Spot Trading vs Margin Trading: ¿Cuáles son sus diferencias?

Contenidos

El trading al contado se refiere a la compra de activos con tu propio capital, mientras que el trading con margen implica adquirir activos con capital prestado. Sin embargo, las diferencias entre estas técnicas de trading no se limitan solo a estos conceptos básicos. La diferencia más significativa radica en la propiedad y el apalancamiento, y hay mucho que explicar al respecto.

Entender estas técnicas de trading se vuelve importante a medida que los mercados evolucionan y las estrategias de trading difieren. Cada método tiene sus aspectos positivos y negativos, que pueden impactar significativamente en el resultado de tus operaciones. Este artículo explicará todo lo que necesitas saber sobre la diferencia entre el trading al contado y el trading con margen.

¿Qué es el comercio Spot?

El comercio al contado es el tipo más simple de comercio de activos. Necesitas tener suficientes fondos en una moneda para intercambiar por otra. En el comercio al contado, cuando operas, compras criptomonedas, acciones u otros activos con el dinero que tienes sin pedir prestado.

La transacción se paga en tiempo real al precio de mercado actual, conocido como el "precio spot". Los instrumentos que compras se acreditan en tu cuenta de inmediato, colocándote en absoluta propiedad y control. El mecanismo elude acuerdos de préstamo complejos y el cálculo de intereses.

Características Clave del Comercio Spot

El comercio al contado opera bajo varios principios básicos que lo distinguen de otros tipos de comercio:

- Propiedad Directa: Lo que compras por completo es tuyo. No entra en juego dinero prestado, por lo que puedes mantener posiciones abiertas indefinidamente sin la necesidad de pagos de préstamos o llamadas de margen.

- Requisitos de Capital: Su capacidad para negociar está limitada por el efectivo disponible. Si tiene $1,000 para negociar, puede comprar activos por $1,000 exactos, no un centavo más.

- Nivel de Riesgo: Menor riesgo en el comercio al contado ya que no hay contrato para un préstamo o ratio de apalancamiento. Tu peor pérdida es tu inversión inicial, con límites de riesgo específicos.

- Proceso de Liquidación: Las transacciones se ejecutan instantáneamente a los precios de mercado vigentes en ese momento. Usted paga la cantidad total por adelantado y posee inmediatamente los activos.

¿Qué es el Trading con Margen?

El trading con margen consiste en tomar dinero adicional prestado de los brókers para aumentar las posiciones de trading, de modo que puedas operar en una mayor escala que el saldo de tu cuenta al pedir dinero prestado temporalmente. Esto aumenta tus posibles pérdidas y ganancias al utilizar apalancamiento.

Los fondos prestados tienen un tipo de interés y algunos términos y condiciones. Debe proporcionar suficiente garantía para financiar sus posiciones apalancadas, y los brókers liquidarán sus operaciones si el saldo de su cuenta cae por debajo de ciertos márgenes.

You may also like

Cómo Funciona el Comercio de Margen

El trading de margen opera a través de un mecanismo sofisticado de préstamos y garantías:

