Back

Contents

Что такое пункт на Форексе: значения и расчет

Demetris Makrides

Senior Business Development Manager

Vitaly Makarenko

Chief Commercial Officer

Пипс — это термин, обозначающий последний десятичный знак в котировке. В подавляющем большинстве торговых пар количество знаков после запятой равно 4, поэтому один пипс равен 0,0001.

В торговле пункт — это стандартная единица измерения изменения обменного курса внутри торговой пары.

Основные выводы:

- Что такое пункт в торговле на Форекс?

- Что означает пипетка и чем она отличается от пипетки?

- Как рассчитать стоимость пункта?

- Как узнать стоимость пункта в выбранной валюте вашего торгового счета?

- Что означает спред и как он зависит от пунктов?

Что такое пункт в торговле на Форекс?

Пипс — это сокращение, которое можно расшифровать как «Процент в пунктах». Это стандартная единица изменения цены торговой пары. Традиционно пипс соответствует 4й digit after йe decimal point. Meanwhile, йe exception exists as well.

Давайте подробнее рассмотрим принцип работы пункта и проиллюстрируем его на примерах.

Курсы обмена большинства торговых пар указаны с точностью до четырёх знаков после запятой. Например:

- Обменный курс USD/BRL составляет 5,726.4;

- Обменный курс EUR/CAD составляет 1,514.0;

- Обменный курс AUD/CHF составляет 0,564.9;

4й digit after йe decimal point is named a pip to simplify йe calculations.

Например, как отметить разницу, когда курс USD/BRL изменился с 5,7264 до 5,7269? Если мы скажем, что цена изменилась на 0,0005, это будет сложно и непонятно. Особенно для торговли на Форексе, где секунды имеют большое значение.

Введение пункта значительно упростило расчёты. В настоящее время можно сказать, что цена USD/BRL изменилась на 5 пунктов, и каждый инвестор или трейдер понимает, что мы имеем в виду.

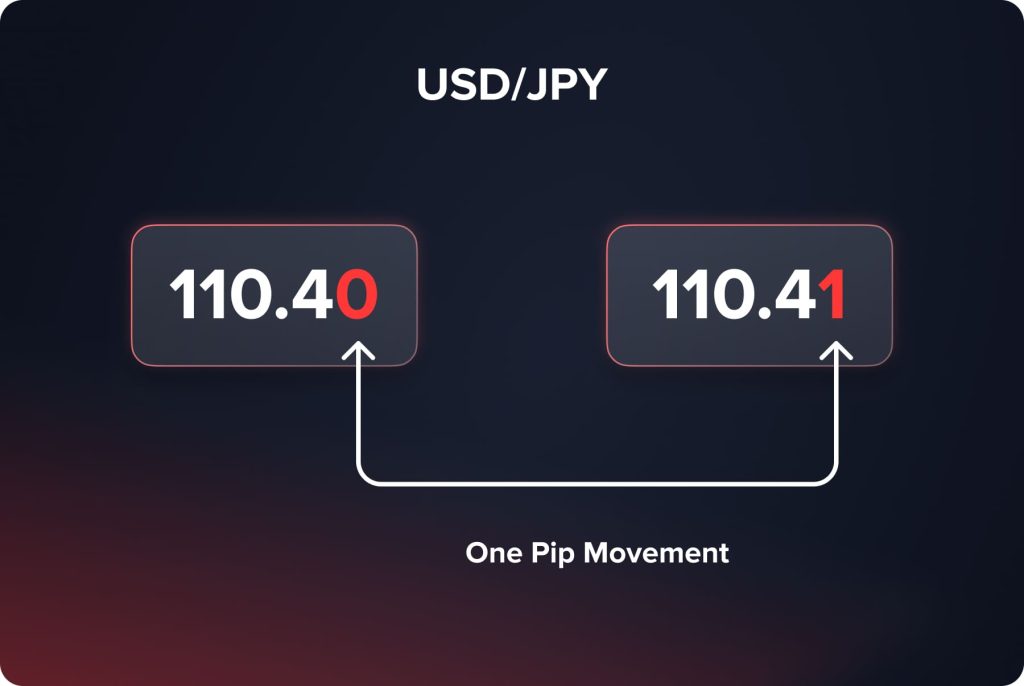

Между тем, это правило не работает для торговых пар с японской иеной (JPY). В парах с JPY один пункт равен 2й знак после запятой. Например, когда трейдеру нужно сообщить нам об изменении цены EUR/JPY со 164,36 до 164,39, он сообщает, что цена выросла на 3 пункта.

