As 10 principais estratégias de negociação de opções

Conteúdo

O que é negociação de opções?

Opções são contratos financeiros que conferem ao titular o direito, mas não a obrigação, de vender ou comprar um ativo subjacente a um preço predeterminado durante um período específico. Esses contratos permitem que os investidores realizem um dos vários objetivos principais de investimento: gestão de riscos , potencial especulação sobre um movimento de mercado e geração adicional de renda. As opções permitiriam que os traders lucrassem com a mesma quantidade de um ativo subjacente sem precisar deter todo o capital necessário para deter o ativo diretamente.

No entanto, negociar opções também apresenta seus perigos. Há decadência temporal dos contratos de opções, mudanças na volatilidade e, por fim, situações fora do dinheiro (out-of-the-money) que podem causar perdas potenciais, a menos que sejam bem gerenciadas. Portanto, qualquer estratégia de negociação de opções requer conhecimento profundo da dinâmica do mercado subjacente, dos modelos de precificação de opções e dos princípios de gestão de risco.

As 10 principais estratégias de negociação de opções

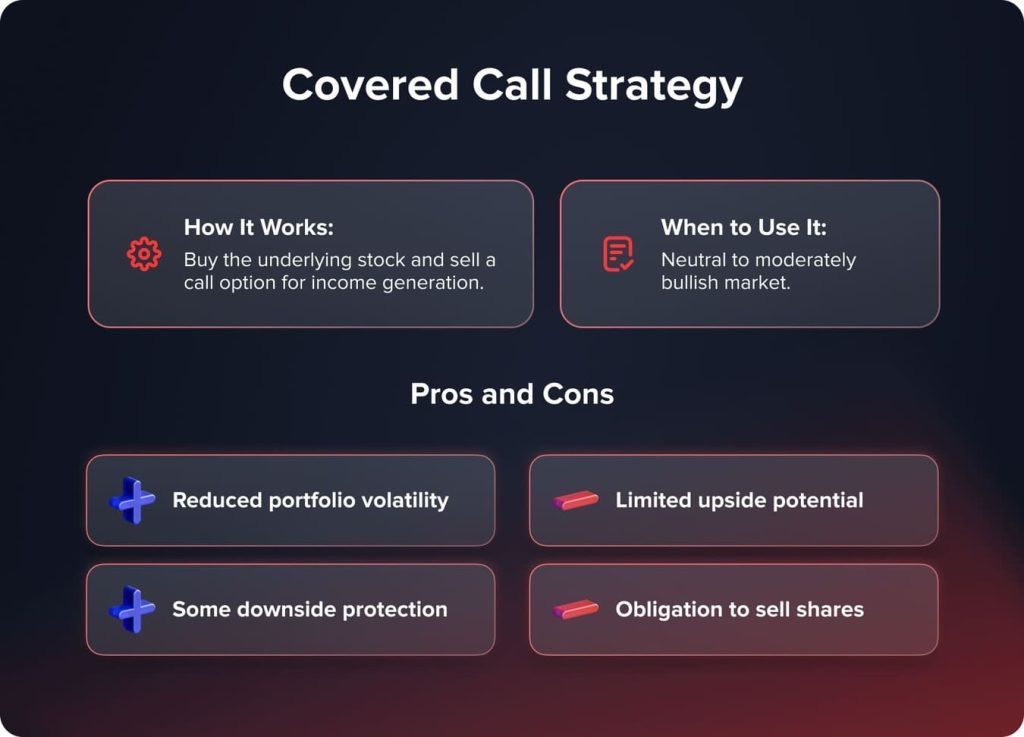

1. Estratégia de Chamada Coberta

A estratégia de negociação de opções mais popular é a chamada coberta, que representa essencialmente um equilíbrio entre os objetivos de geração de renda e gestão de risco. Em uma chamada coberta, o investidor mantém uma posição comprada em um ativo subjacente – digamos, uma ação – e, simultaneamente, vende uma opção de compra sobre o mesmo ativo.

