Launching a Localized Brokerage: Why Niche Markets Pay Better Than Generic Traffic

Contents

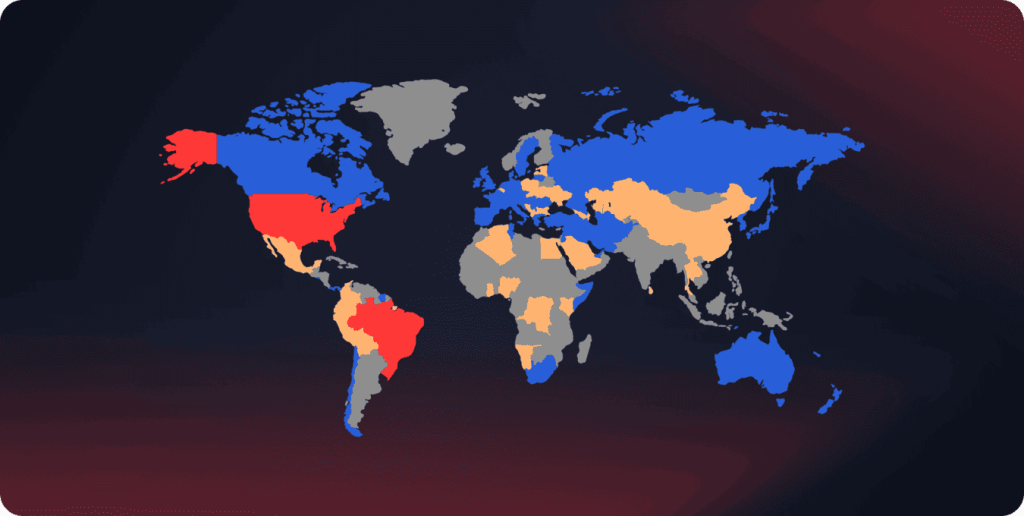

Across the financial markets, generic traffic delivers rising CPAs, declining retention, and shrinking lifetime value (LTV). In markets such as LATAM and MENA, brokerages that tailor their services and marketing to local preferences and trading behaviors do far better. They tend to build stronger trust, deeper engagement, and higher lifetime value than those relying on generic traffic.

Moreover, regional awards and recognitions for such platforms reflect this performance advantage with improved retention and ROI. This article explains why niche markets yield higher returns, how localization further increases these gains, and how brokers can put these concepts into practice using contemporary brokerage systems.

What Does Localization and Niche Market Mean for Brokerages?

For brokerages, particularly in the financial industry, localization means building a trading platform, services, and marketing that align with the legal, cultural, and behavioral realities of the target market. This is to ensure the trading environment is “local” to the new market, thus increasing trust and familiarity.

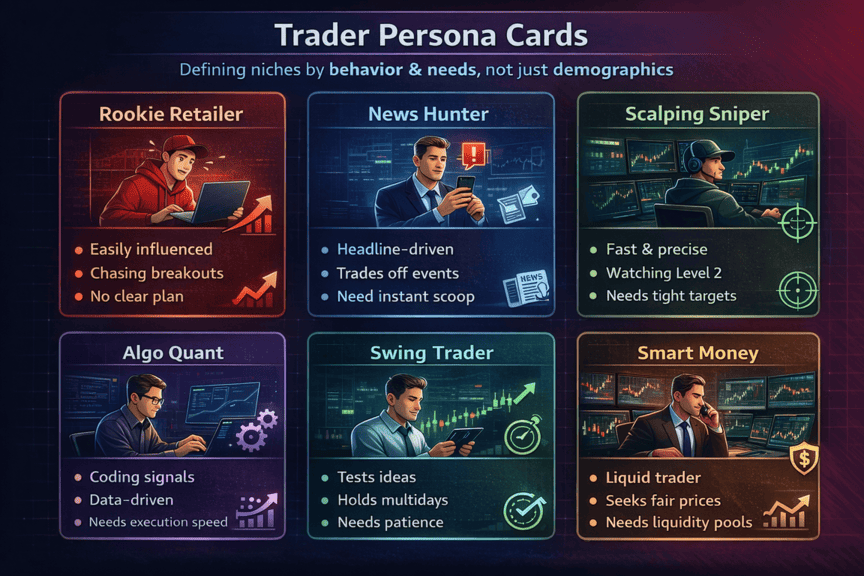

A niche market, on the other hand, describes shared trading behavior, unmet needs, and performance expectations, rather than age, income level, or geography.

