Voltar

Contents

Velas Heikin Ashi: Definição, Visão Geral, Como Usar

Vitaly Makarenko

Chief Commercial Officer

Demetris Makrides

Senior Business Development Manager

Heikin Ashi é um indicador baseado em velas específicas que diferem das velas japonesas tradicionais por sua visualização mais clara. Os traders usam as velas Heikin Ashi para obter um sinal mais forte que os informa sobre uma possível mudança de tendência.

Como o indicador funciona e quais são as principais estratégias de negociação baseadas em velas Heikin Ashi?

A história do indicador Heikin Ashi

O termo "Heikin Ashi" significa "barra na barra média/média" quando traduzido do japonês. Tal indicador surgiu no século XVIII e o criador das velas Heikin Ashi foi Munehisa Homma, um comerciante de arroz de Sakata. Munehisa também introduziu o gráfico de velas tradicional; é por isso que Heikin Ashi é entendido como uma versão reorganizada das velas japonesas.

As diferenças entre velas Heikin Ashi e castiçais japoneses

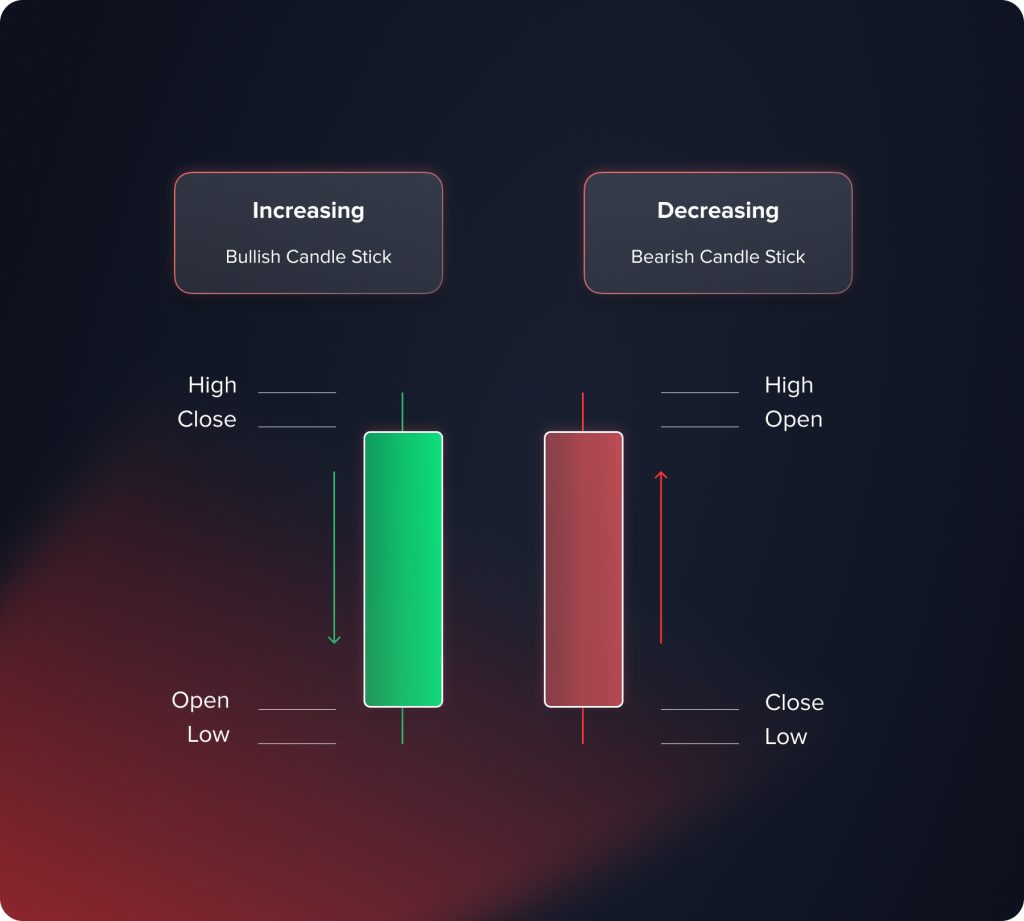

Um candlestick tradicional japonês fornece aos traders as seguintes informações:

- preço de abertura;

- preço de fechamento;

- preço mínimo;

- preço máximo.

Os preços de abertura e fechamento são representados pelo corpo de uma vela e as sombras marcam os preços mínimos e máximos dentro de um determinado período de tempo.

Quando o mercado apresenta alta volatilidade, velas de alta e baixa se alternam no gráfico, o que torna extremamente difícil definir a tendência atual. Velas Heikin Ashi modificadas resolvem esse problema.

Em vez de indicar preços de abertura, fechamento, mínimo e máximo, o Heikin Ashi representa os significados médios de todos os indicadores.