Como funciona:

Em uma opção de compra coberta, você começa comprando as ações subjacentes. Em seguida, vende uma opção de compra com um preço de exercício acima do preço de mercado atual do ativo subjacente. Você recebe o prêmio recebido pela venda da opção de compra. Isso pode ser uma fonte de renda regular. Se, no vencimento, o preço da ação subjacente estiver abaixo do preço de exercício da opção de compra, esta expirará sem valor, portanto, você mantém o prêmio. Em outro cenário, se o preço da ação ultrapassar o preço de exercício, a opção poderá ser exercida, portanto, você será obrigado a vender suas ações pelo preço de exercício.

Quando usar:

A estratégia de compra coberta é ideal para investidores cuja perspectiva para o ativo subjacente é neutra a moderadamente otimista. Ela funciona extraordinariamente bem em mercados estáveis ou com leve tendência de alta.

Prós vs Contras

- As vantagens consistem na geração de renda, redução na volatilidade do portfólio e alguma proteção contra perdas.

- A desvantagem é que você abre mão do potencial de valorização da ação subjacente, caso ela suba acima do preço de exercício da opção de compra vendida.

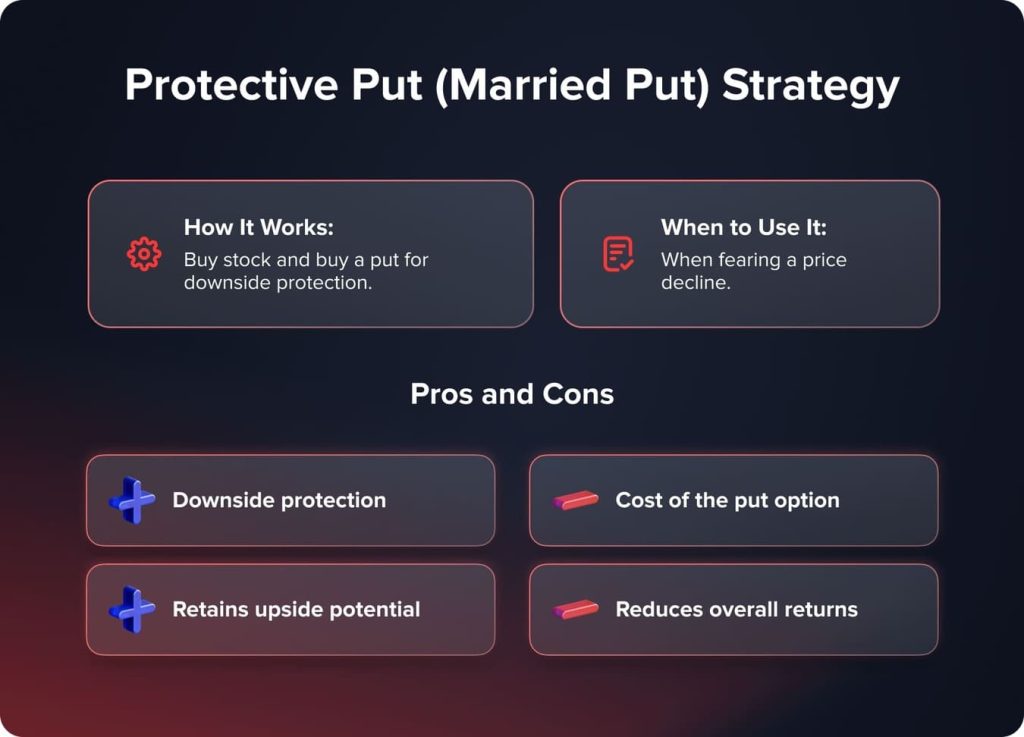

2. Estratégia de Put de Proteção (Put Casado)

A operação de put protetora, popularmente conhecida como put casada, é uma estratégia de negociação de opções na qual se compra o ativo subjacente e, ao mesmo tempo, se compra uma opção de venda sobre esse mesmo ativo subjacente. É empregada principalmente com o objetivo de proteção contra riscos de queda no investimento subjacente.

Como funciona:

Ao comprar uma opção de venda de proteção, você primeiro compra uma ação. Em seguida, compra uma opção de venda com a mesma quantidade de ações que um contrato de venda representa. A opção de venda lhe dá o direito, mas não a obrigação, de vender o ativo subjacente ao preço de exercício da opção de venda, criando assim um preço mínimo para o seu investimento, onde a possível queda é limitada a um nível com o qual você pode conviver.

