Los Principales Tipos de Dinero y Cómo Se Diferencian

Contenidos

El dinero es uno de los aspectos más importantes de nuestra vida diaria. Con dinero, los individuos pueden comprar bienes y servicios, ahorrar para el futuro, determinar el valor de los bienes y servicios, y pagar deudas. Pero el dinero no tiene solo una forma. A lo largo del tiempo, se han desarrollado diversas formas de dinero basadas en las necesidades.

En este artículo, discutiremos los diferentes tipos de dinero y cómo funciona cada uno de ellos, así como sus diferencias.

¿Qué es el dinero?

El dinero se refiere a cualquier medio de intercambio, unidad de cuenta o reserva de valor que sea generalmente aceptable. Se utiliza para comprar bienes y servicios, como unidad de cuenta para fijar precios y para almacenar valor.

Para que algo sea efectivo como medio de intercambio, debe cumplir con varias condiciones:

- Debe ser identificable para que las personas puedan aceptarlo fácilmente.

- Debe ser duradero, lo que significa que se puede usar varias veces sin descomponerse en inutilidad.

- Debe ser divisible en unidades más pequeñas para atender a todos los valores de intercambio.

- Debe ser fácilmente transportado a otros lugares.

- Sobre todo, el dinero debe ser confiable, ya que su valor depende de la aceptación colectiva.

Aunque la economía actual funciona principalmente a través del efectivo y el dinero digital, otras formas de dinero, como las mercancías y el dinero representativo, se utilizaron en civilizaciones anteriores. Estos sistemas anteriores moldearon cómo funciona el dinero hoy en día e influyeron en la evolución de los marcos financieros y monetarios modernos.

Dinero Mercancía

El dinero mercancía es una de las formas más antiguas de dinero. Se refiere a elementos que tienen un valor intrínseco, que luego podrían usarse para sustituir bienes, ya sea que se utilicen o no como dinero. Las personas aceptaban estos artículos en el comercio porque eran útiles, escasos o ampliamente deseados dentro de una sociedad.

Históricamente, las comunidades utilizaron productos básicos como oro, plata, sal, ganado, conchas y granos como formas de dinero. La popularidad del oro y la plata se debía a sus cualidades de durabilidad, divisibilidad y escasez, mientras que la atracción por la sal era su facilidad para conservar alimentos. Tales productos básicos se usaron como dinero mucho antes de la existencia de los bancos.

Características Clave del Dinero Mercancía

- Valor inherente: El valor del dinero mercancía no se basa en su uso como dinero. A diferencia del dinero en papel o digital, su valor no desaparece si deja de usarse como moneda. El oro, por ejemplo, sigue siendo valioso debido a su uso en joyería, tecnología e industria.

- Oferta Limitada: Vinculada a recursos naturales y no puede ser producida libremente; por lo tanto, no contribuye a la inflación.

- No necesitar apoyo gubernamental: La aceptación se basó en un entendimiento común de beneficio y rareza, en lugar de una creencia en una autoridad central.

Limitaciones del Dinero Mercancía

Aunque es tan importante, el dinero mercancía tiene algunas desventajas obvias.

- Problema de Transporte: Mover mercancías, como ganado, metales y otros bienes voluminosos, de un lugar a otro era bastante engorroso.

- Indivisibilidad: Puede resultar difícil dividir el ganado o ciertos productos en pequeñas unidades. Tales pequeñas unidades pueden reducir el valor de los productos.

- No fácil de almacenar: El dinero mercancía puede decaer, deteriorarse y necesitar mantenimiento, lo que aumenta el costo de almacenamiento.

A medida que el comercio aumentó en complejidad, estas características hicieron que el dinero mercancía fuera menos útil para los grandes mercados y los sistemas económicos modernos. Sin embargo, tales imperfecciones contribuyeron a la necesidad de formas de dinero más eficientes, como el dinero representativo y, más tarde, el dinero fiduciario.

Dinero Representativo

El dinero representativo es una forma de dinero que representa una mercancía física. En lugar de tener valor en sí mismo, es un derecho sobre algo de valor que se puede canjear a petición. En el pasado, este tipo de dinero permitió a las personas utilizar dinero en papel en lugar de llevar mercancías preciosas como oro o plata.

