trọng.

Chuẩn bị sẵn các kênh hỗ trợ, câu hỏi thường gặp và hệ thống ticket trước khi triển khai. Thời gian phản hồi nhanh chóng và sự hỗ trợ tận tình có thể thực sự xây dựng lòng trung thành của khách hàng.

Tránh xa những sai lầm này không chỉ bảo vệ khoản đầu tư của bạn mà còn giúp tạo tiền đề cho sự tăng trưởng bền vững. Hãy luôn ghi nhớ danh sách kiểm tra này khi bạn chuẩn bị ra mắt để đảm bảo bạn đang đưa ra những lựa chọn sáng suốt.

Cấu trúc chi phí thiết lập và dòng doanh thu hoạt động như thế nào?

Việc vận hành sàn giao dịch tiền điện tử đòi hỏi một khoản đầu tư ban đầu đáng kể. Tuy nhiên, những sàn giao dịch thành công có tiềm năng tạo ra hàng triệu đô la lợi nhuận hàng tháng. Hãy cùng xem xét cấu trúc chi phí điển hình và cách thức tạo ra doanh thu.

Trước khi tính toán ngân sách, bạn nên cân nhắc xem sự phát triển của mình phù hợp như thế nào với các mục tiêu dài hạn. Bạn đang cân nhắc một sàn giao dịch tiền điện tử nhãn trắng đã sẵn sàng hoạt động, hay bạn muốn xây dựng một nền tảng tùy chỉnh từ đầu?

Sau đây là một bản so sánh tóm tắt nhanh:

| Lựa chọn | Trao đổi nhãn trắng | Sàn giao dịch được xây dựng tùy chỉnh |

| Thời gian đưa ra thị trường | Nhanh (2 đến 8 tuần) | Dài hơn (6 đến 12 tháng trở lên) |

| Chi phí trả trước | Thấp hơn | Cao hơn |

| Tính linh hoạt | Tùy chọn hạn chế | Kiểm soát hoàn toàn các tính năng và thiết kế |

| Khả năng mở rộng | Trung bình - tùy thuộc vào nhà cung cấp | Cao - được thiết kế để tăng trưởng |

| Tốt nhất cho | MVP, công ty khởi nghiệp, dự án ra mắt nhanh | Nền tảng cấp doanh nghiệp, trường hợp sử dụng độc đáo |

Chi phí thiết lập ước tính

Chi phí sẽ thay đổi tùy theo yêu cầu cụ thể của bạn, nhưng sau đây là một số hướng dẫn chung:

- Giải pháp nhãn trắng: Việc dựa vào các nền tảng trao đổi chìa khóa trao tay giúp tiết kiệm thời gian phát triển nhưng hạn chế khả năng tùy chỉnh. Phí cấp phép dao động từ 50.000 đến 200.000 đô la.

- Phát triển tùy chỉnh: Xây dựng từ đầu mang lại khả năng kiểm soát hoàn toàn nhưng cần 6-12 tháng và 150.000-500.000 đô la tùy thuộc vào các tính năng và công nghệ được sử dụng.

Các chi phí bổ sung bao gồm tuân thủ, kiểm tra an ninh mạng, ngân sách tiếp thị và chi phí cơ sở hạ tầng/hỗ trợ liên tục.

Các nguồn doanh thu tiềm năng

Sau khi ra mắt, các sàn giao dịch kiếm tiền chủ yếu thông qua các hoạt động giao dịch:

- Phí giao dịch: Phí 0,1%-0,3% cho tất cả các giao dịch là nguồn thu nhập lớn nhất đối với các sàn giao dịch có khối lượng lớn.

- Phí rút tiền: Phí nhỏ từ 1-5 đô la sẽ được áp dụng khi rút tiền để trang trải chi phí xử lý.

- Phí niêm yết: Các loại tiền điện tử mới phải trả phí niêm yết đáng kể, đôi khi là hàng tháng sau đó.

