Back

Contents

What is a Fill or Kill (FOK) Order – Definition, Examples, How It Works

Iva Kalatozishvili

Business Development Manager

Demetris Makrides

Senior Business Development Manager

A fill or kill (FOK) order is a type of conditional order that you can place with your broker when trading securities like stocks. With an FOK order, the full trade must be executed immediately according to the specifications you outlined, such as price and quantity, or the order is “killed” or cancelled automatically. This ensures you either get the entire trade filled as desired or no trade occurs at all.

Definition of a Fill or Kill Order

A fill or kill (FOK) order provides traders with a strict set of predefined conditions that must be fully satisfied for a trade to be completed. With an FOK order, you precisely outline the trade details upfront, including the desired exchange asset, quantity to transact, and maximum acceptable price.

This order type aims to get an immediate full fill matching your proposed trade structure or no transaction occurs at all. The defining attribute of an FOK is its all-or-nothing execution mandate. If the market cannot instantaneously fulfil the entire order quantity simultaneously at or better than the limit price you set, the trade is cancelled or “killed” rather than partially filled.

No flexibility is given to only partially complete the transaction – it’s either fulfilled seamlessly according to your predefined filters or swiftly retracted. This differentiated condition separates FOKs from other order types that may partially execute before leaving non-matched portions open on the order book.

By specifying the ideal trade construction upfront and requiring adherence to these filters for completion, FOKs help traders take a disciplined, defined approach. The certainty of immediate maximum fulfilment or swift cancellation provides clarity absent partial fills that could compromise an intended position.

How a Fill or Kill Order Works

When preparing a FOK order, you will define the trade specifications directly with your broker. This includes designating the exchange asset, setting the maximum price through a limit, and determining the precise quantity intended for fulfilment.

With details in hand, your broker will immediately transmit the FOK electronically to the corresponding exchange. Here, the order information is exposed to the live market liquidity present within the order book database. Exchange computers then work diligently to search for any matching counter-orders or clusters of orders that fulfil the predefined conditions.

If the exact quantities requested can be fulfilled instantaneously at or better than the limit price, the trade will be completed seamlessly in real time. However, should matching the specifications not be possible instantaneously due to incomplete liquidity within the order book, the FOK programming initiates automatic cancellation of the entire proposed transaction.

Unlike alternate order types such as day or good-til-canceled orders which persist indefinitely until completion or manual retraction, FOKs carry expiration protocols that terminate unfilled orders within seconds. This resets the trade proposal and prevents the order from lingering with incomplete liquidity exposures.

Consider deploying a hypothetical FOK to purchase 50,000 shares of a stock with a $10 limit. Upon receiving this order, your broker will transmit it instantly to exchanges. If 35,000 shares were available at $10 or below, the difference would cancel the entire trade rather than result in a partial fill. This rigid execution assures your pre-defined needs are fully or not at all satisfied.

Variable conditions like price fluctuations or unexpected liquidity gaps may also trigger cancellation due to the inability to precisely fulfil specifications. The accelerated expiration guarantees outcome resolution, avoiding undefined exposures inherent to lingering unfilled orders.

You may also like

How Long Does a Fill or Kill Order Last?

When utilizing the strict conditional nature of an FOK order, it is important to understand their ephemeral lifespan in the markets. Unlike alternate order types that can persist on exchanges for prolonged durations, FOKs carry programmed expirations meticulously designed around the speed of contemporary trading.

Due to the need for instantaneous confirmation of predefined filters upon order exposure, most exchanges limit the period an incoming FOK order can remain unactioned before triggering automatic cancellation. Though timeframes may vary marginally between venues and based on assets, orders are commonly terminated within seconds should matching liquidity fail to materialize immediately.

This minuscule lifespan aligns strategically with the prevailing conditions of contemporary liquid markets. With technological enhancements rapidly redistributing order flow globally at fractions of second speeds, short-time delays can birth price variances sufficient to disrupt pre-calibrated trade parameters. The fleeting eligibility of the unfilled FOK preserves traders’ intended structure against potentially divergent outcomes.

Comparatively, alternate order varieties like day orders or good-till-cancelled instructions may persist on books for indefinite durations, sustaining exposure until closure through either matching trades or discretionary cancellation. While prolonging participation opportunities, risks also arise from the lack of imposed time limits on unfilled orders exposed to fluid market oscillations.

In environments where liquidity is abundant and disseminated without lag, ephemeral FOK durations prove beneficial. Strict fulfilment requirements paired with brief eligibility windows assure resolved outcomes through either instant fill or prompt kill. Partial fills are omitted through rigid “all or nothing” execution disciplines.

