การแลกเปลี่ยน Crypto เทียบกับโบรกเกอร์: ความแตกต่างที่สำคัญสำหรับผู้ใช้และเจ้าของธุรกิจ

เนื้อหา

สกุลเงินดิจิทัลกำลังจะกลายเป็นสินทรัพย์ที่มีการซื้อขายมากที่สุดในโลก เนื่องจากความนิยมของสกุลเงินดิจิทัลกำลังเพิ่มขึ้นอย่างรวดเร็วทั้งในหมู่เทรดเดอร์และนักลงทุน เมื่อพูดถึงการเทรดสกุลเงินดิจิทัล ผู้ใช้มีสองทางเลือกให้เลือก ได้แก่ โบรกเกอร์คริปโตและตลาดแลกเปลี่ยนคริปโต ซึ่งทั้งสองทางเลือกนี้มีข้อดีและข้อเสียที่แตกต่างกัน นี่คือเหตุผลว่าทำไม ทางเลือกที่ดีที่สุดสำหรับเทรดเดอร์/นักลงทุนคริปโตและเจ้าของธุรกิจคืออะไร

ประเด็นสำคัญ:

- ความแตกต่างระหว่างโบรกเกอร์คริปโตและการแลกเปลี่ยนคริปโตคืออะไร?

- โซลูชันที่ดีที่สุดสำหรับผู้ซื้อขาย crypto คืออะไร?

- ตัวเลือกใดดีที่สุดสำหรับนักลงทุนคริปโต?

- วิธีที่ง่ายที่สุดสำหรับเจ้าของธุรกิจในการเข้าสู่ตลาดการซื้อขายคริปโตคืออะไร?

- การเปิดตัวการแลกเปลี่ยน crypto และบริษัทนายหน้า crypto: มีค่าใช้จ่ายเท่าไร?

ความแตกต่างที่สำคัญระหว่างโบรกเกอร์ Crypto และการแลกเปลี่ยน

เพื่อทำความเข้าใจความแตกต่างที่สำคัญระหว่างโบรกเกอร์คริปโตและการแลกเปลี่ยนคริปโต เราก็ต้องเข้าใจก่อนว่าแต่ละประเภทมีบทบาทอย่างไรและทำงานอย่างไร

บริษัทโบรกเกอร์ Crypto คืออะไร?

บริษัทนายหน้าซื้อขายคริปโตทำหน้าที่เสมือนตัวกลางระหว่างเทรดเดอร์คริปโตและตลาดคริปโต เทรดเดอร์ไม่ได้ซื้อหรือขายสกุลเงินดิจิทัลโดยตรง แต่สามารถเข้าถึงสัญญา CFD แทน

CFD (สัญญาซื้อขายส่วนต่าง) คือข้อตกลงระหว่างเทรดเดอร์และบริษัทนายหน้า เมื่อผู้ใช้ตัดสินใจปิดการซื้อขาย พวกเขาจะได้รับส่วนต่างหากราคาของสินทรัพย์อ้างอิงเคลื่อนไหวไปในทิศทางที่ถูกต้อง หรือจ่ายส่วนต่างหากราคาของสินทรัพย์อ้างอิงเคลื่อนไหวไปในทิศทางตรงกันข้าม

ลองมาเจาะลึกข้อตกลงนี้กันให้ลึกลงไปอีก ยกตัวอย่างเช่น เทรดเดอร์คนหนึ่งได้สมัครเข้าร่วมบริษัทโบรกเกอร์แห่งหนึ่ง และต้องการซื้อ ETH จำนวน 10 เหรียญ (ราคาเหรียญละ 2,700 ดอลลาร์) เขาจำเป็นต้องเข้าใจการเคลื่อนไหวของราคาที่เขาคาดการณ์ไว้ สมมติว่าเทรดเดอร์กำลังรอการเติบโตของสินทรัพย์ในอนาคตอันใกล้นี้

- เทรดเดอร์เปิดสถานะ Long มูลค่า 10 ETH ซึ่งหมายความว่าเขา "เกือบจะ" ซื้อมันไปแล้ว อันที่จริง เทรดเดอร์ไม่ได้รับโทเค็น Ethereum ใดๆ ในยอดคงเหลือของเขาเลย

