What is Copy Trading? Definition and Overview

Contents

Understanding Copy Trading

Copy trading involves automatically duplicating open positions taken by other traders. Rather than each copier having to perform their own independent market analysis and trade execution, they can leverage work done by experienced traders and replication trades opened on supported platforms. This replication is done via automated processes integrated into copy trading platforms.

Copy trading has been compared or tagged synonymous with two other common trading operations: social trading and mirror trading. Clarifying these differences will be instrumental in understanding copy trading and differentiating it from other options.

Copy Trading vs Social Trading

Copy trading involves automatically replicating the discretionary trades taken by other individual traders on supported platforms. Replication is performed by integrated automated processes using copier-set parameters like allocation percentages. Trades are synchronously duplicated in copier accounts.

Social trading on the other hand connects traders through discussion platforms, but without automatic trade copying. Traders share market analysis, strategies and intended trades which other traders can manually execute if they choose. Discussion centres on collaboration rather than direct replication of trades and orders remain dependent on individual discretion and execution.

Similarities

- Both involve leveraging insight from other traders

- Traders can potentially gain exposure to new opportunities

- Traders can learn from experienced peers on shared networks

Differences

- Copy trading performs synchronous automated duplication of actual trades

- Social trading keeps discretion over orders through manual execution

- Copy trading replicates positions while social trading emphasizes discussion over replication

- Social trading relies on individual discretion over order submission versus automatic position copying

- Copy trading is hands-off involvement through duplication whereas social trading emphasizes active engagement and collaboration requiring manual participation

- Orders remain dependent on individual discretion and execution for social trading but synchronous replication for copy trading.

Mirror Trading vs Copy Trading

Mirror trading involves automatically replicating pre-programmed quantitative algorithmic strategies. These strategies may result from aggregating inputs from many professional traders. Entire automated programs, rather than individual discretionary trades, are duplicated for copiers. This provides diversification across numerous systematic trades.

Whereas in copy trading, copiers can selectively follow multiple traders with distinct styles. Rather than entire bundles, discrete trades are evaluated and replicated. Copiers exercise choice over traders and customize risk settings for each.

You may also like

Similarities

- Both involve automatically duplicating trades

- Provide passive involvement by leveraging others’ work

- Allow diversification or skills beyond own ability

Differences

- Copy trading replicates discretionary choices while mirroring duplicates quantitative algorithms

- Mirror trading follows unified programs rather than selectivity among diverse traders

- Copy trading allows customizing risk controls trader-by-trader rather than monitoring general strategy

- Mirror trading provides diversification through bundled strategies rather than selectivity among individual traders

- Copy trading retains flexibility unlike absolute commitment to single inflexible programs in mirror trading

How Does Copy Trading Work?

- Social trading platforms and networks — Copy trading is facilitated by specialized social trading platforms and networks that connect individual traders. Traders can publicly share and anonymously duplicate each other’s trades through integrated infrastructure on these platforms.

- Broadcast and copying of trades — When one trader opens a new position on a supported platform, this trade execution is automatically broadcast to the trader’s public profile. Other traders can then opt to automatically replicate this trade by integrating the platform’s copying functions into their own accounts.

- Setting parameters like allocation percentage — Copiers can customize position copying by setting parameters like allocation percentages, risk limits and filters. For example, a copier may choose to allocate 10% of their account to automatically replicate a trader’s positions. This allows copying a portion of another’s trades to proportionally fit one’s own risk tolerance.

Generally, supported third-party platforms connect traders and enable discretionary position replication. Trades are synchronously duplicated across accounts by broadcast updates and integrated functions. Copiers customize exposure by settings like target allocations to independently manage personalized risks from automatic copying. This facilitates hands-off involvement while empowering individual discretion over copying involvement and exposures.

Copy Trading Mechanics in Cryptocurrency

Cryptocurrencies have grown dramatically as a traded asset class. Given their technical nature, experienced cryptocurrency traders have considerable skills valuable for copy trading. Leveraging such expertise provides exposure without demanding copiers independently master volatile new markets. Platforms thus prioritize including cryptocurrencies.

Copy trading platforms add prominent cryptocurrency exchanges and assets to their integrated market coverage. Traders can selectively follow others specifically experienced in these markets. Copied trades are automatically mirrored, long or short, across major cryptocurrencies. Platform filters help copiers identify specialists demonstrating valuable market knowledge.

A trader may open a short position on Ethereum seeing technical signs of a trend reversal forming. Their copiers simultaneously duplicate this trade. With volatility, the copied trade ensures capturing the outcome of analysis without demanding the copiers’ own interpretation. Tight individualized stops are still recommended due to technological risks.