You may also like

Quando usar:

A estratégia de venda de proteção é mais adequada sempre que se mantém uma posição longa no ativo subjacente e se teme uma queda significativa no preço desse ativo.

Prós vs Contras

- O principal ponto positivo aqui é a proteção contra quedas, mas o potencial para ganhos positivos pode ser concretizado.

- O fator compensatório aqui é o custo do prêmio da opção de venda, que pode corroer os retornos gerais.

3. Bull Call Spread

Um chamado de touro espalhar É uma das estratégias populares de negociação de opções, na qual um investidor compra uma opção de compra e, simultaneamente, vende uma opção de compra com strike mais alto sobre o mesmo ativo subjacente e com a mesma data de vencimento. É utilizada quando há uma predisposição otimista sobre o ativo subjacente e se espera que seu preço suba moderadamente.

Como funciona:

Para criar um spread de compra de ações (bull call spread), você compra uma call com preço de exercício mais baixo. Ao mesmo tempo, você vende uma call do mesmo ativo subjacente com preço de exercício mais alto e mesma data de vencimento. O prêmio recebido pela venda da call com preço de exercício mais alto compensa parcialmente o custo de compra da call com preço de exercício mais baixo.

Quando usar:

É mais adequada quando se espera uma alta moderada no preço do ativo subjacente. Essa estratégia de spreads permite a participação no potencial de valorização, ao mesmo tempo que limita o risco e o investimento de capital em comparação com uma simples compra direta de uma opção de compra.

Prós vs Contras

- A principal vantagem será uma exigência de capital reduzida em comparação a uma posição longa de compra; o risco de queda é limitado.

- A desvantagem é que o potencial de valorização também é limitado à diferença entre os dois preços de exercício.

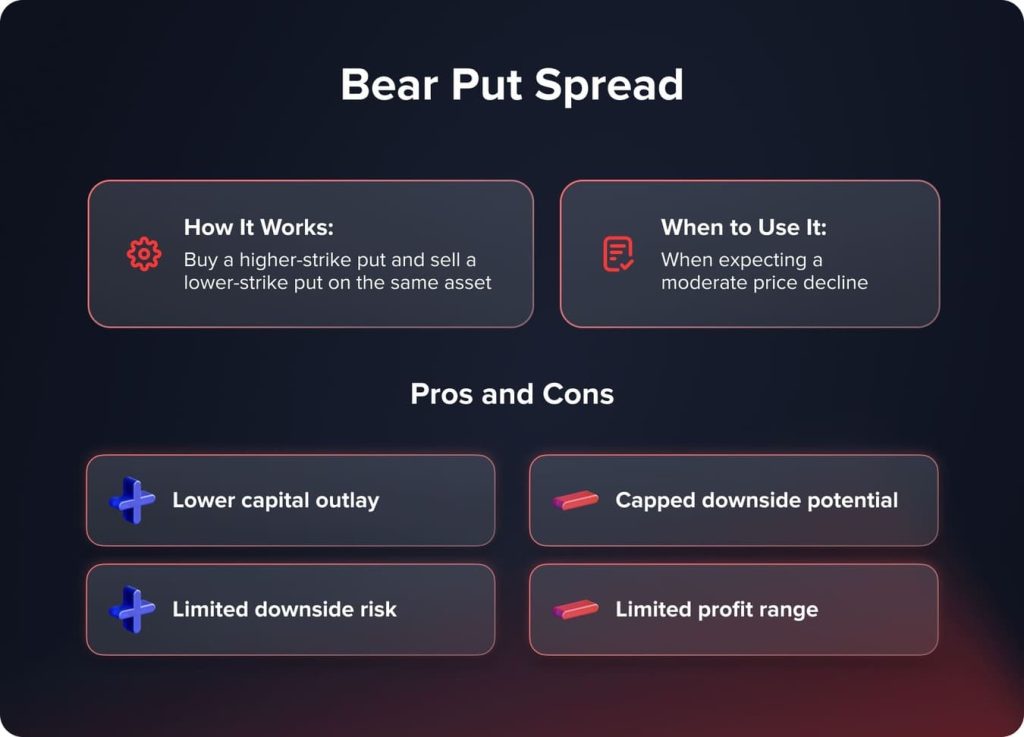

4. Spread de venda de baixa

O spread de venda (put spread) é uma estratégia de negociação de opções que envolve a compra simultânea de uma opção de venda com preço de exercício mais alto e a venda de uma opção de venda com preço de exercício mais baixo, no mesmo ativo subjacente e na mesma data de vencimento. Essa estratégia é usada quando você está pessimista em relação ao ativo subjacente, mas prevê uma queda no preço em um nível razoável.

