What is Slippage in Trading?

목차

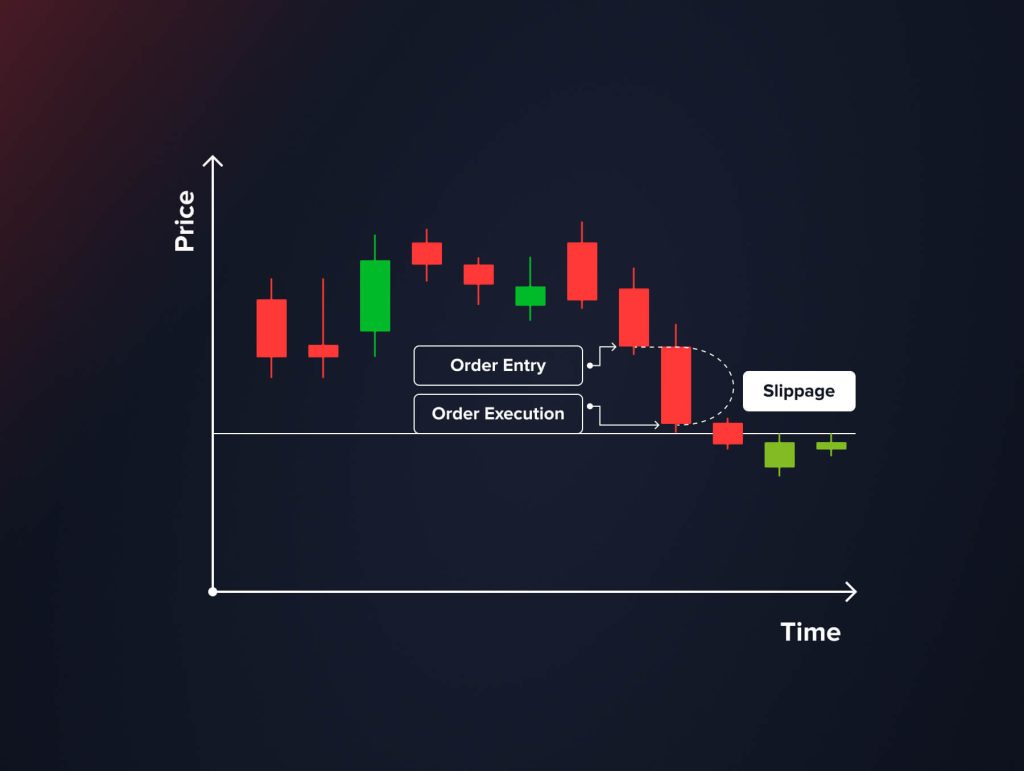

If you’ve ever spent time clicking "buy" or "sell" in a trading app, you’ve likely had that split-second moment of confusion where you see a price you like, hit the button, and then – poof – the trade confirms at a slightly different number.

In the industry, we call that slippage.

It isn't a scam, and it isn’t necessarily a sign of a bad broker. It’s simply a byproduct of how modern markets move. Think of it like trying to buy a specific seat at a concert while thousands of other people are hitting "refresh" at the same time. By the time you click, that specific spot might be gone, and you’re bumped to the next available one.

Whether you are trading stocks, Bitcoin, or gold, slippage is a constant companion. To keep it from eating your profits, you have to get comfortable using tools like limit orders and learning which hours of the day are the "safest" to trade.

Deep Dive into Slippage

To really handle slippage like a pro, you have to understand why it shows up in the first place. While it’s a constant reality in the financial world, it looks a little different depending on what you’re trading and how you’re placing your orders.

At its core, slippage is just the gap between your expected price and the actual execution price. This variance happens because of the tiny lag between when you send an order and when the market actually processes it. In fast-moving markets, prices can twitch and jump in that fraction of a second, meaning your final fill price might not match what you saw on your screen.

The Two Sides of the Coin

Most people talk about slippage as a negative thing, but it actually works both ways:

- Positive Slippage: This is the pleasant surprise. It happens when your trade is executed at a better price than you expected. This means you end up spending less than you planned on a buy order or pocketing a bit more than you thought on a sell. It’s a nice little win for your portfolio.

- Negative Slippage: This is the one we try to avoid. It’s when the market moves against you in the blink of an eye, and you get filled at a worse price. You end up paying more to buy an asset or receiving less when you sell, which directly cuts into your potential gains.