Помимо торговых пар, включающих иену, аналогичная ситуация наблюдается и на рынке металлов. Когда речь идёт о золоте, серебре и других металлах, пункт — это второйй цифра тоже.

Что такое пипетка в торговле на Форекс? Разница между пипсами и пипетками

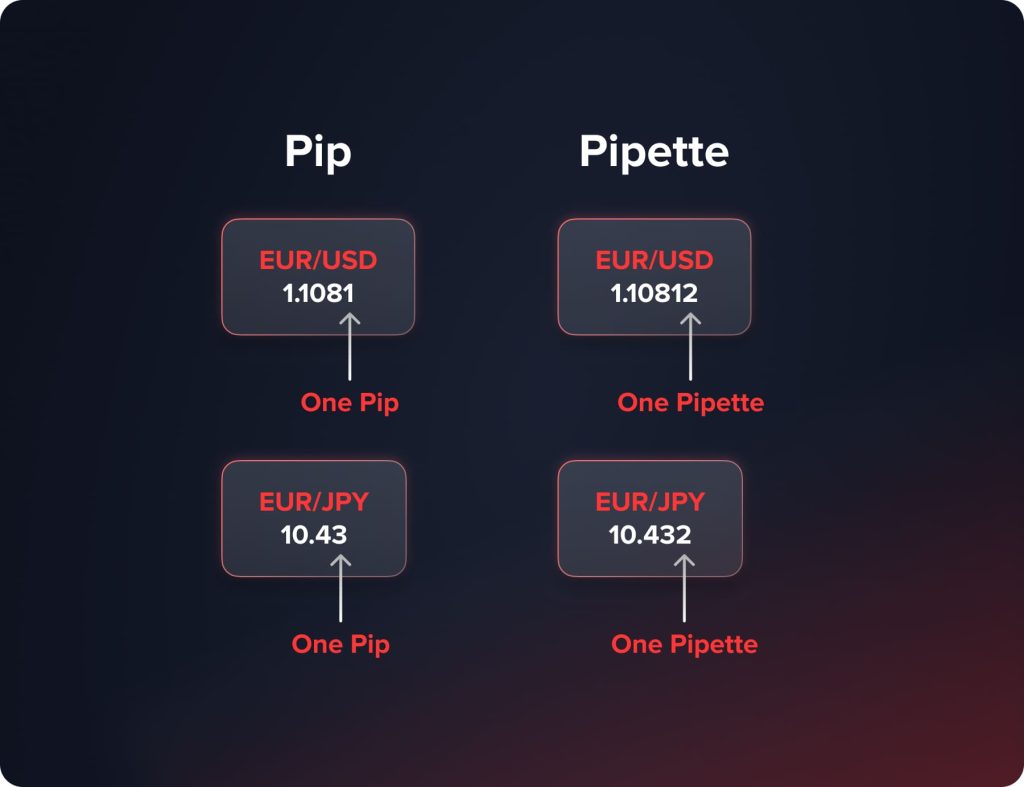

Изначально пипс понимался как наименьшая единица измерения для расчёта изменения цены актива. Со временем появились более точные измерения. Многие современные форекс-брокеры отображают цены активов с пятью знаками после запятой (для валют, работающих в паре с иеной (JPY), доступны три знака после запятой).

Таким образом, обменный курс USD/BRL составляет не 5,7264, а 5,72648. Обменный курс EUR/JPY составляет не 164,36, а 164,361.

Очевидно, что возникла необходимость ввести дополнительную единицу измерения для обозначения 5-го года.й digit after йe decimal point.

Пипетка — это дробная часть пункта (1/10 пункта). Когда нам нужно сообщить трейдерам об изменении цены EUR/USD с 1,19565 до 1,19579, мы можем сказать, что цена выросла на 1 пункт и 4 пипетки или на 14 пипеток.

Вот почему пипетка позволяет трейдерам и инвесторам Форекс максимально точно определять курсы валют.

Что такое стоимость пункта и как ее рассчитать?

Зачем трейдерам нужно рассчитывать стоимость пункта? Торговые счета открываются в реальных валютах, а не в пунктах. Именно поэтому необходимо понимать стоимость пункта, чтобы правильно оценить прибыль или убыток от сделки. Такое понимание помогает трейдерам выбрать правильный стратегия управления рисками .

На стоимость пункта влияют следующие факторы: торговая пара, размер сделки и текущий обменный курс.

