Voltar

Contents

Pares de Moedas Exóticas – Tudo o que Você Precisa Saber

Vitaly Makarenko

Chief Commercial Officer

Demetris Makrides

Senior Business Development Manager

O mercado Forex é representado por centenas de pares de moedas que são divididos em principais, secundárias e exóticas.

Pares exóticos combinam a moeda de um país com economia desenvolvida e a moeda de um país com economia em desenvolvimento. Esses pares são caracterizados por maior volatilidade e menor liquidez. Assim, os traders enfrentam mais oportunidades, mas riscos maiores.

Principais conclusões:

- O que são pares de negociação exóticos?

- Quais são as diferenças entre pares exóticos, maiores e menores?

- Como negociar pares de moedas exóticos?

- Prós e contras de negociar pares exóticos?

- Quais pares de moedas exóticas são mais comuns entre os traders?

- Quais estratégias são mais lucrativas para pares de moedas exóticas?

Explicação dos pares de negociação principais e secundários no mercado Forex

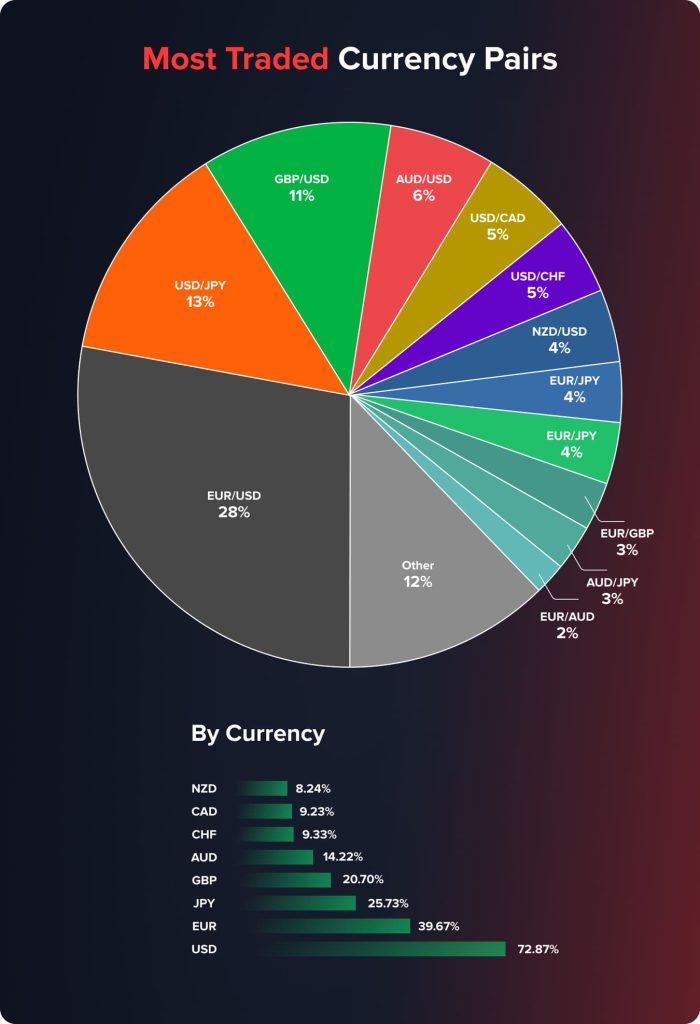

O USD (Dólar Americano) é a moeda mais utilizada no mundo; por isso, os pares de moedas que incluem o USD são os mais negociados. As moedas que são negociadas em USD em maiores volumes são chamadas de principais.

Tradicionalmente, esta categoria contém 7 pares de negociação principais conhecidos pelos maiores volumes de negociação:

- EUR/USD (28% do volume total de negociação do mercado Forex);

- USD/JPY (13%);

- GBP/USD (11%);

- AUD/USD (6%);

- USD/CAD (5%);

- USD/CHF (5%);

- NZD/USD (4%).