Examples of such niches include:

- Crypto traders in emerging markets who require access to volatility, speed, and fiat on-ramp solutions.

- Professional scalpers and algorithmic traders who focus on speed, APIs, and stability rather than promotions.

- Investors who follow ethical or Islamic rules in the MENA region and need Sharia-compliant financial instruments and transparent trading conditions.

- New retail traders in mobile-first markets who require simplified interfaces, education, and confidence-building tools.

These traders are looking for platforms that reflect how they trade, what constraints they face, and what outcomes they expect. Thus, having a niche means limiting the number of decisions such brokerages have to make.

Advantages of Combining Localization and Niching

While a localized brokerage removes friction for regional users, a niche brokerage sharpens relevance for a specific trader profile. But when these two are combined, they don’t just add value; they multiply it. Highlighted below are the associated advantages:

Aligns With How Traders Actually Operate

Traders make fast judgments about whether a platform understands them. This judgment isn’t based on a single feature, but on signals, including language, assets offered, interface complexity, funding options, risk disclosures, and even educational content. All of these contribute to a subconscious question: “Was this platform designed with traders like me in mind?”A localized-niche brokerage answers that question immediately.

Faster Trust and Lower Onboarding Friction

Generic brokerages often rely on broad credibility signals, such as global branding, generic licenses, or lengthy feature lists. These signals are rarely sufficient in regions where traders are cautious about fraud, regulation, or capital safety. Localized-niche brokerages, by contrast, build trust through familiarity and specificity. This includes compliance with recognizable legal frameworks and familiar payment rails.

Better Retention and Higher Lifetime Value

Generic brokerages often depend on promotions, bonuses, and rebates to keep users active. This creates fragile engagement, and once incentives stop, activity drops. However, localized-niche brokerages rely on product-market fit, not incentives. And because the platform aligns with trader behavior, needs, and expectations, users remain active for functional reasons.

Over time, this leads to longer trading lifecycles, higher cumulative deposits, consistent activity patterns, and stronger brand loyalty.

Lower Acquisition Cost With Marketing Efficiency

Generic brokerages market broadly. Their ads compete with hundreds of similar messages, driving up costs and attracting users with mixed intent. Even when traffic converts, quality is inconsistent.

Localized-niche brokerages, on the other hand, market with precision. Their messaging speaks directly to a defined audience in a defined context. For example, the purpose of content is to address specific problems, while partnerships target particular communities, and paid media campaigns filter based on relevance rather than reach. Although fewer users are acquired, a far greater percentage convert, deposit, and remain active.

How to Identify High-Value Brokerage Niches

High-value niches occur at the intersection of demand, friction, and neglect. Finding high-value niches is not about intuition or trend-spotting; it’s about using data to understand human behavior. Highlighted below are steps to identifying such niches:

Start With Real Market Demand

The first requirement is to ensure that traders are indeed searching for and talking about a particular trading need or style. Search volume, long-tail keywords, forum discussions, telegram groups, discord servers, or regional trading communities can be better indicators than top-down reporting. Traders asking the same questions, complaining about the same issues, or requesting the same solutions can also indicate that demand isn’t being met.

Look for Competitive Gaps

A common mistake is assuming that a good niche must be completely underserved. In reality, many high-value niches already have brokers operating within them, but they do so poorly. These are segments where platforms technically exist, yet fail to localize effectively, lack essential tools, or ignore regional realities. Traders may tolerate these platforms because there are no better alternatives, but dissatisfaction remains high.

Competitive gaps often appear as:

- Generic interfaces serving highly specialized traders

- Global brokers ignoring local payment or regulatory nuances

- Platforms built for beginners trying to serve advanced users (or vice versa)

For a focused entrant, these gaps represent leverage points. You don’t need to outspend incumbents, but out-align them.

Account for the Regulatory Environment Early

Some countries make compliance a barrier to entry or participation to discourage broad and generic brokerages.

