Introducing Broker (IB) vs Affiliate: What is The Difference?

Contents

The foreign exchange and iGaming industries rely heavily on intermediaries to attract new clients. Two common types are Introducing Brokers and Affiliates, who play an important role in business development and trader acquisition. Although both strive to promote brokers, significant differences exist in their functions, regulation, and monetization.

While both IBs and Affiliates play a sales and business development role, there are notable differences in their regulatory classification, relationship with brokers, required tasks, and revenue models. In this article, we will examine these distinctions in detail. We will also outline the typical workings of each promotional role within the foreign exchange and binary options sphere.

Definitions

An Introducing Broker (IB) — is typically a licensed individual or firm that forms a contractual relationship with a prime brokerage, also known as the Foreign Exchange Dealer (FXD). The IB is responsible for sourcing new client accounts and handling key responsibilities like onboarding and compliance checks. In exchange, they receive a pre-agreed percentage split of all trading commissions and fees from their introduced account base.

An Affiliate — on the other hand, is an independent third party such as a blogger, influencer, or media property that promotes a broker to earn performance-based compensation. Affiliates are not regulated or licensed and have no direct contractual oversight from the broker. They use various online marketing tactics to generate leads, with revenue tied to metrics like new qualified client signups or total trading volumes.

The Roles and Responsibilities of an IB

1. Licensing and Application

To become an IB, the first step is to obtain the required licenses from the local financial regulatory body. This involves an extensive application process, including thorough background checks and demonstrating the necessary qualifications. Some of the key qualifications assessed are experience in the financial industry, adequate financial resources, and a robust compliance mentality.

2. Contract Negotiation

Once licensed, IBs can apply to established brokerage firms seeking new representatives. They will undergo vetting to ensure cultural fit and shared commitment to compliance. If approved, a legal introduction agreement is drafted outlining key terms like:

- Territories of operation

- Client onboarding and referral procedures

- Supervisory duties and responsibilities

- Revenue sharing model and commission splits

3. Client Onboarding

IBs act as the primary liaison to properly introduce new clients onto the brokerage platform. They are very important, as seen in the name “introducing” in onboarding clients into the platform. This critical function involves:

- Collecting KYC information and verifying identities

- Assessing clients’ investment knowledge, risk tolerance, financial abilities

- Performing detailed needs- profiling to ensure proper account categorization

4. Account Management

IBs maintain regular contact with clients through various support channels. They must address concerns promptly and escalate complex issues to brokerages when needed. Ongoing responsibilities include:

- Performing suitability assessments for recommended trades or strategies

- Monitoring client accounts for any unusual or suspicious activity

- Ensuring clients receive relevant educational and research materials

5. Compliance & Supervision

IBs undergo comprehensive compliance training and are responsible for upholding all regulatory requirements. Some of these roles in ensuring compliance include:

- Pre-approving all marketing materials used

- Maintaining client databases and conducting regular audits

- Reporting any policy violations or suspicious activities detected

6. Revenue Generation

IBs earn ongoing revenue as a set percentage (typically 30-50%) of trading volume commissions and fees from their introduced client base. More successful IBs aim to negotiate upwards over time through exceptional performance and value-added services provided. What this means is that experience, capacity, and some other factors can have a strong effect in determining revenue.

7. Performance Management

Larger and top-performing IBs actively engage clients through webinars, research, and events. They also automate workflows to optimize efficiency through dedicated teams and customized services. Overall, an IB’s success stems from balancing revenue growth and regulatory responsibilities professionally and judiciously.

The Roles and Responsibilities of an Affiliate

1. Business Structure

Unlike IBs, affiliates face no regulatory licensing requirements, allowing total flexibility in business structure and operations. They can choose to operate independently on a part-time or full-time basis. This means that, unlike IBs, they are not explicitly required to possess qualifications in finance and subsequent financial resources.

2. Content Creation & Community Building

Prominent affiliates effectively leverage multiple platforms to develop sizable follower communities through consistently engaging content. This involves:

- Building authority sites through analysis of industry trends

- Producing lifestyle and educational content on social media

- Facilitating forums and communities for peer discussion

3. Lead Generation

Affiliates employ targeted marketing strategies to generate qualified leads, such as:

- Search engine optimization and pay-per-click campaigns

- Customizing landing pages and embeddable affiliate links

- Leveraging networking opportunities both online and offline

4. Lead Nurturing

Top affiliates foster quick progression of prospects through nurturing messages and providing educational resources. This demonstrates in-depth product knowledge to discuss benefits effectively.

