Полное руководство по скальпингу, дневной торговле, свинг-трейдингу и позиционной торговле

В статье

Когда дело доходит до торговые стратегии Понимание различий между скальпингом, дейтрейдингом, свинг-трейдингом и позиционной торговлей крайне важно для любого трейдера, стремящегося усовершенствовать свой подход. Каждая стратегия обладает уникальными характеристиками, таймфреймами и профилями риска, подходящими для разных трейдеров. В этой статье подробно рассматриваются эти стили торговли с их детальным сравнением, которое поможет вам выбрать метод, наилучшим образом соответствующий вашим торговым целям.

Скальпинг

Скальпинг — это высокочастотная торговая стратегия, предполагающая совершение множества сделок в день для захвата небольших ценовых колебаний. Скальперы стремятся быстро получить прибыль от этих незначительных колебаний, часто удерживая позиции в течение нескольких секунд или минут. Этот подход требует внимательного наблюдения за рынком и способности быстро принимать решения.

Характеристики

- Временные рамки: от секунд до минут.

- Цель: зафиксировать небольшие изменения цен.

- Уровень риска: Высокий из-за частых сделок.

- Необходимые инструменты: платформа для быстрого исполнения, данные в реальном времени и инструменты технического анализа.

Скальпинг требует высокой концентрации и быстрой реакции, что делает его подходящим для трейдеров, которые могут посвятить значительное время мониторингу рынков. Главное преимущество — возможность заключения множества прибыльных сделок, хотя транзакционные издержки и необходимость постоянного присутствия на рынке могут быть сложными.

Реализация стратегии

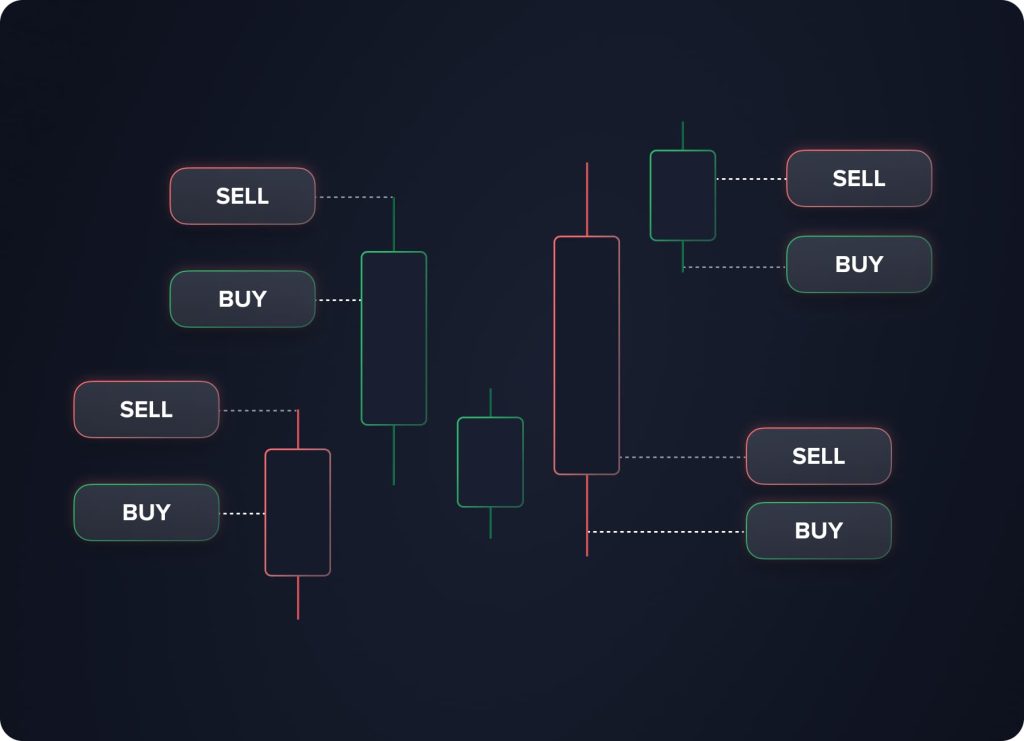

Скальперы полагаются на технический анализ, а не на фундаментальный. Они используют такие инструменты, как скользящие средние, полосы Боллинджера и стохастические осцилляторы, для определения точек входа и выхода. Успешный скальпинг также подразумевает распознавание и использование краткосрочных рыночных неэффективностей. Это требует глубокого понимания графических моделей и рыночных трендов, а также способности… интерпретировать технические индикаторы быстро и точно.