Real-World Practice: Expert Insight

The "Shadow" of the Spread "Many retail traders focus only on the 'last price' shown on the chart, but slippage is actually born in the 'spread' – the gap between the bid and the ask. In quiet markets, that gap is thin. But the moment news breaks, market makers pull their orders back to protect themselves, causing the spread to widen instantly. If you place a market order when the spread is wide, you're essentially volunteering for massive slippage."

Slippage in Volatile Markets

If volatility is the engine of the market, slippage is the friction it creates. The two are basically inseparable. When the market starts moving fast, the gaps between prices get wider and much more obvious.

This usually happens when the market is reacting to something big – maybe a surprise economic report, a major global event, or just a sudden shift in trader sentiment. These "emotional swings" cause prices to whip back and forth so rapidly that slippage doesn't just become more likely; it becomes more severe.

In these high-pressure moments, the price you actually get can be a world away from what you were looking at on your screen. This makes it incredibly tricky to get into a trade or, more importantly, to get out of one when you really need to.

The constant ebb and flow of prices is another reason slippage happens. Markets are living, breathing environments where a dozen different variables are constantly tugging at an asset's price. Because of this fluidity, slippage is always a possibility – even when things seem relatively calm. By the time you’ve looked at a price and hit the button, the market may have already moved on to the next number.

At the end of the day, slippage is just a normal part of the trading game. It brings its share of risks, but occasionally, it can work in your favor, too. Either way, you really need to understand the mechanics behind it, because it directly impacts your bottom line and how well your overall strategy performs.

Now, let’s dig into the specific things that trigger slippage and look at how you can navigate it across different market scenarios.

You may also like

Causes of Slippage

Understanding what triggers slippage is the first step toward beating it. While every trade is a bit different, these four factors are usually the reason your fill price looks a little "off."

Market Volatility

Volatility is essentially a measure of how wild the price swings are. In a high-volatility market, prices don't just move; they jump. This rapid-fire fluctuation is the leading cause of major slippage. For example, if you’re trading a stock or a currency pair during a chaotic session, the price can shift significantly between the millisecond you click "Buy" and the moment the exchange actually processes the trade.

High-Impact News Events

Markets crave information, and when big news drops – like new economic data, a political shift, or an earnings report – they react fast and loud. These are the "danger zones" for slippage. If an economic report comes out much stronger than expected, a currency's value might surge instantly. If you have an order sitting in the system during that surge, it’s likely going to get swept up at a price far from where it started.

Low Liquidity

Think of liquidity as how crowded the marketplace is. If a market is "liquid," there are plenty of people ready to buy and sell at any given moment. In "thin" or illiquid markets, there aren't enough participants to go around. If you place an order but there isn't enough interest at your specific price, the system has to go hunting for the next available person to trade with – often at a much worse price.

Large Orders

Size matters. If you’re trying to move a massive amount of capital, you might literally "eat" through all the available orders at the current price. Once those are gone, the rest of your order has to be filled at the next level, and the level after that. This is especially common in smaller markets where a single large trade can be enough to physically push the price up or down.

Slippage in Different Markets

While slippage is just a fact of life for traders, it doesn't look the same in every corner of the financial world. Every market has its own "personality" and set of rules, which means the way prices jump can vary wildly depending on what you’re trading.

Slippage is often lower in the FX market, which is known for its great liquidity and low volatility. However, The Stock Market

In the world of stocks, slippage is a frequent guest during high-stakes news cycles or when volatility spikes. It usually hits "small-cap" stocks the hardest – these are smaller companies with fewer shares changing hands. Because there isn't a constant stream of buyers and sellers, the gap between your expected price and the actual fill price can get pretty wide. This is especially true during the "market open" and "market close," which are notoriously the most chaotic times of the trading day.

Forex (FX) Market

The foreign exchange market is generally the "smoothest" place to trade because it is incredibly liquid. With trillions of dollars moving every day, you can usually get in and out at the exact price you want. However, even this giant isn't immune. When a major economic report drops or a central bank makes a surprise announcement, prices can "gap" or spike so fast that even the best systems see significant slippage. Forex traders have to stay on their toes during these windows to avoid getting caught in a sudden price vacuum.

Cryptocurrency Market

If Forex is the smoothest market, Crypto is often the "wildest." It’s a space known for being erratic and, at times, lacking deep liquidity. This is especially true for newer "altcoins" or during major industry-shifting events. Because the crypto market moves at breakneck speed 24/7, your entry and exit points need to be calculated carefully. If you aren't paying attention, slippage here can turn a winning trade into a losing one in seconds.