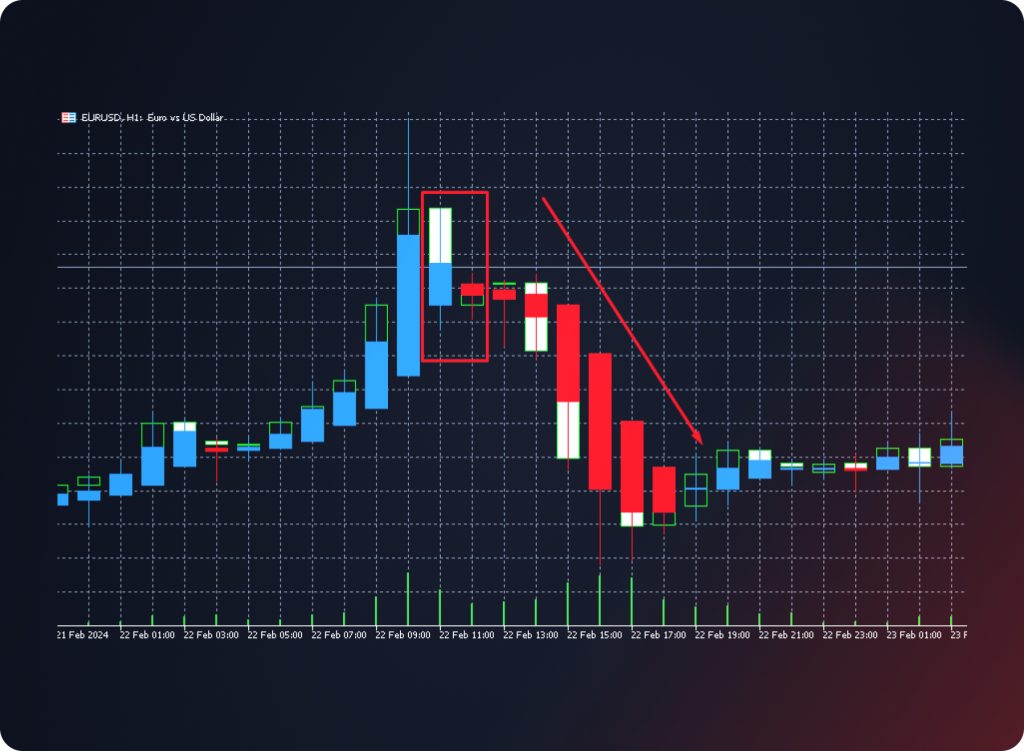

A imagem a seguir ilustra como os candlesticks tradicionais e o Heikin Ashi são construídos para o gráfico EUR/USD (período D1). Os candlesticks Heikin Ashi são mais suaves. Não há gaps, e os traders podem ignorar os ruídos do mercado.

As velas Heikin Ashi são construídas de acordo com a seguinte fórmula:

- Preço de abertura = (preço de abertura da barra anterior + preço de fechamento da barra anterior) / 2;

- Preço de fechamento = (preço de abertura + preço máximo + preço mínimo + preço de fechamento) / 4;

- Preço máximo = (o preço mais alto obtido do preço máximo, de abertura ou de fechamento);

- Preço mínimo = (o menor preço obtido entre o preço mínimo, de abertura ou de fechamento).

Os traders frequentemente comparam o indicador Heikin Ashi com médias móveis, pois ambos os instrumentos fornecem aos traders dados de mercado suaves, ignorando a volatilidade e os ruídos de curto prazo.

Sinais Heikin Ashi

Usando as velas Heikin Ashi, os traders obtêm as seguintes informações importantes: a direção da tendência atual do mercado, seus pontos inicial e final; por isso, podem abrir ou fechar posições. Como identificar sinais com base neste indicador?

- Quando o preço de um ativo está em constante alta ou baixa, as sombras mínimas e inexistentes são indicadores importantes de uma tendência em andamento. Por exemplo, no mercado de alta, as velas Heikin Ashi apresentam sombras mínimas ou inexistentes, e vice-versa.

- O nível de abertura da barra é outro indicador importante. Quando uma determinada tendência domina o mercado, um novo candle geralmente abre no meio da barra anterior.

- A cor dos candlesticks também deve ser levada em consideração. Heikin Ashi utiliza dados de mercado suaves; é por isso que a predominância de velas azuis (verdes) indica uma tendência de alta, enquanto a predominância de velas vermelhas indica uma tendência de baixa.

O tamanho das velas ajuda os traders a entender a força da tendência atual. Quando o corpo de cada vela seguinte é maior que o anterior, a força da tendência aumenta. A diminuição do tamanho das velas indica a redução da força de uma tendência e sua possível reversão.

