Quay lại

Contents

Pip trong Forex là gì: Giá trị và cách tính

Demetris Makrides

Senior Business Development Manager

Vitaly Makarenko

Chief Commercial Officer

Pip là thuật ngữ thể hiện chữ số thập phân cuối cùng của giá. Trong phần lớn các cặp giao dịch, số chữ số thập phân là 4; đó là lý do tại sao một pip tương đương với 0,0001.

Khi nói về giao dịch, pip là đơn vị chuẩn để đo lường mức độ thay đổi của tỷ giá hối đoái trong một cặp giao dịch.

Những điểm chính cần ghi nhớ:

- Pip trong giao dịch Forex là gì?

- Pipet có nghĩa là gì và nó khác với pip như thế nào?

- Làm thế nào để tính giá trị pip?

- Làm thế nào để tìm giá trị pip theo loại tiền tệ đã chọn trong tài khoản giao dịch của bạn?

- Chênh lệch giá có nghĩa là gì và nó phụ thuộc vào pip như thế nào?

Pip trong giao dịch Forex là gì?

Pip là một thuật ngữ viết tắt có thể được giải mã là 'Phần trăm điểm'. Đây là đơn vị chuẩn để đo lường sự thay đổi giá của một cặp giao dịch. Theo truyền thống, một pip tương ứng với 4th chữ số sau dấu thập phân. Trong khi đó, ngoại lệ cũng tồn tại.

Chúng ta hãy cùng tìm hiểu sâu hơn về pip để minh họa cách thức hoạt động của nó thông qua các ví dụ.

Tỷ giá hối đoái của phần lớn các cặp giao dịch được đưa ra với bốn chữ số thập phân. Ví dụ:

- Tỷ giá hối đoái của USD/BRL là 5,7264;

- Tỷ giá hối đoái của EUR/CAD là 1,5140;

- Tỷ giá hối đoái của AUD/CHF là 0,5649;

4th chữ số sau dấu thập phân được gọi là pip để đơn giản hóa phép tính.

Ví dụ, làm thế nào để đánh dấu sự chênh lệch khi tỷ giá hối đoái USD/BRL thay đổi từ 5,7264 thành 5,7269? Nếu chúng ta nói rằng giá thay đổi 0,0005, thì sẽ phức tạp và không rõ ràng. Đặc biệt là đối với giao dịch Forex, khi giây phút có ý nghĩa rất lớn.

Việc giới thiệu pip đã giúp việc tính toán trở nên đơn giản hơn nhiều. Hiện tại, chúng ta có thể nói rằng giá USD/BRL đã thay đổi 5 pip, và mọi nhà đầu tư hoặc nhà giao dịch đều hiểu ý chúng tôi.