Wrapping It Up

Ultimately, successful trading is about preparation. You need to understand the variables – like market volume, the size of your order, and the timing of news events – so you can plan ahead. By knowing how slippage behaves in your specific market, you can protect your capital and avoid the frustration of seeing your trading costs spiral out of control.

The Math of Slippage: A Practical Example

To visualize how slippage eats into profits, let's look at a Market Order scenario for a high-volatility stock.

The Scenario:

- Expected Price: $150.00

- Order Size: 500 shares

- Actual Execution Price: $150.15

The Calculation:

Slippage = (Actual \ Price - Expected \ Price) \ Quantity

(150.15 - 150.00) \ 500 = $75.00

The Result: Even though the price difference was only 15 cents, the trader lost $75.00 in potential profit or buying power before the trade even began.

Impact of Slippage on Traders

Slippage isn’t just a technical glitch; it has a real-world impact on your bankroll and your headspace. Depending on how the market is moving when your order hits the exchange, it can either be a frustrating hidden tax or a lucky bonus.

Negative Impacts of Slippage

The most obvious headache is the "unexpected loss." This happens when the market moves against you faster than the system can process your order. For example, if you’re trying to buy a stock that is climbing rapidly, you might end up paying significantly more than you planned. If you’re a day trader or someone working in volatile markets where every cent counts, these small gaps can add up to a lot of lost capital over time.

Slippage can also completely derail a well-thought-out plan. You might spend hours researching the perfect entry and exit points, only to have slippage force you into a position at a less-than-ideal price. This is a nightmare for "scalpers" – traders who try to make tiny profits on dozens of quick trades. When your strategy relies on catching a $0.05 move, a $0.02 slip on the entry can effectively wipe out nearly half of your potential profit before you even start.

Positive Impacts of Slippage

It’s not all bad news, though. Every once in a while, the market gods smile on you, and you experience positive slippage. This happens when your trade executes at a better price than you expected.

Imagine you put in an order to sell a currency pair, and in the split second before it fills, the price ticks upward. You end up selling for more than you asked for. While this feels like a lucky break, it’s usually the result of trading in a high-activity market with fast execution speeds.

Real-World Practice: Expert Insight

"Traders often focus on the financial cost of slippage, but the psychological cost is just as high. When you get a bad fill, it’s easy to feel 'cheated' by the market, which leads to revenge trading or abandoning a solid strategy. I tell my students to factor in a 'slippage buffer' in their math. If your strategy only works with zero slippage, it isn’t a strategy – it’s a fantasy."

Strategies to Minimise Slippage

If you want to stay in the trading game long-term, you have to learn how to keep slippage under control. You can’t stop the market from moving, but you can definitely change how you interact with it. Here are the best ways to protect your account.

Not all orders are created equal. Choosing the right "tool" for the job is your first line of defense.

- Market Order: * Risk: Extreme. You are telling the broker "get me in at any price." In a fast-moving market, this is a recipe for heavy negative slippage.

- Limit Order: * Risk: Zero. You set a maximum price. If the market moves past it, the trade simply isn't filled.

- Stop-Loss Order: * Risk: High. Once your stop price is hit, the order becomes a Market Order. If a stock "gaps down" overnight, your stop-loss might execute much lower than you intended.

Trading in Highly Liquid Markets

One of the easiest ways to dodge slippage is to trade where the crowds are. In "high-liquidity" markets, there are so many buyers and sellers that your order usually gets filled instantly at the price you see.

In Forex: Stick to major pairs like EUR/USD or USD/JPY. These see massive daily volume, which keeps slippage to a minimum.

In Stocks: Look at "blue-chip" companies – the big, household names. They are much safer than "small-cap" stocks, where a single trade can send the price jumping.

You may also like

Using Limit Orders

A Limit Order is essentially you putting your foot down. Instead of saying "buy this now at any price," you tell the broker the exact maximum you’re willing to pay (or the minimum you’ll accept to sell).

This guarantees that you won’t get a nasty surprise when the trade confirms. The only catch is that if the market moves too fast and never hits your price, the trade won't happen. Most pros agree, however, that missing a trade is better than getting a terrible fill that puts you in the red immediately.

Avoiding Trading During Major News Releases

The market gets incredibly "jumpy" during big news events – think central bank announcements, jobs reports, or major political shifts. Prices can leap over your orders entirely during these times. By checking a financial calendar and avoiding trades right when these reports drop, you stay away from the most dangerous windows for slippage. It’s all about timing; sometimes the best trade is the one you don't take during a chaotic spike.