Technical factors like momentum indicators, order flows and chart patterns assume heightened importance for timing cryptocurrency exposure given their high variability. While automatically mirrored, copiers still customize position sizing and tight stops to independently manage risk commensurate with their tolerance for cryptocurrency market fluctuations.

Pros and Cons of Copy Trading

Pros

- Leveraging others’ expertise — By selectively following experienced traders, copiers can benefit from others’ extensive market knowledge, honed skills and training without demanding equivalent experience themselves. This provides access to insights requiring considerable time to develop.

- Automated trading to save time — Mimicking pre-performed analysis and trades frees copiers from rigidly studying markets and managing positions themselves. This affords flexibility for those needing freedom from the constant active involvement that individual trading demands.

- Learning opportunities — By passively observing copied trades, rationales and performance, copiers can incrementally develop complementary skills and perspectives to eventually moderate copied reliance and risks.

Cons

- Dependence on the copied trader — Since outcomes directly relate to another’s choices, copiers take on increased reliance, assuming a degree of the copied trader’s characteristic strengths but also vulnerabilities.

- Lack of independent analysis — Abdicating discretion requires acknowledgement of sacrificing the ability to autonomously consider and question decisions or alter approaches as personal judgment would otherwise foster. Copiers must accept others’ full control over traded choices and exposures.

- Inability to fully control risk — While customizing settings like leverage and stops, copiers cannot independently manoeuvre from systematic risks fully determining portfolios from others’ dictation alone. They adhere to an intermediary’s actions.

While streamlining workflows, copiers must realistically weigh passively ceding discretion and accepting dependencies to leverage others’ efforts. It warrants balanced discretion over outright automatism. Individual due diligence still applies regarding platform and trader selections.

Profitability of Copy Trading

Factors Determining Profitability

- Performance of followed traders — Copiers’ outcomes directly relate to others’ success, as the copied decision-making alone determines profitability. Considerable time validating skills, and documenting strategies and results strengthens dependability.

- Their trading strategy, risk management — Traders’ methodology, attitude and response to variances also impact reliability. Conservative management of equity, leverage and drawdowns helps sustain performance applicability over fluctuating conditions.

- Consistency of results over time — Documented longer-term disciplined achievements surmounting diverse circumstances provide reassurance of skills transcending specific environments. Consistency maintains applicability for replicating portfolios unlike outlier, unsustainable performance.

Risks to Consider

- Market risk from price volatility — All market participation involves exposure to unpredictable price swings independent of skills. Copiers tolerate volatility inherent to followed traders’ specific asset selections.

- Liquidity risk in less liquid assets — Illiquid options restrict flexibility, while high trading volumes better facilitate positioning and controlling the downside. Copiers consider traders’ chosen instruments’ typical liquidity.

- Systematic risks beyond any trader’s control — Black swan macro shocks defy calculation. Copiers thus diversify among multiple outstanding traders rather than complete reliance on one, lest any face unforeseen crisis.

If diligently selecting demonstrably superior traders persisting through diverse conditions, copy trading profitability proves realistic. Although past performance does not guarantee continuity, documented excellence and resilience strengthen opportunities when choosing traders equipped to sustain reliability. However, individualized risk management remains vital.