However, for companies willing to make the necessary investments in the right kind of licensing, reporting, and compliance knowledge, the same conditions can be taken advantage of. This is because, once the regulatory foundation is established, it is difficult for a competitor to break in, and trust with local traders improves.

Analyze Economic Behavior and Funding Patterns

Understanding how money flows in a niche provides a clear indication of the niche’s real earnings potential. The average deposit amount, funding frequency, preferred payment options, and withdrawal patterns will affect the lifetime value.

These patterns determine whether a niche is occupied and scalable.

Identify Product and Platform Shortcomings

If traders are using third-party solutions to compensate for limitations, it indicates an existing gap in the product. This is where differentiation can happen.

Moreover, if complaints about execution speed, charting, risk management, or mobile friendliness keep popping up, this is probably an indication that the current brokerage platforms were not built with this trader in mind. A brokerage that can address even some of these points will find itself in high demand among this group.

Tactical Signals That Confirm Niche Viability

From an operational perspective, the following signs can be used to verify the value of a niche:

- High organic search volume for niche-related keywords with relatively low competition

- User grievances regarding payment processes, onboarding, or platform usability

- Strong engagement in localized trading communities without a dominant platform presence

- A clear mismatch between trader needs and broker positioning

When these signals align, they point to niches where relevance drives performance.

Designing Your Brokerage Around Your Chosen Niche

[image suggestion: a side-by-side interface comparison showing a simplified beginner experience versus a control-heavy professional trading layout]

Designing for a niche involves harmonizing all levels of the brokerage with trader needs, including:

- User Experience: Beginners require guided flows and simplicity, whereas professionals require in-depth and control-oriented solutions.

- Instruments & Analytics: Provide only what’s important. Too much complexity can lead to a lack of confidence.

- Funding and withdrawal should feel natural, not forced.

- Onboarding & compliance: Local laws should be incorporated smoothly, not presented as hurdles.

- Support/Education: The tone, accessibility, and modality should conform to cultural norms.

Localized Marketing That Works for Financial Niches

Instead of broadcasting one value proposition to many people, niche brokerages create demand by aligning their communications with the mindset, trading, account funding, and risk perceptions of the region’s traders.

Shift from Demographics to Trading Behavior

In traditional brokerage marketing, for example, common demographic segmentation may include age groups, income levels, or general financial interests. These types of factors are helpful in general, but do not tend to explain why a trader acts in a certain manner.

Localized niche marketing starts with how traders behave, including:

- What instruments traders prefer and why

- How often they trade and at what times

- Their sensitivity to spreads, execution speed, or leverage

- Their funding patterns and risk tolerance

These campaigns, based on behavioral triggers, perform much better than general ads because they target intent rather than identity.

Create content that reflects regional reality

One of the most potent localization tools, often underutilized or poorly adapted, is content. Effective localized content goes beyond translation. It considers regional issues such as:

- Market access restrictions or asset availability

- Tax aspects and filings

- Tax aspects are important to

- Macro-regional factors that influence trading activities

By recognizing their real-world limitations in educational resources and trading analyses, brokerages can become more credible. The trading platform is now viewed not as an outside entity, but as a factor within the local trading system.

Leverage Local Partnerships and Community Trust

Trading educators and influencers already have local market attention and influence that new brokerage services do not. Collaborating with them helps fill this gap more effectively compared to brand promotion efforts.

It’s best to undertake these partnerships in a non-promotional, value-based manner. Webinars, market insights, content creation, and platform walkthroughs in the local language and context come across as natural and authentic. This helps position the brokerage as supportive infrastructure rather than a transactional service.

Optimize For Regional Search Intents

SEO remains one of the highest-ROI channels for localized brokerages, but only when executed with regional nuance.

Generic trading keywords are often highly competitive and dominated by global incumbents. In contrast, geo-specific and language-native search terms frequently reveal high-intent users with fewer alternatives.

Regionally optimized SEO focuses on:

- Native-language queries and phrasing, not direct translations

- Geo-modified keywords tied to local regulations or assets

- Content addressing local onboarding, payments, and compliance questions

By aligning content with how traders actually search in their markets, brokerages attract users who are already evaluating options, not casual browsers.