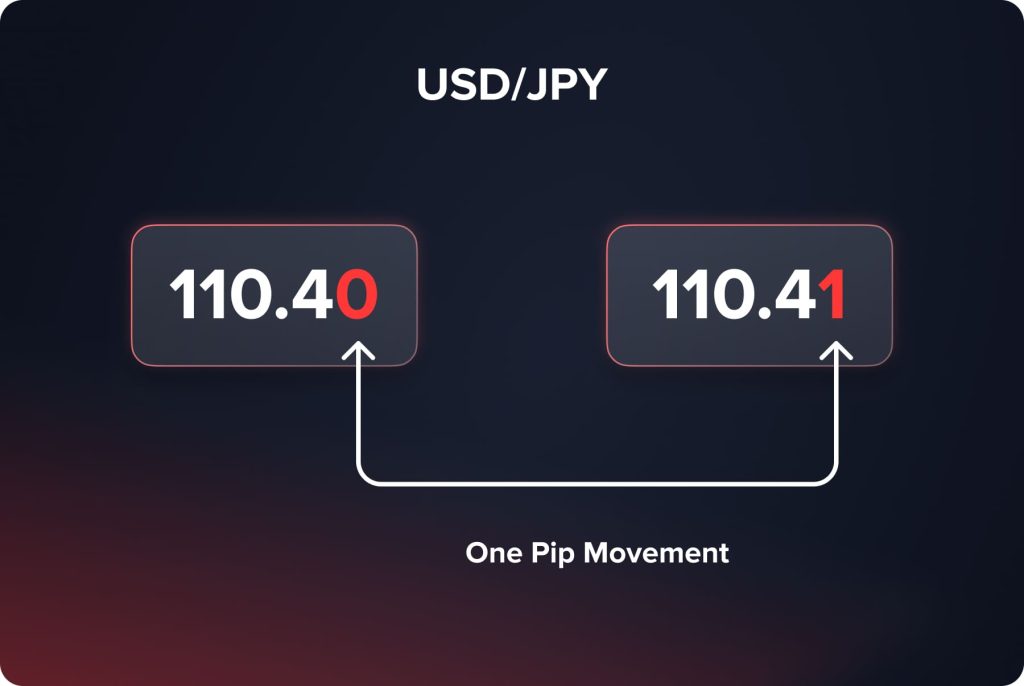

Trong khi đó, quy tắc này không áp dụng cho các cặp giao dịch với đồng Yên Nhật (JPY). Khi nói đến các cặp JPY, một pip là 2.và Chữ số sau dấu thập phân. Ví dụ, khi một nhà giao dịch cần thông báo cho chúng ta về sự thay đổi giá EUR/JPY từ 164,36 lên 164,39, anh ta nói rằng giá đã tăng 3 pip.

Ngoại trừ các cặp giao dịch có đồng JPY, tình hình tương tự cũng xảy ra trên thị trường kim loại. Khi nói đến vàng, bạc và các kim loại khác, một pip là 2và cũng như chữ số.

Pipette trong giao dịch Forex là gì? Sự khác biệt giữa Pip và Pipette

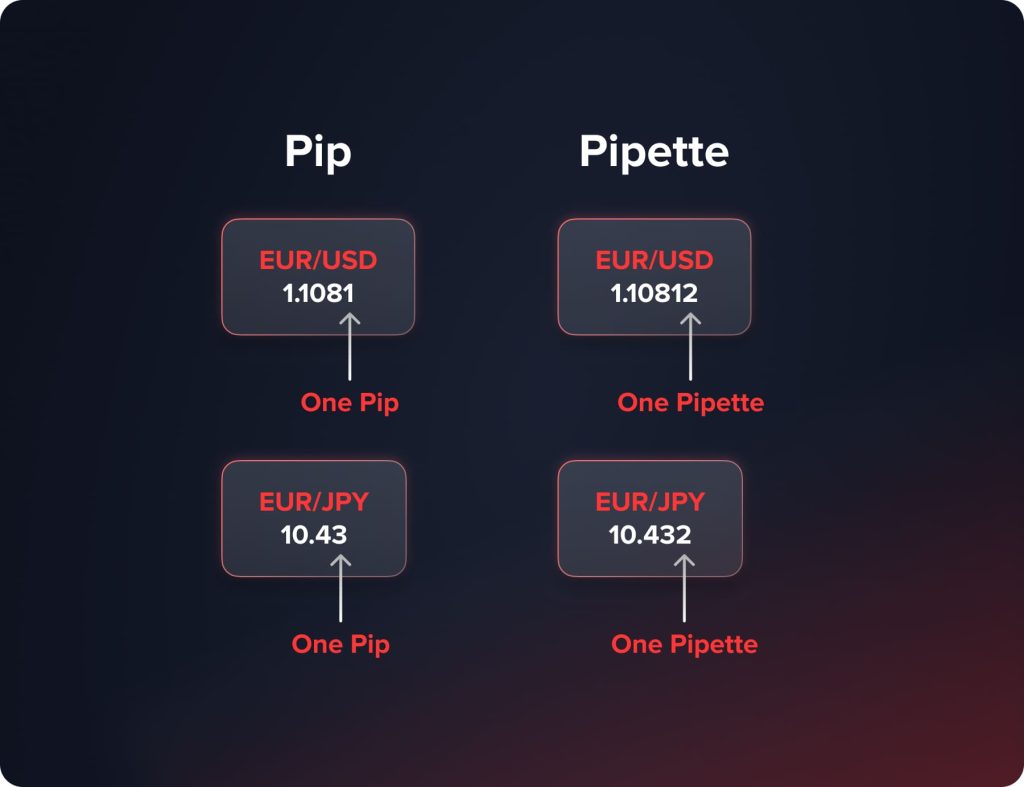

Ban đầu, pip được hiểu là đơn vị đo lường nhỏ nhất để tính toán sự thay đổi giá của một tài sản. Tuy nhiên, theo thời gian, các phép đo lường chính xác hơn đã xuất hiện. Nhiều sàn giao dịch Forex hiện đại hiển thị giá tài sản với 5 chữ số sau dấu thập phân (trong trường hợp cặp tiền tệ với JPY, có thể hiển thị 3 chữ số).

