Как торговать на Форексе: полное руководство

В статье

Торговля на Форексе позволяет инвесторам спекулировать на изменениях валютных курсов, продавая и покупая валюту. Можно открывать как короткие, так и длинные позиции по валютным парам, чтобы потенциально получить прибыль от роста или падения рынка. Важно помнить, что где вероятна прибыль, там и риск. Цены на Форексе могут меняться очень быстро, а кредитное плечо увеличивает не только прибыль, но и убытки.

Ключевые термины торговли на Форекс

Прежде чем углубляться в детали торговли на рынке Форекс, вот несколько распространенных терминов, с которыми вы столкнетесь:

- Валютная пара: Пара валют, образующая торгуемый инструмент, называется валютной парой; типичным примером будет EUR/USD, GBP/JPY и т. д. В паре валют базовая валюта идет первой, а валюта котировки — второй.

- Пип: наименьшее изменение цены любой валютной пары. Для большинства основных пар это четвёртый десятичный знак, или 0,0001. 100 пунктов равны изменению цены на один процент. Если ваш счёт открыт в долларах США, стоимость пункта для таких пар, как EUR/USD, при 1 стандартном лоте и 0,01 микролота составляет 10 и 0,1 доллара соответственно. Однако для таких пар, как GBP/JPY и AUD/CAD, это значение различается для одного типа счёта.

- Использовать: Возможность контролировать крупные позиции, используя гораздо меньшие суммы капитала от вашего брокера, пропорционально увеличивая как прибыли, так и убытки. Распространено использовать На Форексе это соотношение составляет от 50:1 до 200:1. Некоторые брокеры предлагают до 2000:1.

- Капитал: Общая стоимость вашего торгового счета, которая включает в себя любую прибыль или убыток по вашим открытым позициям, а также остаток вашего депозита.

- Допуск: Сумма капитала, необходимая брокеру в качестве залога для открытия кредитной позиции. Чем выше кредитное плечо, тем ниже маржинальные требования.

- Лоты/стандартный лот: стандартизированная единица измерения размера позиции. Стандартный лот контролирует базовую валюту стоимостью 100 000 долларов США. Микро-лоты и мини-лоты контролируют меньшие суммы. Исходя из вашей маржи и кредитного плеча, вы можете рассчитать максимальный размер лота, доступный для конкретного счета.

- Например, если у вас маржа $1000 с кредитным плечом 100x, вы можете открыть сделку на сумму $100 000 ($1000 x 100). Однако стандартный лот составляет $100 000. Следовательно, максимальный размер лота, доступный для этого типа счета, составляет 1 лот ($100 000/$100 000). Вы можете использовать эту формулу для других размеров счетов с другим кредитным плечом: размер лота = (Маржа x Кредитное плечо)/100 000.

- Распространение: The difference between the buy and sell price quoted for a currency pair at any given time. This is how brokers make their money. Распространениеs vary depending on account type, broker, and market conditions. When setting your take profit (tp) or stop loss (sl) it is recommended to factor in the spread.

- Длинная позиция: Когда вы покупаете валютную пару, рассчитывая на рост базовой валюты по отношению к котировке, вы рассчитываете продать её по более высокой цене, чтобы получить прибыль.

- Короткая позиция: Когда вы продаёте валютную пару, рассчитывая на падение стоимости базовой валюты по отношению к котировке, вы рассчитываете выкупить её по более низкой цене, чтобы получить прибыль.

- Проскальзывание: Проскальзывание occurs when your trades are executed are lower or higher prices than your intended prices. This usually occurs during high volatility news like the Consumer Price Index (CPI), NFP (Non-Farm Payrolls), etc. When encountered, it could lead to higher-than-expected losses.

Эти ключевые термины помогут вам понять фундаментальные концепции рынка Форекс, обсуждаемые в этом руководстве. Давайте теперь рассмотрим шаги для правильной подготовки вашей первой сделки на Форекс.