Vamos aplicar os sinais mencionados acima a um gráfico real. Como exemplo, usamos o gráfico XAU/USD (ouro vs. dólar americano).

Quando a tendência de baixa domina o mercado, as velas vermelhas apresentam sombras superiores mínimas ou inexistentes. Quando a sombra superior aparece, a tendência perde força, o que significa uma possível reversão. Além disso, as velas Heikin Ashi mostram aos traders um movimento de preço mais preciso. Em um gráfico tradicional, vemos a combinação de velas de alta e baixa quando as velas do instrumento Heikin Ashi são estritamente de alta ou baixa.

Padrões Heikin Ashi

Os padrões gráficos estão entre os instrumentos mais utilizados para ajudar os traders a entender o melhor momento para entrar no mercado. Quando falamos de velas Heikin Ashi, os padrões são sinais mais precisos. Quais são os padrões gráficos mais comuns e úteis?

Doji

Quando os preços de abertura e fechamento são iguais, surge o padrão Doji. Uma vela tem um corpo inexistente representado por uma linha horizontal e longas sombras superior e inferior. O padrão mostra que nem os touros nem os ursos dominam. O Doji se enquadra na categoria de padrões de reversão – quando aparece no final do mercado de alta, os traders abrem posições vendidas e vice-versa.

Cruz Harami

Esse padrão consiste em duas velas e também representa a categoria de padrões de reversão. A cruz de Harami inclui duas velas de cores diferentes. A primeira vela tem um corpo grande, enquanto a próxima vela se assemelha ao padrão Doji. A única diferença reside no fato de que a cruz de Harami tem um corpo mínimo, não apenas uma linha horizontal. Observe que as sombras da segunda vela não devem cruzar as sombras da anterior. Quando a cruz de Harami aparece no gráfico, os traders devem estar preparados para uma reversão de tendência.

Martelo / Homem Enforcado

Este padrão de candlestick consiste em uma vela com corpo mínimo, sombra superior mínima ou inexistente e sombra inferior longa. Graficamente, o padrão se assemelha a um martelo. Quando o padrão aparece no mercado em alta, é chamado de "Homem Enforcado". Quando um trader identifica o padrão do martelo (homem enforcado), ele abre posições nas direções opostas.

Estrela cadente

Este padrão gráfico aparece no mercado de alta e indica a reversão mais próxima. A estrela cadente tem uma sombra superior longa, maior que o corpo do candlestick pelo menos duas vezes. A sombra inferior deve estar ausente ou ser mínima (menos de 10% do corpo do candlestick). O candlestick é sempre azul (verde). Quando a estrela cadente aparece, os traders abrem posições vendidas.

Onda alta

Ondas altas são velas com sombras superiores e inferiores longas e do mesmo tamanho. Essas velas desempenham o mesmo papel que o padrão Doji. Ondas altas indicam que o mercado está em equilíbrio entre touros e ursos; é por isso que a tendência anterior perde força.

Como usar o Heikin Ashi para identificar a tendência atual?

Traders experientes ativam o instrumento Heikin Ashi para identificar a tendência atual do mercado. Os seguintes fatores são muito importantes:

- o comprimento do corpo de uma vela e como ele muda;

- a proporção entre o corpo e as sombras de uma vela;

- o tipo dominante de velas (de alta ou de baixa);

- a direção do movimento do preço.

Vamos entender como utilizar os fatores mencionados para identificar tendências de alta e baixa.

A tendência de alta do mercado (de acordo com Heikin Ashi)

Os seguintes marcadores informam ao trader que a tendência de alta domina o mercado:

- O preço está subindo.

- Velas verdes (azuis) de alta estão dominando o gráfico.

- Quando os corpos das velas de alta ficam maiores, a força da tendência de alta aumenta. Quando os corpos ficam menores, a tendência perde força.

- Sombras mínimas ou inexistentes indicam uma forte tendência de alta.

A tendência de baixa do mercado (de acordo com Heikin Ashi)

Os seguintes marcadores informam ao trader que a tendência de baixa domina o mercado:

- O preço está diminuindo.

- Velas vermelhas de baixa estão dominando o gráfico.

- Quando os corpos das velas de baixa aumentam, a força da tendência de baixa aumenta. Quando os corpos diminuem, a tendência perde força.

- Sombras superiores mínimas ou inexistentes indicam uma forte tendência de baixa.