5. Promotional Strategies

Promotional strategies are continuously optimized through testing different content formats, platforms and timelines. Metrics expose the highest converting tactics to concentrate efforts.

6. Performance-Based Compensation

Affiliate revenue primarily depends on the performance-based payout models from merchant partnerships such as cost-per-acquisition or revenue sharing on trading volumes.

7. Product Diversification

Savvy affiliates diversify across multiple merchant offerings while developing specialized niche expertise. Partnerships explore synergistic cross-promotion.

8. Technology Leveraging

Affiliates adopt emerging technologies to augment engagement, automate processes, and scale operations through dedicated teams.

9. Network Expansion

Top-tier affiliates may establish affiliate networks by mentoring and facilitating profit-sharing arrangements with enlisted sub-affiliates.

10. Entrepreneurship

The most successful affiliates leverage skills to develop proprietary ventures beyond single merchant promotion such as customized educational products.

11. Continuous Learning

Ongoing self-education, demonstration of integrity, and independently verifying claims maintained are imperative to thriving long-term in this performance-driven industry.

In summary, dynamic strategy differentiation and balanced execution epitomize sustainable affiliate leadership positions over time.

5 Steps to Becoming an Introducing Broker

To become an introducing broker, you should find the steps outlined below helpful.

1. Know the Required Certification You Need

Whether or not a certification is required to become an introducing broker depends on your target location. For example, regions like South Africa, the United States, and Australia require certifications, while the European Union does not. However, this doesn’t guarantee an automatic partnership in the European Union, as other factors would be considered. Info regarding this can be obtained from the appropriate financial regulatory authority.

2. Research and Partner With the Right Broker

Now that you have your certification sorted out, research and ensure you partner with the right brokerage. In-depth research is needed since there are quite several brokers available. Prior to your research, you can prepare a list of questions to work with. Ask questions like;

- Is the broker regulated?

- What is the quality of their services?

- Do they provide marketing resources?

- Do they provide unique tools for both IBs and clients?

- What about demo trading?

- What are clients/users saying about them (reviews)?

- Do they have trading apps?

You can add other questions you deem fit to the list. This would help you filter out many others, leaving you with those that align with your goals.

3. Establish a Deal With Your Selected Broker(s)

At this stage, it is necessary for you to get acquainted with the offering, such as the commission rates of the selected broker. But first, you should have a strategy for how you intend to attract new clients. This should help you define the category of clients you want to attract and determine whether the selected broker offerings are good for you. The commission model can either be RevShare, CPA, or hybrid. Depending on your broker’s flexibility with their offering, you may consider a customized solution.

4. Sign Up New Clients Through Your Referral Link

Having signed an agreement with the company, it is time to get to work and implement your client acquisition strategy. Create a website and publish relevant content that could attract your prospects and/or reach out to them via the appropriate channels. Take your time to study and get to know your prospects. While getting to know them, you could figure out their pain points and chip in your brokerage solutions. Figure out the kind of traders they are — scalpers, swing, or position traders, and make content around their trading styles.

5. Establish an Online Presence

Your goal is to portray yourself as the go-to person in matters related to online forex trading. Therefore, you should put your name all over the internet, including social media platforms, online trading forums, etc. Of course, achieving this requires publishing quality content on these channels and making significant contributions to the trading landscape. Making your name known can earn you significant returns in commission.

Compliance Considerations for IBs and Affiliates

A. Regulatory Obligations for IBs

- Licensing requirements: IBs must obtain the necessary registrations from financial authorities, which involves rigorous background checks.

- Assumed liability: As licensed representatives, IBs take legal and financial responsibility for all client activities and relationships under their authority.

- Internal policies: Robust internal compliance manuals must be maintained to address issues like conflicts of interest, advertising, complaints management, privacy practices, and anti-money laundering procedures.

- Regulatory audits: Systems and controls are subject to periodic audits by regulators to ensure adequate implementation and prevention of misconduct.

- Supervision obligations: Suitability reviews of trading recommendations, marketing material approvals, oversight of client documentation practices, and management of junior broker networks.

- Record keeping: Centralized databases holding sensitive client information are regulated and require certified data security.

- Compliance training: Staff must undergo comprehensive training programs to ensure regulations and internal policies are understood and followed.

B. Compliance Safeguards for Affiliates

1. Management

- Vetting partnerships: Independently verifying qualifications, licenses, and regulatory compliance records of promoted brokerages. While affiliates have no direct oversight, building credibility relies on demonstrating integrity.

- Avoiding problematic entities: Refraining from endorsing brokers with concerning histories of issues like punishment or client complaints.