Relevance Converts Where Incentives Fail

The most important distinction between generic and localized marketing is why it works. Localized marketing improves conversion not through aggressive persuasion, excessive bonuses, or promotional pressure, but through recognition. Traders convert because the platform feels designed for their reality, not because they were convinced to compromise.

Overcoming Challenges of Localized Niche Brokerage Launches

Localized-niche strategies offer some of the most substantial returns in brokerage markets, but they are not without hurdles. Such challenges and how brokerages can overcome them are highlighted below:

Misalignment in Culture

Traders in a particular region may have expectations that differ based on local practices, language, or risk preferences. Failure to comprehend this can lead to issues in onboarding, funding, or trading.

To combat this:

- Bring in local consultants to review the content, user experience, and communications to discover any friction points

- Pilot the cultural adaptation of features such as local vocabulary, trust features, and education modules before launch

- Test the messaging for smaller groups to validate the tone, level of complexity, and perceived credibility

Regulatory Complexity

Regulations are sources of barriers and distinctions. They range from licensing and reporting requirements to investor protection and taxes. An error may trigger possible liabilities, blocked accounts, or damage to reputation.

To guarantee compliance:

- Partner with local attorneys to ensure the requirements are mapped correctly

- Utilize flexible platform stacks so that reporting, account verification, and disclosures can be altered without the need to modify code

- The “compliant-first” features should take preference in the MVP, and more advanced instruments should be implemented after seeking regulatory approval.

Infrastructure and Operational Costs

The infrastructure for a niche brokerage may entail additional costs for backend flexibility, multi-currency payments, and analytics. Such costs may seem exorbitant compared to general launches.

You navigate this by:

- Using modular platforms to enable selective markets, functionalities, or tools rather than customized solutions for each region.

- Beginning with pilot segments to test the infrastructure’s scalability before launching in multiple markets.

- Using cloud-native and white-label offerings to minimize costs and time-to-market.

Tracking and Iterating on Niche-Specific KPIs

Generic metrics such as overall traffic, sign-ups, or deposits can obscure the performance of localized niche projects. Traders operating in smaller segments may appear insignificant on volume graphs, but are actually driving the most significant business activities.

To sort this:

- Describe the following KPIs specific to each niche: First Deposit Conversion, Deposit Frequency, Churn, Average Position Size, LTV, and Retention.

- Measure these KPIs regularly and iterate: even small changes to UX or payment flows can yield huge benefits.

- Benchmark against similar niches rather than global averages to maintain realistic expectations.

Conclusion

Generic traffic may still bring users through the door, but users alone do not build durable brokerage businesses. Localized niche strategies shift the focus from acquisition volume to value creation. By designing platforms around specific traders in specific markets, brokerages improve trust, retention, and profitability, often with less marketing waste.

For businesses considering a brokerage launch, it’s advisable to build for relevance first, then scale later. This usually comes easier when the foundation is strong.

FAQ

A localized-niche brokerage is a trading platform designed specifically for a given region and type of trader. This is where local regulatory compliance, payment methods, and UX are integrated with trading tools and services to cater to such traders.

Generic campaigns may drive traffic, but niches have higher conversion rates, greater retention, higher lifetime value, and lower wasted acquisition spend. Hence, they perform better.

High-value niches are created when demand is substantial, the current solution is ineffective, and government regulations are well-suited to a niche player. The steady search volume on the internet can measure this.

Marketing should be about trader behavior and regional dynamics, not just demographics. This can include localized content focused on regulations, regional realities, partnerships with regional influencers and educators, geographic SEO optimization, or campaigns that target trader intent rather than reach.

A well-optimized and executed "localized niche" approach will typically yield a lower CPA, a higher first-deposit conversion rate, a longer retention period, a higher lifetime value, and a stronger referral rate.

Updated:

February 2, 2026

9 February, 2026

What Is a Trading Halt? Why Stocks Stop Trading and What It Means for You

A trading halt is when an exchange temporarily stops trading in a stock or, in rare cases, the entire market. It’s not a glitch and it’s not random. It’s a deliberate pause triggered when prices move too fast, critical information is about to be released, or regulators need time to step in. From the outside, […]