Como funciona:

O spread de venda a descoberto (long bear put spread) é criado pela compra de uma opção de venda com strike mais alto e, simultaneamente, pela venda de uma opção de venda com strike mais baixo sobre o mesmo ativo subjacente e com a mesma data de vencimento. O prêmio recebido pela venda da opção de venda com strike mais baixo, quando compensado pela compra da opção de venda com strike mais alto, compensa parcialmente o custo dessa opção de venda com strike mais alto.

Quando usar:

Sua utilização é otimizada quando se prevê uma queda considerável no preço subjacente. Isso lhe dá a oportunidade de participar do potencial de queda com risco e investimento de capital limitados, em comparação com a compra direta de uma opção de venda.

Prós vs Contras

- O principal benefício é a redução da exigência de capital em comparação a uma posição longa de venda e o risco limitado de queda.

- A compensação, o potencial de queda, também é limitado à diferença entre os dois preços de exercício.

5. Coleira de proteção

O colar de proteção é uma estratégia de negociação de opções que envolve a compra de uma opção de venda (put) fora do dinheiro e a venda de uma opção de compra (call) fora do dinheiro do mesmo ativo. Geralmente, é aplicado para proteção quando já se possui uma posição comprada no ativo em questão.

Como funciona:

A proteção é iniciada pela manutenção de uma posição comprada no ativo subjacente, que pode ser qualquer ação. Em seguida, você compra uma opção de venda OTM. Ao comprar a opção de venda, você ganha o direito de vender o ativo subjacente ao preço de exercício da opção de venda. Venda uma opção de compra OTM simultaneamente para gerar renda, mas observe que isso também limita o potencial de valorização do ativo subjacente.

Quando usar:

Essa estratégia é apropriada quando se tem uma posição comprada no ativo subjacente e se deseja proteger os lucros, mas ainda assim obter algum ganho. É particularmente útil quando os mercados estão extremamente voláteis ou quando se teme uma queda iminente do mercado.

Prós vs Contras

- O principal ponto positivo dessa estratégia é a proteção contra perdas, com alguma participação em altas.

- A desvantagem é que o potencial de valorização é limitado pelo preço de exercício da opção de compra vendida.

You may also like

6. Long Straddle

Estratégia de Negociação de Opções Long Straddle: O long straddle envolve a compra simultânea de uma opção de compra e uma de venda sobre o mesmo ativo, com a mesma data de vencimento e preço de exercício. Essa estratégia é executada quando você antecipa uma mudança significativa no movimento de preço, mas sem qualquer garantia da direção em que isso ocorrerá.

Como funciona:

Primeiro, para criar um straddle longo, compra-se uma opção de compra juntamente com uma opção de venda sobre o mesmo ativo subjacente, com o mesmo strike e vencimento. Isso lhe daria uma posição que lucra com uma grande variação em qualquer direção do preço do ativo subjacente, desde que a variação seja significativa o suficiente para cobrir o custo de ambas as opções.

Quando usar:

A estratégia de straddle longo é mais adequada em situações em que se espera uma mudança significativa no preço do ativo subjacente, mas não se tem certeza da direção de tal movimento. Pode ocorrer em torno de grandes eventos noticiosos, como anúncios de lucros, decisões regulatórias ou eventos geopolíticos que devem aumentar a volatilidade do ativo subjacente.

Prós vs Contras

- A vantagem é o potencial de se beneficiar de uma grande movimentação no preço do ativo subjacente em qualquer direção.

- A desvantagem é que o preço do ativo subjacente precisa mudar consideravelmente em uma das duas direções para recuperar o custo das duas opções.