2. Disclosure Standards

- Compensation transparency: Clearly indicating any payment received from referenced partners in all public communications to establish trust.

- Separating business lines: Maintaining appropriate divisions between affiliated and independent business ventures or recommendations.

3. Privacy and Data Protection

- Information security: Promoting robust technological and physical security of any client details collected in line with consent and established rights.

- Privacy policies: Outlining intended use, storage duration, and protection measures applied to personal data for transparency.

4. Quality Assurance

- Legal consultation: Monitoring for regulatory changes through ongoing counsel to ensure preparedness.

- Training programs: Administering staff learning initiatives to integrate advancements into daily operations.

- Documentation: Maintaining comprehensive records of compliance framework, decisions, and issues for future defense and improvement identification.

Adherence to carefully structured compliance programs helps navigate complex regulations while building long-term reputations of trustworthiness for both IBs and affiliates. Monitoring industry evolution facilitates continuous enhancement.

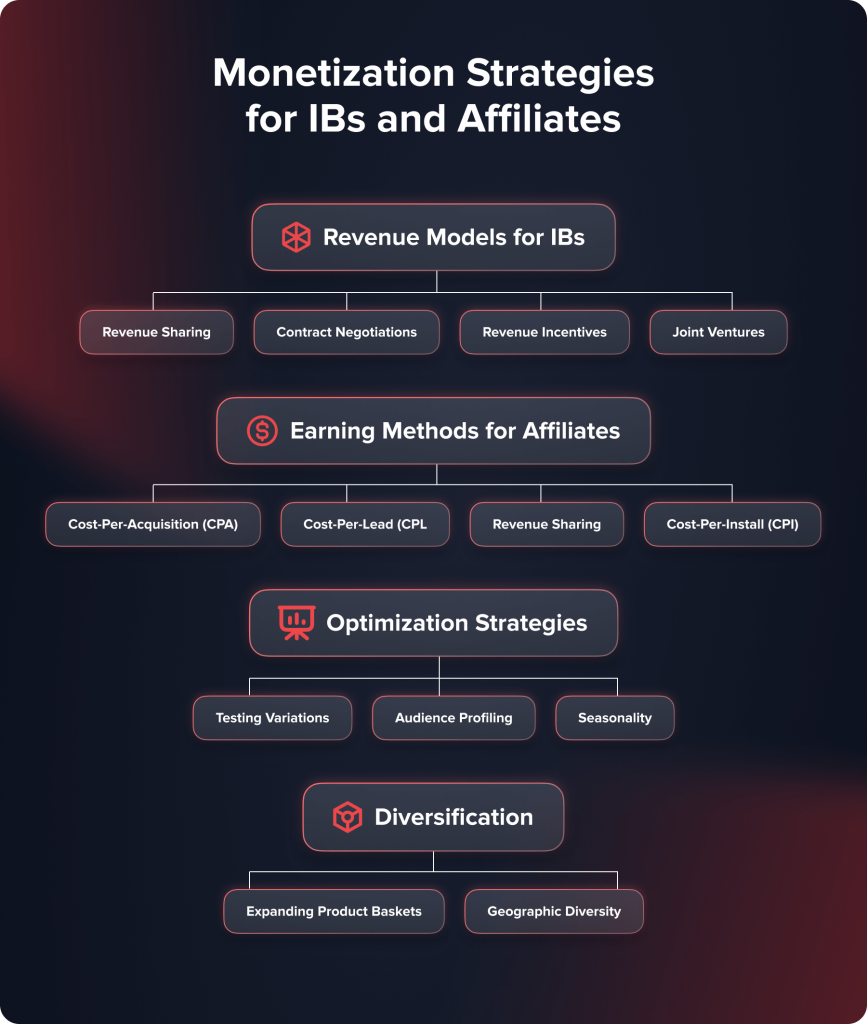

Monetization Strategies for IBs and Affiliates

1. Revenue Models for IBs

- Revenue sharing: IBs primarily earn ongoing commissions as a percentage of trading volume and fees generated by their introduced client base, typically ranging from 30-50%.

- Contract negotiations: Larger IBs have greater bargaining power to adjust percentages upwards based on performance thresholds or assume risk-sharing models.

- Revenue incentives: Some brokers offer adjustable payout algorithms where commission splits can incrementally increase upon clearing predetermined targets.

- Joint ventures: Multiple IBs occasionally pool resources to team up on technology, sales outreach, research, etc., to amplify negotiating leverage.

2. Earning Methods for Affiliates

- Cost-per-acquisition (CPA): One-time payouts of $20-150 or more per referred user that completes broker account registration.

