Voltar

Contents

Negociação Intradiária: Tudo o que Você Precisa Saber

Iva Kalatozishvili

Business Development Manager

Vitaly Makarenko

Chief Commercial Officer

A negociação intradiária é um estilo de negociação limitado a uma sessão de negociação. Todas as posições são abertas e fechadas em um dia.

Os traders intradiários se concentram em oscilações intradiárias de curto prazo e não mantêm suas posições por longos períodos de tempo.

Neste artigo damos ênfase às seguintes questões:

- O que significa negociação intradiária e como ela funciona?

- Quais são as diferenças entre os estilos básicos de negociação?

- Quais são os prós e os contras da negociação intradiária?

- Quais são os princípios básicos da negociação intradiária?

- Quais estratégias os traders devem usar ao abrir posições intradiárias?

A negociação intradiária se enquadra na categoria de estilos básicos de negociação que também compreende scalping, swing-trading e position-trading . Quais são as principais diferenças?

As diferenças entre os estilos básicos de negociação

Diferentes traders se caracterizam por diferentes abordagens sobre como negociar, por quanto tempo manter uma posição e quais instrumentos de negociação usar ao analisar movimentos de preços futuros. Existem quatro estilos básicos de negociação:

- Scalp trading (scalping). Este estilo implica manter uma posição por um período muito curto. Os scalpers mantêm posições por alguns segundos a vários minutos. Esta abordagem visa abrir muitas ordens e obter lucros pequenos, mas frequentes. Os traders precisam estar totalmente envolvidos no mercado, analisar os menores movimentos de preço e encontrar os melhores pontos para entrar e sair do mercado rapidamente.

- Day trading (intraday). A regra principal desse estilo de negociação é fechar todas as posições antes do fechamento do mercado. Os traders abrem e fecham suas posições na mesma sessão de negociação. Eles lucram com movimentos de mercado de curto prazo, mas têm mais tempo para analisar o mercado adequadamente em comparação com o scalping.

- Swing trading. Este estilo envolve manter uma posição por vários dias ou semanas. O principal objetivo de um swing trader é entender a tendência atual do mercado e, em seguida, tirar proveito do movimento. Os traders buscam oscilações máximas quando o preço de um ativo sobe ou oscilações mínimas quando o preço cai.

- Position trading. Essa abordagem se assemelha mais a investimentos do que a negociações, pois você pode manter uma posição por semanas, meses ou até anos. Flutuações de curto prazo do mercado não afetam as previsões dos position traders. Eles se concentram em tendências de mercado de longo prazo e fatores macroeconômicos.

Principais características da negociação intradiária

- Os traders abrem posições e precisam fechá-las na mesma sessão de negociação.

- O foco principal está nos instrumentos de análise técnica. Os traders usam combinações de indicadores para entender se o preço de um ativo vai subir ou cair nos próximos períodos.

- A quantidade de posições é bastante alta. Os traders intradiários geralmente abrem mais de 10 posições e obtêm pequenos lucros com cada uma delas.

- O lucro médio de uma posição é de 2-3%.

- Os comerciantes utilizam diferentes classes de ativos para abrir suas posições.

Para quem a negociação intradiária é adequada?

Por um lado, a negociação intradiária é um dos estilos mais difundidos de abertura e manutenção de posições. Por outro lado, os traders precisam entender se essa abordagem se adequa às suas preferências pessoais. Quando um trader escolhe o estilo errado, acaba tendo prejuízos significativos.

Então, qual é o retrato de um trader intraday bem-sucedido?

- Um trader toma decisões rapidamente e é capaz de analisar grandes quantidades de dados em um curto período de tempo.

- Um trader não é influenciado pelo estresse ao trabalhar com prazos apertados.

- Um trader tem um alto nível de resistência ao estresse, é capaz de controlar as emoções e toma decisões com a cabeça fria.

Quando a necessidade de tomar decisões rápidas e analisar o mercado dentro de prazos apertados leva a erros e estresse, mude seu estilo de negociação para swing ou position trading.

Tipos de negociação intradiária

Negociação intradiária é o nome de um estilo de negociação, mas, ao mesmo tempo, inclui vários tipos que diferem em abordagens, estratégias e lucros possíveis. Aqui está a lista de tipos de negociação intradiária:

- negociação de momentum;

- negociação de fuga;

- negociação reversa;

- negociação baseada em notícias;

Vamos nos aprofundar em cada tipo de negociação intradiária para entender suas peculiaridades.