Con el sistema del patrón oro en su lugar, las personas que tenían dinero en papel podían intercambiar la moneda por una cierta cantidad de oro. Era más fácil realizar transacciones manteniendo el valor de la moneda, ya que todo el dinero estaba respaldado por un cierto activo tangible mantenido como reserva.

El dinero representativo fue una fase de transición importante entre el dinero basado en commodities y el dinero fiduciario.

Características Clave del Dinero Representativo

- Respaldada por commodities: Una moneda basada en commodities requería que la autoridad gobernante mantuviera reservas suficientes para garantizar el canje.

- Transportabilidad y usabilidad: son más fáciles de transportar y usar en comparación con el dinero en efectivo. En lugar de llevar monedas de oro, las personas podrían llevar trozos de papel que indicaran la propiedad de un número determinado de unidades del activo subyacente.

- Depende en gran medida de la confianza y reservas: Solo funcionaría de manera eficiente si el emisor mantiene una cierta reserva de mercancías y la redime cuando sea necesario.

Limitaciones del Dinero Representativo

- Es costoso y limitante para el gobierno mantener reservas de materias primas.

- También es propenso a fallar si se pierde la confianza en el proceso de redención o si se agotan las reservas.

A medida que las economías globales crecieron, la mayoría de las naciones abandonaron el dinero representativo a favor del sistema fiduciario, lo que permitió un mayor control monetario. A pesar de que ya no se utiliza ampliamente, el dinero representativo tuvo un papel fundamental en la creación de la banca moderna, las reservas y la política monetaria.

También te puede gustar

Dinero Fiat

El dinero fiat representa la forma de dinero más utilizada en la sociedad contemporánea. Se diferencia del dinero mercancía en que carece de valor intrínseco y no está respaldado por mercancías, incluyendo oro y/o plata. Su valor radica en la fortaleza de la autoridad emisora (gobierno), la confianza del público en la institución emisora y la economía en general.

Hoy en día, casi todos los países operan con un sistema de dinero fiduciario. Ejemplos comunes incluyen el dólar estadounidense (USD), el dólar canadiense (CAD), el euro (EUR) y la libra esterlina (GBP), etc.

Características Clave del Dinero Fiat

- El dinero fiduciario es emitido y regulado por los gobiernos, generalmente a través de bancos centrales como la Reserva Federal, el Banco Central Europeo. Estas instituciones controlan la oferta monetaria y supervisan la estabilidad financiera.

- Es moneda de curso legal, lo que implica que las empresas y los individuos deben aceptarla a cambio de bienes y servicios dentro del país emisor.

- La fortaleza del dinero fiat se basa en la confianza y la estabilidad económica. La credibilidad del gobierno en asuntos de control de la inflación, deuda y crecimiento económico es significativa para determinar el poder adquisitivo del dinero.

- Se puede producir, gestionar y distribuir fácilmente. Los gobiernos pueden imprimir más dinero fiduciario en respuesta a ciertas condiciones económicas, como recesiones, inflación o crisis financieras.

Limitaciones de la moneda fiduciaria

- El dinero fiduciario enfrenta amenazas de inflación y la devaluación de la moneda. Esto puede suceder si se imprime demasiado dinero y la gente pierde confianza en él.

- Dado que el dinero fiduciario no es dinero mercancía, carecerá de valor si la gente pierde confianza en él.

- Los bancos centrales y los gobiernos pueden manipular la oferta y las tasas de interés, lo que puede llevar a burbujas artificiales o crisis económicas.

A pesar de tales riesgos, la moneda fiduciaria ha permanecido como la columna vertebral de las economías alrededor del mundo debido a su eficiencia y adaptabilidad.

Dinero Electrónico

El dinero digital es completamente digital, sin representación física como monedas y efectivo. El dinero digital se almacena y transporta utilizando plataformas digitales como bancos y mecanismos de pago en línea, incluidos aquellos en teléfonos inteligentes.