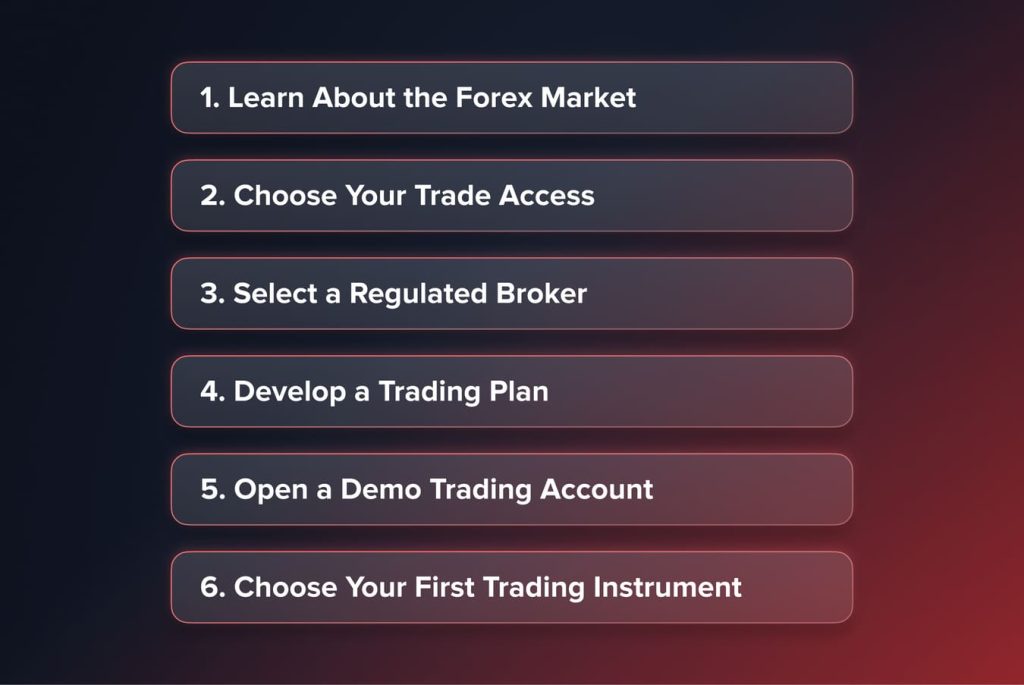

Как подготовиться к первой сделке на Форекс

1. Узнайте о рынке Форекс

Лучший способ начать свой путь на Форекс — расширить свои знания о работе рынка. Уделите время изучению основных концепций Форекс: что движет валютными курсами, кто участвует в торгах, типы ордеров, торговые платформы, изучите экономические календари, чтобы понимать предстоящие события, которые могут повлиять на волатильность. Вам также следует владеть методами технического и фундаментального анализа.

Отличный способ начать — пройти образовательный курс по Форексу для начинающих. Ваш брокер может предлагать обучающие программы и вебинары. Можно читать книги, смотреть обучающие видео, а также посещать бесплатные онлайн-курсы. Попрактикуйтесь в техническом анализе на демо-графиках, используя графические паттерны.

You may also like

2. Выберите свой торговый актив

Любой вид торговли на Форексе подразумевает обмен одной валюты на другую. Два наиболее распространённых способа — это использование CFD или торговля валютными парами на спотовом рынке. В первом случае физическое владение базовым активом не осуществляется, но можно спекулировать на его ценовых колебаниях. Вы даже можете торговать валютными фьючерсами или опционами, если ваш брокер предоставляет такую возможность. Прежде всего, убедитесь, что открываемый вами счёт наилучшим образом соответствует вашим целям, уровню опыта и готовности к риску.