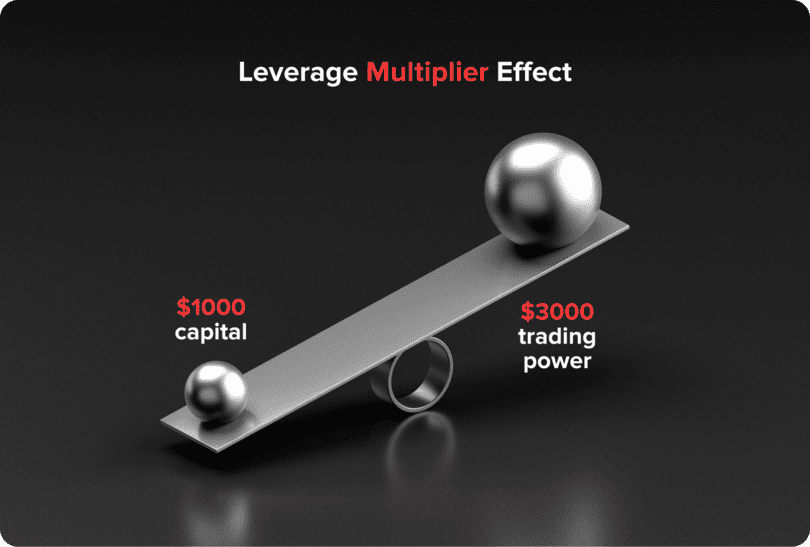

- Mecanismo de Apalancamiento: En la mayoría de los intercambios de criptomonedas, los tamaños de apalancamiento pueden variar de 1x a 100x o de 1:1 a 1:100. Esto significa que un comerciante puede usar una cuenta de $1,000 como garantía y comprar Bitcoin por hasta $100,000, utilizando un apalancamiento de 100x.

- Requisitos de Colateral: Necesitas mantener otros activos de margen como colateral. Este colateral cubre tus fondos prestados y protege al bróker del riesgo de incumplimiento.

- Cargos por Intereses: Las tasas de interés por hora cobradas sobre el préstamo y los intereses acumulados por hora se cargan contra la deuda total de una cuenta de margen. Los cargos se acumulan continuamente hasta que cierras tus posiciones.

- Llamadas de Margen y Liquidación: Cuando el saldo de tu cuenta cae por debajo de los márgenes de mantenimiento, los corredores envían llamadas de margen para depósitos. No cumplir con estas llamadas resulta en la liquidación automática de tus posiciones.

Diferencias Clave Entre el Trading Spot y el Trading con Margen

Conocer las diferencias clave te permite elegir el método de trading más adecuado para tu situación y propósito específicos.

Requisitos de Capital y Apalancamiento

El comercio al contado exige un compromiso total de capital por operación. Tu cuenta de $500 puede acomodar solo $500 en compras. El comercio con margen utiliza esta capacidad con dinero prestado, potencialmente aumentando el poder adquisitivo de una inversión de $500 a $1,500 o incluso más, dependiendo del apalancamiento aplicado.

Esto hace una diferencia significativa en los métodos de tamaño de posición. Los traders de spot deben ser muy selectivos con el capital limitado distribuido en una multitud de oportunidades. Los traders de margen pueden aumentar el tamaño de la posición, pero corren el riesgo de costos más altos.

Perfiles de Riesgo y Recompensa

El riesgo de ganancias y pérdidas varía significativamente entre los dos enfoques. El comercio al contado restringe tanto las ganancias como las pérdidas a tu capital inicial. Un aumento del 10% en una posición al contado de $1,000 equivale a una ganancia de $100.

El trading con margen aumenta estos resultados de manera correspondiente. El mismo aumento del 10% en una posición con margen de 3:1 genera $300 de beneficio, pero una caída del 10% conlleva pérdidas de $300 junto con cargos por intereses.

Sensibilidad al Tiempo y Períodos de Tenencia

Las posiciones spot se pueden mantener indefinidamente sin incurrir en otros gastos, excepto por el costo de oportunidad. Posees los activos y no tienes presión para cerrar posiciones apresuradamente.

Las posiciones de margen tienen cargos de interés constantes. Mantenerlas durante períodos prolongados se volverá costoso, y el comercio con margen es más apropiado para objetivos más cortos. La tensión psicológica de acumular cargos de interés llevará al cierre prematuro de las posiciones.

Complejidad y Requisitos de Gestión

El comercio al contado requiere un análisis de mercado inherente y decisiones de tiempo. Compras activos cuando prevés un aumento en los precios y vendes cuando anticipas caídas.

El comercio con margen requiere un mantenimiento continuo de los saldos de margen, acumulación de intereses y riesgos de liquidación. Debes estar al tanto de las proporciones de apalancamiento, márgenes de mantenimiento y técnicas de gestión de riesgos para evitar pérdidas catastróficas.

Ventajas y Desventajas

Ambas formas de negociación tienen ventajas y desventajas específicas que son adecuadas para diferentes perfiles de traders y situaciones del mercado.