Скорость и технологии

Учитывая стремительный темп скальпинга, наличие платформы с быстрым исполнением ордеров имеет решающее значение. Задержки в исполнении ордеров могут превратить потенциально прибыльную сделку в убыточную. Скальперы часто используют прямой доступ к рынку (DMA) Брокерам сократить задержки и обеспечить быстрое исполнение сделок. Передовые торговые платформы с подключением с низкой задержкой и потоками данных в режиме реального времени необходимы для получения преимущества на рынке. Использование программного обеспечения для автоматизированной торговли может дополнительно повысить скорость и точность исполнения сделок.

Управление рисками

Хотя скальпинг может приносить высокую прибыль, он также сопряжен со значительным риском. Скальперы используют жесткие стоп-лоссы для ограничения потенциальных убытков. Высокий объем торгов означает, что даже небольшие убытки могут быстро накапливаться, поэтому крайне важно поддерживать дисциплину в управлении рисками. Эффективное управление рисками также подразумевает постановку и соблюдение заранее определенных целей по прибыли, тем самым сводя к минимуму эмоциональное принятие решений во время торговли.

Рыночные условия

Скальпинг наиболее эффективен на рынках с высокой ликвидностью и волатильностью. Рынки Форекс особенно подходят для скальпинга благодаря большим объёмам торгов и частым колебаниям цен. Трейдерам необходимо быть в курсе рыночной ситуации и новостных событий, которые могут привести к резким изменениям цен. Отслеживание экономических календарей и новостных лент помогает скальперам предвидеть события, влияющие на движение рынка, и соответствующим образом корректировать свои стратегии.

Расходы и сборы

Частая торговля может привести к значительным транзакционным издержкам. Скальперам необходимо учитывать брокерские сборы, спреды и комиссии. Выбор брокера с конкурентоспособными ценами крайне важен для максимизации чистой прибыли. Кроме того, понимание влияния проскальзывания и применение стратегий для его минимизации может помочь сохранить прибыльность. Благодаря высоким объёмам торговли скальперы часто договариваются с брокерами о более низких комиссиях.

You may also like

Психологические факторы

Скальпинг требует особого настроя. Трейдеры должны уметь справляться со стрессом, связанным с быстрым принятием решений и управлением несколькими сделками одновременно. Эмоциональный контроль и дисциплина критически важны, чтобы избежать чрезмерной торговли или импульсивной реакции на рыночные движения. Скальперам необходимо выработать четкий график работы с регулярными перерывами, чтобы избежать выгорания и поддерживать максимальную эффективность.

Типичные рыночные сценарии

Скальпинг можно применять в различных рыночных условиях, но определённые настройки более благоприятны. Например, в периоды низкой волатильности скальперы могут использовать узкие торговые диапазоны, многократно покупая на уровнях поддержки и продавая на уровнях сопротивления. И наоборот, скальперы могут извлекать выгоду из быстрых ценовых движений в периоды высокой волатильности, быстро входя и выходя из сделок. Понимание нюансов различных фаз рынка и соответствующая адаптация стратегий имеют решающее значение для успеха.

Скальпинг может стать прибыльной торговой стратегией для тех, кто освоил её тонкости и готов соответствовать высоким требованиям, предъявляемым к времени, технологиям и психологической устойчивости. Для успеха в скальпинге важно постоянно совершенствовать стратегии, быть в курсе рыночной ситуации и придерживаться дисциплинированного управления рисками.

Дневная торговля

Дневная торговля Предполагает покупку и продажу финансовых инструментов в течение одного дня, обеспечивая закрытие всех позиций до закрытия рынка. Эта стратегия позволяет избежать риска переноса позиций на следующий день и использовать преимущества дневных колебаний цен.

Характеристики

- Временные рамки: внутри дня, обычно от нескольких минут до нескольких часов.