Do đó, tỷ giá hối đoái của USD/BRL không phải là 5,7264 mà là 5,72648. Tỷ giá hối đoái của EUR/JPY không phải là 164,36 mà là 164,361.

Rõ ràng là cần phải đưa thêm một đơn vị đo lường để đánh dấu 5th chữ số sau dấu thập phân.

Pipette được hiểu là một pip phân số (1/10 của một pip). Khi chúng ta cần thông báo cho nhà giao dịch rằng giá EUR/USD đã thay đổi từ 1,19565 lên 1,19579, chúng ta có thể nói rằng giá đã tăng 1 pip và 4 pipette hoặc 14 pipette.

Sau đây là lý do tại sao pipet cho phép các nhà giao dịch và nhà đầu tư Forex xác định tỷ giá hối đoái chính xác nhất có thể.

Giá trị Pip là gì và cách tính giá trị này như thế nào?

Tại sao các nhà giao dịch cần tính toán giá trị pip? Tài khoản giao dịch được mở bằng tiền tệ thực, không phải pip; đó là lý do tại sao bạn cần hiểu giá trị pip để đánh giá đúng lợi nhuận hoặc thua lỗ từ giao dịch của mình. Sự hiểu biết này giúp các nhà giao dịch lựa chọn đúng chiến lược giao dịch. chiến lược quản lý rủi ro .

Giá trị pip chịu ảnh hưởng của các yếu tố sau: cặp giao dịch, quy mô giao dịch và tỷ giá hối đoái hiện tại.

Hơn nữa, cách tính giá trị pip phụ thuộc trực tiếp vào vị thế tiền tệ trong cặp giao dịch. Dựa trên vị thế đó, có hai cách tính giá trị pip.

Ví dụ, để tính giá trị pip theo đơn vị tiền tệ định giá, chúng ta cần áp dụng công thức sau:

Giá trị Pip = Quy mô giao dịch (theo đơn vị) * 0,0001

Hãy tính giá trị của một lô chuẩn (100.000 đơn vị) cặp EUR/USD. Ta cần nhân 100.000 với 0,0001 và được 10. Điều này có nghĩa là gì? Mỗi pip của giao dịch đó bằng 10 đô la. Khi vị thế của một nhà giao dịch tăng trưởng 3 pip, anh ta sẽ thu được lợi nhuận 30 đô la, và ngược lại.

Đồng thời, có những trường hợp tiền tệ của tài khoản giao dịch không tương ứng với đồng tiền báo giá. Họ nên làm gì? Hãy cùng tính giá trị pip trong cặp giao dịch EUR/JPY. Trước hết, chúng ta cần sử dụng công thức tương tự. Giá trị pip = 100.000 đơn vị * 0,01 (đối với JPY, chúng ta sử dụng hệ số nhân 0,01 thay vì 0,0001). Giá trị pip của cặp giao dịch EUR/JPY là 1000; nghĩa là 1 pip bằng 1000 JPY. Trong khi đó, tài khoản giao dịch của chúng ta sử dụng đô la Mỹ. Vậy giá trị pip của EUR/JPY tính theo USD là bao nhiêu? Chúng ta cần công thức sau cho trường hợp này:

Giá trị Pip (theo đơn vị tiền tệ của tài khoản giao dịch) = Giá trị Pip (của đơn vị tiền tệ báo giá) / Tỷ giá hối đoái

Hãy đưa các giá trị cần thiết vào công thức. Giá trị Pip (tính bằng USD) = 1.000 JPY / 154,133 (tỷ giá hối đoái USD/JPY) = 6,48 USD.

Vì chúng ta đã tính toán giá trị pip bằng USD nên việc tuân theo chiến lược quản lý rủi ro đã chọn, sử dụng các công cụ dừng lỗ và chốt lời, cũng như tính toán lợi nhuận/tổn thất của mỗi giao dịch trở nên đơn giản hơn nhiều.