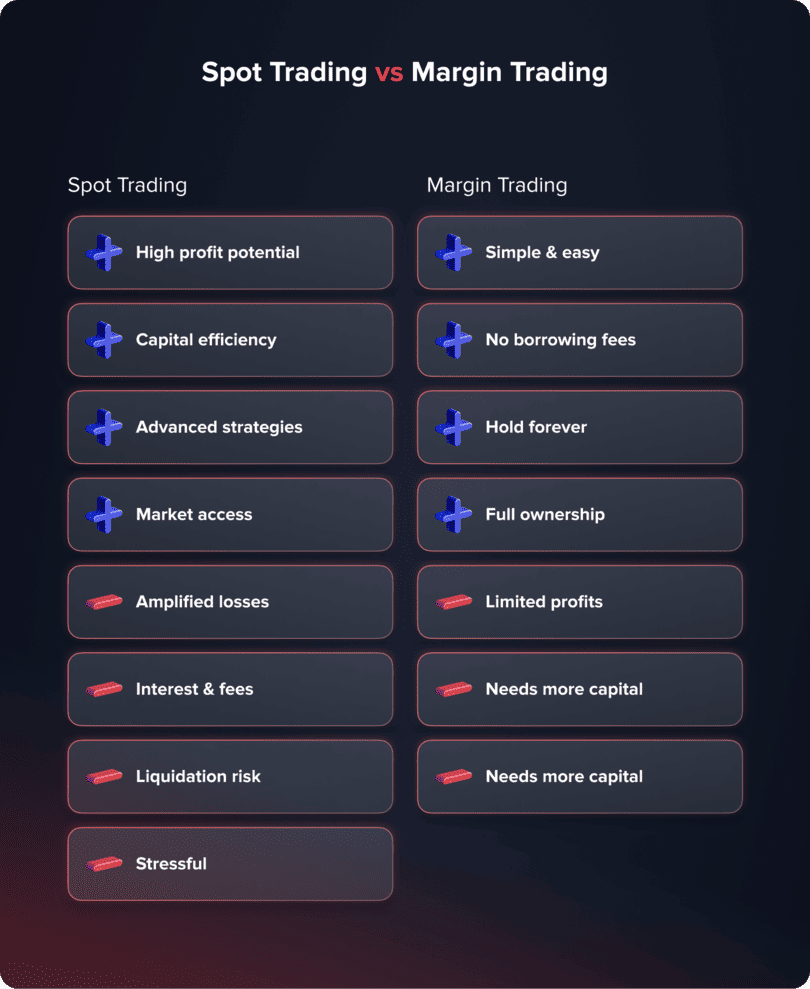

Beneficios del Trading Spot

- Facilidad de Comprensión y Simplicidad: Relaciones básicas de compra y retención sin matemáticas complejas ni obligaciones recurrentes. Ideal para que los principiantes comprendan las relaciones del mercado.

- No hay tarifas adicionales: No hay tarifas de interés ni tarifas de préstamo. Tus únicos costos son las tarifas y los diferenciales por operaciones.

- Sin Restricción de Tiempo para Mantener: Mantén posiciones para siempre sin ansiedad por acumular cargos o llamadas de margen.

- Propiedad Absoluta de Activos: La propiedad completa permite participar en dividendos, derechos de voto, recompensas por staking y todos los beneficios asociados a los activos.

- Confort Psicológico: Los límites de riesgo claramente definidos reducen la presión y el estrés asociados con la toma de decisiones emocionales.

You may also like

Desventajas del Comercio Spot

- Potencial de Ganancia Limitado: Los rendimientos están limitados a tu capital disponible y a la dirección del mercado, perdiendo oportunidades durante tendencias fuertes debido a fondos insuficientes.

- Problema de Eficiencia de Capital: Las grandes inversiones de capital para posiciones prominentes pueden ser demasiado costosas para cuentas pequeñas.

- Costos de Oportunidad: El capital inmovilizado en cada posición impide la diversificación en muchas oportunidades.

Ventajas del Trading con Margen

- Mayor Potencial de Ganancia: El apalancamiento aumenta los retornos ya que las operaciones están a tu favor. Se pueden lograr altos retornos a partir de bajos saldos de cuenta.

- eficiencia de capital: Controlar posiciones más grandes con menores cantidades de dinero, liberando capital para otras oportunidades o cobertura.