Negociação de momentum

Os traders buscam ativos que estejam prestes a apresentar fortes movimentos de preço. As posições são abertas na direção de uma tendência atual, de alta ou de baixa. O objetivo principal é surfar na onda e esperar até que a tendência esteja pronta para reversão. A negociação de momentum pode ser usada para todos os ativos, mas os traders selecionam ações com mais frequência.

Negociação de breakout

Este tipo de negociação baseia-se na identificação dos níveis de suporte e resistência. Traders profissionais utilizam diferentes indicadores para visualizar o canal em que o preço de um ativo está se movendo. Esses indicadores são o Canal de Keltner, o Canal de Donchian, as Bandas de Bollinger e assim por diante. Quando o preço toca a borda superior ou inferior do canal, há uma alta probabilidade de que ele retorne ao canal. A quebra dessas bordas, por sua vez, é um sinal de uma tendência futura. Traders abrem posições quando o preço de um ativo rompe uma das bordas do canal.

Negociação reversa

Uma tendência é, mais cedo ou mais tarde, substituída por outra, e todos os mercados financeiros funcionam de acordo com esse princípio. Traders profissionais utilizam indicadores de análise técnica e padrões gráficos para identificar níveis de preço em que um ativo está sobrecomprado ou sobrevendido. Assim, eles abrem posições na direção oposta, aguardando a reversão da tendência. Quanto aos indicadores utilizados na negociação de reversão, o RSI e o Estocástico são os instrumentos mais difundidos. A categoria de padrões gráficos de reversão inclui o Martelo, o Homem Enforcado, a Estrela Cadente, etc.

Negociação baseada em notícias

Como o próprio nome sugere, os traders baseiam suas previsões em notícias. Eles monitoram os principais eventos que ocorrem nos mercados financeiros (relatórios de lucros, apresentações públicas dos principais players financeiros, atualizações de diferentes índices, eventos políticos, econômicos e outros) e entendem se o preço de um ativo está subindo ou descendo. Ao falar sobre negociação baseada em notícias, você precisa tomar decisões em frações de segundo.

Indicadores usados na negociação intradiária

A negociação intradiária é baseada principalmente em análise técnica; portanto, traders profissionais contam com diversos indicadores e padrões que os ajudam a entender melhor os movimentos de preços.

Aqui estão os indicadores mais amplamente utilizados na negociação intradiária:

- Média Móvel As médias móveis suavizam as flutuações de preços e reduzem os ruídos do mercado, permitindo que os traders entendam a direção da tendência atual. Os traders definem o período necessário para obter uma visão mais ampla da tendência em andamento.

- Bandas de Bollinger. O indicador consiste em três linhas, sendo a central a MMS 20 (Média Móvel Simples com base no período de 20 dias). As Bandas de Bollinger indicam se um ativo está sobrecomprado ou sobrevendido.

- RSI (Índice de Força Relativa). Esse indicador é bastante próximo das Bandas de Bollinger, pois os traders usam o índice para entender onde um ativo está sobrecomprado e sobrevendido. O RSI mostra as situações de mercado em graus de 0 a 100.

- MACD (Convergência e Divergência de Médias Móveis). O indicador sinaliza aos traders se uma tendência atual irá se reverter ou continuar. O instrumento é representado por um histograma que mostra marcadores de tendências de alta e baixa.