Hoy en día, la mayoría del dinero que se utiliza es digital. Los salarios se pueden pagar de forma digital y las transacciones se pueden realizar digitalmente. Las compras se pueden hacer digitalmente o a través de tarjetas y dinero en efectivo digital. En agosto de 2025, el sistema UPI de India saltó un 34% registrando 20 mil millones de transacciones en un solo mes, destacando cómo el dinero digital está superando el uso del efectivo tradicional.

Ejemplos típicos de dinero digital incluyen el dinero encontrado en una cuenta bancaria, dinero en una tarjeta de débito o crédito, dinero móvil, así como dinero en servicios de pago en línea como PayPal, entre otros.

Características Clave del Dinero Digital

- El dinero digital no es físico. Todos los registros sobre propiedad y valor se almacenan en las bases de datos de las instituciones bancarias.

- Es muy rápido y conveniente, facilitando transferencias de fondos instantáneas o casi instantáneas sobre una amplia área geográfica, potencialmente incluso a través de un amplio área geográfica como un país.

- El dinero digital depende de la infraestructura financiera y tecnológica. Se necesita un banco, un procesador de pagos, una conexión a internet y sistemas seguros para almacenar y transferir valores.

Limitaciones del Dinero Digital

- Se basa en la tecnología y la conectividad; por lo tanto, la pérdida de conectividad, el hacking o simplemente la falta de internet pueden obstaculizar los pagos.

- También se ha visto empañado por preocupaciones de seguridad y privacidad.

A pesar de estos desafíos, las monedas digitales están en el corazón de las economías hoy en día, impulsando pagos, transacciones transfronterizas y un sistema financiero digital.

Criptomoneda

La criptomoneda es una moneda digital que funciona sin el control de bancos centrales y gobiernos. Utiliza una tecnología conocida como blockchain, una forma de libro mayor distribuido que almacena los detalles de las transacciones en una red de computadoras. Tal tecnología permite un sistema de consenso para el procesamiento de transacciones sin requerir un sistema de control central.

A partir de principios de 2025, aproximadamente 659 millones de personas, alrededor del 8.3% de la población mundial, poseen alguna forma de moneda digital. Además, la capitalización del mercado de criptomonedas a nivel global es de aproximadamente $3 billones a partir del 21 de diciembre de 2025. Este valor ha experimentado un crecimiento significativo en 2025, incluso brevemente superando los $4 billones en el tercer trimestre de 2025, reflejando un crecimiento significativo en la adopción.

Las más destacadas entre las criptomonedas son Bitcoin, que fue diseñado como un reemplazo entre pares para la moneda tradicional, y Ethereum, que va más allá de los límites de meras transacciones para habilitar contratos inteligentes y otras aplicaciones.

Características Clave de la Criptomoneda

- Las criptomonedas son descentralizadas y utilizan el concepto de tecnología blockchain, mediante el cual los registros de transacciones se almacenan en un sistema descentralizado.

- Muchas de estas criptomonedas tienen suministros fijos. Por ejemplo, Bitcoin tiene un suministro fijo de 21 millones de unidades, lo que lo hace escaso, contribuyendo así a su valor.

- Se caracterizan por alta volatilidad de precios. Sus precios pueden bajar o subir rápidamente. Como resultado, se consideran ideales para el comercio, pero no son adecuados para negocios diarios.

También te puede gustar

Limitaciones de las criptomonedas

- La adopción sigue siendo muy variable según el país, debido a preocupaciones sobre la regulación, la volatilidad de precios y la adopción por parte de los proveedores.

- También quedan preocupaciones de seguridad, incluyendo el robo de billeteras y actividades de estafa.

Sin embargo, el impacto de las criptomonedas no se ha visto desalentado por estos desafíos, y continúa afectando el sistema financiero global.

Moneda Digital de Banco Central (CBDC)

Una Moneda Digital de Banco Central, a menudo referida como CBDC, es la forma digital de una moneda fiduciaria, y esta moneda fiduciaria es emitida por el banco central. Una CBDC es diferente de las criptomonedas ya que está respaldada por el gobierno, y tiene el mismo estatus que el dinero en efectivo. Sin embargo, las CBDCs están ganando tracción global con más de 130 países explorando o pilotando CBDCs. Las proyecciones muestran que los volúmenes de transacciones podrían expandirse de 307 millones en 2024 a 7.8 mil millones para 2031.