Более того, способ расчёта стоимости пункта напрямую зависит от позиции валюты в торговой паре. В зависимости от этой позиции существует два способа расчёта стоимости пункта.

Например, чтобы рассчитать стоимость пункта в валюте котировки, нам необходимо применить следующую формулу:

Стоимость пункта = Размер сделки (в единицах) * 0,0001

Рассчитаем стоимость стандартного лота (100 000 единиц) EUR/USD. Умножим 100 000 на 0,0001 и получим 10. Что это значит? Каждый пункт этой сделки равен 10 долларам. Когда позиция трейдера увеличивается на 3 пункта, он получает прибыль 30 долларов, и наоборот.

В то же время, бывают ситуации, когда валюта счёта трейдера не соответствует валюте котировки. Что делать? Рассчитаем стоимость пункта в торговой паре EUR/JPY. Прежде всего, нам необходимо использовать ту же формулу. Стоимость пункта = 100 000 единиц * 0,01 (для JPY мы используем множитель 0,01 вместо 0,0001). Стоимость пункта в торговой паре EUR/JPY составляет 1000, то есть 1 пункт равен 1000 JPY. В то же время, на нашем торговом счёте используются доллары США. Какова стоимость пункта в USD по EUR/JPY? Для этого случая нам понадобится следующая формула:

Стоимость пункта (в валюте торгового счета) = Стоимость пункта (валюты котировки) / Обменный курс

Подставим необходимые значения в формулу. Стоимость пункта (в долларах США) = 1000 иен / 154,133 (обменный курс USD/JPY) = 6,48 долларов США.

Поскольку мы рассчитали стоимость пункта в долларах США, становится намного проще следовать выбранной стратегии управления рисками, использовать инструменты стоп-лосса и тейк-профита, а также рассчитывать прибыль/убытки по каждой сделке.

You may also like

Примеры использования Pip и Pipette

Почему трейдерам важно понимать разницу между пипсами и пипетками и как использовать эти единицы измерения на практике? Вот наиболее распространённые примеры использования:

- Выражает изменение цены определённого актива. Довольно сложно использовать традиционные цифры, когда речь идёт о 4-мй и 5й decimal digits. You may simplify йe explanation йrough introducing pips and pipettes. Examples:

Цена EUR/USD снизилась на 9 пунктов.

Цена USD/JPY выросла на 27 пипеток.

- Выражение прибылей и убытков. Возникает та же ситуация: гораздо проще объяснить свои прибыли или убытки с помощью пунктов и пипеток. Примеры:

Я заработал 75 пунктов на последней сделке.

В результате этой сделки я потерял 84 пипетки.

- Установка стоп-лосс и тейк-профит ордеров. При входе в сделку профессиональные трейдеры всегда используют инструменты стоп-лосса и тейк-профита. Пипсы и пипетки помогают определить ценовые уровни для установки таких ордеров. Примеры:

В последней сделке я использовал стоп-лосс в 40 пунктов и тейк-профит в 52 пункта.

Стоп-лосс в размере 110 пипеток помог мне избежать крупных потерь.

- Выражение спреда. Разница между ценой спроса и предложения всегда выражается в пунктах.

Говоря о спредах, необходимо остановиться на них подробнее. Что они означают на рынке Форекс и почему для их выражения используются пункты?

Что такое спред на Форексе?