- Цель: получение прибыли от внутридневных колебаний цен.

- Уровень риска: от умеренного до высокого, в зависимости от волатильности рынка.

- Необходимые инструменты: современное программное обеспечение для построения графиков, новостные ленты и сканеры рынка.

Внутридневные трейдеры активно используют технический анализ, рыночные данные в режиме реального времени и новостные обновления для принятия обоснованных решений. Эта стратегия требует значительного времени и внимания в течение всего дня, но обеспечивает гибкость, позволяя избегать рисков переноса позиций на следующий день.

You may also like

Реализация стратегии

Внутридневные трейдеры фокусируются на внутридневных колебаниях цен и используют различные инструменты технического анализа для выявления потенциальных торговых возможностей. Ключевые индикаторы включают скользящие средние, индекс относительной силы (RSI) и полосы Боллинджера. Эти инструменты помогают трейдерам точно определять точки входа и выхода, анализируя закономерности и тренды внутри дня. Кроме того, свечные паттерны, такие как «доджи», «молот» и «поглощение», часто используются для прогнозирования направления и разворота рынка.

Скорость и технологии

Быстрая и надежная торговая платформа крайне важна для дейтрейдинга. Трейдерам необходимы данные в режиме реального времени и высокая скорость исполнения, чтобы извлекать выгоду из краткосрочных рыночных колебаний. Высокочастотные торговые системы и алгоритмические торговые инструменты часто используются для автоматизации торговли на основе заранее заданных критериев. Дэйтрейдеры также получают выгоду от платформ DMA, которые обеспечивают более высокую ликвидность и более быстрое исполнение ордеров благодаря прямому подключению к биржам.

Управление рисками

Внутридневная торговля сопряжена со значительным риском из-за высоких темпов торгов и потенциальной возможности существенных колебаний цен. Эффективные стратегии управления рисками имеют решающее значение, включая установку стоп-лоссов и уровней тейк-профита для защиты от неблагоприятных рыночных колебаний. Трейдеры часто используют соотношение риска и прибыли для оценки потенциальных сделок, стремясь найти такие сетапы, где потенциальная прибыль перевешивает риск. Размер позиции, при котором трейдеры определяют размер каждой сделки на основе допустимого уровня риска, является ещё одним важным аспектом управления рисками.

Рыночные условия

Внутридневная торговля наиболее эффективна на волатильных рынках с частыми и значительными колебаниями цен. Трейдерам необходимо быть в курсе рыночной ситуации и экономических событий, которые могут спровоцировать колебания цен. Отслеживание экономических календарей на предмет таких объявлений, как отчёты по ВВП, решения по процентным ставкам и данные по занятости, помогает трейдерам предвидеть и реагировать на новости, влияющие на движение рынка. Анализ рыночных настроений через новостные ленты и социальные сети также может дать ценную информацию.

Расходы и сборы

Частая торговля может привести к высоким транзакционным издержкам, включая комиссии, спреды и биржевые сборы. Внутридневным трейдерам следует выбирать брокеров с конкурентоспособными ценами, чтобы максимизировать прибыль. Кроме того, понимание влияния проскальзывания — разницы между ожидаемой и фактической ценой сделки — может помочь трейдерам контролировать издержки. Использование брокеров с низкой задержкой и узкими спредами может минимизировать влияние частых сделок на издержки.

Психологические факторы

Внутридневная торговля требует сильной умственной дисциплины и эмоционального контроля. Трейдеры должны уметь быстро принимать решения в стрессовых ситуациях и не позволять эмоциям управлять своими торговыми решениями. Разработка и соблюдение торгового плана помогут справиться со стрессом и уменьшить искушение отклониться от проверенных стратегий. Регулярные перерывы и сбалансированный график необходимы для поддержания концентрации и предотвращения выгорания. Также важно, чтобы внутридневные трейдеры умели адаптироваться, корректируя стратегии по мере изменения рыночных условий.