- Giao dịch ký quỹ: Thu lãi từ các khoản vay cho các nhà giao dịch có đòn bẩy là phổ biến.

- Tài khoản cao cấp: Các công cụ nâng cao thu hút đăng ký hàng tháng.

- API dữ liệu: Việc kiếm tiền từ dữ liệu thị trường theo thời gian thực sẽ phải trả phí từ các tổ chức.

Với hàng triệu giao dịch mỗi ngày trên toàn cầu, ngay cả những sàn giao dịch thành công khiêm tốn cũng có thể đạt được lợi nhuận trong vòng 1-2 năm để bù đắp chi phí thiết lập. Tăng trưởng và đổi mới liên tục sẽ mở rộng hơn nữa các nguồn thu nhập. Việc hiểu rõ chi phí so với doanh thu tiềm năng là chìa khóa cho việc lập kế hoạch chiến lược và các sáng kiến gây quỹ.

Bạn nên sử dụng công nghệ nào?

Nền tảng công nghệ hỗ trợ sàn giao dịch tiền điện tử của bạn ảnh hưởng đáng kể đến hiệu suất, chức năng, khả năng mở rộng và bảo mật. Nền tảng công nghệ bao gồm các ngôn ngữ lập trình như Java, PHP và Swift, cơ sở dữ liệu như MongoDB và MySQL, dịch vụ đám mây từ AWS hoặc Google Cloud Platform, và API từ các sàn giao dịch phổ biến như Binance và Coinbase. Việc lựa chọn và triển khai nền tảng công nghệ một cách cẩn thận là tối quan trọng cho sự thành công.

- Giao diện người dùng

Các framework front-end phổ biến bao gồm React, Angular và Vue.js để xây dựng giao diện giao dịch phản hồi trên web và thiết bị di động.

- Phần cuối

Đối với API và dịch vụ, các tùy chọn hiệu quả là Node.js, Python, Java, C# và Go, tùy thuộc vào chuyên môn của nhà phát triển.

- Cơ sở dữ liệu

Các cơ sở dữ liệu phi quan hệ như MongoDB phù hợp nhất với dữ liệu thương mại phi cấu trúc khối lượng lớn. Hãy cân nhắc PostgreSQL, MySQL hoặc ClickHouse để có thêm dữ liệu quan hệ.

- Cơ sở hạ tầng

Các nhà cung cấp dịch vụ đám mây AWS, Google Cloud và Microsoft Azure cung cấp các kiến trúc không máy chủ có khả năng mở rộng, được tối ưu hóa cho khối lượng công việc liên quan đến tiền điện tử.

- Chuỗi khối

Việc tích hợp với các mạng công cộng như Ethereum, Binance Smart Chain, Solana, v.v. sử dụng cơ sở hạ tầng node. API WebSocket truyền phát giá theo thời gian thực.

- Thư viện & Tích hợp

Các giải pháp được xây dựng sẵn giúp tăng tốc quá trình phát triển, chẳng hạn như CoinGecko để cung cấp dữ liệu về giá, Coinpayments để cung cấp cổng thanh toán fiat và Auth0 để xác thực.

- Bảo vệ

Ví lạnh, thiết lập nhiều chữ ký, kiểm tra thường xuyên, mã hóa, mô hình hóa mối đe dọa và thử nghiệm thâm nhập đảm bảo khả năng phòng thủ mạnh mẽ.

- Kiểm tra

Kiểm tra kỹ lưỡng bằng các công cụ như Jest, Cypress và Cucumber sẽ nâng cao tiêu chuẩn đảm bảo chất lượng trước khi triển khai.

Danh sách kiểm tra bảo mật sàn giao dịch tiền điện tử khi ra mắt

Khi bắt đầu một sàn giao dịch tiền điện tử, bảo mật là điều bắt buộc. Toàn bộ hoạt động của bạn phụ thuộc vào khả năng bảo vệ chống lại các mối đe dọa mạng và giành được lòng tin của người dùng.