- Implementación Flexible de Estrategias: Facilita estrategias sofisticadas que implican tamaños de posición más grandes de lo que el capital disponible soporta.

- Acceso al Mercado: Acceda a instrumentos o mercados de alto costo que anteriormente estaban más allá de sus posibilidades financieras.

Desventajas del Trading con Margen

- Pérdidas Amplificadas: El apalancamiento tiene un impacto bidireccional, amplificando las pérdidas tanto como las ganancias. Pequeños movimientos a la baja pueden eliminar cuentas enteras.

- Intereses y Comisiones: Las comisiones de préstamo continuas devoran las ganancias y amplifican las pérdidas. El tiempo es un factor costoso.

- Riesgos de Liquidación: Las liquidaciones suelen ser más rápidas que el comercio al contado. El cierre automático de posiciones puede generar grandes pérdidas.

- Gestión de Riesgos Compleja: Requiere una comprensión sofisticada de la mecánica de márgenes, el efecto de apalancamiento y las reglas de tamaño de posición.

- Presión Psicológica: Los requisitos de monitoreo constante y las amenazas de liquidación crean un estrés significativo y desafíos en la toma de decisiones.

Consideraciones sobre la Gestión de Riesgos

La gestión efectiva de riesgos se vuelve crucial independientemente del método de trading que elijas, pero los enfoques difieren significativamente entre el trading al contado y el trading con margen.

Gestión de Riesgos en el Comercio Spot

El tamaño de la posición sigue siendo el principal instrumento de control de riesgos. Nunca arriesgues más de lo que puedes perder por completo. La diversificación en múltiples activos e industrias reduce el riesgo de concentración.

Las órdenes de stop-loss ayudan a reducir las pérdidas en la caída, aunque no son una necesidad para las posiciones al contado. Podrías mantener posiciones perdedoras con la esperanza de que se recuperen, aunque esto inmoviliza dinero y podría robarte mejores oportunidades. Mantén el reequilibrio de tu cartera regularmente para mantener una asignación de activos que refleje tu tolerancia al riesgo y las condiciones actuales del mercado.

Gestión de Riesgos en el Comercio de Margen

El control del apalancamiento es de mayor importancia que cualquier otra cosa. Comienza con ratios más bajos (2:1 o 3:1) hasta que entiendas completamente la mecánica del margen. Un apalancamiento adicional aumenta exponencialmente el potencial de ganancias y los riesgos de liquidación.

Mantenga amplios márgenes de reserva por encima de los niveles mínimos. Esto protege contra la liquidación en oscilaciones normales del mercado y permite movimientos de precios negativos.

Otras técnicas esenciales de gestión de riesgos incluyen:

- Fórmulas de Tamaño de Posición: Calcula el tamaño de la posición a partir de la capacidad de riesgo de la cuenta, no a partir de la capacidad máxima de apalancamiento. Arriesga el 1-2% del capital de la cuenta por operación, teniendo en cuenta los efectos del apalancamiento.

- Disciplina de Stop-Loss: Obligatorio en posiciones de margen. Coloca stops antes de entrar en las operaciones y manténlos a pesar de las emociones o opiniones.

- Monitoreo de Costos de Interés: Monitorear regularmente el costo de los préstamos. Incorporar los costos de interés en los cálculos de ganancias y estrategias de salida.

El conocimiento de estos factores de riesgo te permite elegir métodos de trading adecuados y emplear medidas de protección apropiadas. Para técnicas completas de gestión de riesgos, consulta nuestra guía integral sobre gestión de riesgos en el trading .

Elegir el Método Correcto

Su elección de método de trading depende de varios factores, incluyendo la experiencia, la disponibilidad de capital, el apetito por el riesgo y la percepción del mercado.

Idoneidad del Comercio Spot

- Traders Principiantes: El trading al contado sigue siendo un favorito entre los principiantes debido a su simplicidad. La mecánica directa permite centrarse en el análisis del mercado en lugar de la complicada gestión de posiciones.

- Inversores a Largo Plazo: La propiedad de activos y los períodos de tenencia ilimitados son óptimamente adecuados para estrategias de compra y retención—sin estrés por cargos de interés o llamadas de margen.