Estratégias eficazes para negociação intradiária

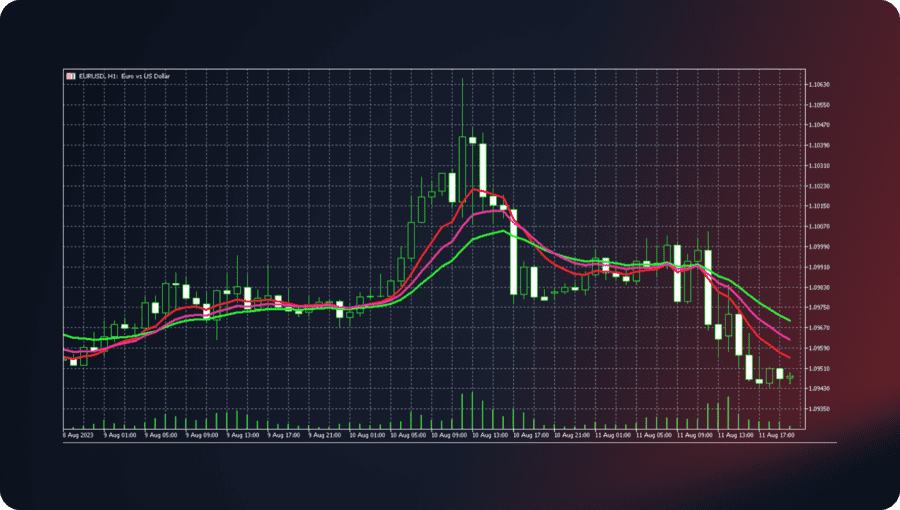

A combinação de EMA, MACD, RSI

Precisamos adicionar o indicador MACD com as configurações padrão. Em seguida, usamos o RSI, deixando também as configurações padrão. Quanto à Média Móvel, adicionamos duas MMs – Média Móvel Exponencial com um período de 7 dias e outra EMA com um período de 26 dias. No gráfico, temos a seguinte imagem:

Abra as posições de acordo com os seguintes critérios:

- A MME 7 cruza a MME 26 de baixo para cima. O índice MACD está subindo e o índice RSI está acima de 50. Abra uma posição comprada.

- A MME 26 cruza a MME 7 de cima para baixo. O índice MACD está em queda e o índice RSI está abaixo de 50. Abra uma posição vendida.

A Estratégia da Fita SLM

Essa estratégia é simples e eficaz. Você precisa adicionar apenas indicadores de Média Móvel (exponencial). Selecione as linhas de MME com períodos de 8 dias, 13 dias e 21 dias.

Abra as posições de acordo com os seguintes critérios:

- A MME 8 cruza as linhas da MME 13 e da MME 21 de baixo para cima. Abra uma posição comprada na vela próxima à de rompimento.

- A MME 8 cruza as linhas da MME 13 e da MME 21 de cima para baixo. Abra uma posição vendida na vela próxima à de rompimento.

You may also like

A combinação de SAR parabólico e média móvel

Adicione o SAR Parabólico, mantendo as configurações padrão. Em seguida, utilize a linha SMA com um período de 20 dias.

Abra as posições de acordo com os seguintes critérios:

- Quando uma vela de alta rompe a linha SMA 20 e fecha acima dela e o SAR Parabólico confirma o sinal (círculo amarelo abaixo), abra uma posição longa.

- Quando uma vela de baixa rompe a linha SMA 20 e fecha abaixo dela e o SAR Parabólico confirma o sinal (círculo amarelo acima), abra uma posição vendida.

Prós e contras da negociação intradiária

Quais são as principais vantagens e pontos fracos desse estilo de negociação?

As principais vantagens da negociação intradiária:

- Os traders conseguem obter lucros em uma única sessão de negociação. Eles lucram com as menores flutuações de preço.

- Os traders utilizam capital mínimo devido às altas alavancagens. Esse estilo de negociação é possível a partir de US$ 10 a US$ 20.

- Ordens de stop-loss e take-profit possibilitam o controle dos riscos. Além disso, os traders não mantêm suas posições durante a noite; é por isso que controlam totalmente suas posições.

As desvantagens da negociação intradiária são as seguintes:

- A negociação intradiária é bastante complicada; é por isso que os traders precisam ter conhecimento profundo de como a análise técnica funciona.

- Os prazos baixos (M1, M5, M15, etc.) são caracterizados por “ruídos” frequentes e os traders podem receber sinais falsos.

- O estilo exige que o trader seja capaz de analisar grandes volumes de informações e tomar decisões rápidas.

- A negociação intradiária está associada a uma alta carga de atividade analítica e emocional do trader. Há o risco de overtrading.

Conclusão

A negociação intradiária se enquadra na categoria dos estilos de negociação mais populares. Os traders abrem e fecham suas posições em uma única sessão de negociação. Esse estilo oferece altos lucros em um curto período de tempo. Em vez disso, o trader precisa ser fluente em análise técnica e capaz de tomar decisões rápidas com base nos sinais recebidos.

Atualizado:

19 de dezembro de 2024