Типичные рыночные сценарии

Внутридневная торговля может применяться к различным финансовым инструментам, включая акции, Forex, сырьевые товары и криптовалюты. Каждый рынок предлагает уникальные возможности и сложности. Например, фондовый рынок может предоставлять возможности в период публикации отчётности, в то время как на валютные рынки могут влиять геополитические события и политика центральных банков. Понимание специфики динамики выбранного рынка крайне важно для успеха в внутридневной торговле. Определение периодов с высоким объёмом торгов, таких как часы открытия и закрытия основных фондовых бирж, также может открыть прибыльные возможности.

Внутридневная торговля может быть прибыльной для тех, кто освоил её тонкости и готов посвятить этому необходимое время и усилия. Успех в внутридневной торговле требует постоянного обучения, адаптации к рыночным условиям и применения дисциплинированных методов управления рисками.

Свинг-трейдинг

Свинг-трейдинг направлен на получение прибыли от колебаний цен в течение периода от нескольких дней до нескольких недель. Свинг-трейдеры отслеживают потенциальные колебания цен на рынке, открывая сделки на основе рыночных тенденций и удерживая позиции до ожидаемого изменения цены.

Характеристики

- Временные рамки: от нескольких дней до нескольких недель.

- Цель: получение краткосрочных и среднесрочных выгод.

- Уровень риска: умеренный, подвержен рискам в ночное время и в выходные дни.

- Необходимые инструменты: инструменты анализа тенденций, технические индикаторы и анализ экономических новостей.

Эта стратегия менее трудоёмка, чем внутридневная торговля, что делает её подходящей для трейдеров, которые не могут постоянно следить за рынком. Свинг-трейдинг требует хорошего понимания рыночных тенденций и терпения, чтобы удерживать позиции в условиях потенциальной краткосрочной волатильности.

Реализация стратегии

Свинг-трейдеры стремятся извлечь выгоду из рыночных колебаний, которые колеблются между максимумами и минимумами в рамках тренда. Они часто используют сочетание технического и фундаментального анализа для определения потенциальных точек входа и выхода. Ключевые инструменты включают скользящие средние, MACD (схождение-расхождение скользящих средних) и уровни коррекции Фибоначчи. Эти индикаторы помогают трейдерам определить направление и силу тренда, а также потенциальные точки разворота.

Скорость и технологии

Хотя свинг-трейдинг не требует высокой скорости исполнения, необходимой для скальпинга или дейтрейдинга, наличие надежной торговой платформы по-прежнему критически важно. Свинг-трейдеры получают выгоду от платформ, предлагающих продвинутые инструменты построения графиков, данные в режиме реального времени и возможности автоматической торговли. Автоматические оповещения и функции алгоритмической торговли помогают свинг-трейдерам использовать возможности, даже если они не следят за рынком активно. Такие платформы, как MetaTrader 4 (MT4), MetaTrader 5 (MT5) и TradingView, популярны среди свинг-трейдеров благодаря своим надежным аналитическим инструментам и удобным интерфейсам.

Управление рисками

Эффективное управление рисками критически важно для свинг-трейдинга. Трейдеры используют стоп-лосс ордера для ограничения потенциальных убытков и защиты своего капитала. Они также применяют методы управления размером позиции, чтобы гарантировать, что ни одна сделка не окажет существенного влияния на весь портфель. Устанавливая стоп-лосс ордера на стратегических уровнях, например, ниже уровней поддержки или выше уровней сопротивления, свинг-трейдеры могут управлять риском, предоставляя своим сделкам достаточно пространства для развития.

Рыночные условия

Свинг-трейдинг наиболее эффективен на трендовых рынках, где цены стабильно движутся в чётком направлении. Трейдерам необходимо быть в курсе рыночной ситуации и уметь определять, находится ли рынок в тренде, а не в диапазоне. Экономические новости, отчёты о прибылях и убытках и геополитические события могут влиять на рыночные тенденции, и свинг-трейдерам необходимо быть в курсе этих факторов. Они также отслеживают индикаторы настроений и объём, чтобы оценить силу тренда.

Расходы и сборы

Хотя свинг-трейдинг обычно сопряжен с меньшими транзакционными издержками, чем внутридневная торговля, трейдерам всё равно необходимо учитывать брокерские комиссии, спреды и потенциальные расходы на финансирование через ночь (свопы). Эти расходы могут накапливаться, особенно если позиции удерживаются в течение длительного времени. Важно выбрать брокера с конкурентоспособными комиссиями и понимать структуру затрат, связанных с удержанием позиций через ночь.