- สัญญา CFD ยังคงเปิดอยู่จนกว่าผู้ซื้อขายจะตัดสินใจปิดสถานะ

- บริษัทนายหน้าจะเปรียบเทียบราคาปัจจุบันของสินทรัพย์อ้างอิงกับราคาในขณะที่เปิดสถานะ

- ตัวอย่างเช่น ราคาของ Ethereum อยู่ที่ 2,700 ดอลลาร์ต่อเหรียญ และปัจจุบันสินทรัพย์ถูกซื้อขายที่ 3,100 ดอลลาร์ เทรดเดอร์จะได้รับส่วนต่าง (400 ดอลลาร์ * 10 = 4,000 ดอลลาร์) จากยอดคงเหลือ เมื่อราคา Ethereum อยู่ที่ 2,500 ดอลลาร์ บริษัทนายหน้าจะรับส่วนต่าง (200 ดอลลาร์ * 10 = 2,000 ดอลลาร์) เป็นค่าตอบแทน

- กลไกการทำงานของการติดต่อ CFD นั้นเข้าใจได้ง่ายเป็นอย่างยิ่ง

นี่คือเหตุผลที่แพลตฟอร์มโบรกเกอร์คริปโตจึงเปิดการเข้าถึงแพลตฟอร์มการซื้อขายที่ผู้ซื้อขายสามารถเปิดสถานะซื้อและขาย ตรวจสอบราคาของคริปโตเคอร์เรนซีแบบเรียลไทม์ ใช้เครื่องมือวิเคราะห์ที่หลากหลาย ฯลฯ ในขณะเดียวกัน ผู้ซื้อขายไม่สามารถซื้อสินทรัพย์คริปโต "ทางกายภาพ" ได้ และสามารถถอนออก ขาย หรือโอนไปยังกระเป๋าเงินอื่นได้

Crypto Exchange คืออะไร?

ภายใต้คำว่า “การแลกเปลี่ยน crypto” ผู้ค้าจะเข้าใจถึงแพลตฟอร์มที่ช่วยให้ผู้ใช้สามารถซื้อและขายสกุลเงินดิจิทัล “ทางกายภาพ” ซึ่งหมายความว่าผู้ค้าจะได้รับเหรียญ/โทเค็นจำนวนหนึ่งในยอดคงเหลือของเขา

ตัวอย่างเช่น เทรดเดอร์จำเป็นต้องซื้อ ETH จำนวน 10 เหรียญ เขาสร้างคำสั่งซื้อและรอให้ดำเนินการ โทเค็น Ethereum จำนวน 10 เหรียญจะถูกส่งไปยังกระเป๋าเงินแลกเปลี่ยนของเขา และเทรดเดอร์มีอิสระที่จะทำอะไรก็ได้ตามต้องการ เช่น ขายคริปโตเคอร์เรนซีผ่านกลไก P2P โอน ETH ไปยังกระเป๋าเงินอื่น ล็อกเหรียญและรับรายได้แบบพาสซีฟ เป็นต้น มีหลายวิธีในการใช้สินทรัพย์ดิจิทัลที่เทรดเดอร์ซื้อจากตลาดแลกเปลี่ยนคริปโต

เมื่อพูดถึงการแลกเปลี่ยนคริปโต แพลตฟอร์มไม่เพียงแต่รับผิดชอบกระบวนการซื้อ/ขายเท่านั้น แต่ยังต้องรับประกันการจัดเก็บข้อมูลคริปโตของผู้ใช้อย่างปลอดภัย แพลตฟอร์มชั้นนำมักถือครองสินทรัพย์ทั้งหมด 80-90% บนกระเป๋าเงินเย็น (cold wallet) เพื่อป้องกันอาชญากรไซเบอร์ขโมยข้อมูลไป