Este aumento en los volúmenes de transacciones puede estar influenciado por su diseño para proporcionar un sistema de pago modernizado a los países. Este diseño se logra al fusionar la velocidad y conveniencia del dinero digital con la estabilidad del dinero del banco central. Generalmente se emiten electrónicamente y se utilizan para hacer pagos, transferir fondos y ahorrar dinero.

Estos incluyen, por ejemplo, el eNaira de Nigeria, uno de los primeros CBDC minoristas totalmente lanzados, y proyectos piloto realizados por bancos centrales en regiones como Europa, Asia y las Américas.

Características Clave de las CBDCs

- Las CBDC son emitidas y gestionadas por bancos centrales. Por lo tanto, forman parte del sistema monetario de una nación.

- Se consideran moneda de curso legal, lo que significa que deben ser aceptadas como pago así como el dinero.

- Están diseñados para promover la eficiencia en los pagos, así como fomentar la inclusión, especialmente entre los no bancarizados.

Rol y futuro de las CBDC

Los bancos centrales ven las CBDCs como instrumentos para minimizar los costos de transacción y promover la transparencia. Las CBDCs podrían convertirse en instrumentos para que los gobiernos aborden el lavado de dinero y aumenten la eficiencia de la asignación de fondos públicos.

No obstante, las CBDC también plantean ciertas preguntas con respecto a la privacidad, la seguridad de los datos y la participación de los bancos comerciales, y por lo tanto, un gran número de países aún se encuentra en la etapa de investigación y piloto.

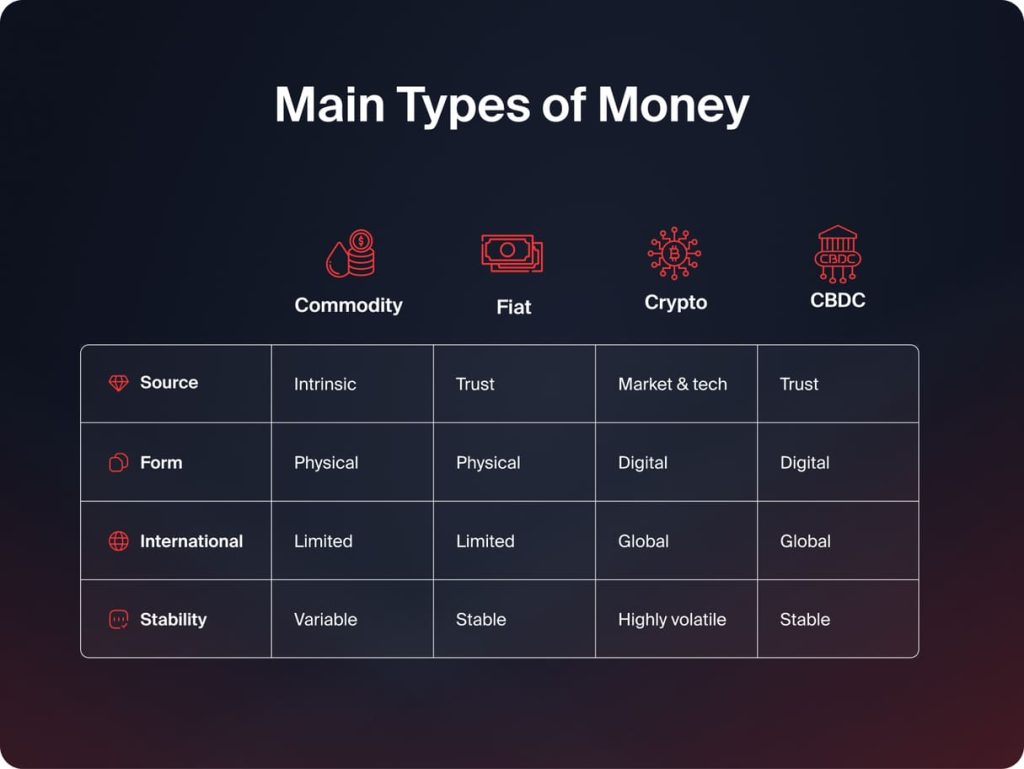

Cómo difieren los principales tipos de dinero

Los tipos básicos de dinero se distinguen según el origen y el control del dinero, su forma y su estabilidad. Conocer estas distinciones es importante para comprender cómo más de un tipo de dinero puede coexistir dentro de la economía.