Психологические факторы

Свинг-трейдинг требует терпения и эмоциональной дисциплины. Трейдеры должны уметь выдерживать психологическое давление, возникающее при удержании позиций в условиях рыночных колебаний, и не поддаваться импульсивному реагированию на краткосрочные ценовые колебания. Разработка и соблюдение чёткого торгового плана поможет контролировать эмоции и сохранять стабильность. Свинг-трейдеры должны быть привержены своему анализу и избегать искушения пересматривать свои стратегии, основываясь на краткосрочном рыночном шуме.

Типичные рыночные сценарии

Свинг-трейдинг можно применять к различным финансовым инструментам, включая акции, Forex, сырьевые товары и криптовалюты. Каждый рынок обладает уникальными особенностями, и свинг-трейдеры должны понимать эти нюансы для эффективного применения своих стратегий. Например, на рынке Forex возможности могут открываться в период выхода важных экономических публикаций, в то время как на фондовых рынках могут формироваться благоприятные условия в период публикации отчётности или после важных новостных событий.

Свинг-трейдинг может быть прибыльным для тех, кто освоил его принципы и готов удерживать позиции в условиях краткосрочной волатильности. Успех в свинг-трейдинге требует постоянного обучения, адаптации к рыночным условиям и применения дисциплинированных методов управления рисками.

Позиционная торговля

Позиционная торговля — это долгосрочная стратегия, при которой трейдеры удерживают позиции неделями, месяцами или даже годами. Этот подход основан на фундаментальном анализе и убеждении, что цена актива будет существенно меняться в течение длительного периода.

Характеристики

- Временные рамки: от нескольких недель до нескольких лет.

- Цель: получение прибыли от долгосрочных ценовых тенденций.

- Уровень риска: более низкий краткосрочный риск, но более высокая подверженность изменениям рынка с течением времени.

- Необходимые инструменты: инструменты фундаментального анализа, макроэкономические индикаторы и финансовые новости.

Позиционная торговля идеально подходит для трейдеров, предпочитающих более невмешательский подход и готовых удерживать позиции даже при колебаниях рынка. Эта стратегия требует глубокого понимания основных факторов, определяющих рыночные тенденции, и терпения, необходимого для ожидания существенных ценовых движений.

Реализация стратегии

Позиционные трейдеры фокусируются на долгосрочных тенденциях и обычно используют фундаментальный анализ для оценки внутренней стоимости актива. Это включает в себя изучение экономических показателей, финансовой отчетности, состояния отрасли и геополитических событий. Ключевые инструменты включают отчёты о прибылях и убытках, темпы роста ВВП, тенденции процентных ставок и данные об инфляции. Технический анализ также играет свою роль, но обычно используется для определения оптимальных точек входа и выхода в рамках более широкого тренда. Позиционные трейдеры часто анализируют недельные и месячные графики для определения значимых уровней поддержки и сопротивления.

Скорость и технологии

Хотя позиционная торговля не требует высокой скорости исполнения, как скальпинг или дейтрейдинг, она использует надежную технологию, предоставляющую комплексные рыночные данные и инструменты анализа. Позиционные трейдеры полагаются на платформы, предлагающие подробные исторические данные, передовые инструменты построения графиков и доступ к финансовым новостям и отчетам. Автоматические оповещения о важных рыночных событиях и экономических новостях также могут быть полезны. Такие платформы, как Bloomberg Terminal и Reuters Eikon, популярны среди позиционных трейдеров благодаря своим обширным исследовательским возможностям и потокам данных в режиме реального времени.

Управление рисками

Позиционная торговля предполагает управление долгосрочными рисками, включая значительные колебания рынка, вызванные экономическими изменениями или геополитическими событиями. Трейдеры используют стоп-лосс ордера для защиты своих инвестиций от существенных потерь и могут использовать трейлинг-стопы для фиксации прибыли при благоприятной рыночной динамике. Диверсификация — ещё одна ключевая стратегия управления рисками, предполагающая распределение инвестиций по различные активы или секторов для смягчения последствий неблагоприятных изменений в любой отдельной позиции. Регулярные обзоры портфелей помогают позиционным трейдерам корректировать свои активы в зависимости от меняющихся рыночных условий и новой информации.