Dưới đây là danh sách kiểm tra bảo mật thiết thực bạn cần cân nhắc trước khi triển khai. Thực hiện theo các bước này có thể giúp sàn giao dịch của bạn an toàn ngay từ đầu và tạo ấn tượng tốt với các cơ quan quản lý và người dùng tổ chức.

Các biện pháp bảo mật chính

- Lưu trữ ví lạnh* - Lưu trữ hầu hết tiền của khách hàng trong ví ngoại tuyến để giảm nguy cơ bị hack.

- Giới hạn tốc độ và bảo vệ chống DDoS - Sử dụng tường lửa và các biện pháp chống DDoS để bảo vệ chống lại các cuộc tấn công bằng vũ lực và tình trạng quá tải lưu lượng có thể làm gián đoạn nền tảng của bạn.

- Kiểm tra hợp đồng thông minh (dành cho nền tảng lai/DEX) - Nếu bạn đang sử dụng hợp đồng thông minh, hãy thực hiện kiểm tra độc lập để tìm và khắc phục lỗ hổng trước khi ra mắt.

- Kiểm tra xâm nhập thường xuyên - Thuê chuyên gia an ninh mạng để kiểm tra hệ thống của bạn trước các cuộc tấn công thực tế, sau đó khắc phục mọi điểm yếu.

- Tùy chọn đăng nhập sinh trắc học và xác thực 2 yếu tố - Triển khai xác thực đa yếu tố cho tài khoản người dùng, khu vực quản trị và quy trình rút tiền. Hãy cân nhắc việc thêm đăng nhập sinh trắc học cho ứng dụng di động.

- Mã hóa dữ liệu nhạy cảm - Đảm bảo thông tin đăng nhập, tài liệu KYC và thông tin giao dịch đều được mã hóa.

- Kiểm soát truy cập dựa trên vai trò (RBAC) - Giới hạn quyền quản trị cho các vai trò cụ thể để giảm nguy cơ vi phạm hoặc sai sót nội bộ.

- Giám sát liên tục - Thiết lập giám sát theo thời gian thực để phát hiện hoạt động bất thường và tạo cảnh báo về các khoản rút tiền lớn, đăng nhập bất thường hoặc sử dụng sai API.

Những cân nhắc khác cho doanh nghiệp giao dịch tiền điện tử của bạn

Ngoài việc phát triển nền tảng kỹ thuật, còn có một số thành phần kinh doanh quan trọng khác cần xem xét:

- Hợp pháp: Hãy dành thời gian để đảm bảo tuân thủ liên tục các quy định khi thị trường thay đổi. Đăng ký các loại hình doanh nghiệp cần thiết và lưu giữ hồ sơ chính xác.

- Tiếp thị: Phát triển các chiến lược tiếp thị dài hạn ngoài các chương trình khuyến mãi ra mắt. Quảng cáo các danh sách coin mới, sự kiện, hướng dẫn, v.v. một cách liên tục.

- Việc bán hàng: Xây dựng quy trình bán hàng để thu hút khách hàng mới và chuyển đổi người dùng thành người đăng ký trả phí theo thời gian. Cung cấp các tính năng cao cấp, gói đăng ký hoặc giải pháp doanh nghiệp.

- Tài chính: Xây dựng các quy trình kế toán, ngân sách và mô hình dự báo. Quản lý bảng cân đối kế toán, dòng tiền và tỷ giá hối đoái giữa tiền pháp định và tiền điện tử một cách hiệu quả.

- Hoạt động: Thiết lập các thủ tục hỗ trợ khách hàng, giám sát trang web, quản lý rủi ro và bảo mật. Liên tục kiểm tra hệ thống và tiến hành thử nghiệm xâm nhập.