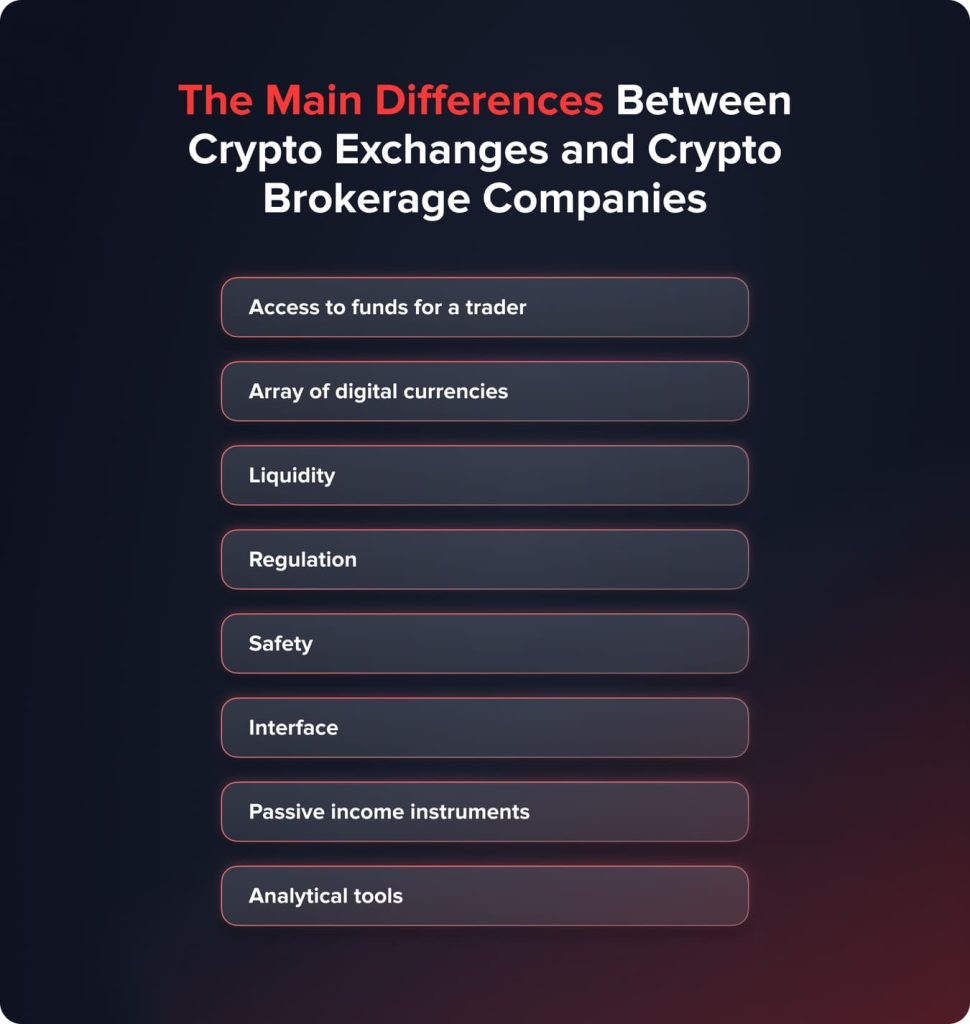

ความแตกต่างหลักระหว่างการแลกเปลี่ยน Crypto และบริษัทนายหน้าซื้อขาย Crypto

เราได้กล่าวถึงวิธีการทำงานของโบรกเกอร์คริปโตและตลาดแลกเปลี่ยนคริปโตไปแล้ว มาสรุปความแตกต่างกัน

การเข้าถึงเงินทุนสำหรับผู้ค้า

- บริษัทโบรกเกอร์คริปโต เทรดเดอร์ไม่สามารถเข้าถึงกองทุนคริปโตได้โดยตรง พวกเขา "ลงนาม" สัญญาส่วนต่างและรับส่วนต่าง หรือจ่ายหลังจากปิดสถานะ

- ตลาดแลกเปลี่ยนคริปโต เทรดเดอร์สามารถซื้อและขายสินทรัพย์คริปโต โอนเข้าบัญชี และทำทุกอย่างที่ต้องการ (ขาย โอน ถอน ส่งไปยังกลุ่มอื่น ฯลฯ)

อาร์เรย์ของสกุลเงินดิจิตอล

- บริษัทโบรกเกอร์คริปโต โดยทั่วไปโบรกเกอร์จะปลดล็อกการเข้าถึงเฉพาะสกุลเงินดิจิทัลที่ได้รับการจัดอันดับสูงสุดเท่านั้น