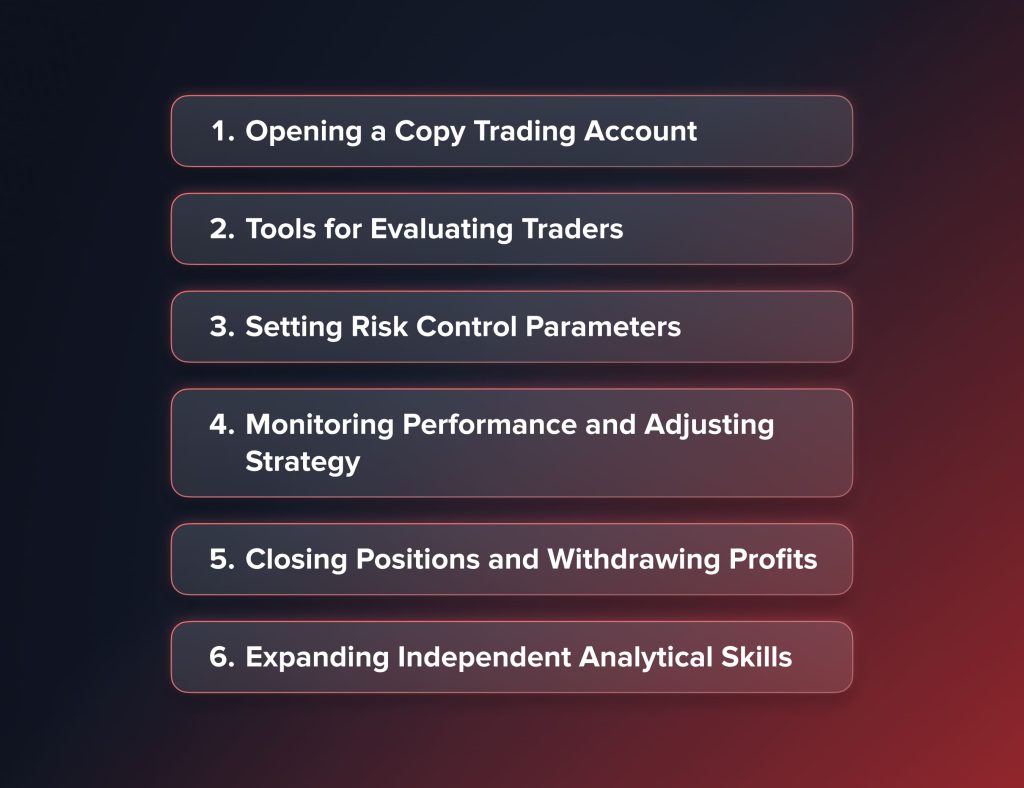

How to Get Started with Copy Trading

Opening a Copy Trading Account

When starting out with copy trading, the first step is to open an account with a reputable platform. There are several considerations to keep in mind when choosing a platform. Look for one that has been in operation for several years and has a large number of active traders and funds under management, as this indicates stability. Consider research platforms by reading reviews online from traders and crypto media.

Ensure the platform offers the types of markets you want to trade like stocks, forex, cryptocurrency etc. Support for deposit and withdrawal through common payment options like debit/credit cards and wire transfers is also important. Most reputable platforms require identity verification for regulatory reasons. Carefully read all terms and conditions before signing up and funding your account.

Tools for Evaluating Traders

Once registered, the next key step is to identify skilled traders to copy. Evaluation is important to filter out underperforming traders and minimize risks. Platforms usually provide various performance metrics to evaluate traders.

Some important metrics to consider include profit factor which indicates risk-adjusted returns, trading history preferably longer than 1-2 years to see performance over market cycles, maximum drawdown indicating the biggest losing streak, average return on investment, total profits generated and risk-reward ratio showing gains versus losses.

You can also check traders’ description of their trading style, strategy, experience and risk management approach. Filter options allow shortlisting traders specializing in your preferred markets, timeframes and instruments to ensure applicability.

Setting Risk Control Parameters

Before copying trades, set various parameters on the platform to independently manage risks from automatic trading. Key parameters include the overall budget or percentage of your account to allocate to a trader, maximum exposure per trade as a dollar or percentage value, and stop-loss or trailing stop levels that automatically close losing positions.

You can also set alerts to be notified of open positions, large gains/losses or other relevant actions. Different alert protocols help monitor copied trades more closely. Leverage if available should be used judiciously keeping in mind historical volatility of copied positions.

Risk parameters should proportionally limit drawdown exposure commensurate with your risk tolerance and portfolio goals. These controls empower independent risk management while automatically copying others’ trades.

You may also like

Monitoring Performance and Adjusting Strategy

After enabling signal or trade copying, monitor initial performance closely on a daily or weekly basis versus expectations. Regular reassessment is prudent to ensure out-performance over time continually.

Platform analytics help analyze profitability, the effectiveness of risk controls, return statistics and drawdown periods of copied trades. Based on monitoring, recalibrate involvement as needed, by altering individual trader allocations, follow count, tightening stops or leveraging.

Reassessing copied trader selections identifies underperformers for replacements. This ongoing responsiveness maintains relevance amid changing scenarios. Over time, complement manual trade entries with copying selectively adding to pre-existing analysis. Gradually increase independent work relative to relying on others to sustain benefits long-term.

Closing Positions and Withdrawing Profits

As objectives are fulfilled, manually close open positions as warranted by tactical revisions. The platform automates closing based on assigned stop-levels too. Any accumulated profits can then be safely withdrawn into a linked bank account or wallet.

Partial extractions maintain ongoing copied activity as desired. Prudent reviews track long-term performance and capital preservation to maximize benefits while containing risks inherent to depending on others’ expertise alone determining outcomes.