Dessa forma, os principais pares de negociação cobrem 72% dos volumes de negociação de moedas do mundo.

Pares de negociação menores consistem em moedas incluídas em pares principais, exceto o USD. Também são chamados de pares de moedas cruzadas. Exemplos de pares de negociação menores são EUR/JPY (4% do volume total de negociação do mercado Forex), GBP/JPY (4%), EUR/GBP (3%), AUD/JPY (3%), EUR/AUD (2%), etc.

Todos os outros pares que não estão relacionados nem aos pares principais nem aos pares menores se enquadram na categoria de pares de negociação exóticos.

O que são pares de negociação exóticos?

Pares de negociação exóticos consistem em duas moedas:

- A primeira moeda representa a categoria de pares principais ou secundários (USD, EUR, CHF, GBP, etc.).

- A segunda moeda está fora dos pares principais e secundários (TRY, RUB, INR, MXN e assim por diante).

Aqui estão alguns exemplos de pares de negociação exóticos: USD/TRY, EUR/INR, GBP/SGD, USD/MXN, etc.

Pares exóticos conversíveis vs. não conversíveis

Pares exóticos de negociação são divididos em conversíveis e não conversíveis. Não conversibilidade significa que uma determinada moeda dificilmente ou quase impossível é convertida em outras moedas. Quanto mais lento o crescimento econômico de um país, menor a conversibilidade de sua moeda nacional.

A categoria de pares exóticos não conversíveis inclui KPW (Won norte-coreano), CUP (Peso cubano), CLP (Peso chileno) e outros exemplos.

A grande maioria dos pares de moedas exóticas são conversíveis: TRY (Lira Turca), SGD (Dólar de Singapura), MXN (Peso Mexicano) e muitos outros.

O papel dos pares de moedas exóticas no mercado Forex

Pares de moedas exóticas desempenham um papel excepcionalmente importante no mercado Forex, pois os traders têm muito mais oportunidades. Enquanto os pares maiores e menores ocupam o centro do palco, os pares exóticos participam de situações de negociação únicas e oferecem aos traders retornos potencialmente maiores. Além disso, os traders podem diversificar seus portfólios com a ajuda de pares exóticos.

Ao mesmo tempo, pares de moedas exóticas são entendidos como um indicador do que está acontecendo no mercado Forex. Esses pares são mais sensíveis a fatores macroeconômicos em países com economias em desenvolvimento. As variações nos pares de moedas exóticas permitem compreender a situação geral e prever movimentos futuros dos pares principais e secundários.

Os traders profissionais sempre levam em consideração os pares exóticos, pois obtêm uma visão abrangente do mercado Forex.

You may also like

Prós e contras de negociar pares de moedas exóticas

Quais são as principais vantagens e desvantagens de negociar pares exóticos?

Aqui estão os principais prós:

- Pares exóticos possibilitam retornos mais elevados. Esses pares são caracterizados por alta volatilidade, razão pela qual surgem condições de negociação promissoras.

- Esses pares são adequados para todos os estilos de negociação. Scalpers e traders intradiários utilizam esses pares para se beneficiar de altas de preços em curtos períodos. Operadores de swing e posição adicionar pares exóticos aos seus portfólios para diversificação.

- Pares exóticos desbloqueiam o acesso a economias impactadas por rápido crescimento. Com a análise correta, é muito mais fácil entender a direção do movimento do preço de uma moeda.

Os riscos relacionados à negociação de pares exóticos são os seguintes:

- Pares de moedas exóticas geralmente são caracterizados por baixa liquidez e spreads amplos, o que pode dificultar muito a execução de uma ordem.

- Esses pares são altamente impactados por fatores geopolíticos e econômicos que frequentemente ocorrem de forma imprevisível. Instabilidade política ou crises econômicas nos países representados por uma das duas moedas levam a movimentos de preços repentinos e bruscos que os traders não esperam.