- Crypto Exchange ตลาดแลกเปลี่ยนมีสกุลเงินดิจิทัลมากมาย รวมถึงสกุลเงินที่เพิ่งเปิดตัวใหม่ แพลตฟอร์มชั้นนำมีสกุลเงินดิจิทัลให้เลือกมากกว่า 1,000 สกุล

สภาพคล่อง

- บริษัทโบรกเกอร์คริปโต สภาพคล่องขึ้นอยู่กับจำนวนเทรดเดอร์ที่กระตือรือร้นและสินทรัพย์ที่เลือก

- การแลกเปลี่ยน Crypto การแลกเปลี่ยน Crypto รับประกันสภาพคล่องสูงสุด

ระเบียบข้อบังคับ

- บริษัทโบรกเกอร์คริปโต บริษัทโบรกเกอร์ส่วนใหญ่อยู่ภายใต้การกำกับดูแลของสถาบันชั้นนำ (SEC, CySEC, FCA ฯลฯ)

- ตลาดแลกเปลี่ยนคริปโต ตลาดแลกเปลี่ยนคริปโตหลายแห่งได้รับอนุญาตนอกเขตอำนาจศาลที่เข้มงวดที่สุด

ความปลอดภัย

- บริษัทโบรกเกอร์คริปโต เทรดเดอร์ไม่สามารถสูญเสียทรัพย์สินจากการขโมยได้ เพราะในความเป็นจริงแล้ว พวกเขาไม่ได้เป็นเจ้าของเงินทุนเหล่านั้น

- การแลกเปลี่ยนคริปโต บางครั้งการแลกเปลี่ยนคริปโตอาจถูกแฮ็กจนทำให้เงินทุนมหาศาลไหลออก

อินเทอร์เฟซ

- บริษัทนายหน้าซื้อขายคริปโต บริษัทนายหน้าซื้อขายมักจะเรียบง่ายและเข้าใจง่ายที่สุด

- Crypto Exchange อินเทอร์เฟซอาจขึ้นอยู่กับแพลตฟอร์ม แต่การแลกเปลี่ยน crypto มักจะค่อนข้างยากสำหรับมือใหม่

ตราสารสร้างรายได้แบบพาสซีฟ

- บริษัทโบรกเกอร์คริปโต บริษัทโบรกเกอร์มักไม่ค่อยเสนอเครื่องมือเพิ่มเติม

- ตลาดแลกเปลี่ยนคริปโต ตลาดแลกเปลี่ยนคริปโตมักเสนอบริการสเตคกิ้ง ออปชั่น การคัดลอกเทรด แพล็ตฟอร์ม และเครื่องมือสร้างรายได้แบบพาสซีฟอื่นๆ

เครื่องมือวิเคราะห์

- บริษัทโบรกเกอร์คริปโต โบรกเกอร์นำเสนอเครื่องมือและเครื่องมือวิเคราะห์ที่หลากหลายให้กับลูกค้า เพื่อให้สามารถคาดการณ์ได้ว่าราคาจะเคลื่อนไหวหรือไม่

- การแลกเปลี่ยน Crypto การแลกเปลี่ยน Crypto มักจะปลดล็อคเฉพาะเครื่องมือวิเคราะห์พื้นฐานเท่านั้น

อะไรคือทางออกที่ดีที่สุดสำหรับเทรดเดอร์?

เทรดเดอร์ควรเลือกแพลตฟอร์มซื้อขายคริปโตประเภทใด ลองคิดดูว่าอะไรสำคัญที่สุดสำหรับเทรดเดอร์ส่วนใหญ่

ประการแรกและสำคัญที่สุด เทรดเดอร์ต้องมั่นใจว่าเงินทุนของตนได้รับการปกป้องอย่างเพียงพอและไม่ตกเป็นเป้าหมายของแฮกเกอร์ นอกจากนี้ เทรดเดอร์ยังคาดหวังที่จะเข้าถึงเครื่องมือวิเคราะห์และเครื่องมือต่างๆ ที่ครอบคลุมที่สุด เพื่อวิเคราะห์ตลาดคริปโตอย่างถูกต้อง

ดังนั้น แพลตฟอร์มโบรกเกอร์คริปโตจึงดูเหมือนจะเป็นทางออกที่ดีที่สุดสำหรับเทรดเดอร์ เมื่อพูดถึงข้อเสีย เทรดเดอร์อาจต้องเผชิญกับสินทรัพย์ที่สามารถซื้อขายได้จำกัด แต่ข้อดีที่หลากหลายก็ช่วยชดเชยข้อเสียเหล่านั้นได้

อะไรคือทางออกที่ดีที่สุดสำหรับนักลงทุน?