Expanding Independent Analytical Skills

While copy trading streamlines market involvement, gradually devote more time to manually analyzing preferred assets using supplied platform tools and external sources. Develop an independent market perspective assessing copied traders’ ideas.

Also, enhance due diligence processes on traders by examining finer performance details, risk exposures, drawdown behavior and strategy robustness through changing market areas. Strengthened trader selections reflect directly while augmenting dependability of copied activity.

By progressing through these systematic steps which cover the key processes and continuously refining the strategic and risk management approaches, traders develop a viable long-term copy trading methodology alongside expanding analytical skills. This balance optimizes benefits while containing inherent risks and dependencies over time.

Developing a Copy Trading Strategy

Considerations for Trader Selection

Thoroughly evaluating potential traders to copy is crucial for success. Consider traders with a minimum history of 2-3 years of demonstrated performance through different market conditions. Analyze profitability ratios like annual return, Sharpe ratio, profit factor and maximum drawdown to evaluate risk-adjusted returns.

Study monthly and yearly performance growth over time to identify consistency versus outliers relying on brief performances. Check average winning and losing trade size to ensure risk-balanced rewards. Review description of trading approach, risk management style, experience and adaptability.

Diversifying among multiple top performers with varying yet complementary styles across diverse markets reduces reliance on any single individual’s forecasts. Identify specialists excelling within areas aligning personal interests to improve comprehension.

Consider verifying the identity and credentials of prospective traders where possible to evaluate legitimacy. Reassess selections periodically ensuring continued fulfillment of analyzed criteria.

Market Areas and Instruments

Initially focus copying within most familiar markets requiring least additional research. For example, major forex pairs or stock indices for individuals more experienced in macroeconomics versus cryptocurrencies or less mainstream assets. Limiting scope enhances comprehending others’ rationales for sound risk controls.

Prioritize instruments with adequate liquidity avoiding dependence on narrowly traded assets vulnerable to pricing inefficiencies. Complement copied exposure selection with manual trades in under-represented fields developing skills.

Gradually broaden scope incorporating less familiar classes as knowledge expands but avoid diversifying too widely initially at expense of capable oversight. Dedicate research to understanding specialists’ proficiency, judging aptitude within preferred areas facilitating value. Preference experiential uniqueness minimizing overlapping personally held strengths for optimized learning.

Leverage and Position Sizing

Personally set a maximum leverage ceiling below historically proven sustainable levels for replicated traders. Consider initially copying positions without added gearing until verifying compatibility under varying circumstances.

Limit leveraged volumes comprising a judicious portion of total exposure avoiding over-reliance on any individual copied source. Systematically test and prove viability of increased gearing as skills and monitoring abilities concurrently rise. Separately customized sizing upholds prudent risk distribution across followed traders irrespective of their applied margins.

Construct a diversified portfolio composition complementing automated exposures with independent manual selections conservatively positioned. This balance curbs over-amplifying any singular copied risk while retaining flexibility.

Continuous Evaluation and Documentation

Revisit selections reacting to market changes using platform tools analyzing detailed performance metrics beyond advertising. Assess intra-monthly or weekly fluctuations versus longer-term progression. Question poorly explained drawdowns to validate sustained ability.

Document evolving perspective from failed versus thriving choices enhancing future assessments. Pose copied discussions stimulating independent deductions. Gradually supersede reliance on external signals focusing manual research on identifying replicable patterns. Note-generated questions establish self-directed learning avenues.

Adjust copied exposures amid variance ensuring compatibility. Extract maximum knowledge from the process, maintaining a flexible yet prudent approach containing overdependence on others’ decisions alone governing portfolios.

A meticulous, adaptive and well-rounded execution of each core discipline facilitates constructing a viable long-term copy trading methodology empowering self-development alongside proficient guidance.

Final Thoughts

In conclusion, developing a comprehensive yet balanced copy trading strategy requires diligently evaluating traders, focusing on compatible markets, independently managing risks, and continuously refining the approach over time. A disciplined methodology that combines the benefits of automation with independent analytical skills can help optimize outcomes while mitigating inherent risks and dependencies associated with relying solely on others’ trading decisions.

Updated:

December 19, 2024

9 February, 2026

What Is a Trading Halt? Why Stocks Stop Trading and What It Means for You

A trading halt is when an exchange temporarily stops trading in a stock or, in rare cases, the entire market. It’s not a glitch and it’s not random. It’s a deliberate pause triggered when prices move too fast, critical information is about to be released, or regulators need time to step in. From the outside, […]