3. Выберите регулируемого брокера

Прежде чем вкладывать средства, тщательно изучите несколько лучших форекс-брокеров. Вам нужен надежный брокер с проверенной репутацией и лицензией от авторитетных финансовых органов, таких как FCA, CySEC или ASIC. Учитывайте все важные факторы, такие как стоимость, платформы, инструменты, репутация и регулирование. Большинство из них позволят вам открыть учебный счет для демо-торговли, пока вы оцениваете их. Не торопитесь с выбором, поскольку брокер станет вашим основным торговым партнером.

4. Разработайте торговый план

Подготовьте подробный план торговли на Форексе, прежде чем инвестировать реальный капитал. Определите свои краткосрочные и долгосрочные цели. Чётко определите свою стратегию, включая технические и фундаментальные факторы, которые вы будете отслеживать. Определите размер позиции и благоприятные настройки риска/прибыли для входа в сделку. Тщательно продумайте размер риска, который вы готовы принять, и то, как вы будете управлять им. Хороший план поможет вам не сбиться с пути и сохранять дисциплину в условиях волатильности цен. Возвращайтесь к своему плану и корректируйте его по мере приобретения опыта и знаний.

5. Откройте демо-счет для торговли

Демо-счет важен, поскольку позволяет практиковаться и имитировать торговлю, не рискуя капиталом. Практикуйтесь в открытии и закрытии сделок, установке стоп-лосс и лимитов, а также проводите анализ на демо-графиках. Применяйте свою стратегию на реальном рынке, но без реального давления и последствий. Это самый безопасный способ проверить свои знания и выявить пробелы ещё до начала торговли. Демо-счета у брокеров иногда ограничены по времени, поэтому это хорошее время для обучения.

6. Выберите свой первый торговый инструмент

На рынке Форекс торгуются сотни валютных пар по всему миру. Тем, кто хотел бы начать с небольших позиций, настоятельно рекомендуется начать с торговли основными валютными парами, включая UDS, EUR, GBP и JPY, поскольку они обладают высокой ликвидностью и узкими спредами. Популярные инструменты входа, такие как EUR/USD и GBP/USD, чрезвычайно ликвидны и часто освещаются в новостях.

Благодаря этому они создают идеальные условия для применения и отработки навыков анализа. Приобретите опыт хотя бы на нескольких из этих пар, прежде чем торговать второстепенными и экзотическими валютными парами с ещё меньшим количеством участников. Правильный анализ и надлежащее управление рисками всегда превосходит любой «специальный» выбор пары.

Как осуществить свою первую сделку на Форекс

Подготовка завершена, и теперь пора начинать ваши первые реальные сделки. Анализируя возможности и ориентируясь в реальных рыночных условиях, помните о следующем. Постоянно проверяйте свои предположения, постоянно обучаясь.

1. Технический и фундаментальный анализ

Анализ как краткосрочных графиков, так и долгосрочных тенденций помогает выявить торговые возможности. Технические индикаторы Выявите закономерности, формирующиеся при колебаниях валют. Фундаментальный анализ учитывает экономические публикации, чтобы предсказать их влияние на обменные курсы. Объедините обе точки зрения для получения наиболее полного обзора. Будьте открыты новому — графики сами по себе не учитывают неожиданные новости, а фундаментальные факторы игнорируют технические взгляды других трейдеров. Ваша цель — найти точку соприкосновения между ними.

2. Решение о покупке или продаже

Как только появится аналитический сигнал, используя свою стратегию, определите, благоприятствуют ли условия для открытия длинной (покупки) или короткой (продажи) позиции. Учитывайте такие аспекты, как направление тренда, импульс, уровни поддержки и сопротивления. Запишите обоснование своих решений о входе в рынок. Немедленно установите защитный стоп-лосс для защиты от неблагоприятных движений. Также разместите предполагаемую цель или уровень тейк-профита выше уровня сопротивления или ниже уровня поддержки. Будьте уверены только в хорошо проработанных позициях.