สำหรับนักลงทุน พวกเขามีเป้าหมายที่แตกต่างจากเทรดเดอร์ นักลงทุนคริปโตคาดหวังว่าจะได้พบกับแพลตฟอร์มที่สามารถซื้อ ขาย และถือครองสกุลเงินดิจิทัลได้อย่างง่ายดาย ความหลากหลายของสินทรัพย์คริปโตถือเป็นเกณฑ์สำคัญในการกระจายความเสี่ยงของพอร์ตการลงทุน

ตลาดแลกเปลี่ยนคริปโตช่วยให้นักลงทุนสามารถโอนเงินได้ทุกที่ที่ต้องการ นอกจากนี้ นักลงทุนยังสามารถใช้เครื่องมือสร้างรายได้เพิ่มเติม เช่น การซื้อสินทรัพย์ดิจิทัล แล้วใช้กลไกการ Staking เพื่อรับรายได้แบบพาสซีฟ

การแลกเปลี่ยน crypto ถือเป็นตัวเลือกที่ดีกว่ามากสำหรับนักลงทุนที่ต้องการถือครองสินทรัพย์ดิจิทัลเป็นเวลานาน

You may also like

ตัวเลือกใดดีที่สุดสำหรับเจ้าของธุรกิจในการเข้าสู่ตลาด Crypto?

การซื้อขายคริปโตกำลังเป็นที่นิยมอย่างมากสำหรับธุรกิจใหม่ เนื่องจากภาคส่วนนี้เพิ่งเริ่มมีการเติบโตอย่างรวดเร็ว เจ้าของธุรกิจควรเลือกเส้นทางใดในการเข้าสู่ตลาดนี้? ลองเปรียบเทียบขั้นตอนที่จำเป็นในการเปิดธุรกิจนายหน้าซื้อขายคริปโตและตลาดแลกเปลี่ยนคริปโต เพื่อทำความเข้าใจว่าวิธีใดที่ง่ายที่สุดในการดำเนินธุรกิจของคุณเอง

วิธีเปิดตัวการแลกเปลี่ยน Crypto: ขั้นตอนสำคัญ

เมื่อเจ้าของธุรกิจจะดำเนินการแลกเปลี่ยน crypto ที่ทำงานได้เต็มรูปแบบ เขาจะต้องปฏิบัติตามขั้นตอนต่อไปนี้:

- การบริหารบริษัทประการแรกและสำคัญที่สุด เจ้าของธุรกิจจำเป็นต้องก่อตั้งบริษัทที่จะเป็นฐานทางกฎหมายสำหรับการแลกเปลี่ยนสกุลเงินดิจิทัลในอนาคตของคุณ

- รับใบอนุญาตในทางทฤษฎีแล้ว ตลาดแลกเปลี่ยนคริปโตที่ไม่มีใบอนุญาตสามารถเกิดขึ้นได้ แต่อาจไม่มีโอกาสดึงดูดนักเทรดจำนวนมาก ยิ่งใบอนุญาตของคุณแข็งแกร่งมากเท่าไหร่ก็ยิ่งดีเท่านั้น แพลตฟอร์มที่ได้รับการจัดอันดับสูงสุดจะได้รับใบอนุญาตจาก CySEC, FCA, ASIC และหน่วยงานกำกับดูแลระดับโลกอื่นๆ

- บูรณาการซอฟต์แวร์ระดับไฮเอนด์หลังจากปัญหาทางกฎหมาย เจ้าของธุรกิจจำเป็นต้องผสานรวมระบบเครื่องรับคำสั่งซื้อที่มีประสิทธิภาพเพียงพอที่จะประมวลผลธุรกรรมได้อย่างรวดเร็วที่สุด แพลตฟอร์มชั้นนำมีเครื่องรับคำสั่งซื้อที่สามารถประมวลผลได้มากกว่า 10,000 รายการต่อวินาที ด้วยระยะเวลาประมวลผลเพียง 0.05 มิลลิวินาที