Naturally, decreased longevity reduces the probability of matching emerging orders relative to persistent instructions. However, for strategies reliant on time sensitivity and predefined criteria, immediate certainty outranks potential longer-term opportunities as conditions evolve. Fleeting FOKs foster clarity befitting modern fast markets.

Difference Between FOK and IOC Orders

When pursuing an immediate trade, you will need to determine which conditional order fits your specific needs – a fill or kill (FOK) or immediate or cancel (IOC). While both demand expedited execution upon entry, their divergent handling of incomplete liquidity presents variable pros and cons to examine carefully.

An IOC will attempt to execute your order in full immediately at the specified limit price. However, if complete matching is unavailable, any portion achievable will be completed while the residual is cancelled from open order books without residual risk. In contrast, an unmatched FOK order will result in the cancellation of the entire proposed transaction quantity as a single unit.

Consider placing a purchase for 25,000 shares of stock with a $15 limit using both conditions sequentially. An IOC may obtain 10,000 shares immediately while the remaining 15,000 shares are cancelled due to insufficient liquidity. An FOK in the same scenario would invalidate the full 25,000 share request on the initial failure to fully match constraints.

Naturally, the IOC proves forgiving of incomplete fills, while an FOK oversees rigid enforcement of total fulfilment or full termination. This distinction matters significantly based on priorities between speedy completion rates versus preserving accurate position sizes through guaranteed finishes.

When timeliness trumps the benefits of even partial executions, as in high-frequency strategies, the FOK presents reliable instant resolution. Conversely, the IOC proves more forgiving for opportunistic scalpers when rapid turnover outranks preserving preset allocation filters. Careful consideration of your unique objectives and market conditions will determine the optimal conditional tool.

You may also like

Example of Using a Fill or Kill Order

As a professional trader, you regularly seek out opportune entry points for substantial positions across various liquid shares. One morning, your algorithms highlight a potential upward move brewing in the technology firm MegaTech, Inc. based on strengthening order flow signals and receding supply above pivotal support at $50 per share.

Given the large 100,000 share position your strategy requires and the anticipated speed of market reaction, you opt to place an immediate FOK limit order to fully secure your position on a test of $50. Upon hitting your brokerage platform, you place the “GTD FOK BUY 100,000 shares of MegaTech @ $50” request and it flashes to exchanges via low latency connections.

The market doesn’t hesitate, as sell orders are swept and MegaTech bounces $0.25 above your trigger. However, open liquidity proves scarce above support and can only satisfy 80,000 shares of your order at this time. Here, the unforgiving nature of FOK conditioning comes to light – being unable to fully match the 100,000 share criteria on the initial test, your entire order is promptly cancelled without partial execution.

Had you selected an IOC instead, 80,000 shares would have been harvested with the remainder nullified. While capturing a portion, this leaves you short of the intended scale. By demanding stringent, immediate, or total fulfilment, the FOK protects your strategy from compromising its intended position size due to incomplete initial matches in fast markets. In scenarios leveraging massive size, this level of execution certainty proves invaluable.

When Should I Use a Fill or Kill Order?