- Perfiles de Riesgo Conservadores: Límites de pérdida claros atraen a inversores reacios al riesgo. La pérdida máxima es igual a la inversión inicial sin compromiso adicional.

- Fase Educativa: Es más fácil aprender las condiciones del mercado sin depender de complejidades. Los errores son costosos pero no catastróficos.

Idoneidad del Trading con Margen

- Comerciantes Vocacionales: Los comerciantes profesionales pueden emplear el comercio con margen para realizar planes anticipados con una mayor inversión de capital.

- Planes de Trading Activos: Los planes a corto plazo explotan la magnificación del apalancamiento. El scalping, el day trading y el swing trading pueden lograr ganancias significativas con pequeños movimientos de precios.

- Cuentas con Restricciones de Capital: Cuentas con menos capital pueden participar en activos de alto precio o implementar planes diversificados a través del apalancamiento.

- Traders Profesionales: Los traders profesionales que tienen habilidades de gestión de riesgos completas pueden utilizar el apalancamiento para obtener rendimientos magnificados.

Conclusión

La decisión entre el trading con margen y el trading al contado finalmente depende de tu nivel de experiencia, apetito por el riesgo y necesidades de trading. El trading al contado ofrece simplicidad y seguridad para los nuevos participantes, mientras que el trading con margen ofrece apalancamiento para los inversores experimentados en su búsqueda de mayores rendimientos. Ambos pueden ser efectivos cuando se comprenden y aplican adecuadamente, siempre que apliques técnicas efectivas de gestión de riesgos.

FAQ

¿Puedo comenzar a operar con margen como principiante?

No, los principiantes deben dominar primero los fundamentos del comercio al contado. El comercio con margen requiere una comprensión del apalancamiento, la gestión de riesgos y el análisis del mercado. Comienza con el comercio al contado para aprender la dinámica del mercado sin riesgos amplificados.

¿Cuál es la cantidad mínima necesaria para el trading con margen?

Las cantidades mínimas varían según la plataforma, normalmente oscilando entre $100 y $1,000. Sin embargo, el comercio de margen efectivo requiere montos mayores para mantener márgenes de seguridad adecuados y gestionar las posiciones de manera adecuada.

¿Cómo funcionan las tasas de interés en el comercio de margen?

Se aplica interés sobre los fondos prestados, normalmente de forma horaria o diaria. Son específicos de la plataforma y del activo, y varían entre el 0.01% y el 0.1% diario. Los cargos se acumulan continuamente hasta que se cierra la posición.

¿Estoy en peligro de perder más que mi inversión inicial con el trading al contado?

No, el comercio al contado limita las pérdidas a tu inversión inicial. Posees los activos y no puedes perder más de lo que pagaste inicialmente, excluyendo las comisiones de trading.

¿Qué pasa si mi posición de margen se liquida?

La liquidación ocurre cuando tu capital en la cuenta cae por debajo de los niveles de margen de mantenimiento. El sistema liquida automáticamente tus posiciones a los precios de mercado actuales, lo que puede causar enormes pérdidas.

¿Podemos combinar ambos métodos de trading?

De hecho, la mayoría de los traders utilizan técnicas híbridas con posiciones centrales en el mercado spot y trading de margen estratégico para ocasiones especiales. Esta estrategia combina estabilidad y potencial de ganancia.

¿Cuál es mejor para el comercio de criptomonedas?

Ambos funcionan bien con criptomonedas. El comercio al contado es adecuado para inversores a largo plazo y principiantes, mientras que el comercio con margen es adecuado para traders profesionales que buscan rendimientos apalancados. Su elección depende de la experiencia, la sensibilidad a los riesgos y los objetivos de trading.

¿Cómo varían los impuestos en el comercio de margen y en el comercio al contado?

El tratamiento fiscal depende de la jurisdicción. El comercio de margen está sujeto típicamente a tasas a corto plazo debido a la rotación, y el comercio al contado puede ser tratado como ganancias de capital a largo plazo. Se debe buscar asesoramiento fiscal profesional.

Actualizado:

18 de septiembre de 2025