- มอบอินเทอร์เฟซที่ใช้งานได้จริงและใช้งานง่ายให้กับผู้ค้าการแลกเปลี่ยนคริปโตต้องใช้งานง่ายและใช้งานได้จริง อย่าให้อินเทอร์เฟซของคุณโหลดมากเกินไป ให้ผู้ใช้ค้นหาฟีเจอร์ที่จำเป็นทั้งหมดได้ภายในไม่กี่คลิก ให้ความสำคัญกับแอปพลิเคชันมือถือเป็นพิเศษ เนื่องจากเทรดเดอร์และนักลงทุนส่วนใหญ่ใช้อุปกรณ์มือถือเพื่อเข้าถึงตลาดการเงิน

- รับประกันความปลอดภัยระดับสูงสุดใช้กระเป๋าเงินเย็น (Cold Wallet) เพื่อเก็บคริปโต นอกจากนี้ โปรดตรวจสอบให้แน่ใจว่าผู้ใช้ของคุณมั่นใจว่าแพลตฟอร์มนั้นใช้โปรโตคอลความปลอดภัยล่าสุดและสอดคล้องกับมาตรฐานสูงสุด

- ระบุทรัพย์สินให้ได้มากที่สุดเท่าที่จะเป็นไปได้การแลกเปลี่ยน Crypto ต้องหาจุดกึ่งกลางที่ดีที่สุด โดยในด้านหนึ่ง พวกเขาควรให้ผู้ลงทุนเข้าถึงสกุลเงินดิจิทัลที่หลากหลาย และในอีกด้านหนึ่ง การแลกเปลี่ยนไม่ควรปล่อยให้เหรียญหลอกลวงเข้ามาในแพลตฟอร์มได้

- เพิ่มเครื่องมือวิเคราะห์และเครื่องมือสร้างรายได้เพิ่มเติมยิ่งแพลตฟอร์มของคุณมีฟังก์ชันการใช้งานมากเท่าไหร่ ก็ยิ่งดีเท่านั้น

นี่คือขั้นตอนสำคัญในการเปิดตัวการแลกเปลี่ยน crypto ของคุณเอง แต่เจ้าของธุรกิจอาจต้องเผชิญกับปัญหาหลายประการซึ่งขึ้นอยู่กับเขตอำนาจศาล กลุ่มเป้าหมาย ฯลฯ

เมื่อพูดถึงค่าใช้จ่าย ขั้นตอนอาจ ราคาสูงถึง 500,000 เหรียญสหรัฐ-

วิธีการเปิดตัวบริษัทนายหน้าซื้อขาย Crypto: ขั้นตอนสำคัญ

ในกรณีที่ต้องการเปิดบริษัทนายหน้า เจ้าของธุรกิจจะต้องดำเนินการตามขั้นตอนต่อไปนี้:

- การวางแผนธุรกิจและการวิจัยตลาดวางแผนอย่างละเอียดถี่ถ้วน ครอบคลุมประเภทของบริษัทนายหน้า กลุ่มเป้าหมาย และข้อจำกัดทางการเงิน/ภูมิศาสตร์ เลือกรูปแบบธุรกิจ (STP หรือ ECN)

- บริหารบริษัทและรับใบอนุญาตเขตอำนาจศาลที่ได้รับการจัดอันดับสูงนั้นได้รับการแนะนำอย่างยิ่งหากคุณต้องการที่จะเป็นผู้นำในภาคส่วนนี้

- สร้างเว็บไซต์และแพลตฟอร์มการซื้อขายเมื่อพิจารณาถึงระดับการแข่งขันที่สูงในกลุ่มนี้ เทรดเดอร์จึงค่อนข้างมีความต้องการสูง เมื่อสมัครใช้บริการบริษัทโบรกเกอร์ พวกเขาคาดหวังว่าจะได้เว็บไซต์ที่ใช้งานง่ายสำหรับทั้งเทรดเดอร์มือใหม่และมืออาชีพ

- ร่วมมือกับผู้ให้บริการสภาพคล่องชั้นนำของ Primeขั้นตอนนี้มีความสำคัญอย่างยิ่งในการมอบเงื่อนไขการซื้อขายที่ดีที่สุดให้กับลูกค้าในอนาคตของคุณ