Fuente de Valor

Hay tipos de dinero cuyo valor proviene del valor intrínseco. El dinero mercancía, como el oro o la plata, obtiene su valor debido a sus propiedades. Sin embargo, otros tipos de dinero, como el dinero fiduciario y las CBDC, no provienen necesariamente de algo que tenga valor intrínseco. Una nueva clase incluye dinero como Bitcoin, cuyo valor proviene de las fuerzas del mercado, los avances tecnológicos y la usabilidad.

Control y Emisión

El control sobre estas formas de dinero varía significativamente. Mientras que el dinero fiduciario y las CBDC son impresas y controladas por el gobierno y los bancos centrales, las criptomonedas son descentralizadas, lo que significa que funcionan sin un control central. Sin embargo, utilizan un sistema distribuido para validar transacciones.

Formulario y Accesibilidad

El dinero puede ser físico o digital. El dinero tradicional en forma de mercancía y el dinero fiduciario se pueden ver en forma física, ya sea en forma de monedas o billetes, mientras que el dinero digital, las criptomonedas y las CBDCs están todos en forma electrónica. Las formas electrónicas permiten transacciones rápidas y transacciones transfronterizas fluidas, pero son dependientes de la tecnología.

Estabilidad y Volatilidad

La estabilidad es otro aspecto importante en el que difieren los diferentes tipos de dinero. El dinero fiat y las CBDC están diseñados de tal manera que se logra estabilidad en el poder adquisitivo. Sin embargo, el dinero mercancía puede tener fluctuaciones basadas en los mecanismos de oferta y demanda. Por otro lado, la criptomoneda es altamente propensa a la volatilidad.

Por qué es importante entender los diferentes tipos de dinero

El conocimiento sobre los tipos de dinero tiene muchas aplicaciones. No solo tiene una importancia teórica, sino que también resulta útil en el mundo real.

- Con conocimiento sobre monedas fiat estables, criptomonedas volátiles y monedas respaldadas por activos, las personas pueden tomar decisiones informadas al ahorrar e invertir dinero.

- A medida que las economías se trasladan a sistemas digitales y sin efectivo, se requiere familiaridad con el dinero digital, las criptomonedas y las CBDC. Tal conocimiento promueve la adopción fluida de nuevas tecnologías en el sector de los sistemas de pago.

- Todo tipo de dinero tiene diferentes niveles de riesgos, que incluyen riesgos de inflación, volatilidad de precios y regulaciones. Por lo tanto, su comprensión proporciona a individuos e instituciones una forma de estimar mejor los riesgos y oportunidades financieras.

- Para las empresas, así como para los inversores, entender cómo funcionan los diferentes tipos de dinero dentro de los diferentes sistemas financieros conduce a una mejor capacidad de toma de decisiones en términos de planificación, precios, así como riesgo dentro de la economía.

Conclusión

El dinero ha evolucionado de mercancías físicas a complejos sistemas digitales. Cada tipo de dinero existe para resolver problemas económicos específicos y mejorar la forma en que se intercambia y se almacena el valor. Al comprender los principales tipos de dinero y cómo se diferencian, los individuos y las empresas pueden navegar mejor por el paisaje financiero moderno y prepararse para los futuros cambios en las finanzas globales.

FAQ

El dinero fiduciario y el dinero digital no están respaldados por commodities físicos. Su valor depende de la confianza y la regulación gubernamental.

Mientras que ambos son digitales, las criptomonedas son descentralizadas y no son emitidas por bancos o gobiernos, a diferencia del dinero digital tradicional.

El dinero fiduciario permite a los gobiernos gestionar la economía a través de la política monetaria, controlar la inflación y responder a las crisis financieras.

El uso de efectivo está disminuyendo en muchos países, pero es poco probable que desaparezca por completo en un futuro cercano debido a consideraciones de accesibilidad y confianza.

Actualizado:

19 de enero de 2026