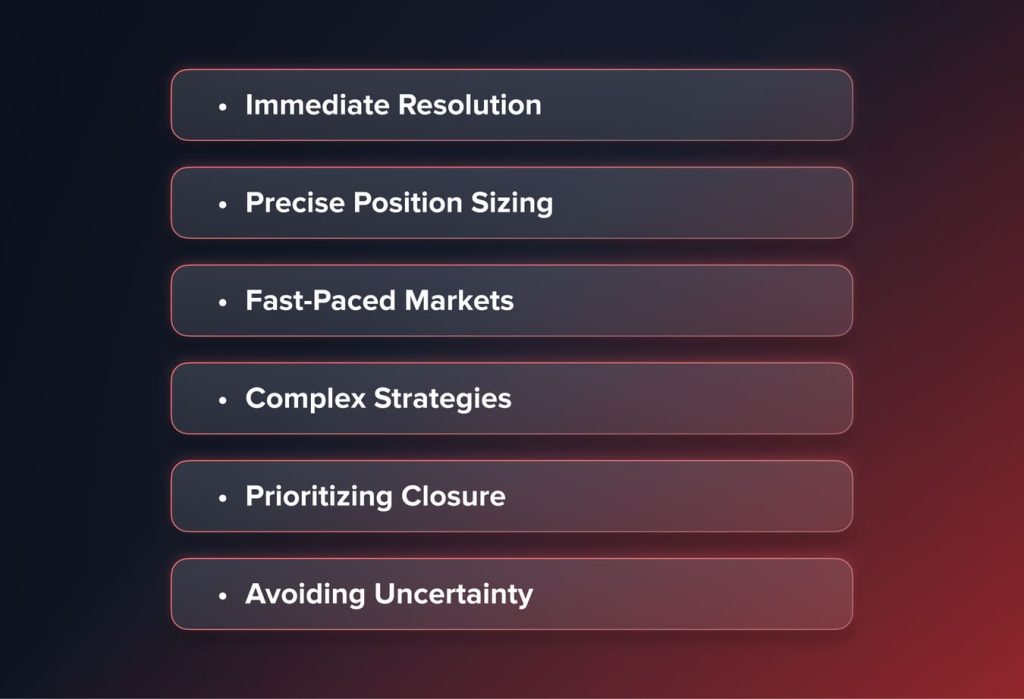

In certain market conditions, utilizing a fill-or-kill (FOK) order can provide clear benefits over other order types. Here are some scenarios where a FOK may be especially well-suited:

- Immediate Resolution: When the speed of execution is paramount, a FOK ensures immediate closure of the order upon submission, either through fulfilment or cancellation. This delivers prompt certainty compared to other orders that could remain unfilled.

- Precise Position Sizing: For trades requiring an exact number of shares or contracts, an FOK guarantees the specified volume will transact or none at all. This avoids incomplete fills that could disrupt intended trade sizes.

- Fast-Paced Markets: In listings prone to rapid price fluctuations, an FOK’s instant settlement prevents exposure to movement away from the order’s terms before closure. Partial fills leave the remainder at risk.

- Complex Strategies: Trading systems demanding precise inputs may prefer the clarity of a filled or cancelled FOK to the ambiguity of partially completed orders. This facilitates clear process tracking.

- Prioritizing Closure: Certain techniques like day trading focus on speed of order conclusion over maximizing each trade’s fill percentage. FOKs perfectly suit this objective.

- Avoiding Uncertainty: Rather than enduring unfinished orders’ uncertainties, an FOK resolves placement immediately, excluding the risk of hanging trades and altering positions.

When conditions demand well-defined, risk-limited outcomes through full instant fills or prompt cancellation, fill-or-kill logic can effectively streamline trading activities. Its clarity of purpose is well-aligned with specific best practices.

How to Place a Fill or Kill Order

Entering an FOK order is straightforward once you understand the key parameters and the placement process with your broker. Let’s break down the basic steps:

1. Selecting a Broker

Before getting started, evaluate which brokers cater to your preferred markets and order types. Desktop, web, and mobile platforms can streamline order entry.

2. Initiating the Trade Ticket

Log into your chosen broker’s trading interface via the website or dedicated app. Locate the “New Order” option and select the desired exchange.

3. Populating Trade Details

Fill in fields such as symbol, side (Buy/Sell), order quantity, price type (Limit), limit price, and order type (Fill or Kill). Review each element carefully.

4. Order Type Selection

On interactive menus or dropdowns, pick “Fill or Kill” or similar wording to specify your intention for immediate full execution or cancellation.

5. Reviewing Order Parameters

Cross-check that all details match your intended trade blueprint, including conditional behaviour, before confirming. Make edits as needed.

6. Submitting for Effect

Send the order off to designated market centres by clicking a button clearly labelled “Confirm” or similar. Verify submission details.

7. Understanding Time Risks

Keep in mind exchanges may kill unfilled FOKs within seconds, so utilize only liquid assets unless comfortable with risks.

8. Alternative Execution Methods

Some brokers let you call in FOK orders by phone if preferred over digital placement. Ensure the representative understands conditional logic.

By learning placement process quirks with your chosen intermediary, you can strategically harness the clarity and crisp outcomes enabled by fill-or-kill functionality for optimal results. Never hesitate to confirm full comprehension.

Conclusion

In today’s high-speed digital markets, conditional orders like FOK provide sophisticated traders with powerful tools to precisely define trades at a granular level. By understanding their mechanics and appropriate uses, you can seamlessly take advantage of opportunities as they flash across multiple time horizons.

Used strategically, fill or kill orders guarantee you either secure intended positions instantly based on preset filters, or withdraw cleanly from potential trades that can’t be immediately satisfied. For trading scenarios favouring absolute clarity and strict conformance to volume or pricing criteria, FOK logic forms a valuable tactical option.

Updated:

December 19, 2024

9 February, 2026

What Is a Trading Halt? Why Stocks Stop Trading and What It Means for You

A trading halt is when an exchange temporarily stops trading in a stock or, in rare cases, the entire market. It’s not a glitch and it’s not random. It’s a deliberate pause triggered when prices move too fast, critical information is about to be released, or regulators need time to step in. From the outside, […]