- Tính thanh khoản: Tìm nguồn thanh khoản đầy đủ từ các nhà cung cấp bên thứ ba hoặc tự mình trở thành nhà cung cấp thanh khoản. Đảm bảo khả năng khớp lệnh đầy đủ để tránh tình trạng chậm trễ hoặc ngừng hoạt động trong giai đoạn biến động cao.

Phần kết luận

Vậy là chúng ta đã kết thúc phần tổng quan về việc thiết lập một sàn giao dịch tiền điện tử. Quá trình này đòi hỏi sự lập kế hoạch và thực hiện kỹ lưỡng trên cả ba phương diện kỹ thuật, vận hành và kinh doanh. Tuy đầy thách thức, nhưng với bản thiết kế phù hợp, bất kỳ doanh nhân hay đội ngũ tận tâm nào cũng có thể biến tầm nhìn của mình thành hiện thực.

Đối với những ai quyết tâm thực hiện các bước tiếp theo, hãy nhớ thường xuyên xem lại tài liệu này để tham khảo, tận dụng các nguồn lực sẵn có khác và liên hệ để được giải đáp bất kỳ thắc mắc nào khi cần. Với sự nỗ lực không ngừng, các sàn giao dịch được thiết lập từ đầu có thể đạt hiệu suất cao ngang bằng với những tên tuổi hàng đầu hiện đang dẫn đầu lĩnh vực.

FAQ

Chi phí thay đổi tùy thuộc vào việc bạn chọn giải pháp nhãn trắng hay quyết định xây dựng từ đầu. Với các giải pháp nhãn trắng, dự kiến chi phí từ 50.000 đến 200.000 đô la. Đây là lựa chọn tuyệt vời nếu bạn muốn triển khai nhanh chóng nhưng không cần nhiều tính năng tùy chỉnh. Đối với các sàn giao dịch tùy chỉnh, bạn sẽ cần từ 150.000 đến hơn 500.000 đô la, tùy thuộc vào nhu cầu, địa điểm hoạt động và yêu cầu bảo mật của bạn. Đừng quên dành thêm tiền cho việc tuân thủ, kiểm tra bảo mật, cơ sở hạ tầng, tiếp thị và bảo trì liên tục.

Có, thông thường bạn cần có giấy phép hoặc một số loại phê duyệt theo quy định để hoạt động hợp pháp, đặc biệt nếu bạn đang xử lý giao dịch hoán đổi tiền pháp định sang tiền điện tử hoặc lưu giữ tiền của khách hàng. Bạn thường phải tuân thủ các quy tắc như: - Quy định về KYC (Biết Khách hàng của Bạn) và AML (Chống Rửa tiền) - Luật bảo vệ dữ liệu - Đăng ký dịch vụ tài chính tại các quốc gia như EU, UAE, Anh hoặc Hoa Kỳ

Nếu tốc độ là mối quan tâm chính của bạn, lựa chọn một nền tảng giao dịch tiền điện tử nhãn trắng (white-label) là lựa chọn nhanh nhất. Các nền tảng này đi kèm: Thiết lập sẵn; – Ví, hệ thống giao dịch và giao diện người dùng tích hợp sẵn; – Khởi chạy nhanh (vài tuần thay vì vài tháng). Tuy nhiên, hãy lưu ý rằng bạn có thể mất một số khả năng tùy chỉnh sau này. Nếu bạn có những ý tưởng cụ thể hoặc phức tạp, phát triển tùy chỉnh vẫn có thể là lựa chọn tốt hơn.

Đã cập nhật:

25 tháng 6, 2025

9 tháng 2, 2026

What Is a Trading Halt? Why Stocks Stop Trading and What It Means for You => Hủy giao dịch là gì? Tại sao cổ phiếu lại ngừng giao dịch và điều đó có nghĩa gì đối với bạn

Hướng dẫn này sẽ đưa bạn qua CPA so với RevShare (và các sự kết hợp hỗn hợp), giải thích ý nghĩa thực sự của chúng đối với doanh nghiệp môi giới của bạn.