You may also like

Các trường hợp sử dụng Pip và Pipette

Tại sao các nhà giao dịch cần hiểu sự khác biệt giữa pip và pipet, cũng như cách sử dụng các đơn vị đo lường này trong thực tế? Dưới đây là những trường hợp sử dụng phổ biến nhất:

- Thể hiện sự thay đổi giá của một tài sản nhất định. Thật khó để sử dụng các con số truyền thống khi nói về 4th và 5th chữ số thập phân. Bạn có thể đơn giản hóa lời giải thích bằng cách giới thiệu pip và pipet. Ví dụ:

Giá EUR/USD đã giảm 9 pip.

Giá USD/JPY đã tăng 27 pip.

- Biểu thị lợi nhuận và thua lỗ. Tình huống tương tự cũng xảy ra – việc giải thích lợi nhuận hoặc thua lỗ của bạn thông qua pip và pipet sẽ dễ dàng hơn nhiều. Ví dụ:

Tôi đã kiếm được 75 pip từ giao dịch cuối cùng.

Giao dịch này khiến tôi mất 84 ống nhỏ giọt.

- Thiết lập lệnh dừng lỗ và chốt lời. Khi tham gia giao dịch, các nhà giao dịch chuyên nghiệp luôn sử dụng các công cụ dừng lỗ và chốt lời. Pip và pipet giúp hiểu rõ mức giá để thiết lập các lệnh đó. Ví dụ:

Trong giao dịch gần đây nhất, tôi đã sử dụng mức dừng lỗ là 40 pip và mức chốt lời là 52 pip.

Mức dừng lỗ là 110 pipet đã giúp tôi tránh được những khoản lỗ lớn.

- Thể hiện mức chênh lệch. Chênh lệch giữa giá chào bán và giá chào mua luôn được tính bằng pip.

Khi nói về spread, chúng ta cần tìm hiểu kỹ hơn về nó. Nó có nghĩa là gì trên thị trường Forex, và tại sao bạn cần sử dụng pip để diễn đạt nó?

Spread trong Forex là gì?

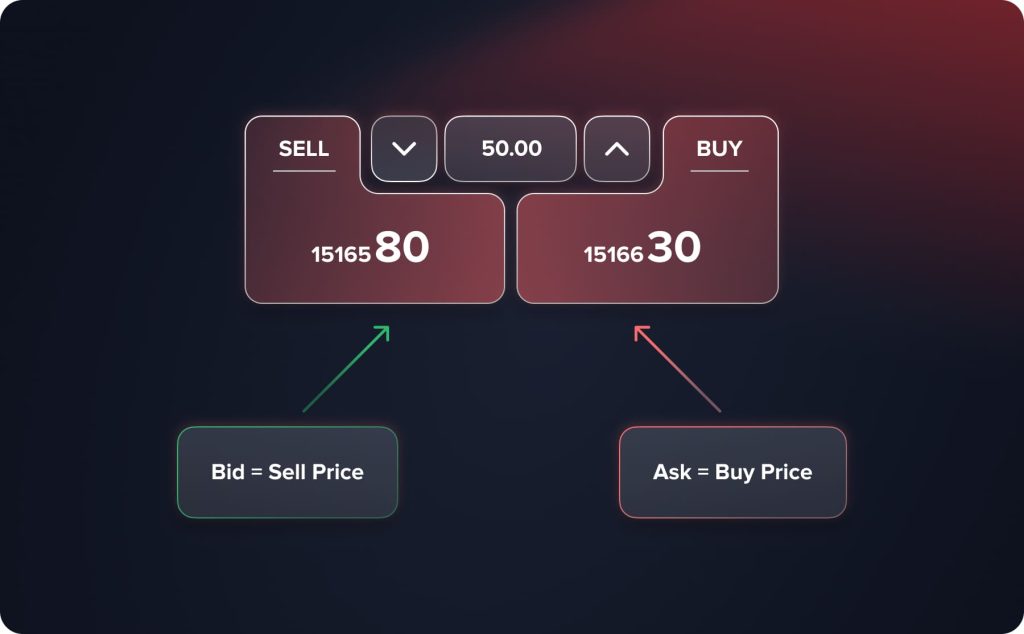

Bất kể thị trường tài chính nào được xem xét, chênh lệch giá (spread) là sự chênh lệch giữa giá mua và giá bán. Nó có nghĩa là gì?

- Giá thầu là mức giá mà nhà giao dịch có thể bán tài sản của mình.

- Giá bán là mức giá mà nhà giao dịch có thể mua tài sản.

