Mesa de negociação vs. sem mesa de negociação: qual é a diferença?

Conteúdo

Dois tipos de corretoras dominam o Forex: mesa de negociação sem negociação (NDD) e mesa de negociação (DD). Para traders e qualquer pessoa que pretenda administrar sua própria corretora, o conhecimento desses modelos é essencial. Ao contrário das corretoras de mesa de negociação, que lidam com as transações internamente e determinam os preços, as corretoras de mesa de negociação sem negociação conectam os traders com operações externas. provedores de liquidez . Essa diferença principal afeta muito o ambiente de negociação e a dinâmica operacional de uma corretora.

O modelo de mesa de negociação

Frequentemente descrito como um formador de mercado, o modelo de Mesa de Negociação (DD) é um ator importante no complexo cenário da corretagem Forex. Este modelo influencia naturalmente o ambiente de negociação e a abordagem para a corretora, bem como para seus clientes. Seja corretor ou trader, todos que pensam em ingressar nessa área precisam primeiro entender sua mecânica operacional.

Mecânica Operacional do Modelo de Mesa de Negociação

Execução de Negociações e Definição de Preços

No cerne da funcionalidade do modelo DD está sua capacidade de atuar como contraparte nas negociações do cliente. Isso significa que, quando um trader decide comprar ou vender, a corretora DD frequentemente assume o lado oposto da transação. Essa posição única concede às corretoras DD ampla liberdade na definição dos preços de compra e venda. Ao contrário dos preços refletidos diretamente no mercado interbancário, estes podem ser ligeiramente ajustados para se adequarem à estratégia da corretora. Essa capacidade de controlar a execução das negociações não apenas ajuda a gerenciar a exposição ao risco da corretora, mas também permite a oferta de spreads fixos, um recurso que pode ser particularmente atraente para certos traders que preferem previsibilidade de custos.

You may also like

Gestão de Riscos em Corretoras DD

A gestão de risco é um aspecto complexo e crucial da gestão de uma corretora de DD. O método principal envolve assumir a posição oposta à operação de um cliente ou compensá-la com a contra-operação de outro cliente. Quando não há correspondência interna imediata, a corretora pode recorrer à proteção no mercado aberto. Essa estratégia adiciona camadas de complexidade à gestão de risco da corretora, mas é crucial para manter o equilíbrio e garantir a continuidade dos negócios, especialmente em condições de mercado voláteis.

Estratégias de Geração de Lucro

O ponto crucial da geração de lucro de uma corretora de DD reside nos spreads entre os preços de compra e venda. Além disso, pode haver casos em que a corretora lucra com operações que resultam em perdas para os clientes. Embora isso possa parecer simples, manter spreads competitivos e garantir a satisfação e a retenção dos clientes exige um equilíbrio delicado.

Prós e contras para corretores

Ao considerar o modelo de corretagem DD, os aspirantes a corretores devem primeiro compreender as inúmeras vantagens e desvantagens desse método. Essa abordagem, baseada na atuação do corretor como um formador de mercado , tem perspectivas únicas de renda e controle, mas também implica enormes obrigações de comportamento ético, confiança do cliente e conformidade regulatória.

Vantagens do Modelo DD

No modelo DD, os corretores encontram oportunidades únicas de lucro por meio da flexibilidade na definição e ajuste de spreads. Esse controle é particularmente vantajoso em mercados menos voláteis, onde os corretores podem garantir lucros maiores por meio de margens de spread estáveis. No entanto, mesmo em mercados mais turbulentos, essa flexibilidade permite que os corretores DD se adaptem rapidamente, potencialmente se beneficiando do aumento dos volumes de negociação causado pelas oscilações do mercado.

Outro benefício fundamental é o grau de controle que as corretoras de DD têm sobre seus ambientes de negociação. Atraindo traders que valorizam a consistência e a confiabilidade em suas operações, elas atuam como formadoras de mercado e proporcionam um ambiente mais previsível e estável. Esse controle se refere tanto à gestão de riscos quanto ao lucro. As corretoras de DD podem mitigar movimentos adversos do mercado gerenciando eficazmente o saldo de operações em seus livros ou optando por hedge externo. Essas capacidades são essenciais para sustentar a retenção de clientes e construir confiança, visto que os traders frequentemente buscam um ambiente de negociação que ofereça estabilidade e confiabilidade.

Desafios do Modelo DD

Um dos desafios mais profundos para as corretoras de DD reside nas considerações éticas de seu modelo operacional. O conflito de interesses inerente, em que os lucros de uma corretora podem, por vezes, coincidir com as perdas dos clientes, exige um alto padrão ético e práticas comerciais transparentes. Manter uma estrutura ética robusta é crucial para proteger os interesses dos clientes. Isso se estende à gestão de relacionamento, onde estabelecer confiança por meio da transparência e clareza na execução de negociações e nas estratégias de precificação torna-se fundamental para a sustentação do relacionamento com os clientes.