7. Estrangulamento Longo

O long strangle é uma estratégia de negociação de opções que envolve a compra simultânea de uma call (opção de compra) e uma put (opção de venda) out-of-the-money do mesmo ativo subjacente. A data de vencimento seria a mesma. Essa estratégia é empregada quando se espera uma variação drástica no preço do ativo subjacente, mas não se tem certeza em qual direção.

Como funciona:

Comece comprando uma opção de compra OTM e uma opção de venda OTM sobre o mesmo ativo subjacente com a mesma data de vencimento. O preço de exercício das opções de compra e venda deve ser o mais distante possível do preço de mercado atual do ativo subjacente.

Quando usar:

O estrangulamento longo é mais adequado quando se espera uma grande variação de preço no ativo subjacente e não se tem certeza sobre a direção. Isso pode ocorrer em torno de grandes eventos noticiosos, como anúncios de lucros, decisões regulatórias ou eventos geopolíticos que provavelmente aumentarão a volatilidade do ativo subjacente.

Prós vs Contras

- A principal vantagem aqui é que você pode potencialmente lucrar com uma grande movimentação, seja para cima ou para baixo, no preço do ativo subjacente.

- A desvantagem é que o subjacente precisa se mover o suficiente em uma das duas direções para compensar o custo das duas opções envolvidas.

8. Borboletas espalhadas

Butterfly spreads são um grupo de estratégias de negociação de opções que envolvem a venda e a compra simultâneas de opções de compra ou venda, diferindo apenas nos preços de exercício, sobre o mesmo ativo subjacente e com a mesma data de vencimento. Essas estratégias são geralmente empregadas quando se deseja aproveitar a ação de preço mínima ou limitada a uma faixa de variação no ativo subjacente.

Como funciona:

Existem basicamente dois tipos de spreads borboleta: long call butterfly e long put butterfly. Em um long call butterfly, uma opção de compra com strike mais baixo é comprada, duas opções at-the-money são vendidas e uma opção com strike mais alto é comprada da mesma série de call. Por outro lado, em um long put butterfly, as posições seriam invertidas com as opções de venda.

Quando usar:

Os spreads borboleta são mais adequados quando se espera que o preço do ativo subjacente permaneça relativamente estável ou seja negociado dentro de uma faixa estreita. Eles podem ser usados para gerar renda ou capturar movimentos limitados de alta/baixa.

Prós vs Contras

- O grande ponto positivo é que você pode gerar renda e lucro se a ação subjacente continuar sendo negociada dentro de uma faixa específica, com risco definido.

- O problema é que seu potencial de alta e baixa também é limitado.