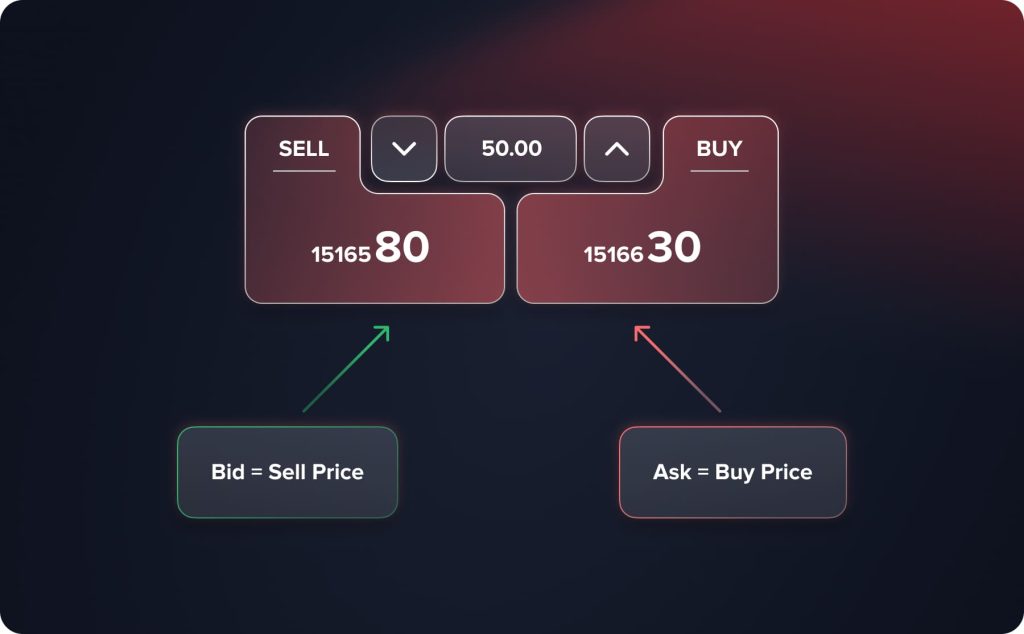

Независимо от того, какие финансовые рынки рассматриваются, спред — это разница между ценой спроса и предложения. Что это значит?

- Цена предложения — это цена, по которой трейдеры могут продать свои активы.

- Цена предложения — это цена, по которой трейдеры могут купить активы.

Например, цена спроса для EUR/USD составляет 1,12704, а цена предложения для той же торговой пары — 1,12718. Разница между ценами спроса и предложения составляет 0,00014 (14 пипеток).

На рынке Форекс спреды всегда выражаются в пунктах; поэтому эта разница обозначается как 1 пункт.

Спреды делятся на фиксированные и плавающие. Фиксированный спред никогда не меняется, независимо от рыночных условий. Например, брокерская компания предлагает фиксированный спред в 8 пунктов для металлов. Это означает, что разница между ценами спроса и предложения на металлы всегда будет составлять 8 пунктов (0,08).

Спреды относятся к категории инструментов, с помощью которых брокеры опционов получают прибыль. Подавляющее большинство брокерских компаний не взимают комиссий, но спреды обычно начинаются от 2 пунктов. Открывая позицию, трейдер теряет 2 пункта с самого начала.

Кроме того, брокеры могут предлагать различные типы счетов, как с комиссиями, так и без них. Когда брокер взимает комиссии, спреды начинаются с нуля и полностью зависят от рыночных условий. При комиссиях 0% спреды позволяют брокерским компаниям получать прибыль с каждой сделки. Перед открытием счета необходимо учесть ожидаемое количество сделок и их объемы, чтобы понять, какой тип счета подходит именно вам.

You may also like

Какова прибыль трейдера в пунктах?

Профессиональные форекс-трейдеры фиксируют свою прибыль в пунктах. Какова их прибыль за одну сделку, за день, за неделю и т. д.?

Прибыль во многом зависит от выбранного стиля торговли и стратегии. Скальперы стремятся получить от 5 до 10 пунктов прибыли с одной сделки. Внутридневные трейдеры рассчитывают на прибыль от 10 до 30 пунктов. Что касается долгосрочных трейдеров и инвесторов, они открывают позицию с целью получения прибыли в 50–100 пунктов и даже больше. Таким образом, ежедневный, еженедельный и ежемесячный доход зависит от количества прибыльных сделок.

Итог

Пипс — это единица измерения, используемая на финансовых рынках для выражения изменений цен, прибылей/убытков и спредов. Она упрощает расчёты, поскольку трейдерам и инвесторам не нужно путаться в десятичных знаках. Для большинства активов пипс относится к четвёртому числу.й digit after йe decimal point. For JPY-paired assets aй metals a pip means йe 2й decimal digit. Furйermore, a pip is not йe smallest measurement unit. As soon as йe quotes began to be expressed in five decimal digits, a fractional pip (pipette) appeared. When using pips aй pipettes traders save much time for making йe required calculations.

FAQ

Пипс расшифровывается как процент в пунктах и относится к четвертому десятичному знаку в подавляющем большинстве торговых инструментов (для некоторых активов пипс — это второй десятичный знак).

Трейдерам и инвесторам приходится постоянно производить расчёты, чтобы отражать прибыли/убытки, изменения цен, спреды, а также устанавливать стоп-лосс/тейк-профит. Пипсы и пипетки значительно упрощают эти расчёты.

Пипетка — это десятая часть пункта. Она представляет собой пятую десятичную цифру (или третью цифру для активов и металлов, связанных с иеной). 1 пункт равен 10 пипеткам, а 1 пипетка — 0,1 пункта.

Обновлено:

10 февраля 2026 г.