- สร้างแคมเปญส่งเสริมการขายและการตลาดเว็บไซต์ที่ออกแบบมาอย่างดีและแพลตฟอร์มที่ใช้งานได้จริงจะไม่ทำให้คุณประสบความสำเร็จหากปราศจากการโปรโมตแบบไฮเอนด์ ท่ามกลางการแข่งขันที่เติบโตอย่างรวดเร็ว คุณจำเป็นต้องให้ความสำคัญกับการตลาดให้มากเพียงพอ

You may also like

เมื่อพูดถึงค่าใช้จ่าย กระบวนการเปิดตัวทั้งหมดต้องใช้ จาก 160,000 ดอลลาร์ถึง 500,000 ดอลลาร์ในขณะเดียวกัน เจ้าของธุรกิจอาจเลือกตัวเลือกอื่นได้ เช่น การเปิดบริษัทนายหน้าซื้อขายหลักทรัพย์ผ่านรูปแบบ WL (White Label) ซึ่งหมายความว่าคุณจะได้รับแพลตฟอร์มสำเร็จรูปที่ได้รับใบอนุญาตแล้วและไม่จำเป็นต้องทำตามขั้นตอนที่กล่าวข้างต้น ผู้ให้บริการโซลูชัน WL ช่วยให้เจ้าของธุรกิจสามารถเริ่มต้นธุรกิจได้ภายในไม่กี่สัปดาห์ ไม่ใช่หลายเดือน นอกจากนี้ ค่าใช้จ่ายยังต่ำกว่ามาก

ดังนั้น การเปิดบริษัทโบรกเกอร์คริปโตจึงง่ายขึ้นมากหากเจ้าของธุรกิจใช้ “โบนัสลับ” ที่แสดงโดยโมเดล WL ส่วนตลาดแลกเปลี่ยนคริปโตจะไม่มีสิทธิพิเศษเช่นนี้

สรุป: โบรกเกอร์ Crypto เทียบกับการแลกเปลี่ยน Crypto

บริษัทนายหน้าซื้อขายคริปโตและตลาดซื้อขายคริปโตไม่สามารถนำมาเปรียบเทียบกันภายในกรอบแนวคิดเดียวกันได้ ทั้งสองประเภทมีความแตกต่างและมุ่งเน้นไปที่กลุ่มเป้าหมายที่แตกต่างกัน ในขณะเดียวกัน รูปแบบนายหน้าซื้อขายคริปโตนั้นง่ายกว่ามากสำหรับเจ้าของธุรกิจมือใหม่ที่ต้องการก้าวแรกในตลาดซื้อขายคริปโต โดยเฉพาะอย่างยิ่งเมื่อพวกเขาใช้รูปแบบ White Label

FAQ

ในทางทฤษฎี พวกเขาสามารถทำได้ แต่วิธีการดังกล่าวจะไม่สร้างกำไรโดยปริยาย ในขณะเดียวกัน เจ้าของธุรกิจอาจเลือกใช้โมเดล White Label ที่ให้แพลตฟอร์มลิขสิทธิ์สำเร็จรูปแก่พวกเขา

เมื่อพูดถึงการเปิดบริษัทนายหน้าซื้อขายคริปโตหรือตลาดแลกเปลี่ยนคริปโตด้วยตัวเอง เจ้าของธุรกิจจำเป็นต้องใช้งบประมาณสูงถึง 500,000 ดอลลาร์สหรัฐ รูปแบบ White Label ที่เป็นไปได้สำหรับธุรกิจนายหน้า ทำให้การเข้าสู่ตลาดด้วยเงินทุนเพียง 20,000 - 30,000 ดอลลาร์สหรัฐ เป็นจริงได้

นั่นเป็นคำถามที่ยาก ในมุมมองของผู้ใช้งานแล้ว ทั้งสองอย่างนี้ต่างกัน โบรกเกอร์นั้นดีกว่าสำหรับเทรดเดอร์มาก และตลาดแลกเปลี่ยนก็เป็นทางออกที่สมบูรณ์แบบสำหรับนักลงทุน สำหรับเจ้าของธุรกิจ การเปิดบริษัทนายหน้าซื้อขายคริปโตนั้นง่ายกว่ามาก

อัปเดต:

27 กุมภาพันธ์ 2568