- A possibilidade de mudanças regulatórias é mais um risco relacionado à negociação de pares exóticos. Alguns países podem impor restrições e regulamentações atualizadas que afetam o mercado doméstico. Portanto, os traders precisam estar cientes das mudanças regulatórias nos países cujas moedas adicionaram aos seus portfólios.

Principais fatores que afetam pares de moedas exóticas

Os três principais fatores que afetam os pares de moedas exóticas são os indicadores econômicos, a situação política e as notícias importantes do país.

Indicadores econômicos

Ao negociar pares de moedas exóticas, você precisa levar em consideração os principais indicadores econômicos. Variações no PIB, na taxa de inflação, na taxa de emprego e outros indicadores importantes podem afetar significativamente o valor das moedas e ajudar os traders a lucrar com as oscilações de preços.

Por exemplo, um país com alto crescimento do PIB e baixa inflação pode atrair investidores estrangeiros. Os traders entendem que a infusão de investimentos fortalece o valor da moeda; é por isso que abrem posições compradas em tal situação.

Situação política

A estabilidade ou instabilidade política impacta significativamente os pares de moedas exóticas. Eventos políticos importantes, como eleições, crises governamentais, mudanças políticas, revoltas e outros, levam ao aumento da volatilidade e da incerteza quanto ao valor da moeda subjacente.

Além disso, a situação política também influencia as perspectivas econômicas de longo prazo de um país e define sua classificação entre os investidores. Com base nessas informações, os traders podem abrir posições de longo prazo que incluem pares de moedas exóticas.

Notícias importantes

Assim como qualquer outra moeda, os pares exóticos reagem a eventos sociais, climáticos e culturais no país. Por outro lado, as moedas exóticas são mais influenciadas por tais eventos.

Por exemplo, as enchentes no Brasil desvalorizaram significativamente o real brasileiro (BRL). A moeda perdeu 14% em dois dias.

Como negociar pares de moedas exóticas?

A popularidade de pares de moedas exóticas entre os traders de Forex está ganhando força. Enquanto isso, iniciantes podem facilmente perder dinheiro. Como negociar pares exóticos?

Análise Técnica vs. Análise Fundamental

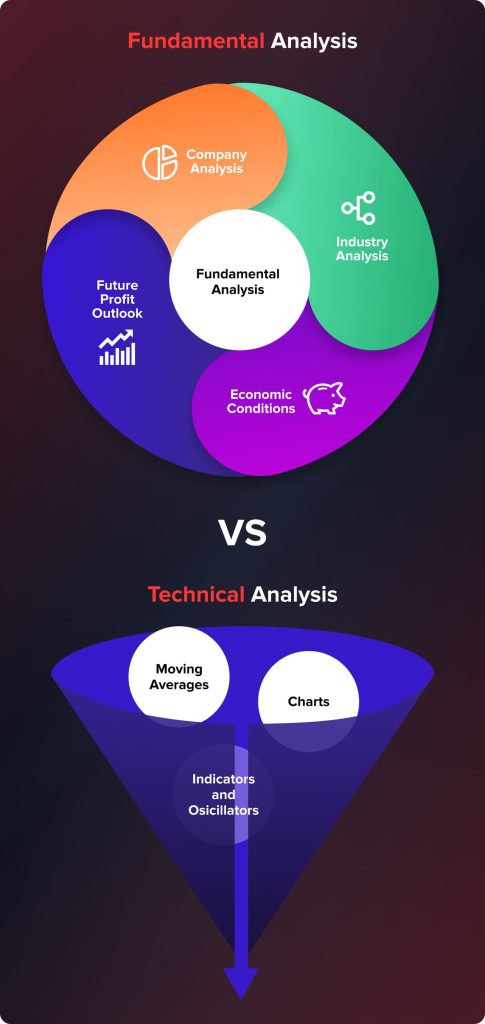

Traders profissionais focam na análise técnica ou fundamentalista ao prever movimentos futuros de preços. Qual abordagem é a melhor para pares de moedas exóticas?