3. Выполнение с правильным выбором размера позиции

Начните с очень малого объёма — с 0,01 лота или микролота, пока не освоитесь с реальными балансами. Масштабируйте позиции осознанно, учитывая волатильность и вашу готовность к риску. Сохраняйте дисциплину, соблюдая все параметры риска, указанные в вашем плане, включая общие дневные лимиты убытков. Правильный размер позиции в сочетании со стоп-ордерами допускает некоторые краткосрочные потери, предотвращая чрезмерные просадки, которые могут опустошить счёт. Ваша цель — устойчивый рост, а не мгновенное обогащение.

4. Внимательно следите за динамикой цен

Постоянно отслеживайте экономические календари, чтобы быть в курсе предстоящих потенциальных изменений на рынке. Внимательно следите за своими сделками, особенно во время выхода важных новостей. Будьте готовы ужесточить стоп-лоссы или быстро выйти из позиции, если анализ окажется неверным. Зафиксируйте прибыль на ранней стадии, постепенно снижая темпы роста или полностью выходя из позиции при превышении целевых показателей. Проявите гибкость и терпение, чтобы принять небольшую прибыль вместо больших убытков, если сомневаетесь. С опытом вы научитесь распознавать паттерны, которые также работают вам на пользу.

5. Правильное закрытие сделок

Никогда не привязывайтесь эмоционально к позициям. Закрывайте прибыльные сделки, методично фиксируя прибыль, следуя заранее составленному плану. В случае убыточных сделок не усредняйтесь — соблюдайте стоп-лосс и выходите немедленно, без лишних вопросов. Строгое следование плану сохраняет ясность ума и повторяемость. Анализируйте точность каждой сделки и своё эмоциональное состояние во время неё для получения опыта. Успешные трейдеры постоянно переоценивают свои стратегии и себя, оставаясь открытыми для совершенствования.

Популярные стратегии Форекс

По мере роста вашего опыта, вот несколько популярных концепций для изучения:

- Скальпинг: Получайте множество небольших прибылей, всего несколько пунктов за раз, на очень краткосрочных движениях, часто в течение одной торговой сессии. Скальперы удерживают сделки от нескольких секунд до нескольких минут. Опираются на скорость, правила по размеру позиции и дисциплину.

- Свинг-трейдингСвинг-трейдеры обычно удерживают свои позиции от нескольких дней до нескольких недель. Стремитесь к быстрой прибыли в 30–200 пунктов за счёт внутридневных краткосрочных ценовых колебаний. Используйте более короткие таймфреймы и уровни коррекции Фибоначчи, чтобы увеличивать позиции по мере развития сделки в вашем направлении, пока не убедитесь в скором развороте.

- Позиционная торговля: Позиционных трейдеров не беспокоят краткосрочные движения цен, поскольку они могут держать сделки от нескольких недель до нескольких месяцев и даже до года, чтобы максимизировать свою прибыль.

- Дневная торговля: Как дейтрейдер, вы несёте ответственность за открытие и закрытие сделок в течение торгового дня. Это означает, что открытые позиции дейтрейдеров не переносятся на следующий торговый день.

- Трендовая торговля: Отслеживайте движения валют в рамках четко определенных восходящих или нисходящих трендов, анализируя графики более высоких таймфреймов и подтверждая сигналы тренда.

- Основы или новостная торговля: Предвидьте реакцию на запланированные объявления, открывая позиции до публикации и быстро закрывая их. Преимущество достигается за счёт понимания ожидаемых последствий событий. К таким фундаментальным публикациям относятся индекс потребительских цен (ИПЦ), данные о занятости в несельскохозяйственном секторе (NFP), данные FOMC и т. д.

- Модели продолжения и разворота тренда: Такие фигуры, как флаги, вымпелы и треугольники, являются распространёнными примерами фигур продолжения тренда и часто предшествуют движению. Примерами фигур разворота являются «Голова и плечи», «Двойная вершина», «Двойное дно» и т. д. Определите, как вели себя предыдущие тренды, и найдите повторяющиеся паттерны на графиках.