Ví dụ, giá mua vào cho cặp EUR/USD là 1,12704, và giá bán ra cho cùng cặp giao dịch này là 1,12718. Chênh lệch giữa giá mua vào và giá bán ra là 0,00014 (14 pipet).

Trên thị trường Forex phết luôn được thể hiện bằng pip; đó là lý do tại sao sự khác biệt này được đánh dấu là 1 pip.

Chênh lệch giá được chia thành cố định và thả nổi. Chênh lệch giá cố định không bao giờ thay đổi, bất kể điều kiện thị trường. Ví dụ, một công ty môi giới cung cấp mức chênh lệch giá cố định là 8 pip cho kim loại. Điều này có nghĩa là chênh lệch giữa giá chào bán và giá chào mua kim loại sẽ luôn là 8 pip (0,08).

Chênh lệch giá nằm trong danh mục các công cụ mà các nhà môi giới quyền chọn kiếm lợi nhuận. Phần lớn các công ty môi giới không tính phí và hoa hồng, nhưng chênh lệch giá thường bắt đầu từ 2 pip. Khi một nhà giao dịch mở một vị thế, anh ta sẽ lỗ 2 pip ngay từ đầu.

Hơn nữa, các sàn giao dịch có thể cung cấp nhiều loại tài khoản khác nhau, có hoặc không có phí. Khi sàn giao dịch tính phí hoa hồng, chênh lệch giá bắt đầu từ 0 và hoàn toàn phụ thuộc vào điều kiện thị trường. Khi phí là 0%, chênh lệch giá cho phép các công ty môi giới kiếm lời từ mỗi giao dịch. Trước khi mở tài khoản, bạn cần cân nhắc số lượng giao dịch dự kiến và khối lượng giao dịch để tìm ra loại tài khoản phù hợp nhất với mình.

You may also like

Lợi nhuận của nhà giao dịch tính bằng Pip là bao nhiêu?

Các nhà giao dịch Forex chuyên nghiệp cố định lợi nhuận của họ bằng pip. Lợi nhuận của họ từ một giao dịch, một ngày, một tuần, v.v. là bao nhiêu?

Lợi nhuận phụ thuộc rất nhiều vào phong cách và chiến lược giao dịch được lựa chọn. Các nhà đầu cơ lướt sóng cố gắng kiếm được từ 5 đến 10 pip mỗi giao dịch. Các nhà giao dịch trong ngày kỳ vọng kiếm được từ 10 đến 30 pip mỗi giao dịch. Đối với các nhà giao dịch và nhà đầu tư dài hạn, họ mở một vị thế để kiếm lợi nhuận từ 50-100 pip, thậm chí còn hơn thế nữa. Do đó, thu nhập hàng ngày, hàng tuần và hàng tháng phụ thuộc vào số lượng giao dịch có lợi nhuận.

Kết luận

Pip là một đơn vị đo lường được sử dụng trên thị trường tài chính để thể hiện sự thay đổi giá, lãi/lỗ và chênh lệch giá. Nó giúp đơn giản hóa các phép tính vì các nhà giao dịch và nhà đầu tư không cần phải tính toán đến các chữ số thập phân. Trong hầu hết các tài sản, pip được gọi là 4th chữ số sau dấu thập phân. Đối với tài sản và kim loại được ghép cặp với JPY, một pip có nghĩa là 2và decimal digit. Furthermore, a pip is not the smallest measurement unit. As soon as the quotes began to be expressed in five decimal digits, a fractional pip (pipette) appeared. When using pips avà pipettes traders save much time for making the required calculations.

FAQ

Pip được giải mã dưới dạng phần trăm theo điểm và đề cập đến chữ số thập phân thứ 4 trong phần lớn các công cụ giao dịch (đối với một số tài sản, pip là chữ số thập phân thứ 2).

Các nhà giao dịch và nhà đầu tư cần phải tính toán liên tục để thể hiện lợi nhuận/thua lỗ, biến động giá, chênh lệch giá và thiết lập các công cụ dừng lỗ/chốt lời. Pip và pipet giúp việc tính toán trở nên dễ dàng hơn nhiều.

Một pipet bằng một phần mười của một pip. Nó truyền tải chữ số thập phân thứ 5 (hoặc chữ số thập phân thứ 3 đối với tài sản và kim loại được ghép cặp với JPY). 1 pip bằng 10 pipet, và 1 pipet bằng 0,1 pip.

Đã cập nhật:

10 tháng 2, 2026