- Cost-per-lead (CPL): Compensation of $2-10 for capturing basic contact information passed to merchants.

- Revenue sharing: Earning a 2-5% percent cut of actual trading losses/profits or deposits from clients remaining active after 180 days.

- Cost-per-install (CPI): Flat $1-5 fees paid per app installation or widget integration on websites driving installs.

3. Optimization Strategies

- Testing variations: Experiments with promotional formats, platforms, hashtags, etc. to identify the highest converting campaigns.

- Audience profiling: Tailoring content, offers, and messaging to payer preferences yields better response rates.

- Seasonality: Leveraging current events, financial reports, and holiday periods when audiences are most receptive.

4. Diversification

- Expanding product baskets: Reduces over-reliance by cross-promoting across asset classes like FX, indices and cryptocurrency brokers.

- Geographic diversity: Localizing engaging strategies considering cultural nuances and legal differences aids global scaling.

Automating workflows through affiliate networks facilitates multi-vendor portfolio management and performance tracking. Comprehensive analytics pinpoint top monetizing tactics.

Dynamic optimization and diversification underpin lucrative monetization for both IBs and affiliates in competitive performance-based environments.

Typical profiles for IBs and Affiliates

1. Suitable Traits for IBs

- Sales/Relationship Building: Representative roles demand passionate client interfacing through networking, public speaking, and relationship-nurturing skills.

- Regulatory Acumen: Maintaining compliance requires diligent individuals experienced in relevant legislation and procedures.

- Market Knowledge: Regional experts leveraging a nuanced understanding of local customer segments perform exceptionally.

- Flexibility: Mobile technologies enable a hybrid remote/travel-based workstyle, effectively balancing responsibilities and personal obligations.

2. Career Paths

- Independent Contractors: Self-employed IBs independently grow new referral streams and manage portfolios autonomously.

- Employed Representatives: Larger brokerages hire full internal teams handling defined territories or specialist roles.

- Management Trajectories: Top producers may eventually oversee additional junior brokers or open independent branch locations.

3. Dedication Requirements

- Full-time Commitment: Representing an entire brokerage calls for intensive commitment to daily responsibilities and business development.

- Hybrid Arrangements: Some permit reduced schedules supplemented through virtual oversight of referrals, training, and research for teams.

4. Suitable Traits for Affiliates

- Entrepreneurial Spirit: Thriving relies on perseverance, creativity, and independence in a performance-based environment.

- Self-motivation: Sustained progress stems from self-discipline and drive rather than oversight.

- Technical Aptitude: Content creation, programming and digital marketing skills optimize engagement and results.

5. Career Flexibility

- Location Independence: Operate internationally, leveraging digital platforms from any location.

- Variable Commitments: Balance affiliation with other ventures according to availability and goals.

- Outsourcing Options: Scale beyond solopreneurship by establishing virtual assistant or content teams.

6. Dedication Requirements

- Flexible Scheduling: Affiliates can choose their level of involvement from part-time side projects to full-time active operations.

- Self-management: Success relies on independent self-motivation without structured supervision.

- Continual Optimization: Thriving affiliates remain up-to-date with industry changes through online and in-person training.

Suitability depends on matching strengths, aspirations, and priorities to the responsibilities of each pathway for long-term career satisfaction and success within business development domains.

Conclusion

While both play important promotional roles, Introducing Brokers and Affiliates differ substantially in their regulatory classifications, contractual relationship structures, operational responsibilities and revenue-earning models.

IB careers provide more stability for those wanting a mix of entrepreneurial spirit with regulated financial support. However, the workflow demands regional commitment and ongoing license/compliance hurdles.

Affiliate work suits independent go-getters wanting complete flexibility yet performance-based incentives. It allows for maximizing existing online skills and expertise. Entrepreneurship and adaptability to changing dynamics prove more important than a formal finance background.

Both roles remain crucial for expanding client bases, especially as digital transformation ushers in new frontiers. Technologies augment the human touch, but advanced credentials and niche knowledge retain relevance.

Whether to operate as a licensed broker or independently as an affiliate intermediary depends on individual strengths, risk appetite, and lifestyle goals. With diligent practices on either path, ongoing innovation charts successful careers in business development.

Updated:

December 18, 2024

9 February, 2026

What Is a Trading Halt? Why Stocks Stop Trading and What It Means for You

A trading halt is when an exchange temporarily stops trading in a stock or, in rare cases, the entire market. It’s not a glitch and it’s not random. It’s a deliberate pause triggered when prices move too fast, critical information is about to be released, or regulators need time to step in. From the outside, […]