- Тестирование стратегий MetaTrader: Разрабатывайте и тестируйте торговые роботы, индикаторы и алгоритмы на исторических данных для оптимизации. Оцените их жизнеспособность перед запуском.

You may also like

Постоянно развивайте свой подход по мере накопления знаний и практического опыта в реальных рыночных условиях. Уточняйте моменты, которые работают неэффективно, но в целом не усложняйте стратегии. Техническая и рисковая дисциплина остаются такими же важными, как и прежде.

Важность управления рисками и постоянного обучения

Хотя ваши торговые стратегии и возможности будут постоянно меняться по мере вашего развития на рынке Форекс, правильные методы управления рисками должны оставаться незыблемой основой успеха. Ключевые моменты, которые следует учитывать:

- Управление деньгами: Контролируйте общий риск на сделку до крошечного процента (1–2%) от вашего счёта, используя строгий контроль размера позиции и стоп-ордеров. Никогда не рискуйте более чем 2–5% от вашего баланса в течение 24 часов, чтобы избежать краха.

- Эмоциональная дисциплина: Отстраненность от результатов жизненно важна. Придерживайтесь исключительно сигналов вашего проверенного плана, несмотря на просадки или временное отклонение прибыли. Позвольте убыткам идти своим чередом, чтобы их можно было сократить, никогда не усредняйтесь.

- Лимиты по снятию средств: Определите максимальную просадку портфеля (например, 15–20%), которую нельзя превышать, прежде чем пересматривать свой подход. Защитите капитал для долгосрочного использования.

- Ведение учета: Регулярно анализируйте все сделки, обращая внимание на сигналы, качество анализа, эмоции и другие факторы. Постоянно корректируйте и оптимизируйте стратегии, используя эти ценные качественные данные.

- Непрерывное образование: Постоянное обучение из разных источников повышает вашу осведомленность, помогает адаптироваться к меняющимся условиям и открывает новые возможности. Оспаривайте устоявшиеся представления и будьте любознательны каждый день.

- Использование демо-счета: Всегда пробуйте новые стратегии сначала на демо-счете, прежде чем рисковать реальными деньгами. Это защитит вас от разорения и позволит методично оттачивать методы на протяжении множества сделок.

- Сеть поддержки: Участвуйте в онлайн-сообществах, посвященных форексу, чтобы помогать другим и решать проблемы, используя коллективный опыт. Будьте ответственны, открыто делясь своим прогрессом.

Целью остаётся устойчивый рост вашего счёта в течение многих лет, независимо от рыночных циклов. Относитесь к торговле как к бизнесу, концентрируясь на совершенствовании, снижении рисков и постоянном развитии. Сохраняйте скромность, помня, что риски сохраняются, и многие терпят неудачу из-за чрезмерной уверенности в своих силах или погони за убытками. Однако, стремясь к совершенству и оттачивая навыки трейдинга, вы открываете безграничные возможности.

Заключение

В заключение мы рассмотрели ключевую терминологию Форекс, шаги по подготовке к вашей первой реальной сделке и стратегии для достижения устойчивой прибыльной торговли. Важно понимать, что ваша личность может влиять на ваши сделки, поэтому необходимо понимать себя, чтобы решить, каким трейдером вы хотите стать: скальпером, свингером, дейтрейдером, позиционным трейдером и т. д.

Успех на Форексе зависит не от стремления к мгновенному обогащению, а от постоянного обучения, тщательного планирования, технического понимания и эмоциональной дисциплины, необходимой для преодоления неизбежных просадок. Если вы всецело отнесётесь к этому долгосрочному процессу и будете применять эффективные методы управления рисками, ваши усилия имеют высокий потенциал для успеха в долгосрочной перспективе. Удачи в торговле на Форексе!

Обновлено:

12 сентября 2024 г.