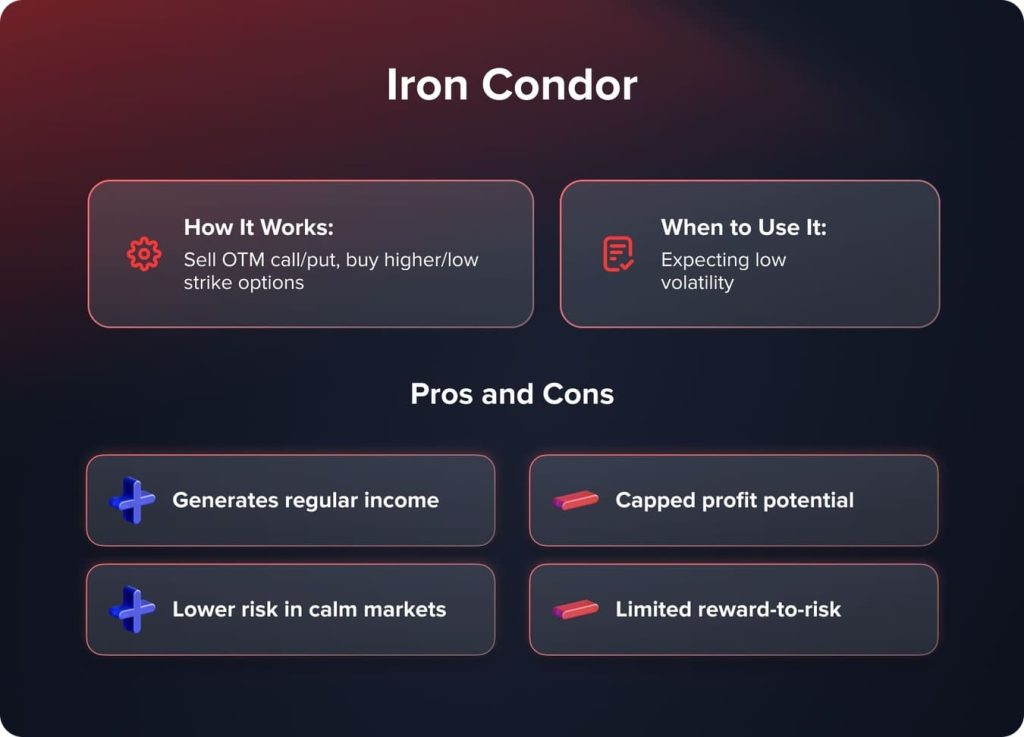

9. Condor de Ferro

O condor de ferro é uma estratégia de negociação de derivativos que consiste em tomar posições simultaneamente na compra e venda de calls e puts com strikes diferentes, mas com a mesma data de vencimento no mesmo instrumento subjacente.

Como funciona:

Isso é obtido vendendo uma opção de compra (call) OTM e uma opção de venda (put) OTM e, simultaneamente, comprando uma opção de compra (call) OTM com preço de exercício mais alto e uma opção de venda (put) OTM com preço de exercício mais baixo. Isso resulta em uma posição neutra em relação ao preço do ativo subjacente.

Quando usar:

É mais aplicável quando se prevê que o preço do ativo subjacente será negociado dentro de uma determinada faixa com baixa volatilidade. Isso pode ser utilizado para obter renda e também para explorar condições de mercado quando se espera que a volatilidade seja baixa.

Prós vs Contras

- O principal benefício é a capacidade de gerar renda regular a partir de condições de mercado de baixa volatilidade ou com limites definidos.

- A desvantagem é que o potencial de alta e baixa é limitado.

10. Borboleta de Ferro

Difere do condor de ferro apenas pelo fato de que as opções de compra e venda compradas de uma borboleta de ferro estão com o mesmo preço de exercício, o que serviria como o meio termo entre as duas opções vendidas. Isso levará a uma posição muito mais sensível a mudanças na volatilidade implícita.

Como funciona:

A borboleta de ferro é semelhante ao condor de ferro, mas com uma diferença fundamental. Uma borboleta de ferro consiste na compra e venda simultâneas de opções de compra e venda, mas as opções de compra e venda compradas têm o mesmo preço de exercício, que serve como um ponto médio entre as duas opções vendidas. Essa estrutura torna a borboleta de ferro mais sensível a mudanças na volatilidade implícita em comparação com o condor de ferro.

Quando usar:

É melhor utilizado quando o trader espera que o ativo subjacente seja negociado dentro de uma determinada faixa com baixa volatilidade. Pode ser usado para gerar renda e aproveitar condições de mercado de baixa volatilidade.

Prós vs Contras

- O principal benefício dessa estratégia é que é possível obter renda regular em condições de mercado de baixa volatilidade ou com limites definidos e risco definido.

- A desvantagem é que ele é mais sensível a mudanças na volatilidade implícita em comparação ao condor de ferro.

Conclusão

Portanto, a chave para a negociação de opções reside em compreender não apenas a mecânica de cada estratégia, mas também os perfis de risco-recompensa e os casos de uso. Só então você poderá posicionar suas opções de acordo com sua perspectiva de mercado, sua tolerância ao risco e seus objetivos de investimento. Ao praticar essas estratégias, tenha em mente a importância de avaliar cuidadosamente a ação do preço do ativo subjacente, os padrões de volatilidade e outros catalisadores que podem levar a movimentos bruscos de preço.

FAQ

A estratégia de opções de compra cobertas permite a geração consistente de renda por meio da venda de opções de compra contra ações próprias. Isso proporciona uma cobrança de prêmio, mantendo o investimento subjacente.

Puts de proteção, calls cobertas e collars são três das estratégias de opções mais básicas e comumente usadas pelos traders.

Desenvolver disciplina é essencial para o sucesso na negociação de opções. Isso inclui pesquisa completa, identificação de oportunidades, configuração adequada das operações, aderência a uma estratégia, definição de metas e um plano de saída.

Atualizado:

11 de junho de 2025