A análise técnica se baseia em dados históricos. Com a ajuda dela, os traders determinam a tendência atual, sua força, possíveis reversões, etc. Por um lado, a análise técnica fornece aos traders informações importantes; por outro, pares de moedas exóticas dependem muito de eventos políticos, econômicos, climáticos e outros que ocorrem em um determinado país. Assim, a ênfase principal é colocada na análise fundamentalista.

You may also like

A abordagem da análise fundamentalista envolve a avaliação de fatores econômicos e geopolíticos para prever os movimentos futuros de uma moeda. Ao estudar indicadores econômicos e monitorar as notícias atuais, os traders podem identificar potenciais negócios e tomar decisões acertadas. No entanto, é importante ter em mente que os fatores fundamentais nem sempre podem prever com precisão os movimentos dos preços.

A maneira mais eficaz de prever movimentos de pares de moedas exóticas está na combinação de análise técnica e fundamental.

Principais pares de moedas exóticas

O mercado Forex contém centenas de pares de moedas exóticas; entretanto, é possível destacar os mais negociados e os menos negociados.

Os pares de moedas exóticas mais negociados são USD/ZAR, EUR/TRY, USD/MXN, USD/THB, USD/SGD, USD/NOK e USD/HKD.

Por que é importante saber quais pares de moedas exóticas são os mais negociados? Esses pares abrem novos horizontes para os traders, mas os pares menos negociados são conhecidos pela maior volatilidade e menor liquidez. Como tal, os traders enfrentam lacunas de preço, spreads elevados e manipulações de mercado imprevisíveis.

As estratégias mais difundidas para negociar pares de moedas exóticas

Aqui estão as estratégias de negociação mais eficazes para pares de moedas exóticas:

Negociação de tendências

A negociação de tendências é a estratégia mais comum para pares exóticos. Os traders precisam identificar a tendência atual do mercado e, em seguida, simplesmente comprar ou vender ativos de acordo com sua direção. Para identificar a direção de uma tendência e sua força, os traders geralmente utilizam os seguintes indicadores de análise técnica: Média Móvel, Índice RSI, MACD, Alligator, Bandas de Bollinger, SAR Parabólico e Estocástico.

Negociação de alcance

A estratégia consiste em abrir posições dentro de uma faixa de preço. Na maioria dos casos, quando um preço se aproxima da borda superior ou inferior, há uma alta probabilidade de que ele retorne a uma faixa. Traders profissionais utilizam as Bandas de Bollinger, o Canal de Donchian e o Canal de Keltner para essa estratégia.

Negociação de notícias

O principal objetivo da estratégia é abrir uma posição rapidamente após a divulgação da notícia. Há duas abordagens diferentes. A primeira consiste em reagir à notícia, e a segunda exige esperar que a notícia impacte o mercado para então abrir uma posição na direção oposta.

Recomendações sobre como negociar pares de moedas exóticas

- Utilizar stop-loss e take-profit Instrumentos para evitar perdas pesadas. Observe que alta volatilidade requer espaço suficiente – não defina ordens de stop-loss perto do ponto de entrada.

- Siga rigorosamente as regras de gerenciamento de risco ao abrir posições.

- Pares de moedas exóticas são altamente impactados por indicadores econômicos; portanto, analise cuidadosamente o cenário econômico antes de abrir uma nova posição.

- Durante períodos de instabilidade política e econômica, o mercado se move de forma caótica. Não abra posições durante esses períodos.

Conclusão: Vale a pena negociar pares de moedas exóticas?

Pares de moedas exóticas são negociados com menos frequência do que pares maiores ou menores; entretanto, desempenham um papel importante no mercado Forex. Pares exóticos oferecem oportunidades para os traders obterem retornos maiores. Além disso, os traders podem diversificar seus portfólios adicionando pares de moedas exóticas. Por outro lado, esses pares são caracterizados por maior volatilidade e menor liquidez quando comparados aos pares maiores e menores; é por isso que os traders precisam prestar muita atenção à análise fundamentalista.

Atualizado:

19 de dezembro de 2024