Pro-Tip: The "Slippage Tolerance" Setting

If you are trading on Decentralized Exchanges (DEXs) like Uniswap or via modern brokerage apps, look for the Slippage Tolerance setting. This allows you to set a percentage (e.g., 0.5%). If the execution price moves more than 0.5% away from what you see on the screen, the system will automatically cancel the transaction to protect you.

Real-World Use Cases: When to Expect Slippage

| Scenario | Why it Happens | Severity |

| The "Flash Crash" | A sudden disappearance of buyers causes prices to plummet in seconds. | Severe: Prices can slip 5–10% in milliseconds. |

| Earnings Gaps | A company reports profits after the market closes. The price "jumps" over your pending orders. | Moderate to High: Often seen in individual stocks. |

| The Friday Close | Liquidity thins out as traders close positions before the weekend. | Low to Moderate: Common in the Forex market. |

| Low-Cap Crypto | A trader tries to sell $10,000 of a coin that only has $2,000 of "buy" interest at the current price. | High: The order "eats" through the order book to lower prices. |

Slippage vs. Spread: A Quick Comparison

Many novice traders confuse slippage with the bid-ask spread. While both represent a cost of trading, they are fundamentally different.

| Feature | Bid-Ask Spread | Slippage |

| Definition | The difference between the highest buy price and lowest sell price. | The difference between your requested price and actual execution price. |

| Predictability | Usually fixed or stable in calm markets. | Unpredictable; occurs during the "latency" of the trade. |

| Control | You can see it before you click "buy." | You only see it after the trade is executed. |

| Direction | Always a cost (negative). | Can be negative or positive. |

Slippage Management Checklist

Before you place your next trade, run through this quick audit to minimize your risk:

- Market Hours: Is the primary exchange for this asset currently open? (Avoid "After-hours" or "Pre-market").

- Liquidity Check: Am I trading a "Blue Chip" asset or a low-volume "Penny Stock/Altcoin"?

- News Calendar: Are there any major economic reports (NFP, CPI, Earnings) due in the next 30 minutes?

- Order Type: Have I used a Limit Order instead of a Market Order where possible?

- Tolerance Setting: If on a DEX, is my slippage tolerance set to a reasonable level (usually 0.1% to 1%)?

Conclusion

To be a successful trader, you have to respect the fact that prices are always in motion. Whether you’re into stocks, crypto, or forex, managing slippage is just as important as picking the right direction.

By focusing on liquid markets, using limit orders, and being smart about your timing, you can cut down on those frustrating hidden costs. You’ll never eliminate slippage entirely, but once you understand how to navigate it, your trading will become much more predictable and, ultimately, more profitable.

FAQ

In most cases, no. Slippage is a natural market phenomenon caused by low liquidity or high volatility. However, if you consistently experience significant negative slippage with a specific broker—even in calm, liquid markets—it could be a sign of poor execution technology or "unethical" price markups. Always use a regulated, reputable broker to ensure fair execution.

Yes, many modern trading platforms and decentralized exchanges (DEXs) have a Slippage Tolerance setting. For example, if you set your tolerance to 0.5%, the platform will automatically cancel the trade if the price moves more than 0.5% away from your requested price before execution.

Generally, no. A limit order is an instruction to buy only at your price or better. If the market "gaps" past your limit price, the order simply won't fill. This protects you from slippage but introduces the risk of missing the trade entirely if the market moves away from you too quickly.

Crypto markets often have "thinner" order books compared to major stock or forex markets. Because there are fewer buyers and sellers at every price level, a single large order can "eat through" the available supply, forcing the rest of the order to fill at much higher or lower prices. This is especially common on decentralized exchanges (DEXs) like Uniswap.

Yes, and this is where it is most dangerous. A standard Stop-Loss becomes a Market Order the moment your trigger price is hit. If a stock "gaps down" overnight (e.g., it closes at $50 but opens at $40), your stop-loss set at $48 will execute at $40, resulting in a much larger loss than planned. Solution: Use a "Guaranteed Stop-Loss" if your broker offers it (usually for a small fee) to ensure execution at your exact price.

Yes! While traders usually complain about negative slippage, positive slippage happens when the market moves in your favor during the split second it takes to process your order. Example: You click "Buy" at $10.00, but a sudden influx of sellers at that exact microsecond pushes the price to $9.98. If your broker passes that improvement to you, you’ve just experienced positive slippage.

업데이트:

2026년 2월 18일