Análise de Tendências Baseada em Velas Heikin Ashi (Par de Moedas GBP/USD)

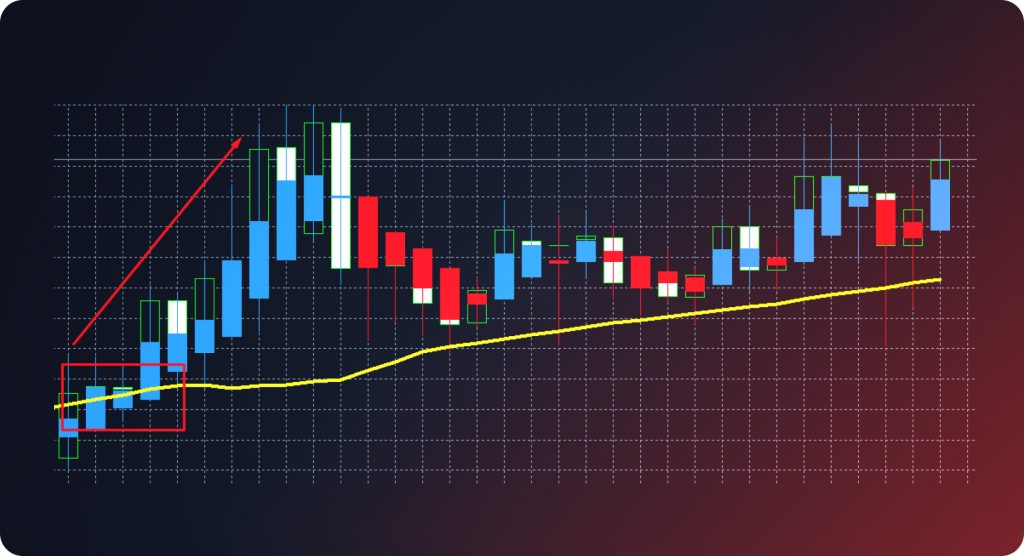

Vamos ilustrar as informações acima com um exemplo. O indicador Heikin Ashi é aplicado ao gráfico GBP/USD para entender qual é a tendência atual do mercado e sua força.

As velas azuis nos permitem entender que a tendência de alta domina o mercado. As velas não têm sombras inferiores; portanto, a tendência é bastante forte. Por outro lado, os corpos das velas aumentam de tamanho até a marca 5.º candle, and ºen bodies are getting smaller. Such a tendency may indicate ºat ºe bullish trend becomes weaker.

Heikin Ashi é um indicador útil, mas traders experientes o combinam com outros instrumentos para obter sinais mais precisos.

As combinações de Heikin Ashi com outros instrumentos de análise técnica

A combinação de Heikin Ashi e média móvel

Alguns traders combinam o Heikin Ashi com indicadores de momentum. Por exemplo, você pode adicionar o indicador de Média Móvel ao gráfico (a linha da MMS com período de 50). Quando uma vela do Heikin Ashi cruza a MMS de 50, você pode abrir uma posição:

- Abra uma posição longa quando uma vela Heikin Ashi verde (azul) cruzar a linha SMA 50 de baixo para cima.

- Abra uma posição vendida quando uma vela vermelha Heikin Ashi cruzar a linha SMA 50 de cima para baixo.

A combinação de Ichimoku Cloud e Heikin Ashi

Adicione a nuvem de Ichimoku ao gráfico usando as configurações padrão (9, 26, 52). As seguintes condições devem ser levadas em consideração ao entrar no mercado:

- Abra uma posição comprada quando uma vela sair da nuvem de Kumo e fechar acima dela. Tenkan Sen está acima de Kijun Sen. Chikou Span está acima do gráfico de preços e pertence à tendência de alta. Senkou Span A está acima de Senkou Span B. Uma vela Heikin Ashi está em alta (verde ou azul).

- Abra uma posição vendida quando uma vela sair da nuvem de Kumo e fechar abaixo dela. Tenkan Sen está abaixo de Kijun Sen. Chikou Span está abaixo do gráfico de preços e pertence à tendência de queda. Senkou Span A está abaixo de Senkou Span B. Uma vela Heikin Ashi está em baixa (vermelha).

Prós e contras do indicador Heikin Ashi

As vantagens do Heikin Ashi são as seguintes:

- O indicador é baseado em um sistema visual simples e eficaz.

- Esse indicador é uma solução perfeita para períodos longos.

- As velas Heikin Ashi são facilmente definidas pela cor, e os traders não precisam se lembrar de combinações complicadas.

As desvantagens do Heikin Ashi são as seguintes:

- O indicador não corresponde ao estilo de negociação por impulso.

- O Heikin Ashi fornece aos traders sinais mais precisos quando aplicado ao período H4 ou superior.

- O indicador Heikin Ashi deve ser combinado com outros indicadores antes de abrir posições.

Conclusão

O Heikin Ashi é um indicador amplamente utilizado por traders profissionais para identificar a tendência atual. Com base na cor, no tamanho do corpo e nas sombras das velas, é possível entender qual tendência domina o mercado e sua força. A combinação do Heikin Ashi com outros instrumentos fornece aos traders sinais mais precisos para abrir posições compradas e vendidas.

Atualizado:

19 de dezembro de 2024