O sucesso de uma corretora de DD depende significativamente de sua reputação de imparcialidade e transparência operacional. É fundamental que as corretoras de DD comuniquem com clareza como as negociações são executadas e como os preços são definidos, fomentando um ambiente de confiança e confiabilidade. Isso abrange a abordagem de preocupações frequentes no setor relacionadas à manipulação de preços ou negociação contra clientes. Manter uma imagem empresarial respeitável e confiável depende fundamentalmente da transparência nas operações, o que também ajuda a estabelecer uma clientela fiel.

Além disso, a conformidade regulatória constitui um aspecto crucial do modelo de corretagem DD. Seguir regras rigorosas garante métodos de negociação justos, o que não é apenas uma necessidade legal, mas também um componente fundamental para construir confiança no mercado Forex. Manter uma empresa em conformidade e reconhecida depende de se manter atualizado com as mudanças legislativas e ajustar os procedimentos comerciais de acordo com elas.

O modelo de mesa sem negociação

Com um ambiente de negociação e um método operacional claros, o conceito de No-Dealing Desk (NDD) marca uma mudança radical em relação à estratégia convencional de Dealing Desk. Aspirantes a corretores e traders precisam entender as sutilezas desse modelo, pois ele abrange uma gama de elementos, desde o acesso ao mercado até as necessidades tecnológicas.

Compreendendo a funcionalidade do NDD

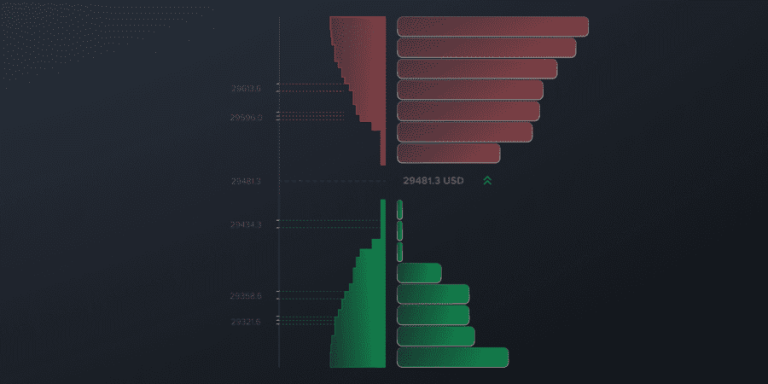

A abordagem NDD se transforma a partir do modelo tradicional de Mesa de Negociação. Fundamental para sua funcionalidade é fornecer aos traders acesso direto ao mercado interbancário, uma vasta rede de bancos e instituições financeiras que são a força vital da liquidez nos mercados Forex. Esse acesso direto muda significativamente o cenário de negociação. Diferentemente do modelo DD, em que a corretora atua como formadora de mercado, definindo preços e gerenciando negociações, o modelo NDD vê a corretora como uma facilitadora, conectando os traders a um conjunto maior de provedores de liquidez. Aqui, a corretora não atua mais como intermediária nas transações comerciais, mas sim conecta os traders ao mundo dinâmico e fluido do mercado interbancário.

Na configuração NDD, a determinação de preços passa da corretora para o mercado interbancário. Muitas instituições financeiras agora moldam os preços, que refletem a situação do mercado, em vez de serem estabelecidos por uma única organização. Essa configuração oferece aos traders uma visão mais direta e aberta do mercado Forex, refletindo, portanto, os movimentos e ritmos naturais do mercado.

You may also like

Transparência e Influência de Mercado

Uma característica fundamental do modelo NDD é seu elevado nível de transparência. Nesse ambiente, os movimentos de preços e spreads são resultado direto da dinâmica do mercado, não moldados ou manipulados por uma corretora. Essa abertura é fundamental para atrair traders que desejam uma experiência de negociação consistente com os princípios básicos de oferta e demanda. A natureza competitiva do mercado interbancário frequentemente resulta em spreads mais estreitos e preços mais vantajosos para os traders, aumentando seu potencial de lucratividade.

DMA

Acesso direto ao mercado é outro pilar do modelo NDD, permitindo que os traders se beneficiem dos melhores preços disponíveis em tempo real. Como as negociações são executadas com base em cotações de diversos provedores de liquidez, os traders são expostos a preços diversos, o que frequentemente leva a condições de negociação mais vantajosas. Além disso, o modelo NDD é conhecido por sua rápida execução de ordens. Com ordens colocadas diretamente no sistema de provedores de liquidez, as velocidades de execução são geralmente mais rápidas do que as encontradas no modelo DD. Essa rapidez é particularmente benéfica para estratégias de negociação específicas que dependem de entradas e saídas rápidas do mercado, como scalping ou negociação de alta frequência.

Gestão de Riscos em Corretoras NDD

Um pilar para as corretoras de NDD, uma boa gestão de risco garante a conformidade regulatória e a viabilidade a longo prazo. As corretoras de NDD comunicam a maioria das transações diretamente aos provedores de liquidez, portanto, sua principal abordagem de gestão de risco é selecionar e gerenciar cuidadosamente esses provedores para que possam oferecer taxas competitivas regularmente e realizar negociações eficientes.