Рыночные условия

Позиционная торговля наиболее эффективна на рынках, где долгосрочные тренды более предсказуемы и менее подвержены краткосрочной волатильности. Эта стратегия требует постоянного внимания к макроэкономическим факторам и глобальным событиям, которые могут влиять на рыночные тенденции. Позиционные трейдеры должны уметь интерпретировать экономические данные и понимать, как они влияют на их инвестиции. Мониторинг политики центральных банков, государственного регулирования и международных торговых соглашений имеет решающее значение для прогнозирования долгосрочных рыночных тенденций. Например, динамика процентных ставок или существенные изменения в политике крупнейших экономик могут существенно влиять на долгосрочную динамику цен.

Расходы и сборы

Позиционная торговля, как правило, сопряжена с более низкими транзакционными издержками, чем стратегии высокочастотной торговли. Однако трейдерам следует учитывать потенциальные расходы, такие как комиссии за управление, проценты по марже и налоги на долгосрочный прирост капитала. Важно выбирать брокеров, предлагающих конкурентоспособные комиссии и политику, соответствующую принципам долгосрочной торговли. Понимание налоговых последствий долгосрочного инвестирования, включая льготные налоговые ставки на долгосрочный прирост капитала, может помочь оптимизировать доходность. Кроме того, позиционным трейдерам следует учитывать возможные комиссии за обслуживание счета, связанные с длительным удержанием позиций.

Психологические факторы

Позиционная торговля требует высокого уровня терпения и эмоциональной дисциплины. Трейдеры должны уверенно удерживать позиции в периоды рыночной волатильности и не реагировать импульсивно на краткосрочные колебания рынка. Крайне важно разработать продуманную инвестиционную стратегию и придерживаться её, несмотря на рыночный шум. Позиционные трейдеры также должны быть готовы пересмотреть свои стратегии в случае значительного изменения основополагающих инвестиционных предположений. Долгосрочный подход и избегание искушения часто сверяться с рыночными ценами помогут снизить эмоциональный стресс.

Типичные рыночные сценарии

Позиционная торговля может применяться к различным финансовым инструментам, включая акции, облигации, сырьевые товары и валюту (Forex). Эта стратегия особенно эффективна для инвесторов, которые понимают свои рынки и умеют выявлять долгосрочные возможности роста. Позиционные трейдеры часто ищут активы с сильными фундаментальными показателями, например, компании со стабильным ростом прибыли, стабильным управлением и конкурентными преимуществами. На рынке Forex трейдеры могут сосредоточиться на валютах стран с сильными экономическими показателями и благоприятной разницей в процентных ставках.

Позиционная торговля может быть весьма прибыльной стратегией для тех, кто обладает терпением и дисциплиной, позволяющими удерживать позиции в долгосрочной перспективе. Успех в позиционной торговле требует глубокого понимания фундаментальных рыночных принципов, дисциплинированного управления рисками и постоянного отслеживания общих экономических тенденций.

Заключение

Каждая торговая стратегия — скальпинг, дейтрейдинг, свинг-трейдинг и позиционная торговля — имеет свои преимущества и сложности. Скальпинг и дейтрейдинг требуют постоянного взаимодействия с рынком и быстрого принятия решений, в то время как свинг-трейдинг и позиционная торговля предлагают большую гибкость, но требуют глубокого понимания рыночных тенденций и фундаментальных факторов. Вы можете выбрать стратегию, оптимальную для ваших потребностей, оценив свои временные затраты, готовность к риску и торговые цели. Понимание этих различий необходимо для разработки надежного торгового плана, учитывающего ваши индивидуальные предпочтения и перспективы рынка. Независимо от того, стремитесь ли вы к быстрой прибыли или долгосрочному росту, выбор правильного торгового стиля имеет решающее значение для достижения ваших финансовых целей.

Обновлено:

19 декабря 2024 г.