O hedge é outra ferramenta vital no arsenal de gestão de risco da corretora NDD. O hedge estratégico pode mitigar o risco em situações de exposição significativa – seja devido à volatilidade do mercado ou a posições desequilibradas dos clientes. Essa abordagem protege o capital da corretora e pode ser uma forma sutil de geração de lucro, especialmente quando executada com perspicácia de mercado. Portanto, embora os fluxos de receita do modelo NDD sejam amplamente transparentes e diretos, a manutenção da lucratividade também depende da capacidade da corretora de navegar habilmente pelos riscos de mercado e desafios operacionais inerentes a esse modelo.

Estratégias de Geração de Lucro

No modelo de corretagem NDD, a geração de receita está intimamente ligada aos seus princípios operacionais fundamentais. Ao contrário das corretoras DD, que lucram principalmente com spreads, as corretoras NDD normalmente geram receita por meio de comissões. Essas comissões geralmente são transparentes, com taxas fixas por operação ou uma porcentagem do volume negociado, criando um fluxo de receita claro e direto que se adapta à atividade de negociação do cliente.

Além disso, os corretores NDD podem negociar termos benéficos com vários provedores de liquidez, alavancando seu volume de negociação para garantir taxas mais favoráveis, aumentando indiretamente a lucratividade. Além das receitas baseadas em transações, as corretoras NDD podem diversificar sua receita oferecendo serviços de valor agregado, como plataformas de negociação avançadas, análises de mercado aprofundadas e recursos educacionais. Esses serviços, especialmente as versões premium, proporcionam fontes de renda adicionais e ajudam a cultivar relacionamentos de longo prazo com os clientes, oferecendo mais do que apenas uma plataforma de negociação.

Prós e contras para aspirantes a corretores

Vantagens de iniciar uma corretora NDD

Os aspirantes a corretores que consideram o modelo NDD encontrarão seus pontos fortes em sua transparência inerente e abordagem orientada ao mercado.

O grau de abertura do modelo NDD está entre seus benefícios mais importantes. O possível conflito de interesses no modelo DD é bastante reduzido, visto que o mercado afeta diretamente a precificação e não está sob o controle da corretora. Desenvolver a confiança dos clientes depende muito da transparência. Em um mercado onde a confiança do trader é crucial, a capacidade de proporcionar um ambiente de negociação livre de manipulação da corretora pode diferenciar uma corretora NND e fortalecer relacionamentos duradouros com os clientes.

A capacidade das corretoras NND de oferecer preços competitivos e orientados pelo mercado as torna únicas. Para traders experientes que estão sempre em busca das condições ideais de negociação, este é um grande atrativo. Em um mercado altamente competitivo, o modelo NND pode ser bastante atraente, pois acessa diretamente o mercado interbancário e frequentemente oferece aos traders spreads mais estreitos e preços mais vantajosos.

Desafios na gestão de uma corretora NDD

No entanto, o modelo NDD também traz seus desafios, principalmente no que diz respeito aos requisitos tecnológicos e ao gerenciamento de spreads variáveis.

Um dos principais desafios na criação de uma corretora NDD é a necessidade de uma infraestrutura tecnológica robusta e sofisticada. Essa tecnologia é vital para facilitar a conectividade em tempo real com diversos provedores de liquidez. Manter a alta velocidade de execução característica do modelo NDD e garantir que os traders tenham acesso contínuo aos melhores preços disponíveis depende de um sistema confiável e eficaz. Investir em tecnologia exige manutenção e atualizações constantes para acompanhar os desenvolvimentos técnicos e de mercado; não se trata de uma configuração única.

As corretoras NND lidam com spreads variáveis que mudam com as circunstâncias do mercado, diferentemente do modelo DD, em que as corretoras podem oferecer spreads estáveis. Particularmente em períodos de grande volatilidade do mercado, a incerteza resultante pode ser difícil de controlar. As corretoras devem encontrar um equilíbrio entre oferecer spreads atrativos para atrair negócios e garantir que esses spreads sejam sustentáveis para a lucratividade da corretora. Um bom controle dos spreads variáveis exige tanto um profundo conhecimento da dinâmica do mercado quanto a flexibilidade para se adaptar às rápidas mudanças nas circunstâncias do mercado.

Conclusão

É vantajoso para corretores e comerciantes, atuais e potenciais, compreender as diferenças entre os modelos de Mesa de Negociação e Sem Mesa de Negociação. A decisão é influenciada por uma infinidade de fatores, como objetivos estratégicos, requisitos do consumidor e posicionamento de mercado, visto que cada modelo tem suas próprias vantagens e desvantagens. Alinhar o modelo de corretagem com esses elementos ajuda a criar uma plataforma de negociação lucrativa e respeitável. No mundo acelerado do Forex, uma escolha consciente nesse sentido é o primeiro passo para o possível sucesso, tanto para traders quanto para aspirantes a corretores.

Atualizado:

18 de dezembro de 2024